Kings New York Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years

Description

How to fill out Grantor Retained Income Trust With Division Into Trusts For Issue After Term Of Years?

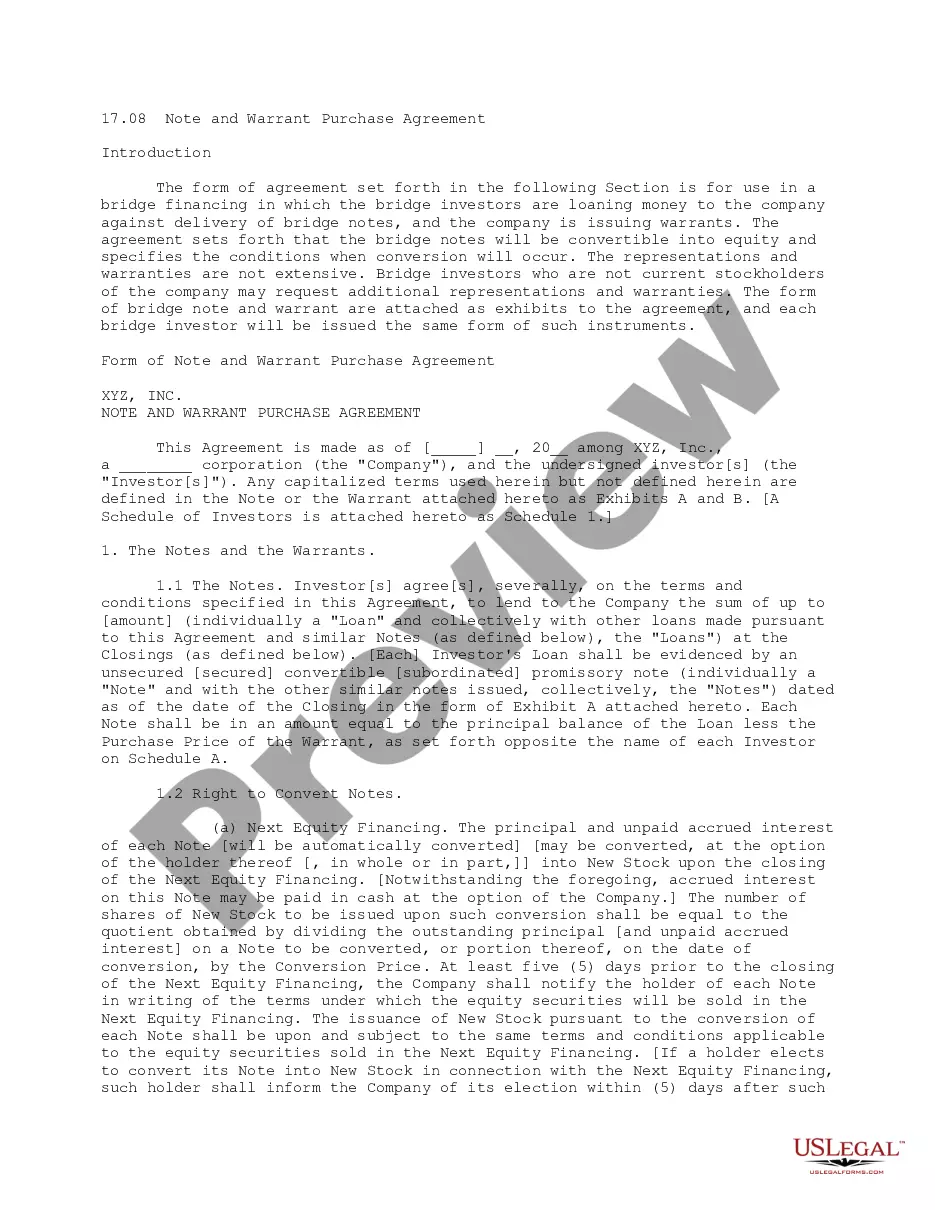

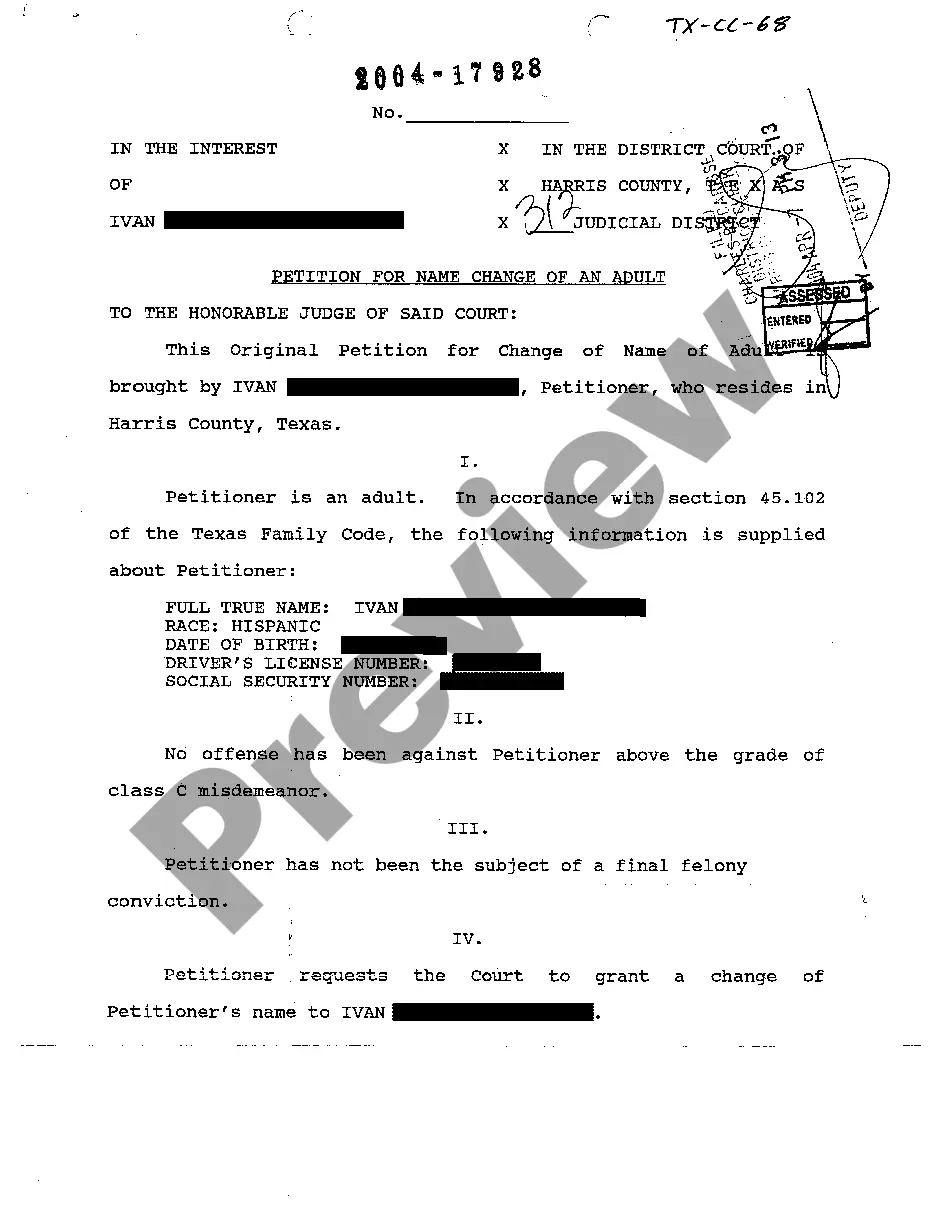

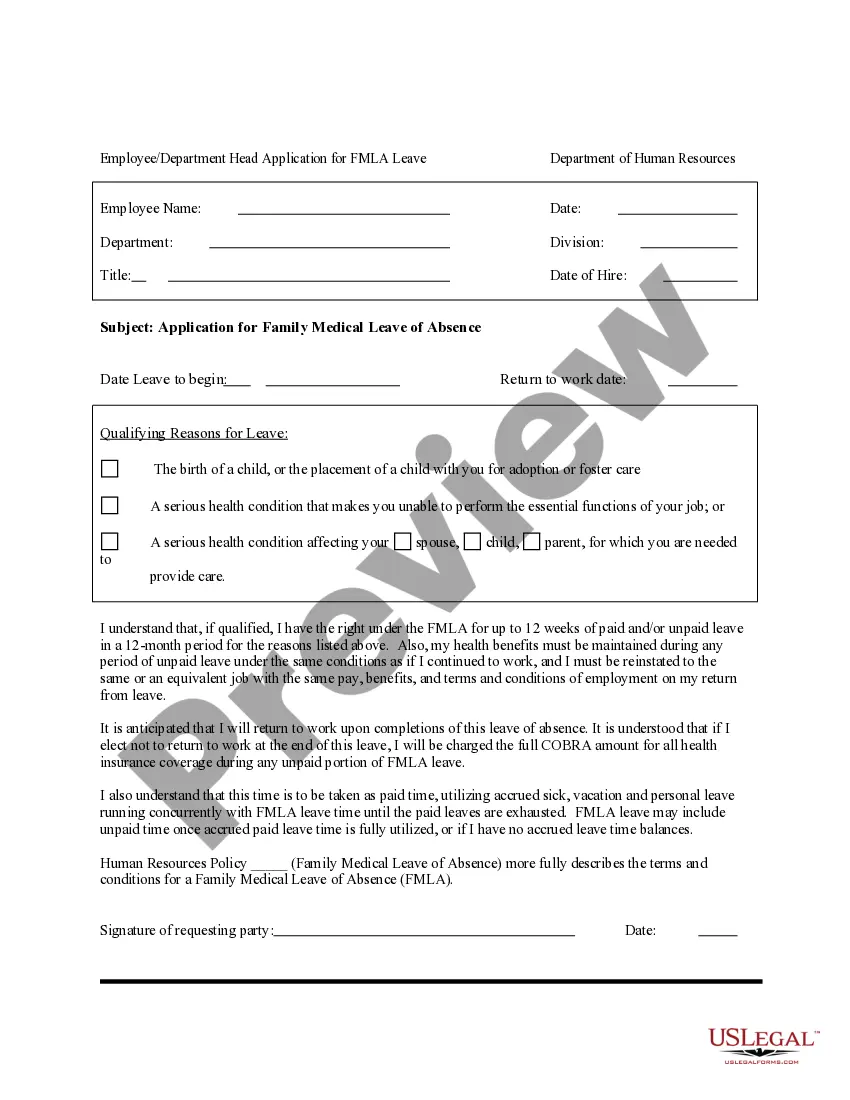

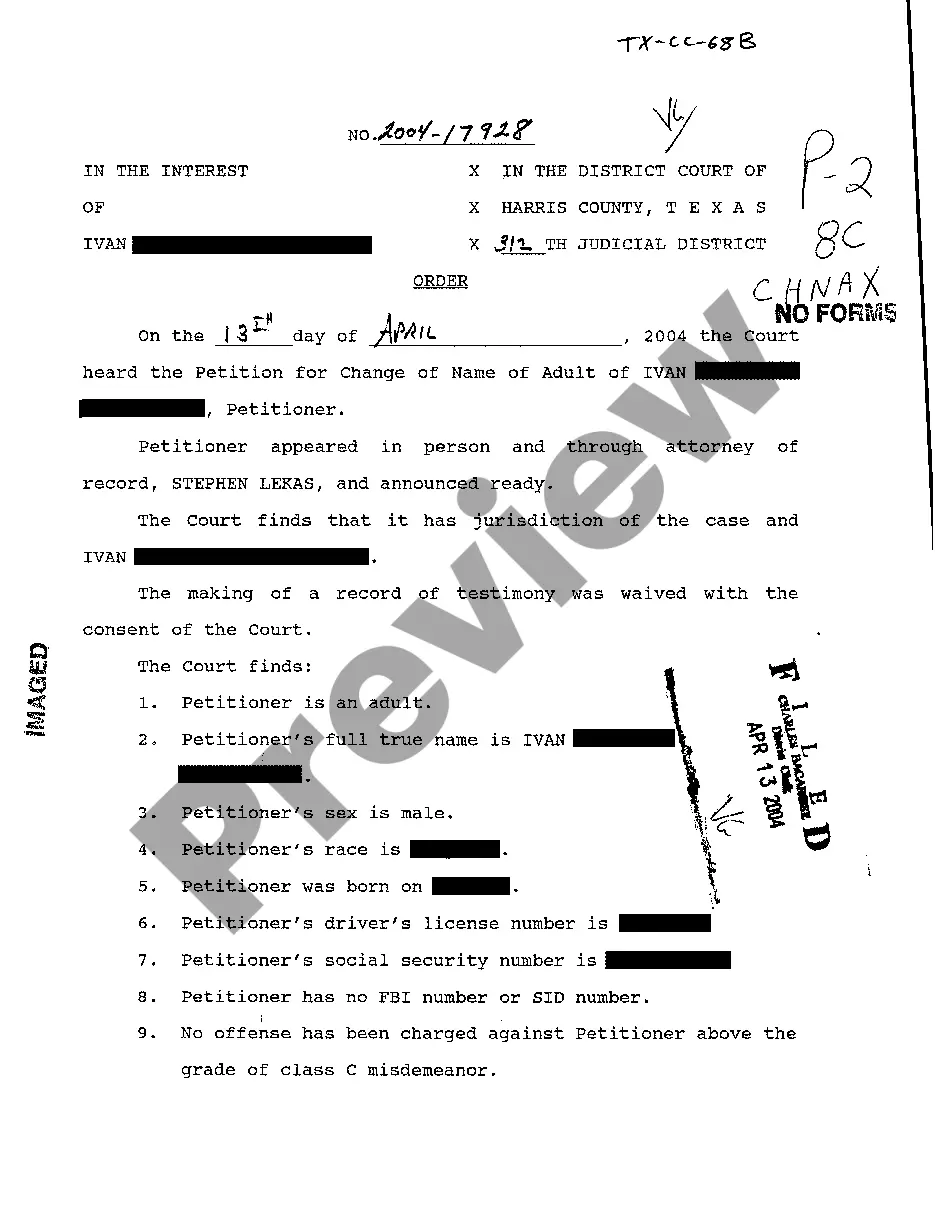

Whether you aim to launch your enterprise, enter into an agreement, request your ID extension, or settle family-related legal matters, you must prepare specific documentation in accordance with your local laws and regulations.

Locating the appropriate documents may require considerable time and effort unless you utilize the US Legal Forms library.

The service offers users over 85,000 professionally drafted and verified legal documents for any individual or commercial case. All files are organized by state and area of use, making it quick and easy to select a copy like Kings Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years.

Forms available on our site are reusable. With an active subscription, you can access all your previously procured documents at any time through the My documents tab in your profile. Stop wasting time on an endless search for current official documentation. Register for the US Legal Forms platform and keep your paperwork organized with the most extensive online form library!

- Ensure the sample aligns with your personal requirements and state law stipulations.

- Examine the form description and review the Preview if available on the page.

- Use the search function specifying your state above to find another template.

- Hit Buy Now to obtain the sample once you locate the appropriate one.

- Choose the subscription plan that appeals to you the most to continue.

- Log in to your account and settle the service with a credit card or PayPal.

- Download the Kings Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years in your preferred file format.

- Print the document or complete it and sign it electronically using an online editor to save time.

Form popularity

FAQ

QPRT and Other Trust Forms In a bare trust, the beneficiary has the absolute right to the trust's assets (both financial and non-financial, such as real estate and collectibles), as well as the income generated from these assets (such as rental income from properties or bond interest).

How Are GRATs Taxed? GRATs are taxed in two ways: Any income you earn from the appreciation of your assets in the trust is subject to regular income tax, and any remaining funds/assets that transfer to a beneficiary are subject to gift taxes.

The annuity amount is paid to the grantor during the term of the GRAT, and any property remaining in the trust at the end of the GRAT term passes to the beneficiaries with no further gift tax consequences.

GRATs are taxed in two ways: Any income you earn from the appreciation of your assets in the trust is subject to regular income tax, and any remaining funds/assets that transfer to a beneficiary are subject to gift taxes.

out GRAT allows the grantor to transfer any appreciation in excess of the Sec. 7520 rate without using any of the grantor's lifetime exemption. If the assets fail to appreciate at the Sec. 7520 rate, the only cost to the grantor will have been the legal and administrative costs of setting up the GRAT.

If the grantor does not survive the term, the GRAT will fail, but again no assets are lostthey will simply be included in the grantor's taxable estate.

If a trust receives assets passing under the will from life insurance proceeds, the trust is called a/an: Pourover trust. What can a grantor use to fund a QPRT? A home or vacation home.

Out GRAT is a GRAT where the annuity payable to the trust's creator is set in a manner that results, mathematically, in a net gift of zero.

JL: The term of the GRAT is chosen by the grantor when the GRAT is first created. The minimum duration for a GRAT is two years, and that is a very popular choice for many clients. But longer GRATs are also common, and some clients decide to establish GRATs that last 3, 5 or 10 years.

Key Takeaways. Grantor retained annuity trusts (GRATs) are estate planning instruments in which a grantor locks assets in a trust from which they earn annual income. Upon expiry, the beneficiary receives the assets with minimal or no gift tax liability. GRATs are used by wealthy individuals to minimize tax liabilities.