The Riverside California Termination of Granter Retained Annuity Trust in Favor of Existing Life Insurance Trust is a legal process that allows the granter to terminate their Granter Retained Annuity Trust (GREAT) and transfer the remaining assets into an existing Life Insurance Trust (IIT) in Riverside, California. This termination can be a strategic decision to maximize the benefits and financial planning opportunities for the granter and their beneficiaries. One type of Riverside California Termination of Granter Retained Annuity Trust in Favor of Existing Life Insurance Trust is when the granter decides to terminate their GREAT due to changes in their financial situation or estate planning goals. This could be prompted by a change in investment strategies, a desire to secure a larger life insurance policy, or to take advantage of current estate planning laws. Another type of termination that may occur is if the granter wants to transfer the assets from their GREAT into their existing IIT. This could be done to consolidate assets, simplify estate planning, or enhance the liquidity of the IIT. The termination process requires careful consideration and requires the expertise of an estate planning attorney who is well-versed in the specific laws and regulations of Riverside, California. The attorney will guide the granter through the necessary legal steps, ensuring compliance, and addressing any potential tax implications. Upon termination of the GREAT, the remaining assets are typically transferred to the existing IIT. This trust will hold the life insurance policy and provide the granter's chosen beneficiaries with the specified benefits. By terminating the GREAT in favor of the IIT, the granter can ensure the continuation of their estate planning goals, such as providing financial security, minimizing tax liabilities, and preserving their wealth for future generations. In summary, the Riverside California Termination of Granter Retained Annuity Trust in Favor of Existing Life Insurance Trust enables granters in Riverside to strategically terminate their GREAT and transfer the assets into an existing IIT. By utilizing this legal process, individuals can optimize their estate plans and provide for their beneficiaries in a more efficient and effective manner.

Riverside California Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust

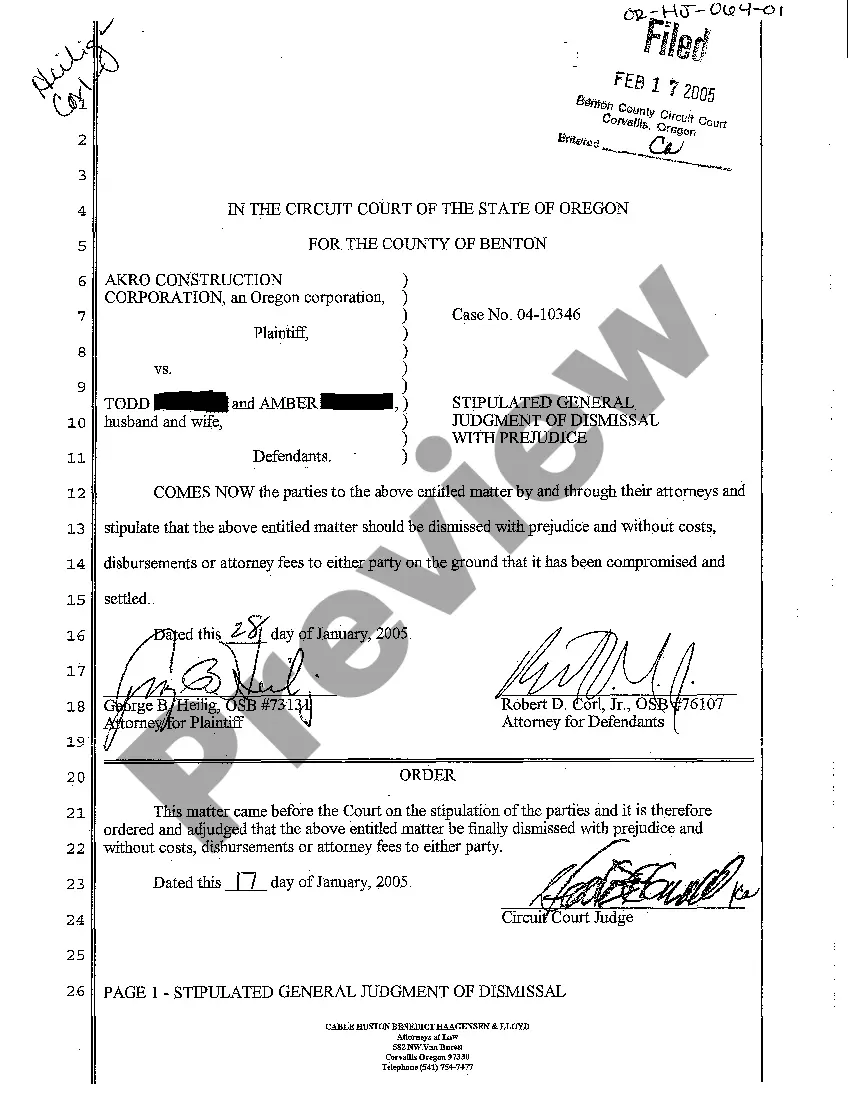

Description

How to fill out Riverside California Termination Of Grantor Retained Annuity Trust In Favor Of Existing Life Insurance Trust?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for qualified assistance to draft some of them from scratch, including Riverside Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in different categories varying from living wills to real estate papers to divorce documents. All forms are organized based on their valid state, making the searching process less challenging. You can also find information resources and guides on the website to make any activities related to document execution straightforward.

Here's how you can locate and download Riverside Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust.

- Go over the document's preview and outline (if available) to get a basic information on what you’ll get after getting the document.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can impact the validity of some documents.

- Check the similar document templates or start the search over to find the appropriate document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment method, and purchase Riverside Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Riverside Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust, log in to your account, and download it. Of course, our website can’t take the place of a lawyer entirely. If you have to cope with an exceptionally challenging case, we recommend using the services of a lawyer to review your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of users. Join them today and get your state-specific paperwork with ease!