The Harris Texas Irrevocable Funded Life Insurance Trust is a specialized trust designed to provide financial security and peace of mind for the beneficiaries. This type of trust combines the benefits of an irrevocable life insurance policy with a unique feature known as the Crummy power of withdrawal. Additionally, it includes a First to Die policy with a Survivorship Rider, ensuring that both spouses/partners are covered under one policy. The Harris Texas Irrevocable Funded Life Insurance Trust, with beneficiaries retaining a Crummy right of withdrawal, offers several advantages for estate planning and wealth preservation. It allows the granter to gift funds to the trust, which are then used to pay the premiums on a life insurance policy. This not only provides a tax-efficient way to transfer wealth but also ensures that the beneficiaries receive a tax-free death benefit upon the granter's passing. The Crummy right of withdrawal is a significant aspect of this trust. It allows the beneficiaries to withdraw a limited amount of money from the trust within a specific timeframe, typically 30 or 60 days. This withdrawal right makes the contributions to the trust qualify for the annual gift tax exclusion, offering the granter additional tax benefits. Furthermore, the Harris Texas Irrevocable Funded Life Insurance Trust utilizes a First to Die policy with a Survivorship Rider. This means that both spouses or partners are covered by a single policy, and the death benefit is paid out upon the passing of the first insured individual. The surviving spouse/partner then continues to be covered under the same policy, offering continued protection and financial security. Different variations of the Harris Texas Irrevocable Funded Life Insurance Trust, with beneficiaries having a Crummy right of withdrawal and a First to Die policy with a Survivorship Rider, may include: 1. Single-life Harris Texas Irrevocable Funded Life Insurance Trust: In this case, the trust is established for a single individual, providing lifelong insurance coverage and asset protection for the beneficiaries. 2. Joint-life Harris Texas Irrevocable Funded Life Insurance Trust: This trust is created for spouses or partners, ensuring that both individuals are covered under one policy. The death benefit is paid out upon the death of the first insured person, providing financial support for the surviving spouse/partner. It is essential to consult with a licensed attorney or financial advisor well-versed in estate planning and life insurance trusts to determine the most suitable variation of the Harris Texas Irrevocable Funded Life Insurance Trust for individual circumstances and objectives.

Harris Texas Irrevocable Funded Life Insurance Trust where Beneficiaries Have Crummey Right of Withdrawal with First to Die Policy with Survivorship Rider

Description

How to fill out Harris Texas Irrevocable Funded Life Insurance Trust Where Beneficiaries Have Crummey Right Of Withdrawal With First To Die Policy With Survivorship Rider?

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to draft some of them from scratch, including Harris Irrevocable Funded Life Insurance Trust where Beneficiaries Have Crummey Right of Withdrawal with First to Die Policy with Survivorship Rider, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in different types varying from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching experience less frustrating. You can also find detailed materials and guides on the website to make any activities associated with paperwork completion straightforward.

Here's how you can locate and download Harris Irrevocable Funded Life Insurance Trust where Beneficiaries Have Crummey Right of Withdrawal with First to Die Policy with Survivorship Rider.

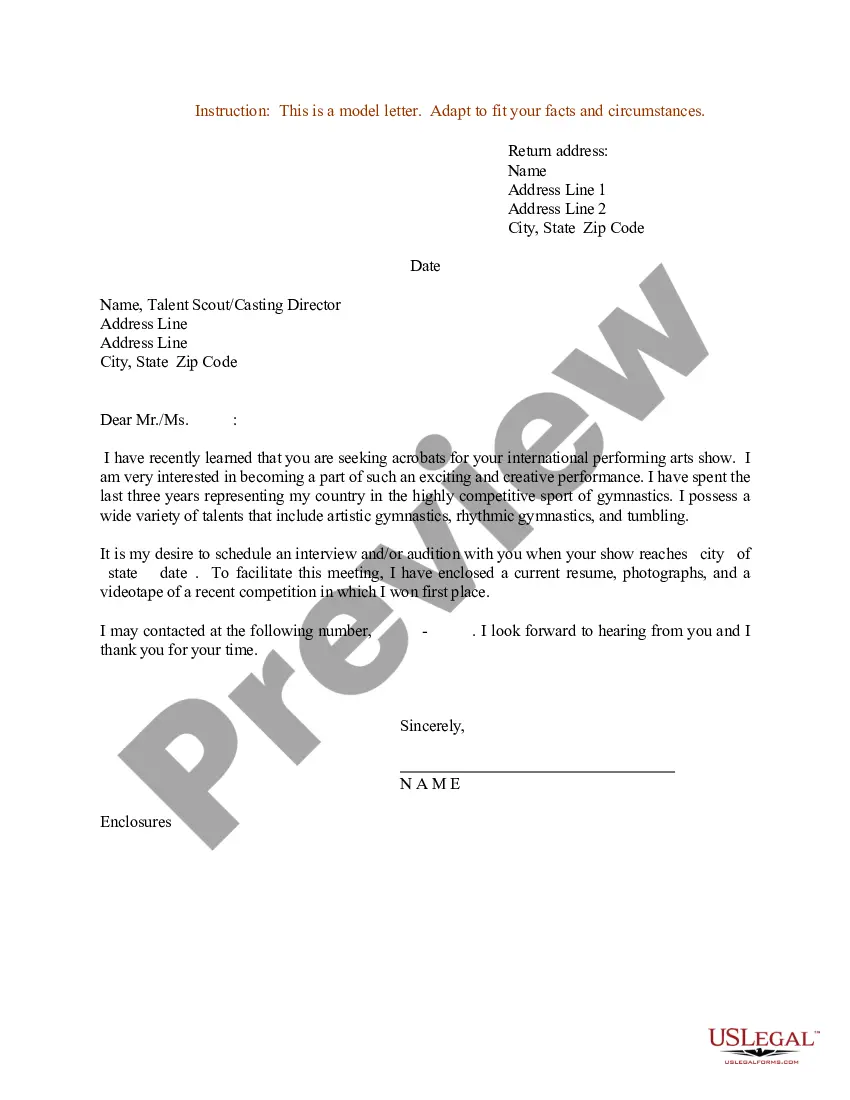

- Take a look at the document's preview and outline (if available) to get a general idea of what you’ll get after getting the document.

- Ensure that the template of your choosing is specific to your state/county/area since state regulations can affect the legality of some documents.

- Examine the similar forms or start the search over to find the correct file.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the option, then a suitable payment method, and buy Harris Irrevocable Funded Life Insurance Trust where Beneficiaries Have Crummey Right of Withdrawal with First to Die Policy with Survivorship Rider.

- Choose to save the form template in any offered format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Harris Irrevocable Funded Life Insurance Trust where Beneficiaries Have Crummey Right of Withdrawal with First to Die Policy with Survivorship Rider, log in to your account, and download it. Needless to say, our platform can’t take the place of a legal professional completely. If you have to cope with an exceptionally challenging case, we advise getting a lawyer to check your document before executing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Join them today and get your state-specific paperwork with ease!