Dallas Texas Renunciation of Legacy is a legal procedure that allows individuals to give up or relinquish their rights to inherit assets or properties left to them in a will or trust. This process is commonly referred to as disclaiming an inheritance. In Dallas, Texas, Renunciation of Legacy falls under the probate laws and can be initiated by anyone who is entitled to receive an inheritance, such as heirs, beneficiaries, or will executors. By renouncing their claim to an inheritance, individuals ensure that the assets or properties pass to the next eligible party, according to the terms outlined in the will or trust document. The primary purpose of Dallas Texas Renunciation of Legacy is to provide individuals with the flexibility to decline inheriting assets. This can be done for various reasons, including the desire to avoid potential tax liabilities associated with the inheritance, disengagement from family disputes or conflicts, or to redirect assets to other beneficiaries who may have greater need or use for the inheritance. There are different types of Renunciation of Legacy that can take place in Dallas, Texas. One of them is a partial renunciation, where an individual may choose to disclaim only a portion of the inheritance rather than the entire amount. This allows them to retain certain assets while giving up the rest. Another type is known as a qualified disclaimer, which may be used to redirect an inheritance to a specific alternate beneficiary or directly to a charity. It's important to note that Dallas Texas Renunciation of Legacy must be done in compliance with the state's probate laws and within specific timeframes. Generally, the renunciation needs to be made within a certain period after the death of the testator or donor, and it must be in writing, signed, and witnessed. In conclusion, Dallas Texas Renunciation of Legacy is a legal process that provides individuals with the ability to waive their rights to inherit assets or properties. This can be done for various reasons and is subject to specific guidelines and timeframes set by the state's probate laws. By understanding and utilizing this process, individuals can exercise control over their inheritance and ensure it benefits the intended recipients.

Dallas Texas Renunciation of Legacy

Description

How to fill out Dallas Texas Renunciation Of Legacy?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask a legal professional to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Dallas Renunciation of Legacy, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case collected all in one place. Therefore, if you need the latest version of the Dallas Renunciation of Legacy, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Dallas Renunciation of Legacy:

- Look through the page and verify there is a sample for your region.

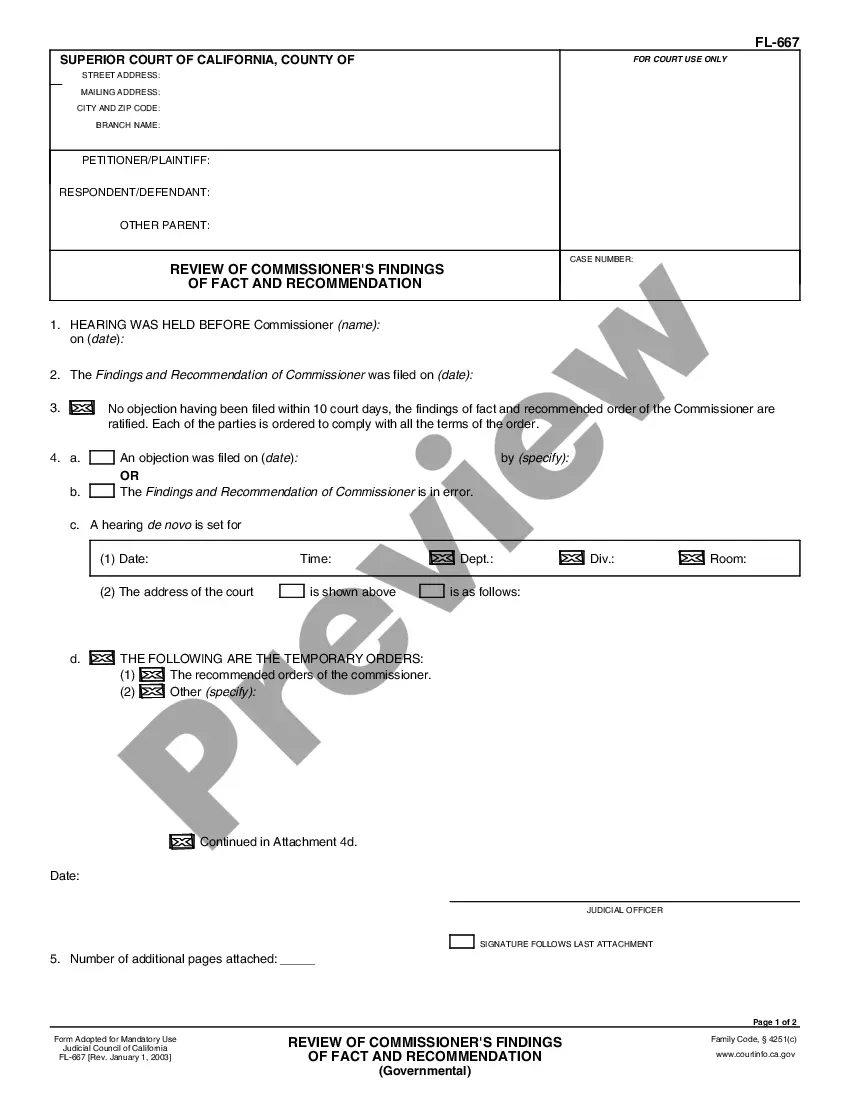

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your Dallas Renunciation of Legacy and download it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!