Maricopa, Arizona, Renunciation of Legacy is a legal process that allows individuals to formally disclaim or reject their right to accept an inheritance or legacy. This renouncement can be made by someone who believes that accepting the inheritance may not align with their personal or financial interests. The Maricopa, Arizona, Renunciation of Legacy serves as a legal mechanism that provides individuals with an opportunity to decline the assets or benefits passed down to them through a will or trust. By renouncing the legacy, individuals can avoid assuming any associated responsibilities or liabilities. There are different types of Maricopa, Arizona, Renunciation of Legacy, which are generally categorized based on the circumstances of the renunciation: 1. Conditional Renunciation: This type of renouncement occurs when an individual sets specific conditions or terms for the inheritance before accepting or declining it. For example, they may request that certain debts or taxes associated with the inheritance be settled before accepting it. 2. Full Renunciation: In this case, individuals choose to completely decline all rights and benefits associated with the inheritance. They forfeit any claim to the assets, effectively passing them on to the next eligible beneficiary. 3. Partial Renunciation: Some situations may warrant a partial renunciation. This type allows individuals to accept certain portions of the inheritance while renouncing others. For example, they may choose to decline real estate assets but accept financial accounts. The Maricopa, Arizona, Renunciation of Legacy process requires individuals to follow specific legal procedures. They must formally submit a written renunciation to the appropriate court and notify all interested parties involved, such as the executor of the estate or other beneficiaries. This renunciation should include relevant details, such as the specific inheritance being renounced and the reasons for doing so. It is crucial for individuals considering the Maricopa, Arizona, Renunciation of Legacy to consult with an attorney who specializes in estate planning and inheritance laws. They can provide guidance on the legal implications and help navigate the complexities of renouncing an inheritance. By understanding the various types and procedures involved in Maricopa, Arizona, Renunciation of Legacy, individuals can make informed decisions regarding their desired level of involvement with inheritances and ensure their personal interests and financial well-being are prioritized.

Maricopa Arizona Renunciation of Legacy

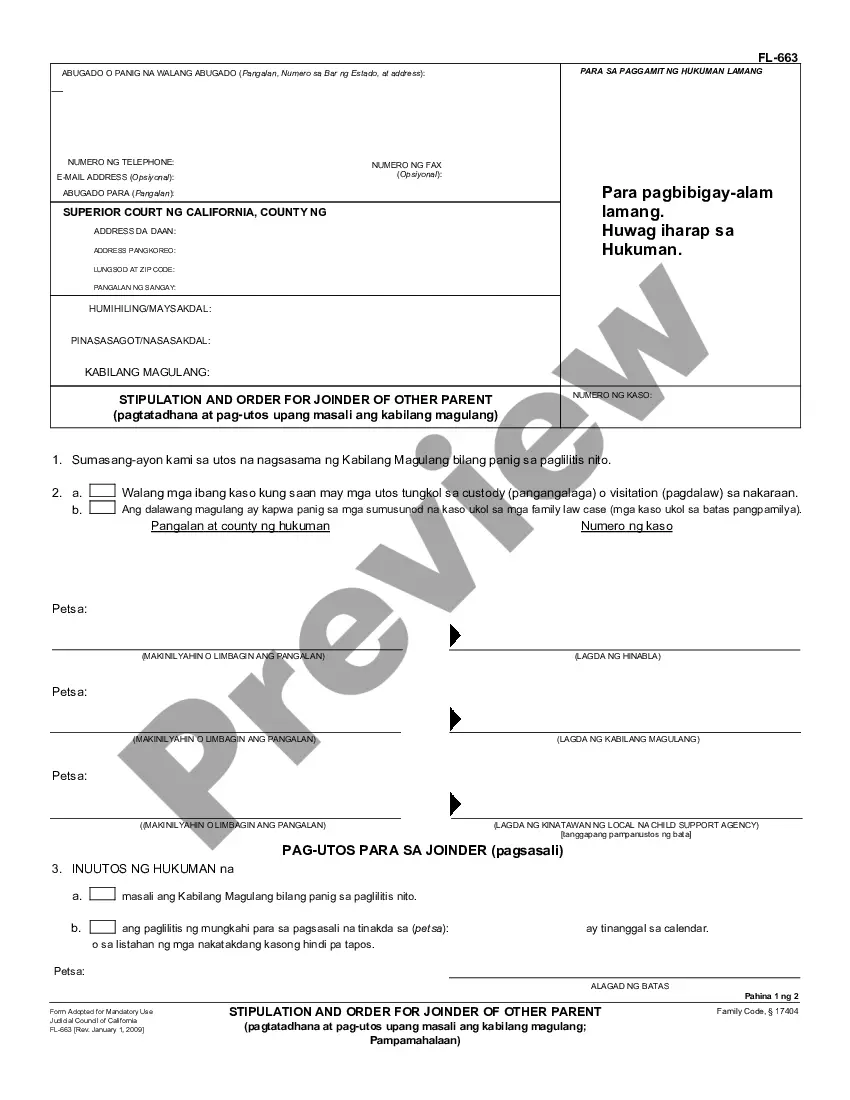

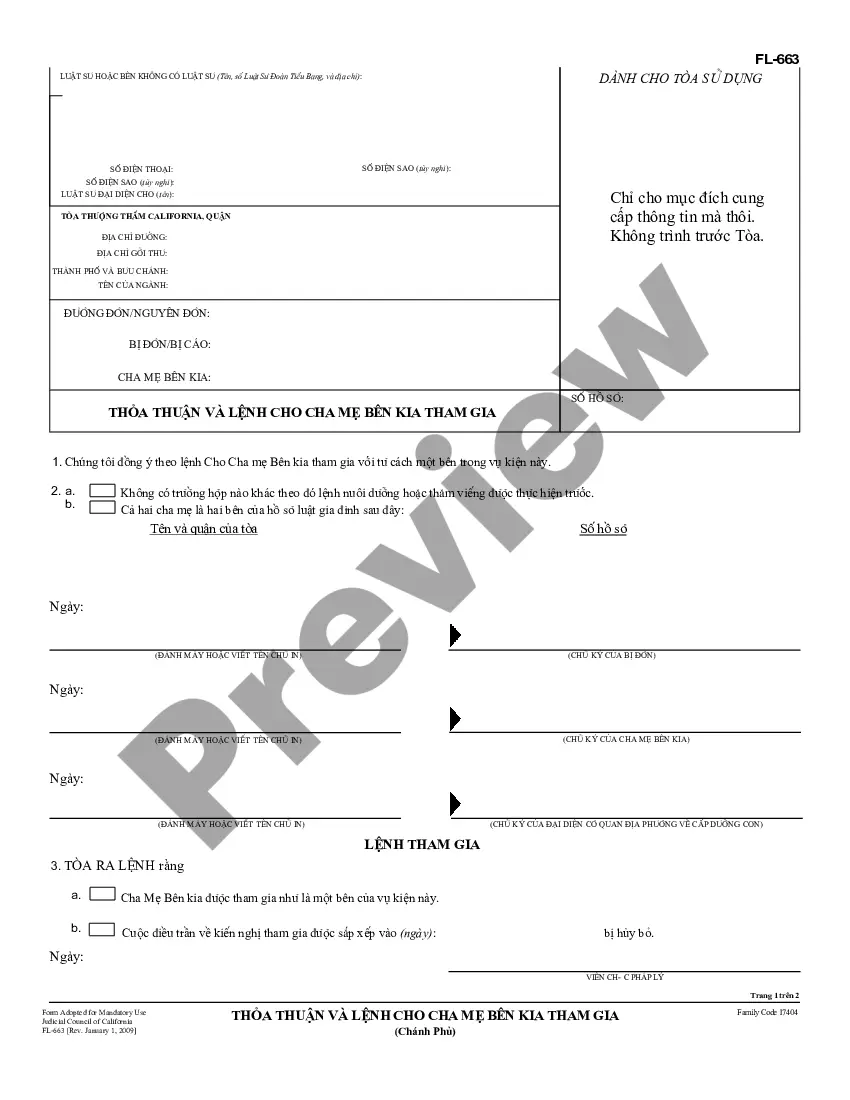

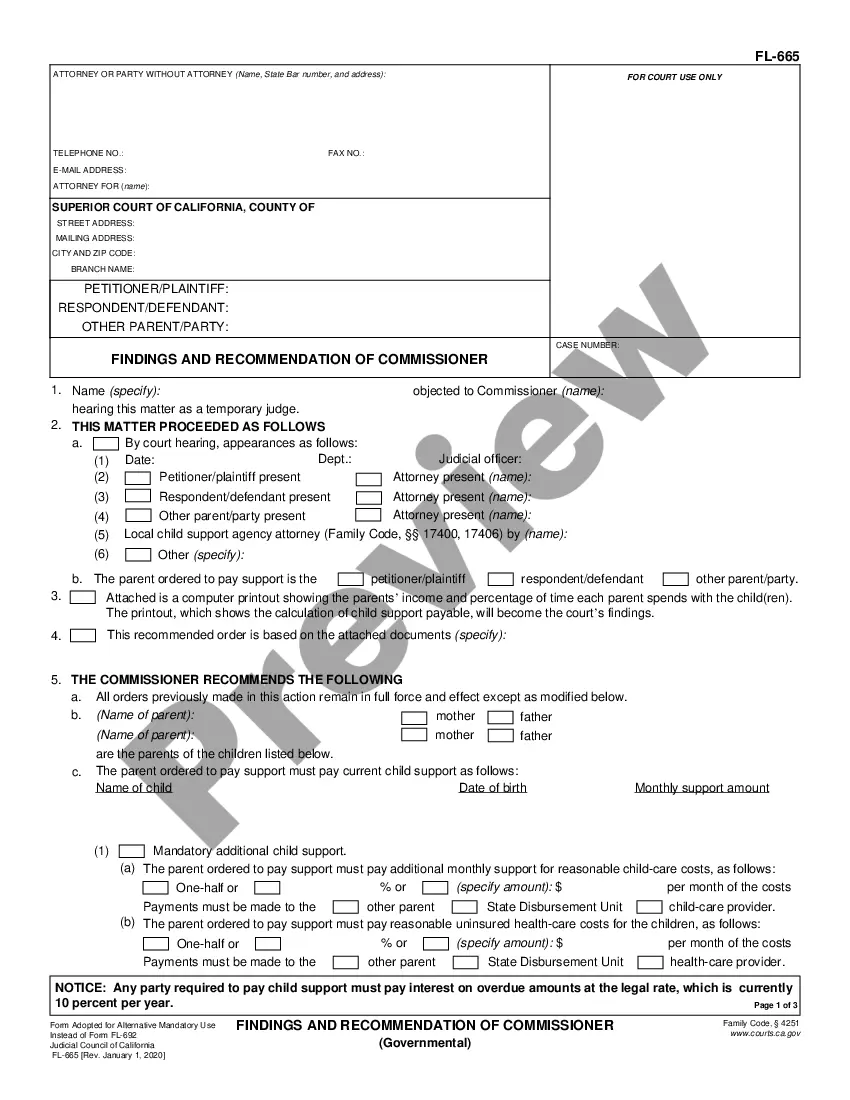

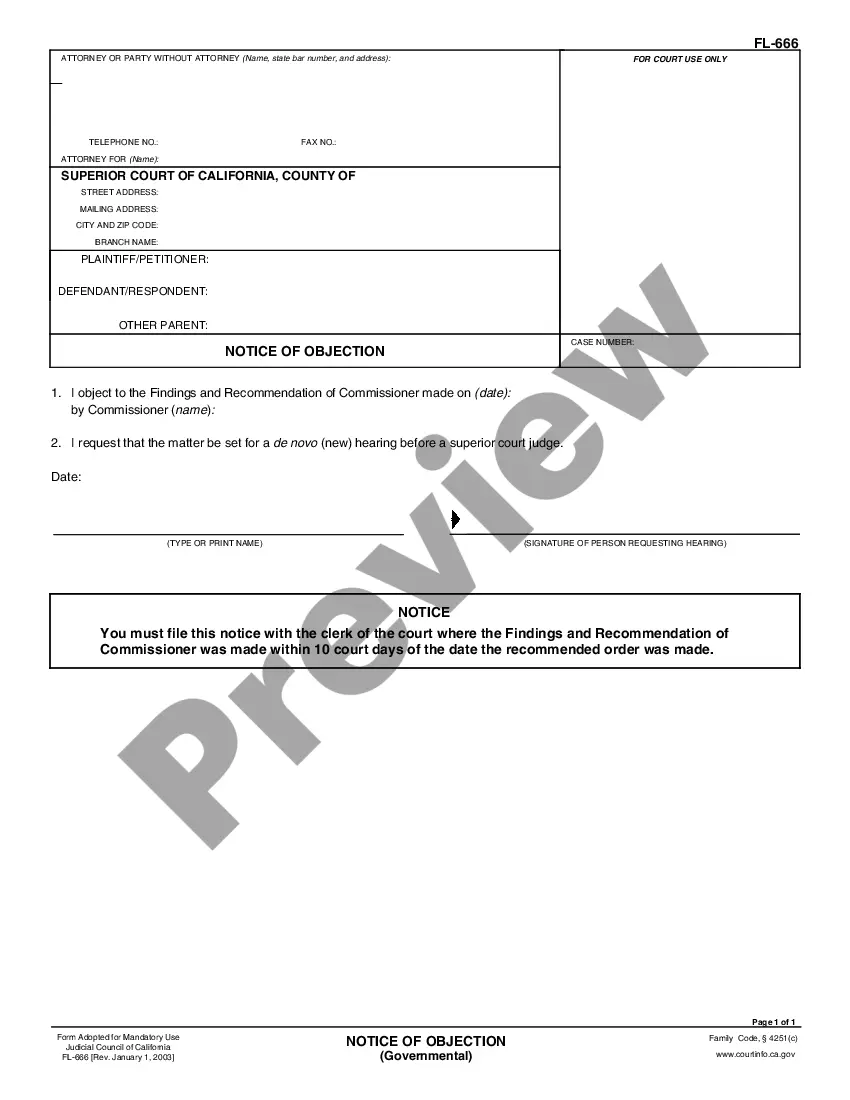

Description

How to fill out Maricopa Arizona Renunciation Of Legacy?

Draftwing documents, like Maricopa Renunciation of Legacy, to manage your legal matters is a tough and time-consumming task. A lot of situations require an attorney’s participation, which also makes this task expensive. Nevertheless, you can acquire your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal forms crafted for different cases and life situations. We ensure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Maricopa Renunciation of Legacy form. Simply log in to your account, download the form, and customize it to your needs. Have you lost your document? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is just as simple! Here’s what you need to do before downloading Maricopa Renunciation of Legacy:

- Ensure that your document is compliant with your state/county since the rules for writing legal papers may differ from one state another.

- Learn more about the form by previewing it or going through a brief description. If the Maricopa Renunciation of Legacy isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to start using our service and download the form.

- Everything looks good on your side? Click the Buy now button and choose the subscription option.

- Select the payment gateway and enter your payment details.

- Your template is good to go. You can go ahead and download it.

It’s easy to locate and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!