Maricopa Arizona Termination of Granter Retained Annuity Trust in Favor of Existing Life Insurance Trust Termination of a Granter Retained Annuity Trust (GREAT) in favor of an Existing Life Insurance Trust (IIT) is a legal process that can take place in Maricopa, Arizona. This type of trust termination comes into play when the granter (the person who creates the trust) desires to terminate the GREAT and transfer its assets into an existing IIT. There are various types of Maricopa Arizona Termination of Granter Retained Annuity Trust in Favor of Existing Life Insurance Trust, including: 1. Irrevocable IIT Conversion: In this scenario, the granter converts the GREAT into an irrevocable IIT by terminating the GREAT and transferring its assets to the existing IIT. This may be done to utilize the benefits of an IIT, such as estate tax savings and asset protection. 2. Policy Replacement: Another form of termination involves replacing the life insurance policy within the GREAT with a new policy held by the IIT. The granter terminates the GREAT, and its assets are used to fund the new policy within the existing IIT. 3. Conversion to Long-Term Care IIT: Some individuals may choose to terminate a GREAT in favor of an existing IIT designed specifically for long-term care planning. The assets from the GREAT are transferred to the long-term care IIT, which provides financial protection for potential future healthcare expenses. 4. Charitable Beneficiary Modification: In certain cases, the granter may wish to modify the beneficiaries of the existing IIT by terminating the GREAT and redirecting its assets towards charitable beneficiaries. When engaging in the termination of a Granter Retained Annuity Trust in Favor of an Existing Life Insurance Trust, it is crucial to follow Arizona state laws and consult with an experienced estate planning attorney. The attorney will guide the granter through the legal process, ensuring all necessary documents are prepared and filed correctly. Keywords: Maricopa Arizona, Termination, Granter Retained Annuity Trust, Existing Life Insurance Trust, GREAT, IIT, Irrevocable IIT Conversion, Policy Replacement, Long-Term Care IIT, Charitable Beneficiary Modification, estate planning attorney, Arizona state laws.

Maricopa Arizona Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust

Description

How to fill out Maricopa Arizona Termination Of Grantor Retained Annuity Trust In Favor Of Existing Life Insurance Trust?

Laws and regulations in every sphere differ from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Maricopa Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for various life and business scenarios. All the forms can be used multiple times: once you purchase a sample, it remains accessible in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Maricopa Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust from the My Forms tab.

For new users, it's necessary to make several more steps to get the Maricopa Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust:

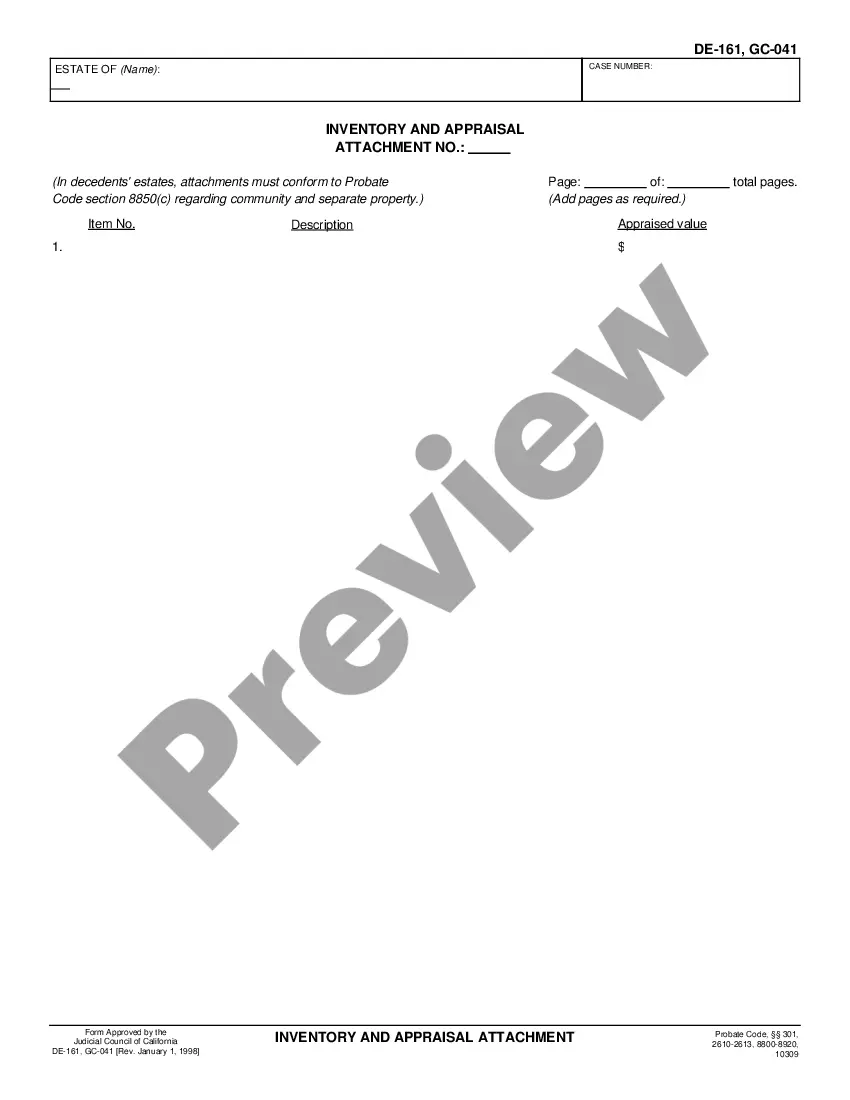

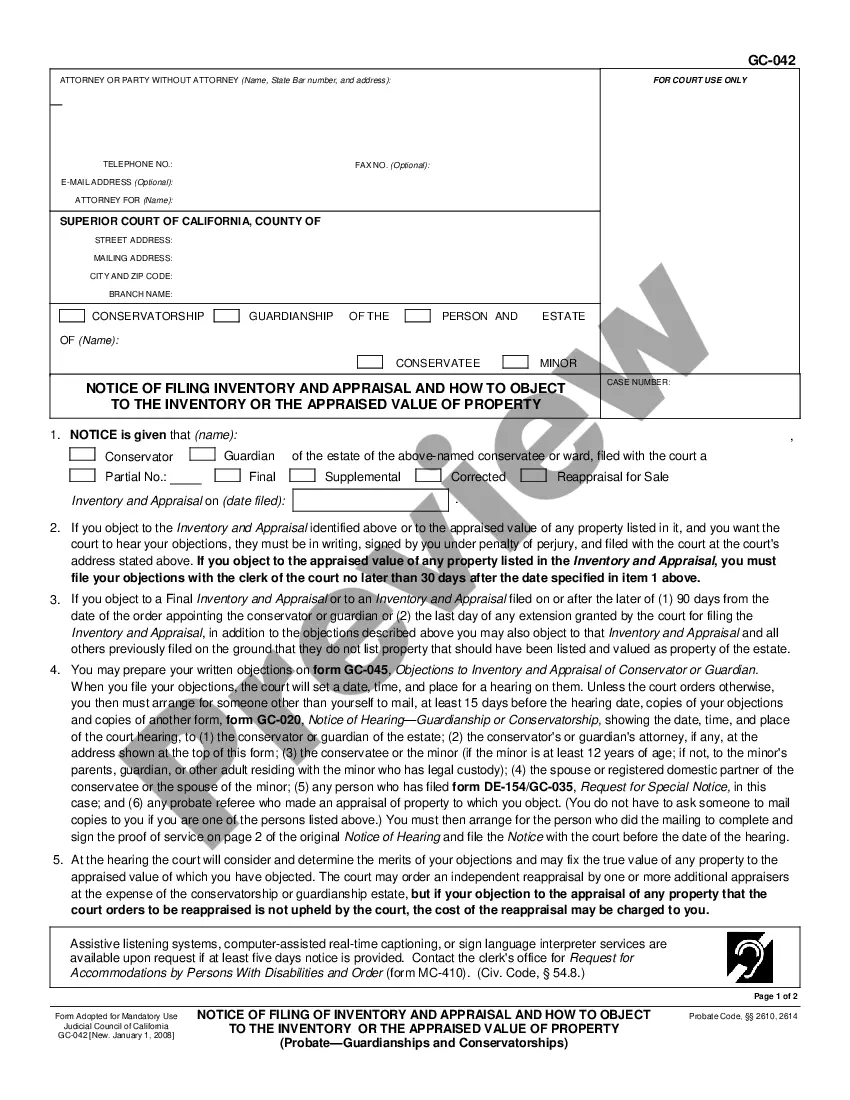

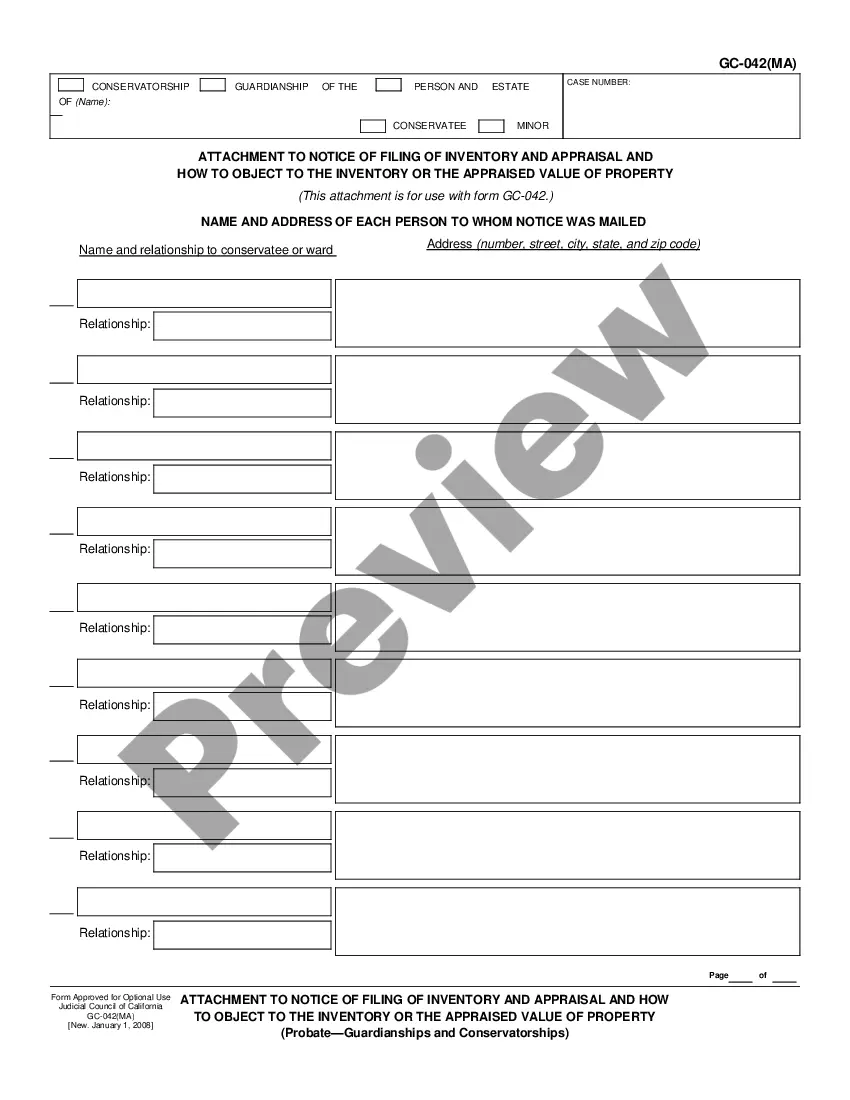

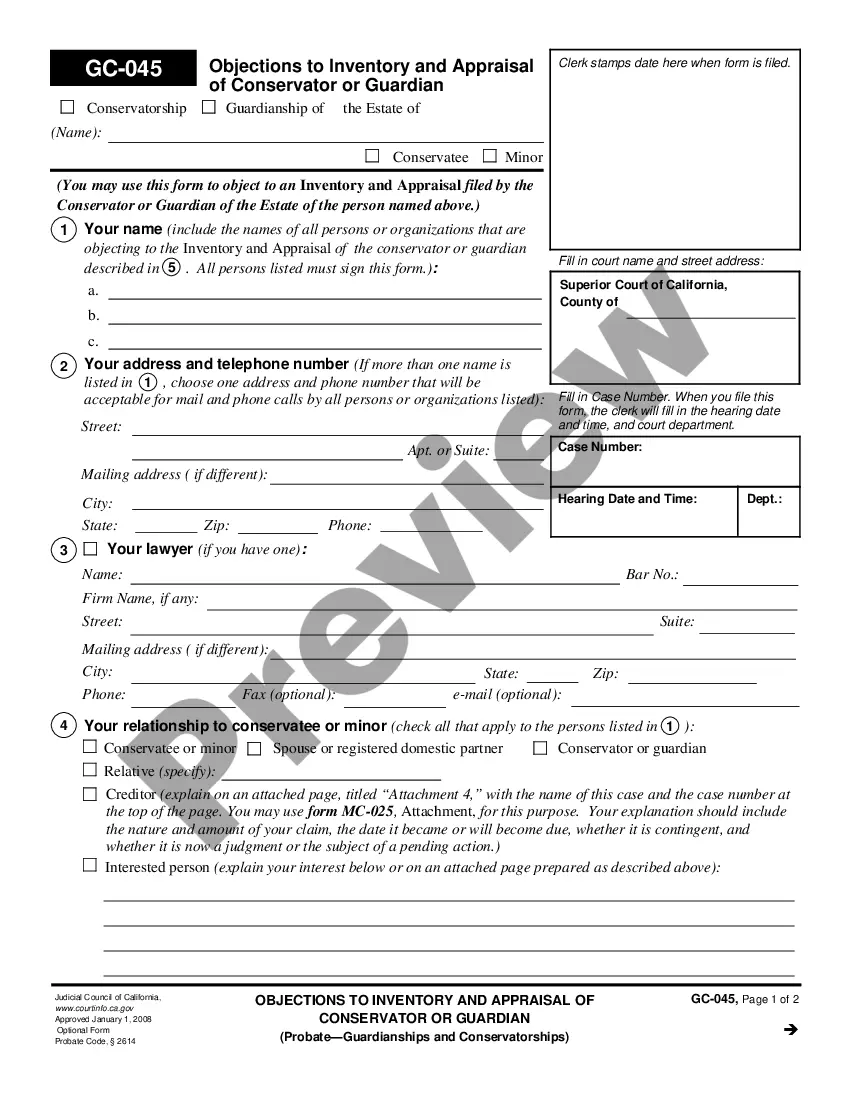

- Take a look at the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the document once you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!