Alameda California Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor

Description

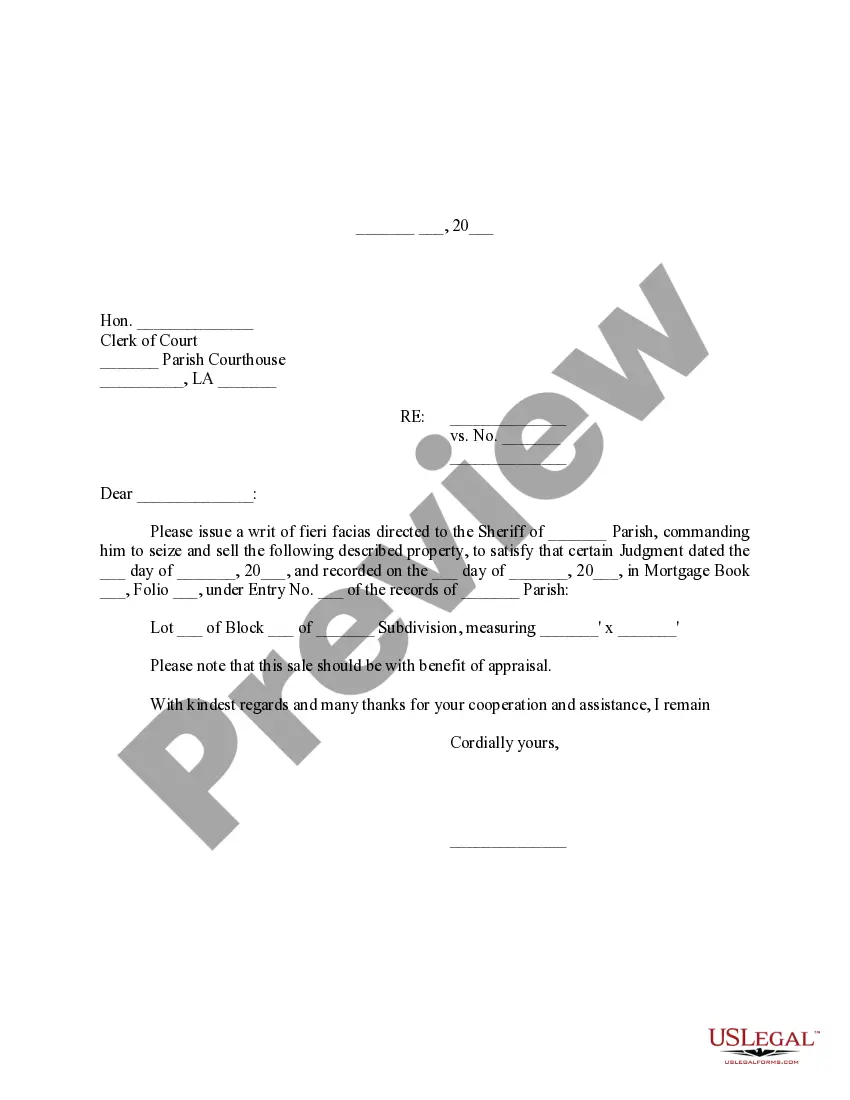

How to fill out Irrevocable Trust For Lifetime Benefit Of Trustor With Power Of Invasion In Trustor?

Gathering paperwork for business or personal needs is consistently a significant obligation.

When formulating a contract, a public service application, or a power of attorney, it's vital to consider all federal and state regulations of the specific location.

Nevertheless, smaller counties and even towns also have legislative processes that you must take into account.

Join the platform and effortlessly acquire validated legal forms for any purpose with just a few clicks!

- All these factors render it cumbersome and time-consuming to establish an Alameda Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor without expert assistance.

- It is possible to evade incurring expenses by hiring attorneys to draft your paperwork and create a legally binding Alameda Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor independently, utilizing the US Legal Forms online library.

- It is the largest online repository of state-specific legal templates that are professionally verified, ensuring you can be confident in their legality when selecting a template for your locale.

- Previously subscribed users merely need to Log In to their accounts to access the required document.

- If you do not possess a subscription yet, follow the detailed instructions below to obtain the Alameda Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor.

- Review the page you've opened and verify if it contains the template you require.

- To do this, utilize the form description and preview if these features are accessible.

Form popularity

FAQ

Irrevocable trusts are primarily set up for estate and tax considerations. That's because it removes all incidents of ownership, removing the trust's assets from the grantor's taxable estate. It also relieves the grantor of the tax liability on the income generated by the assets.

Generally, taxpayers who have large estates are the ones who benefit the most from having an irrevocable trust. If you leave more than the IRS-allowed lifetime tax-free gift limit in estate assets to your beneficiaries, the amount over this tax-free limit is subject to a federal estate tax of 40 percent.

With an irrevocable trust, the transfer of assets is permanent. So once the trust is created and assets are transferred, they generally can't be taken out again. You can still act as the trustee but you'd be limited to withdrawing money only on an as-needed basis to cover necessary expenses.

So, the list below are some more disadvantages of an irrevocable trust: Loss of Control over Assets. Inflexible as opposed to a Revocable Trust. Unforeseen circumstances.

The only three times you might want to consider creating an irrevocable trust is when you want to (1) minimize estate taxes, (2) become eligible for government programs, or (3) protect your assets from your creditors.

Irrevocable trusts can work well to protect assets from lawsuits, cut taxes and manage an estate plan. The limitations on making unencumbered changes to the trust mean that the courts are also restricted from stepping into the shoes of the settlor or beneficiaries and making changes against their wishes.

Irrevocable trusts are generally set up to minimize estate taxes, access government benefits, and protect assets. This is in contrast to a revocable trust, which allows the grantor to modify the trust, but loses certain benefits such as creditor protection.

Irrevocable trusts can help you lower your tax liability, protect you from lawsuits and keep beneficiaries from mishandling assets. But you also have to accept the downsides of loss of control and an inflexible structure too.

One of the greatest advantages of an irrevocable trust is that it can offer great protection from future creditors and lawsuits as well as bad marriages.

A grantor can reserve a limited power of appointment for themselves. This allows the grantor to change the trust's beneficiaries at anytime before the grantor's death. The grantor may also choose to give a limited power of appointment to someone else.