Houston Texas Termination of Granter Retained Annuity Trust in Favor of Existing Life Insurance Trust is a legal process that involves terminating a Granter Retained Annuity Trust (GREAT) and transferring the assets held in the GREAT to an Existing Life Insurance Trust (ELITE). This allows for the preservation and efficient transfer of wealth to beneficiaries while maximizing tax benefits for the granter. A GREAT is a trust commonly used as an estate planning tool to transfer assets to future generations while minimizing estate and gift taxes. The granter contributes assets to the GREAT and retains the right to receive annuity payments for a specific period. At the end of the annuity term, any remaining assets in the GREAT pass to the designated beneficiaries, typically the granter's family members. However, in certain situations, it may be beneficial to terminate the GREAT before the annuity term expires. One such circumstance is when the granter wishes to redirect the assets from the GREAT to an existing life insurance trust. This can provide additional benefits, such as increased liquidity and the potential for a higher death benefit to be paid to beneficiaries. By terminating the GREAT and transferring its assets to an ELITE, the granter ensures that the assets are preserved and efficiently transferred to the chosen beneficiaries. The ELITE, which already exists, may have been established to hold life insurance policies that offer significant financial advantages, such as tax-free death benefit proceeds or the ability to accumulate cash value. In Houston, Texas, the Termination of Granter Retained Annuity Trust in Favor of Existing Life Insurance Trust follows the state laws and regulations governing trusts and estate planning. It is important to work with experienced legal professionals who specialize in trust and estate matters to ensure compliance with local laws and to optimize the benefits of this strategy. While Houston Texas Termination of Granter Retained Annuity Trust in Favor of Existing Life Insurance Trust generally refers to the process described above, there may be variations or specific types depending on individual circumstances, such as the type of assets involved or the specific goals of the granter. It is recommended to consult with attorneys specializing in estate planning to determine the most appropriate strategy for each unique situation.

Houston Texas Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust

Description

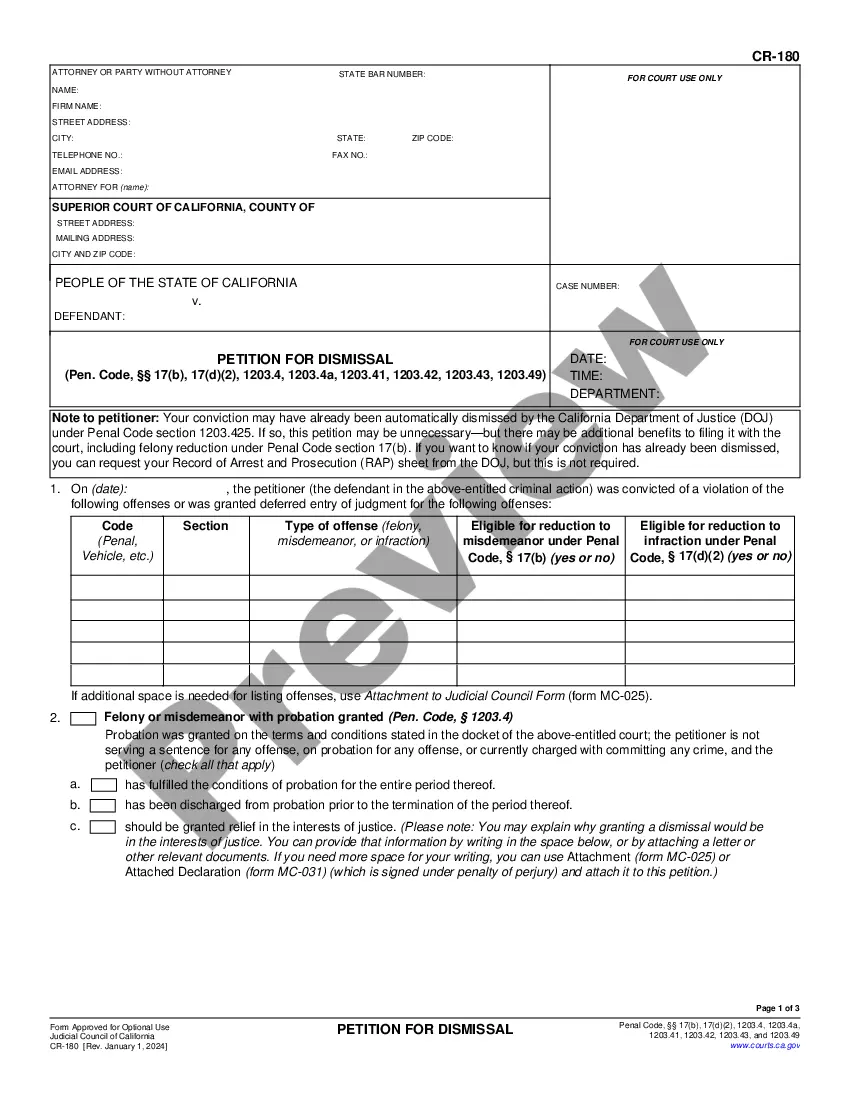

How to fill out Houston Texas Termination Of Grantor Retained Annuity Trust In Favor Of Existing Life Insurance Trust?

Are you looking to quickly draft a legally-binding Houston Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust or probably any other document to manage your personal or corporate matters? You can go with two options: contact a professional to write a legal paper for you or draft it entirely on your own. Thankfully, there's another option - US Legal Forms. It will help you receive professionally written legal documents without having to pay sky-high fees for legal services.

US Legal Forms offers a huge catalog of more than 85,000 state-compliant document templates, including Houston Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust and form packages. We offer documents for an array of life circumstances: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed template without extra hassles.

- To start with, double-check if the Houston Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust is tailored to your state's or county's laws.

- If the document includes a desciption, make sure to verify what it's intended for.

- Start the search again if the document isn’t what you were looking for by using the search box in the header.

- Select the subscription that is best suited for your needs and move forward to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Houston Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. In addition, the documents we provide are updated by industry experts, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

The most common power that creates grantor trust status is the power to substitute assets in a non-fiduciary capacity with assets that have the same fair market value as the assets in the trust. To toggle off grantor trust status the grantor must release this power.

If an irrevocable trust has its own tax ID number, then the IRS requires the trust to file its own income tax return, which is IRS form 1041. During the lifetime of the grantor, any interest, dividends, or realized gains on the assets of the trust are taxable on the grantor's 1040 individual income tax return.

With respect to income taxes, the grantor is treated as the owner of the assets during the GRAT term and reports all income earned by the GRAT on his individual income tax return. To avoid having to file its own fiduciary income tax return, the GRAT should not apply for a separate taxpayer identification number.

Thus, the trustee cannot terminate the GRAT before expiration of the term of the grantor's qualified interest by distributing to the grantor and the remainder beneficiaries the actuarial value of their term and remainder interests, respectively.

The annuity payments cannot, however, be made in advance of the payment date. For that reason, it is important to consider the cash flow constraints on the grantor when deciding which assets will be used to fund the GRAT.

To implement this strategy, you ?zero out? the grantor retained annuity trust by accepting combined payments that are equal to the entire value of the trust, including the anticipated appreciation. In theory, there would be nothing left for the beneficiary if the trust is really zeroed out.

The annuity amount is paid to the grantor during the term of the GRAT, and any property remaining in the trust at the end of the GRAT term passes to the beneficiaries with no further gift tax consequences.

How Are GRATs Taxed? GRATs are taxed in two ways: Any income you earn from the appreciation of your assets in the trust is subject to regular income tax, and any remaining funds/assets that transfer to a beneficiary are subject to gift taxes.

The generation-skipping transfer occurs when the grantor's interest in the GRAT terminates. Thus, GST exemption must be applied when the GRAT terminates and the ability to leverage the client's GST exemption is lost.