Title: San Jose California Granter Retained Income Trust with Division into Trusts for Issue after Term of Years Introduction: A San Jose California Granter Retained Income Trust with Division into Trusts for Issue after Term of Years is a powerful estate planning tool designed to provide substantial benefits for both the granter and the beneficiaries. This specialized trust allows the granter to retain income from the assets placed within the trust for a specified term, while also allowing for the ultimate distribution of assets to beneficiaries after the term ends. Types of San Jose California Granter Retained Income Trusts with Division into Trusts for Issue after Term of Years: 1. Granter Retained Annuity Trust (GREAT): A GREAT is a type of Granter Retained Income Trust where the granter receives a fixed annuity payment from the trust for the term of years specified. At the end of the term, the remaining trust assets pass to the designated beneficiaries. The value of the annuity is determined based on a formula specified in the trust agreement, taking into account the IRS Section 7520 interest rate. 2. Granter Retained Unit rust (GUT): A GUT is another variant of the Granter Retained Income Trust, but instead of receiving a fixed annuity payment, the granter receives a fixed percentage of the trust assets' fair market value each year. Similar to the GREAT, the remaining trust assets are distributed to the beneficiaries after the specified term expires. 3. Granter Retained Income Trust with a Qualified Personnel Residence (PRT): This specialized variant of the Granter Retained Income Trust allows the granter to transfer their primary residence or vacation home to the trust, retaining the right to use the property for a defined term. At the end of the term, the property passes to the designated beneficiaries, therefore reducing the granter's taxable estate. Advantages of a San Jose California Granter Retained Income Trust with Division into Trusts for Issue after Term of Years: 1. Estate Tax Minimization: By placing assets into an appropriately structured trust, the granter can effectively reduce their taxable estate, resulting in potential estate tax savings. 2. Income Retention: Granters can continue to receive income from the assets within the trust for a specified period, ensuring a steady income stream during their lifetime. 3. Asset Appreciation: Any appreciation on the assets held within the trust will pass to the beneficiaries at the end of the term, potentially allowing for significant wealth transfer while avoiding estate taxes on the appreciated value. 4. Gift Tax Efficiency: Structured properly, a Granter Retained Income Trust can be an effective gifting strategy, allowing for the transfer of assets to beneficiaries at a potentially lower gift tax value. Conclusion: A San Jose California Granter Retained Income Trust with Division into Trusts for Issue after Term of Years can be a powerful strategy for estate planning for residents in San Jose and surrounding areas. By retaining income, minimizing estate taxes, and facilitating the transfer of wealth to beneficiaries, these trusts can offer valuable benefits to granters and their loved ones. Consulting with a qualified estate planning attorney is crucial to ensure the trust is tailored to meet individual needs and comply with California laws.

San Jose California Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years

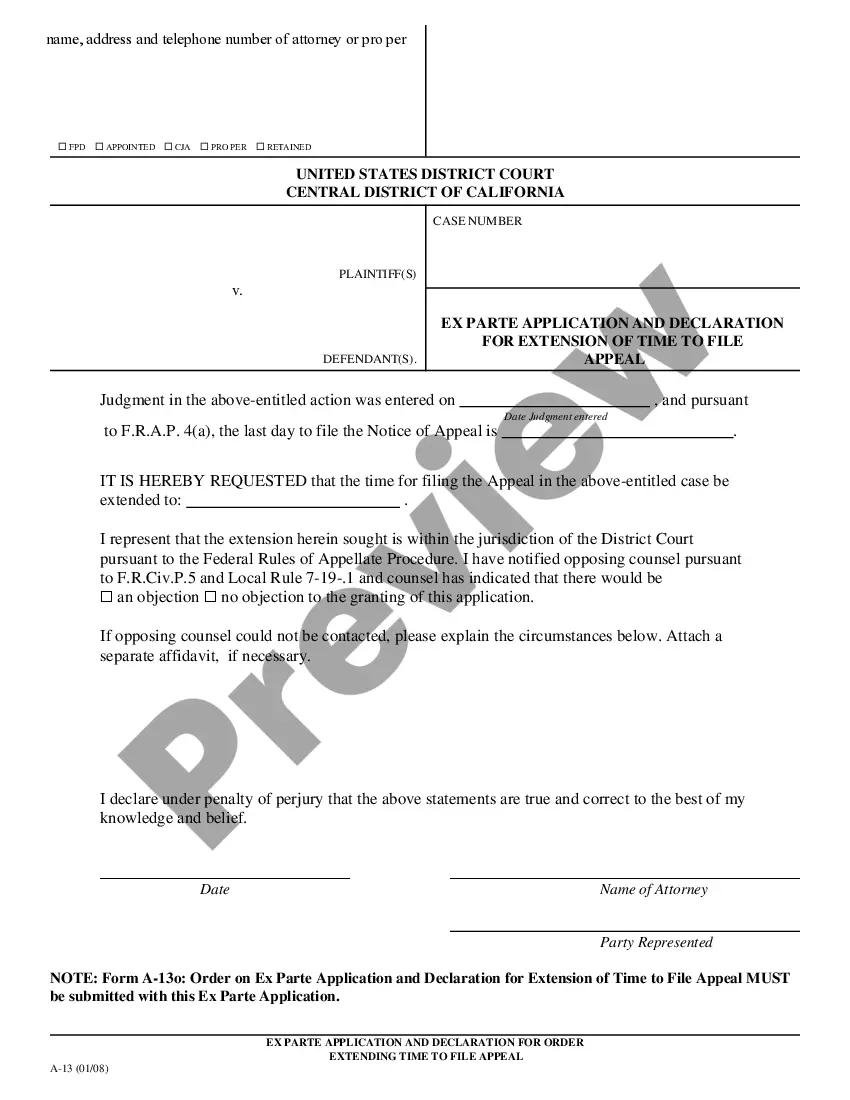

Description

How to fill out San Jose California Grantor Retained Income Trust With Division Into Trusts For Issue After Term Of Years?

If you need to find a trustworthy legal paperwork supplier to obtain the San Jose Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years, look no further than US Legal Forms. Whether you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed template.

- You can search from over 85,000 forms arranged by state/county and case.

- The intuitive interface, variety of supporting materials, and dedicated support team make it simple to locate and complete various papers.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

Simply select to look for or browse San Jose Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years, either by a keyword or by the state/county the form is intended for. After locating necessary template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the San Jose Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years template and check the form's preview and description (if available). If you're confident about the template’s language, go ahead and click Buy now. Create an account and select a subscription plan. The template will be immediately ready for download once the payment is processed. Now you can complete the form.

Taking care of your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes these tasks less expensive and more affordable. Set up your first company, arrange your advance care planning, create a real estate contract, or complete the San Jose Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years - all from the comfort of your home.

Sign up for US Legal Forms now!