Maricopa, Arizona Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years: The Maricopa, Arizona Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years is a legal document that outlines the specific instructions for creating a trust that benefits both charities and individuals in the Maricopa region. This trust is designed to provide consistent income to beneficiaries for a set duration, after which the remaining assets are donated to charitable organizations. There are two main types of Maricopa, Arizona Testamentary Provisions for Charitable Remainder Annuity Trusts for Term of Years: 1. Charitable Remainder Annuity Trust (CAT) — In this type of trust, the beneficiaries receive a fixed annual income predetermined at the creation of the trust. The annuity payout remains constant throughout the agreed-upon term, regardless of any investment gains or losses within the trust. At the end of the specified term, the remaining assets are distributed to the designated charitable organizations. 2. Net Income Charitable Remainder Annuity Trust (NITRATE) — This type of trust also provides beneficiaries with an income stream for a specific period. However, the annual payment is determined by a percentage of the trust's net income. If the trust's investments perform well, beneficiaries may receive higher payments, but if the trust experiences a decrease in income, the annuity payment may be lower. Similar to CAT, the remaining assets go to the chosen charitable beneficiaries after the term ends. Both types of Maricopa, Arizona Testamentary Provisions for Charitable Remainder Annuity Trusts for Term of Years offer significant benefits for both the beneficiaries and charitable organizations: 1. Beneficiaries enjoy a reliable stream of income for the specified duration, which can help cover living expenses, educational costs, healthcare needs, or any other predetermined financial goals. 2. The trust provides potential tax advantages for the donor and beneficiaries. Charitable contributions made through these trusts can result in tax deductions for the donor, potentially reducing their income tax liability. Additionally, the assets placed in the trust are typically removed from the donor's taxable estate, reducing potential estate taxes. 3. Charitable organizations receive significant contributions at the end of the trust term, helping them fund charitable programs, research, scholarships, or other initiatives benefiting the Maricopa community. It is important to consult with a qualified estate planning attorney in Maricopa, Arizona, to properly establish a Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years. They can guide individuals through the legal requirements, ensure proper drafting of the trust, and help determine the most suitable type of trust to meet specific philanthropic and financial goals.

Maricopa Arizona Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years

Description

How to fill out Maricopa Arizona Testamentary Provisions For Charitable Remainder Annuity Trust For Term Of Years?

Preparing legal documentation can be burdensome. In addition, if you decide to ask a lawyer to draft a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the Maricopa Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario gathered all in one place. Therefore, if you need the latest version of the Maricopa Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Maricopa Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years:

- Look through the page and verify there is a sample for your area.

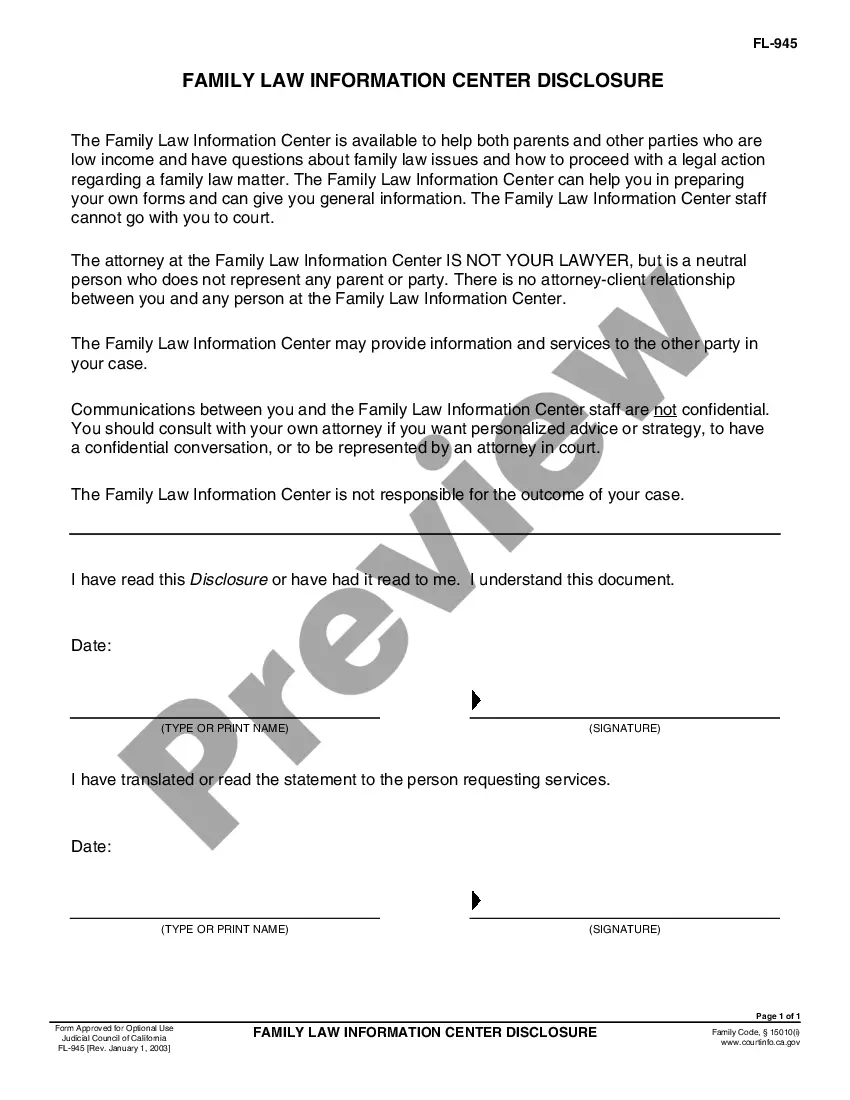

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the file format for your Maricopa Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years and save it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!