In Houston, Texas, an "Assignment of Interest in Trust" is a legal document used to transfer ownership or control of a trust interest from one party to another. This assignment serves as a vital mechanism in managing and distributing assets held within a trust. By understanding the various types of Houston Texas Assignment of Interest in Trust, individuals involved in estate planning, real estate transactions, or wealth management can choose the most suitable approach for their specific needs. One type of Houston Texas Assignment of Interest in Trust is the "Assignment of Beneficial Interest." This type of assignment deals with transferring the beneficial ownership of assets within a trust to a new beneficiary. For example, if a person wishes to pass their interest in a trust holding real estate to their child, they can assign their beneficial interest to the child using this document. By doing so, they ensure a smooth transition of ownership while maintaining the trust structure intact. Another commonly used Houston Texas Assignment of Interest in Trust is the "Assignment of Trustee Interest." This assignment is employed when someone wants to transfer the authority and responsibilities of serving as a trustee to another individual or entity. Trustees hold a fiduciary duty to act in the best interest of the trust beneficiaries, and this assignment enables the appointment of a new trustee who can carry out these obligations effectively. Furthermore, there is the "Assignment of Income Interest in Trust." This type of assignment primarily focuses on the transfer of income generated from the assets held within the trust. It allows the assignor to relinquish their right to receive income from the trust, instead passing it to another individual or organization. Such assignments can be beneficial for tax planning purposes or if the original assignor prefers someone else to benefit from the trust’s income. It is essential to note that any Houston Texas Assignment of Interest in Trust must comply with the laws and regulations governing trusts in the state. The document should clearly identify the assignor, assignee, and the specific interest being transferred, ensuring everyone involved fully understands their rights and obligations after the assignment. When drafting or executing a Houston Texas Assignment of Interest in Trust, it is recommended to consult with an experienced attorney who specializes in trust law. This professional can provide personalized guidance, ensuring the assignment accurately reflects the intentions of the parties involved and meets the necessary legal requirements. By engaging an attorney, individuals can have peace of mind knowing their asset transfers and distributions within the trust are carried out in compliance with the laws of Houston, Texas.

Houston Texas Assignment of Interest in Trust

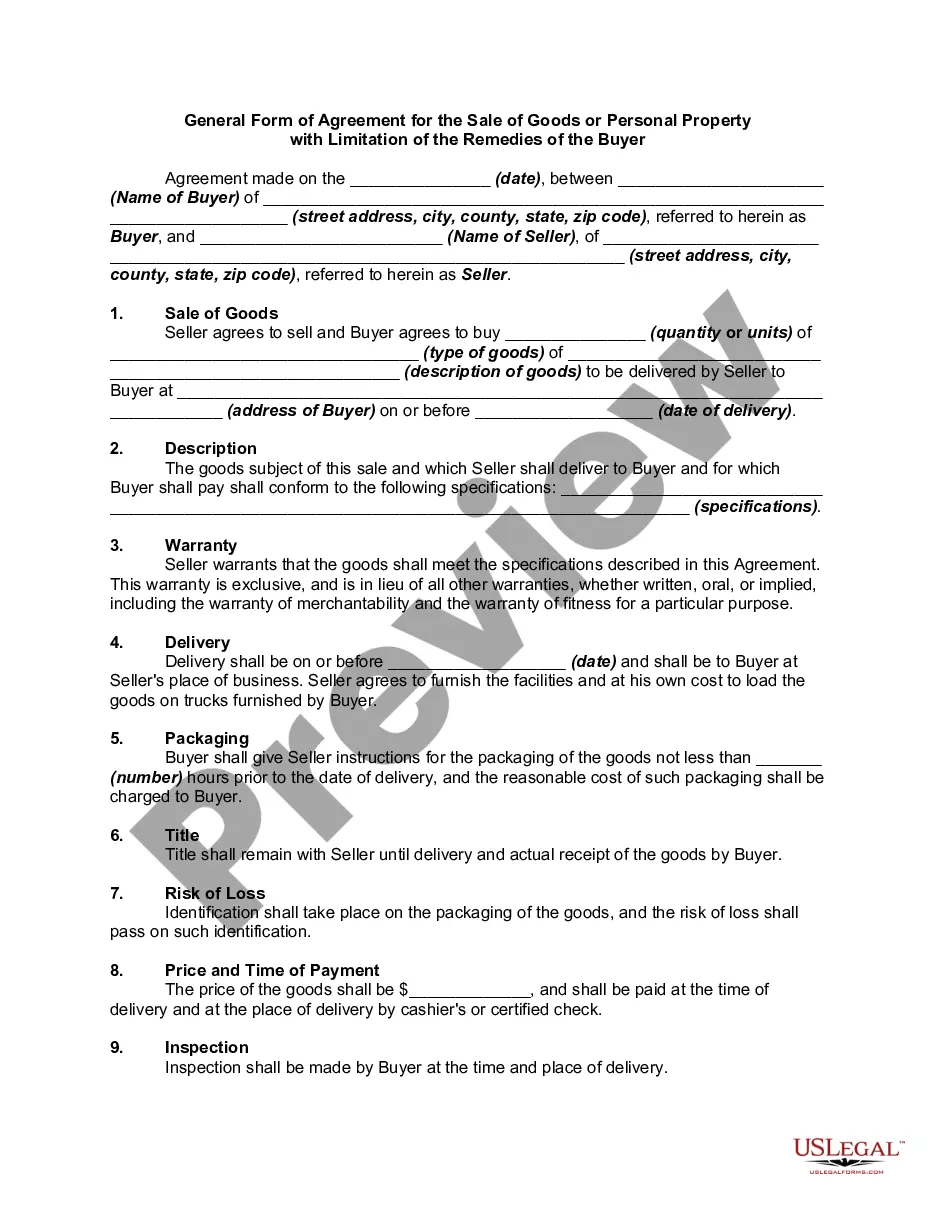

Description

How to fill out Houston Texas Assignment Of Interest In Trust?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare official paperwork that differs throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and download a document for any individual or business objective utilized in your region, including the Houston Assignment of Interest in Trust.

Locating samples on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the Houston Assignment of Interest in Trust will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guide to get the Houston Assignment of Interest in Trust:

- Ensure you have opened the right page with your regional form.

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Search for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Houston Assignment of Interest in Trust on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!