San Diego California Granter Retained Income Trust with Division into Trusts for Issue after Term of Years refers to a specific type of trust arrangement available in the state of California. This trust structure allows the granter to retain an income stream from the assets contributed to the trust for a specified period of time. The trust assets are then divided into separate trusts for the benefit of the granter's designated beneficiaries after the term of years has expired. The primary purpose of this trust is to provide the granter with a stream of income while allowing for the transfer of wealth to future generations. By retaining the income generated by the trust assets, the granter can secure financial stability throughout the term of years defined in the trust agreement. During the term of the trust, the income generated by the trust assets can be utilized by the granter for personal expenses, investments, or any other approved purposes outlined in the trust agreement. The granter still maintains control of the assets during this time, allowing him or her to manage and make decisions regarding the investments. Once the specified term of years has elapsed, the trust assets are divided into separate trusts, often referred to as "sub-trusts," for the benefit of the designated beneficiaries. These sub-trusts are typically created with the intention of providing a continued income stream or to preserve and grow the principal for future generations. San Diego California Granter Retained Income Trust with Division into Trusts for Issue after Term of Years can be further categorized into various types, based on the specific requirements and objectives of the granter and beneficiaries. Some of these types may include: 1. Charitable Remainder Unit rust (CUT): This type of trust provides income to the granter during the term of years and allows for a charitable deduction upon contribution. After the term, the remaining assets are distributed to a charitable organization or foundation. 2. Charitable Remainder Annuity Trust (CAT): Similar to a CUT, this trust pays a fixed annual income to the granter during the term, but with a fixed annuity payment instead of a variable income stream. Upon termination, the remaining assets are distributed to a charitable organization. 3. GREAT (Granter Retained Annuity Trust): With a GREAT, the granter receives a fixed annuity payment during the term, and any remaining assets pass to the beneficiaries at the end of the trust term. This type of trust can be used to transfer assets to family members with limited or no gift tax consequences. 4. GUT (Granter Retained Unit rust): A GUT provides the granter with a variable income stream based on a fixed percentage of the trust assets' value. At the end of the term, the remaining assets are distributed to the beneficiaries. 5. Dynasty Trust: This type of trust allows for the transfer of wealth and generation-skipping, ensuring assets are protected and benefit multiple generations. The trust can be structured to minimize or avoid estate taxes. It is crucial to consult with an experienced estate planning attorney or financial advisor in San Diego, California, to determine the most suitable Granter Retained Income Trust with Division into Trusts for Issue after Term of Years based on individual circumstances and objectives. The knowledge and expertise of these professionals will help ensure the trust is structured properly and aligns with the granter's goals for wealth transfer and asset protection.

San Diego California Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years

Description

How to fill out San Diego California Grantor Retained Income Trust With Division Into Trusts For Issue After Term Of Years?

Laws and regulations in every area differ from state to state. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the San Diego Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for further use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the San Diego Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years from the My Forms tab.

For new users, it's necessary to make a few more steps to get the San Diego Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years:

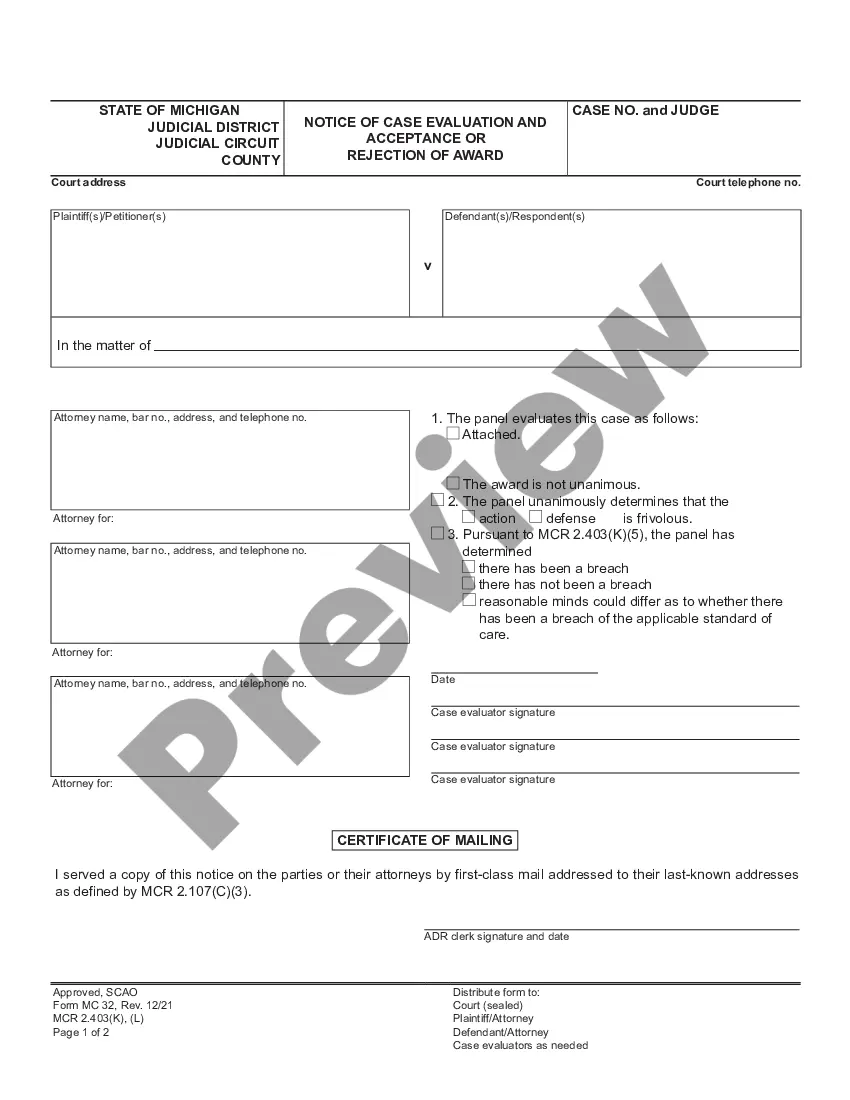

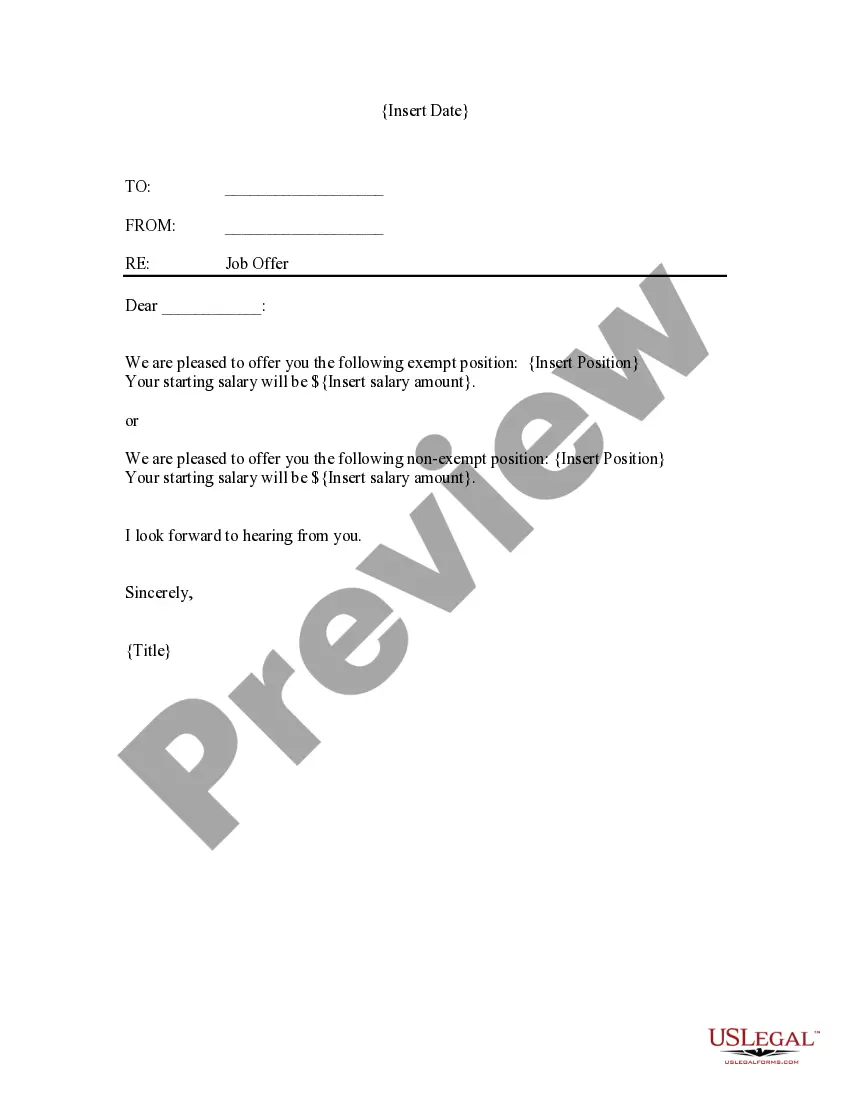

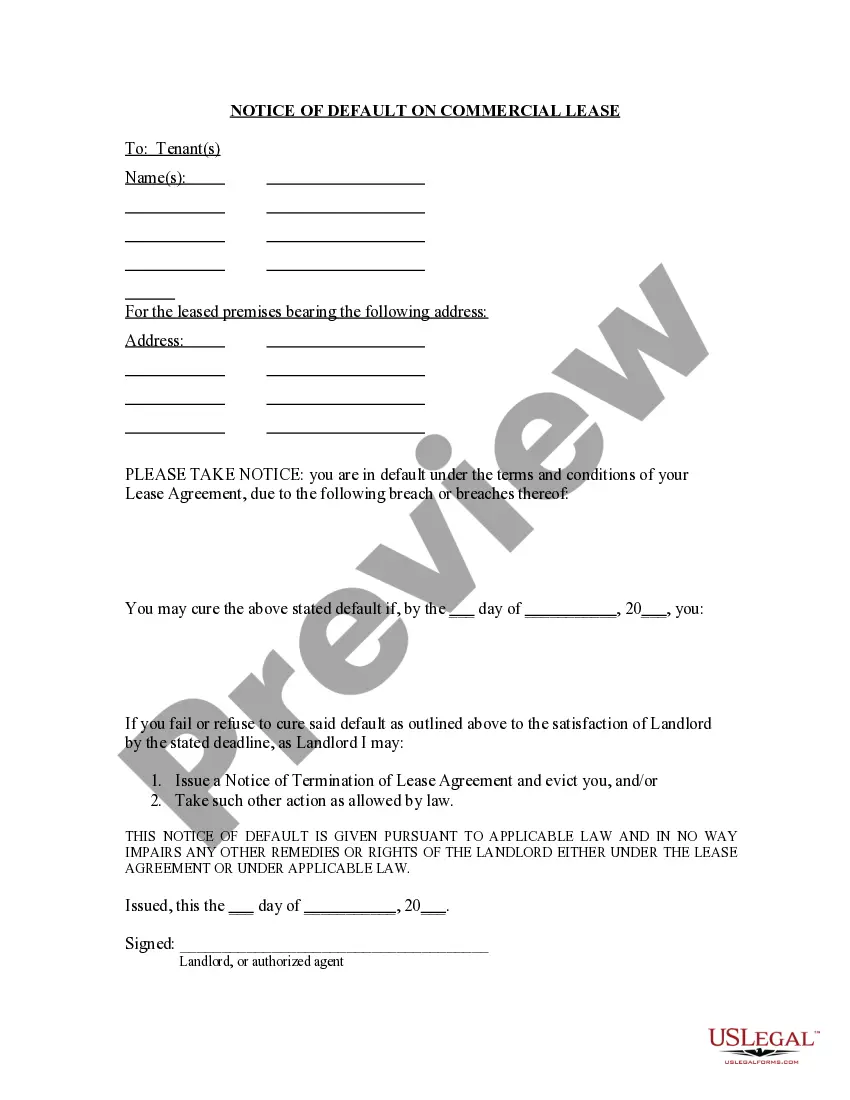

- Examine the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the template once you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!