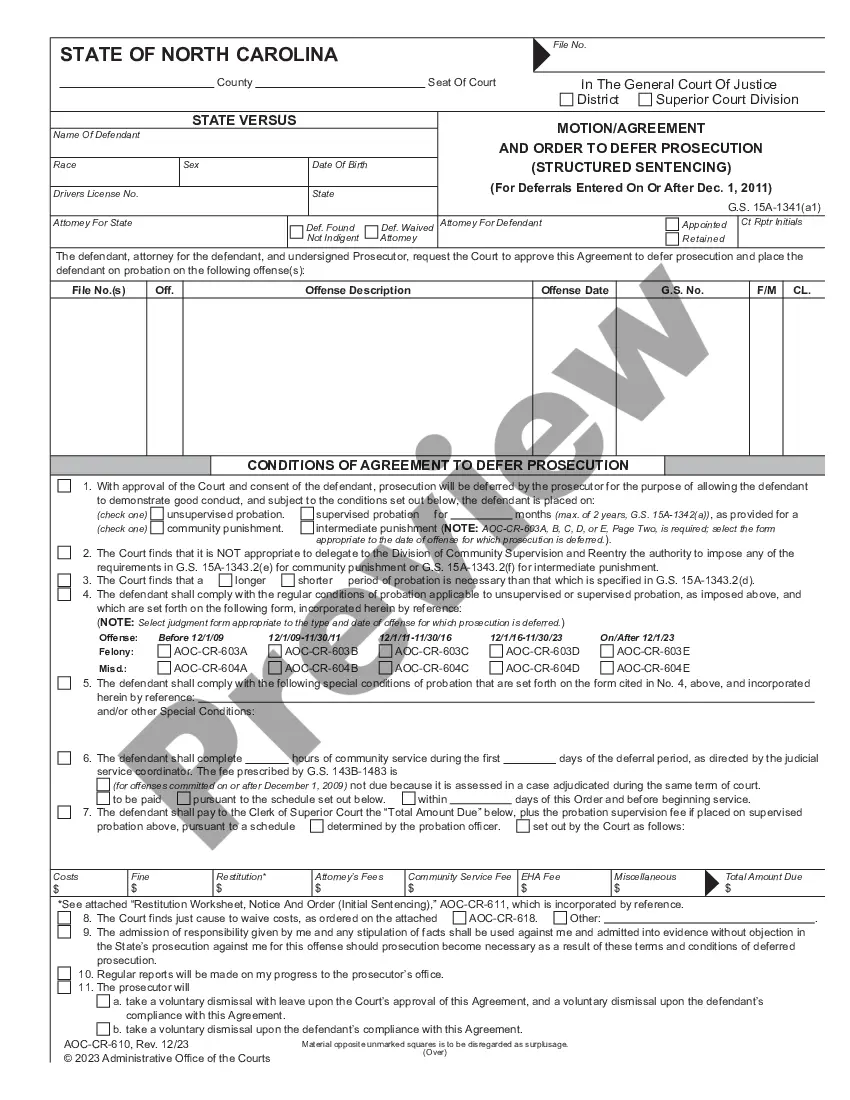

Clark Nevada Termination of Granter Retained Annuity Trust in Favor of Existing Life Insurance Trust refers to a legal process by which a Granter Retained Annuity Trust (GREAT) is terminated in favor of an existing Life Insurance Trust in the state of Nevada. This process involves the conversion of a GREAT into a life insurance policy, thereby providing the granter and beneficiaries with potential tax advantages and estate planning benefits. The primary purpose of a Clark Nevada Termination of Granter Retained Annuity Trust in Favor of Existing Life Insurance Trust is to leverage a GREAT by converting its assets into a life insurance policy that will ultimately benefit the granter's chosen beneficiaries. By doing so, the granter can potentially eliminate or reduce estate tax liabilities, enhance the value of their estate, and ensure the financial protection of their loved ones. There are different types of Clark Nevada Termination of Granter Retained Annuity Trust in Favor of Existing Life Insurance Trust that can be employed, depending on the specific circumstances and goals of the granter. These include: 1. Standard Clark Nevada Termination: This involves the straightforward termination of a GREAT in favor of an existing life insurance trust, where the assets held in the GREAT are transferred to the life insurance policy. 2. Specialized Clark Nevada Termination: This type of termination may involve additional estate planning strategies, such as reconfiguring the terms of the life insurance policy to accommodate specific needs, changing beneficiaries, or adjusting the distribution of proceeds. 3. Clark Nevada Termination with Alternative Investments: In some cases, the assets held within the GREAT can be converted into alternative investments, such as real estate, stocks, or private equity, before ultimately being transferred to the life insurance trust. This strategy allows for potential growth and diversification of assets. Overall, the termination of a Granter Retained Annuity Trust in Favor of Existing Life Insurance Trust provides granters with a flexible and efficient way to transfer assets to their chosen beneficiaries while maximizing potential tax benefits and protecting their estate. It is crucial to consult with legal and financial professionals to ensure compliance with Clark Nevada laws and to develop a comprehensive estate plan that aligns with the granter's specific objectives.

Grantor Retained Annuity Trust

Description

How to fill out Clark Nevada Termination Of Grantor Retained Annuity Trust In Favor Of Existing Life Insurance Trust?

Draftwing paperwork, like Clark Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust, to take care of your legal affairs is a tough and time-consumming task. A lot of circumstances require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can get your legal affairs into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal forms created for various scenarios and life situations. We ensure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Clark Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust template. Go ahead and log in to your account, download the template, and personalize it to your needs. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as straightforward! Here’s what you need to do before downloading Clark Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust:

- Ensure that your document is specific to your state/county since the rules for writing legal documents may differ from one state another.

- Find out more about the form by previewing it or going through a quick description. If the Clark Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to begin using our website and get the form.

- Everything looks good on your side? Hit the Buy now button and select the subscription option.

- Select the payment gateway and type in your payment details.

- Your template is good to go. You can try and download it.

It’s easy to find and buy the appropriate template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!