The Phoenix Arizona Granter Retained Income Trust (GRIT) with Division into Trusts for Issue after Term of Years is a robust estate planning tool designed to preserve and transfer wealth effectively. This legal structure allows individuals in Phoenix, Arizona, to retain an income stream from the assets they place in the trust while ultimately transferring these assets to their chosen beneficiaries after a specified term of years. Grits are particularly advantageous for individuals looking to minimize estate taxes, protect assets from creditors, or provide for multiple generations. By utilizing this specialized trust, individuals can strategically transfer their assets while still enjoying an income stream. There are several types of Phoenix Arizona Granter Retained Income Trust with Division into Trusts for Issue after Term of Years, including: 1. GRIT with Annuity: Under this arrangement, the granter receives a fixed annual income determined at the inception of the trust. The income payments remain constant throughout the term of the trust, and at its conclusion, the remaining assets are distributed to the selected beneficiaries. 2. GRIT with Unit rust: In contrast to the GRIT with Annuity, this type of trust provides the granter with a fixed percentage of the trust assets' fair market value, recalculated annually. This ensures that as the trust assets appreciate, the granter's income also increases. At the end of the term, the remaining trust assets are distributed among the identified beneficiaries. 3. GREAT with Flip Provisions: This variation allows the trust to convert from a granter retained annuity trust (GREAT) to a granter retained unit rust (GUT) after a specified triggering event. The conversion allows for more flexibility in managing the trust's assets and potential tax implications. 4. Charitable Remainder GRIT: This type of trust includes a charitable organization as the ultimate beneficiary. The granter retains an income stream from the trust for a term of years or their lifetime. At the conclusion of the trust, the remaining assets are then transferred to the designated charity. 5. Zeroed-Out GRIT: This particular trust seeks to minimize gift taxes by distributing to the granter the exact value of the initial gift made into the trust, effectively canceling out any potential tax liability. The remaining appreciation and income generated by the trust assets are passed on to the beneficiaries. When establishing a Phoenix Arizona Granter Retained Income Trust with Division into Trusts for Issue after Term of Years, it is crucial to consult with a knowledgeable estate planning attorney to ensure compliance with applicable laws and to tailor the trust to meet one's specific objectives.

Phoenix Arizona Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years

Description

How to fill out Phoenix Arizona Grantor Retained Income Trust With Division Into Trusts For Issue After Term Of Years?

How much time does it usually take you to draw up a legal document? Given that every state has its laws and regulations for every life situation, finding a Phoenix Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years suiting all local requirements can be exhausting, and ordering it from a professional lawyer is often costly. Numerous online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, gathered by states and areas of use. Aside from the Phoenix Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years, here you can get any specific form to run your business or individual affairs, complying with your county requirements. Professionals verify all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can pick the file in your profile at any time in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Phoenix Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years:

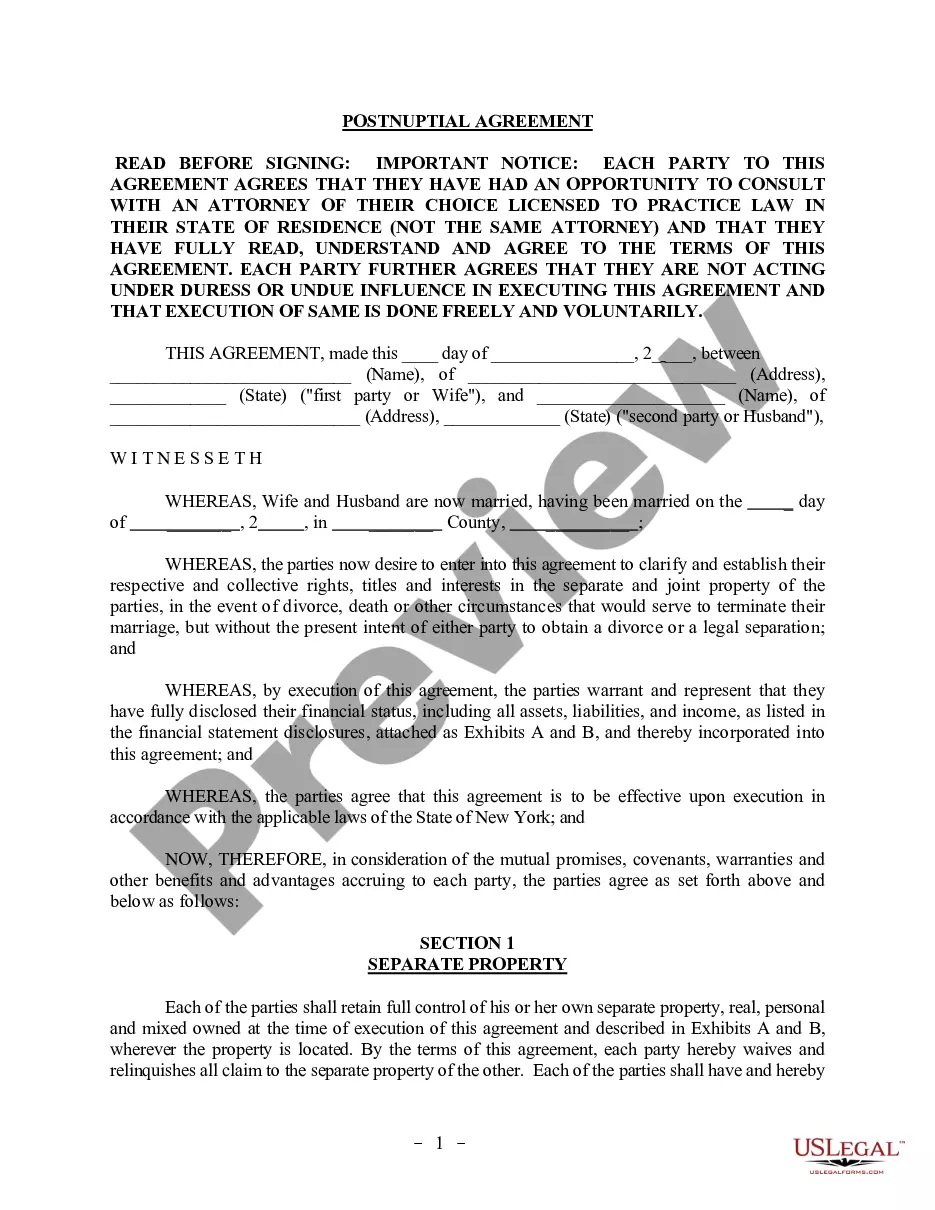

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Phoenix Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!