Orange, California, Termination of Granter Retained Annuity Trust in Favor of Existing Life Insurance Trust In Orange, California, the termination of a Granter Retained Annuity Trust (GREAT) in favor of an existing Life Insurance Trust provides individuals with a strategic financial planning tool. This process allows for the conversion of assets held in a GREAT into an existing Life Insurance Trust (IIT), offering various benefits to the granter and their beneficiaries. A Granter Retained Annuity Trust is a legally binding trust in which the granter transfers assets to the trust and retains the right to receive an annuity payment back from the trust for a specific term or for the remainder of the granter's life. During the annuity term, the GREAT's assets may appreciate, allowing any appreciation to pass to the beneficiaries free of estate taxes. However, circumstances may change, and the granter may wish to terminate the GREAT and redirect its assets to an existing Life Insurance Trust. This termination process can be done in several ways, depending on the specific goals and objectives of the granter and beneficiaries. One type of termination method is to distribute the assets of the GREAT to the existing Life Insurance Trust. This transfer can provide numerous advantages, such as leveraging the value of the GREAT assets, ensuring the tax-efficient transfer of wealth, and protecting the assets from potential creditors. Another termination method is a direct redesignation of the GREAT to an IIT. By reassigning the GREAT as an IIT, the assets originally held in the GREAT become assets of the IIT, thus allowing for continued tax advantages and control over the assets by the granter. The termination of a granter retained annuity trust in favor of an existing life insurance trust requires careful analysis and planning. Consulting with experienced professionals specializing in estate planning and wealth management is crucial to ensure the process adheres to legal requirements and maximizes benefits for the granter and beneficiaries. In Orange, California, individuals can seek the guidance of reputable financial advisors, estate planning attorneys, and tax experts who possess expertise in terminating Grants in favor of existing Life Insurance Trusts. These professionals assist with navigating the complex legalities, tax implications, and administration involved in the process, ultimately helping individuals create a comprehensive and efficient estate plan. In conclusion, Orange, California, offers individuals the opportunity to terminate a Granter Retained Annuity Trust and redirect its assets to an existing Life Insurance Trust. By leveraging the benefits of both trusts, individuals can optimize their estate planning strategies, protect assets, and ensure the efficient transfer of wealth for themselves and their beneficiaries.

Orange California Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust

Description

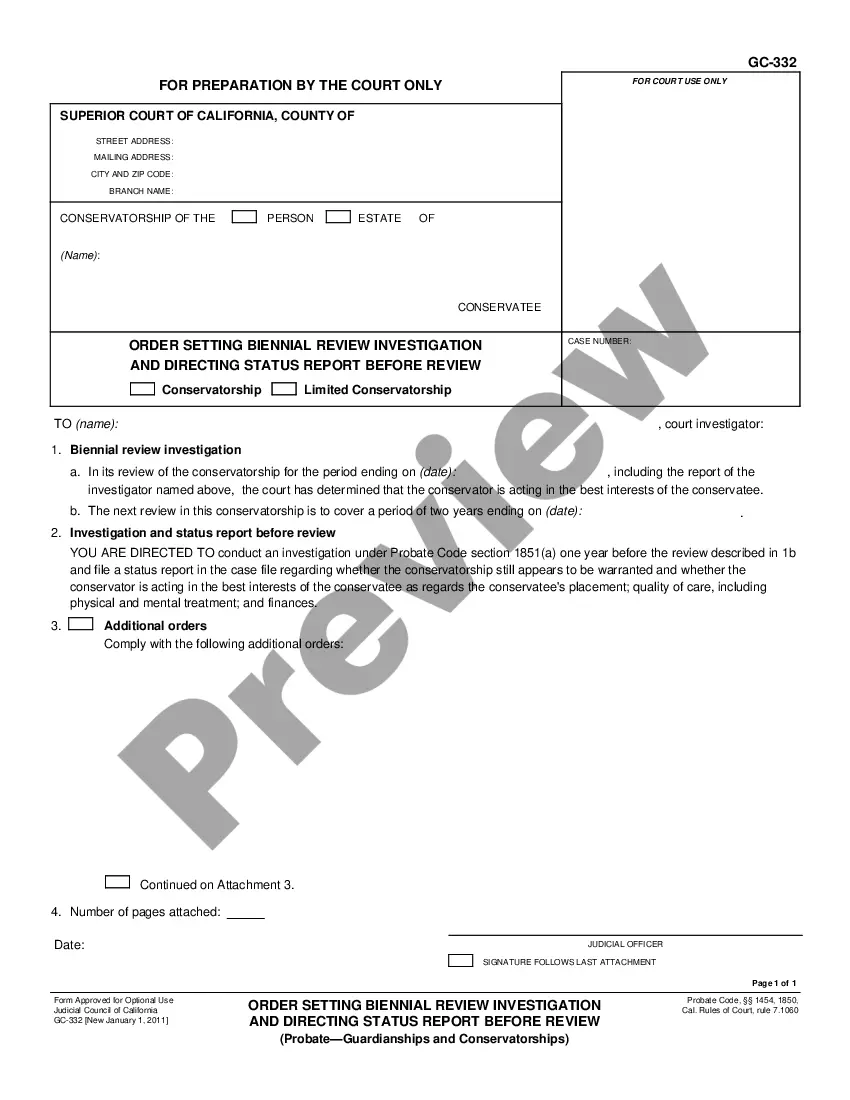

How to fill out Orange California Termination Of Grantor Retained Annuity Trust In Favor Of Existing Life Insurance Trust?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and lots of other life situations require you prepare official documentation that varies from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal templates. Here, you can easily locate and download a document for any individual or business purpose utilized in your county, including the Orange Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust.

Locating forms on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Orange Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to obtain the Orange Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust:

- Ensure you have opened the proper page with your local form.

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form satisfies your requirements.

- Search for another document via the search option in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Select the appropriate subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Orange Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!