Riverside California Irrevocable Trust for Lifetime Benefit of Trust or with Power of Invasion in Trust or The Riverside California Irrevocable Trust for Lifetime Benefit of Trust or with Power of Invasion in Trust or is a legal arrangement designed to protect and distribute assets in Riverside, California. It offers significant benefits for the trust or and provides control and flexibility through the power of invasion. An irrevocable trust is a trust that cannot be modified or revoked by the trust or once it is established, ensuring the longevity and stability of the asset protection. This type of trust is suitable for individuals who want to secure their assets and ensure their preservation for themselves and their beneficiaries. The Trust for Lifetime Benefit of Trust or allows the trust or to receive income or benefits from the trust during their lifetime while still maintaining control and protection of the assets. This means that even though the assets are held within the trust, the trust or can avail themselves of a predetermined portion of the trust's income. The Power of Invasion in Trust or further enhances flexibility by giving the trust or the ability to access or withdraw assets if necessary, providing a safety net for unforeseen circumstances or financial needs. This power ensures that the trust or can maintain control and adapt the trust according to their changing circumstances. There are various types of Riverside California Irrevocable Trust for Lifetime Benefit of Trust or with Power of Invasion in Trust or, including: 1. Medicaid Asset Protection Trust: This type of trust is specifically designed for individuals looking to protect their assets from being counted when qualifying for Medicaid. 2. Special Needs Trust: Created to provide financial support and resources for beneficiaries with special needs without jeopardizing their eligibility for government benefits. 3. Charitable Remainder Trust: This trust allows the trust or to receive an income stream from the trust and make a charitable contribution while reducing estate taxes. 4. Life Insurance Trust: Designed to exclude life insurance proceeds from the taxable estate, ensuring their efficient transfer to the beneficiaries. 5. Dynasty Trust: Intended to provide for multiple generations, this trust minimizes estate taxes and ensures the preservation of the assets for the future. 6. Qualified Personnel Residence Trust: For individuals looking to retain their residence during their lifetime while transferring it to beneficiaries with reduced gift tax implications. 7. Granter Retained Annuity Trust: This trust permits the trust or to retain an annual income stream while transferring assets to beneficiaries with limited or no gift tax consequences. These are just a few examples of the various types of irrevocable trusts available in Riverside, California. Each trust provides unique benefits and provisions to meet different asset protection and financial planning goals. Seeking the advice of a qualified estate planning attorney is crucial to determine the most suitable trust type based on individual needs and objectives.

Riverside California Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor

Description

How to fill out Riverside California Irrevocable Trust For Lifetime Benefit Of Trustor With Power Of Invasion In Trustor?

Drafting paperwork for the business or individual needs is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state laws and regulations of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to create Riverside Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor without professional help.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid Riverside Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor by yourself, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required form.

If you still don't have a subscription, adhere to the step-by-step guide below to get the Riverside Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor:

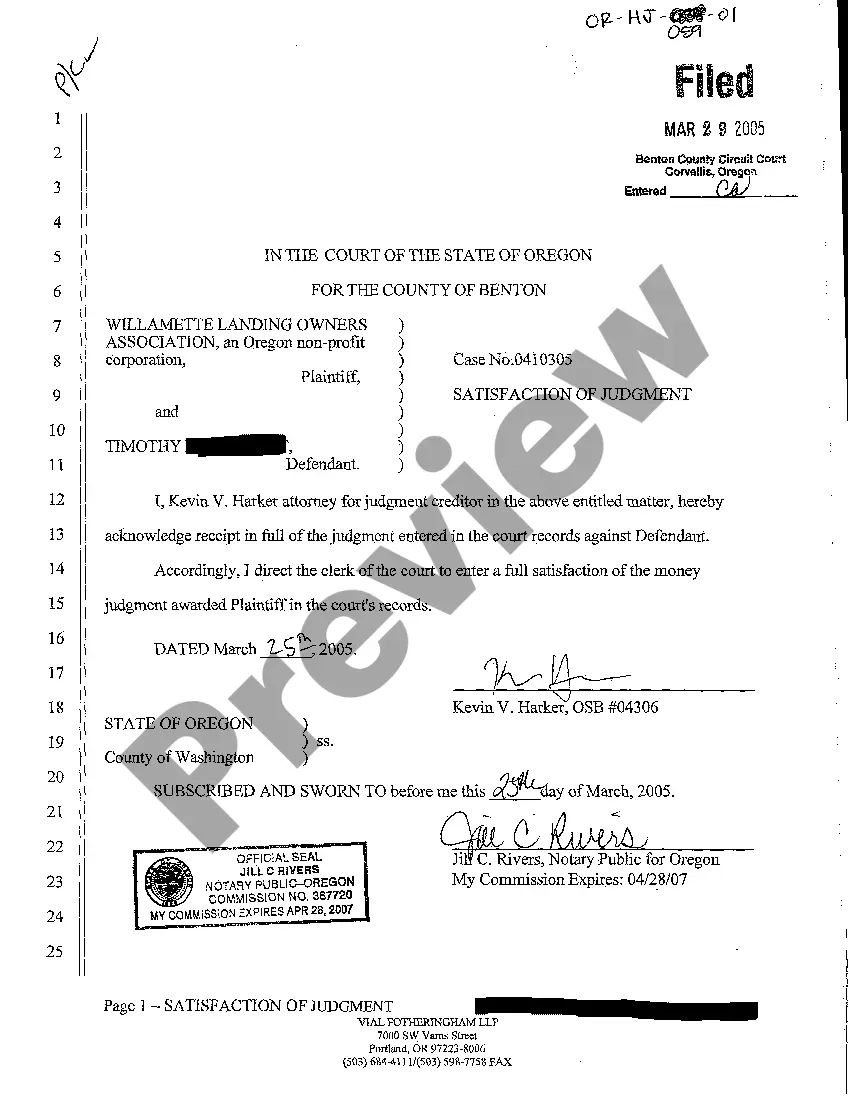

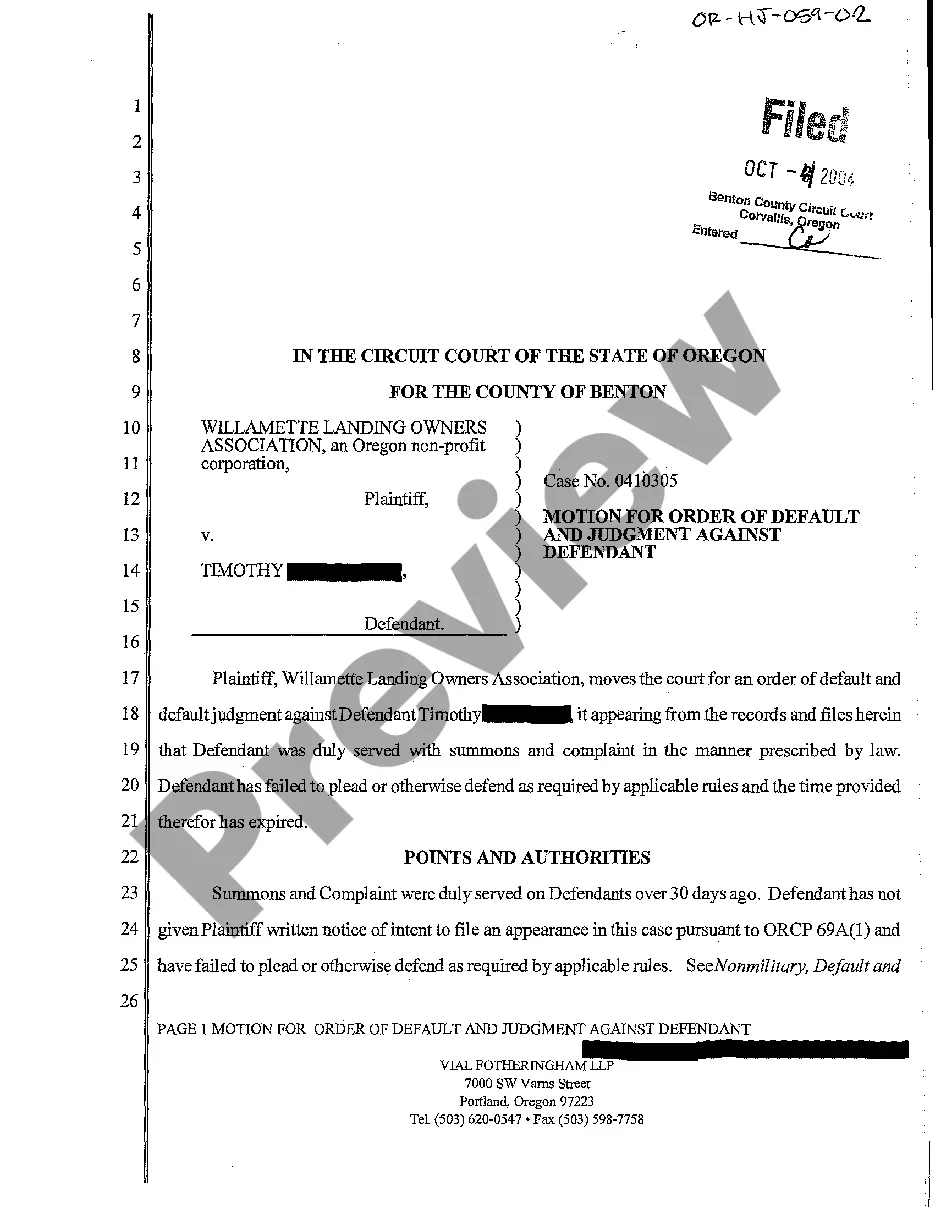

- Look through the page you've opened and check if it has the sample you require.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that meets your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any scenario with just a few clicks!