Kings New York Assignment of Interest in Trust is a legal document that involves the transfer of ownership or rights in a property to a trust for the purpose of management and protection. It is a crucial tool used in estate planning and asset protection strategies. The assignment can take different forms and may be categorized based on the specific purpose it serves. Here are some types of Kings New York Assignment of Interest in Trust: 1. Real Estate Assignment of Interest in Trust: This type of assignment is commonly used when transferring ownership or partial interest in real estate properties to a trust. It ensures that the property remains within the trust's control, allowing for efficient management and distribution of assets. 2. Assignment of Business Interest in Trust: This assignment is utilized to transfer the ownership or shares of a business entity, such as a corporation or limited liability company, into a trust. It provides a structured approach for managing and protecting the business's interests while ensuring a smooth transition of ownership. 3. Assignment of Intellectual Property Interest in Trust: For individuals or businesses holding intellectual property rights, such as patents, trademarks, or copyrights, this assignment allows the transfer of those interests to a trust. It safeguards the intellectual assets and ensures their proper utilization or distribution according to the trust's provisions. 4. Assignment of Financial Interest in Trust: This type of assignment involves transferring financial interests, such as stocks, bonds, or investment accounts, into a trust to be managed on behalf of the beneficiary. It provides a framework for the trust to oversee the assets and make informed financial decisions in accordance with the beneficiary's best interests. Kings New York Assignment of Interest in Trust serves as a legal mechanism to protect assets, facilitate estate planning, and preserve wealth for future generations. It offers various benefits, including asset consolidation, tax advantages, and the ability to avoid probate. It is essential to consult with a knowledgeable attorney to ensure compliance with relevant laws and to tailor the assignment to individual needs and objectives. By utilizing this powerful legal tool, individuals and businesses can effectively secure their assets and promote long-term financial stability.

Kings New York Assignment of Interest in Trust

Description

How to fill out Kings New York Assignment Of Interest In Trust?

How much time does it normally take you to draft a legal document? Because every state has its laws and regulations for every life situation, finding a Kings Assignment of Interest in Trust meeting all regional requirements can be tiring, and ordering it from a professional attorney is often pricey. Many web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web catalog of templates, gathered by states and areas of use. Apart from the Kings Assignment of Interest in Trust, here you can find any specific form to run your business or personal deeds, complying with your regional requirements. Experts check all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can get the document in your profile at any time in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your Kings Assignment of Interest in Trust:

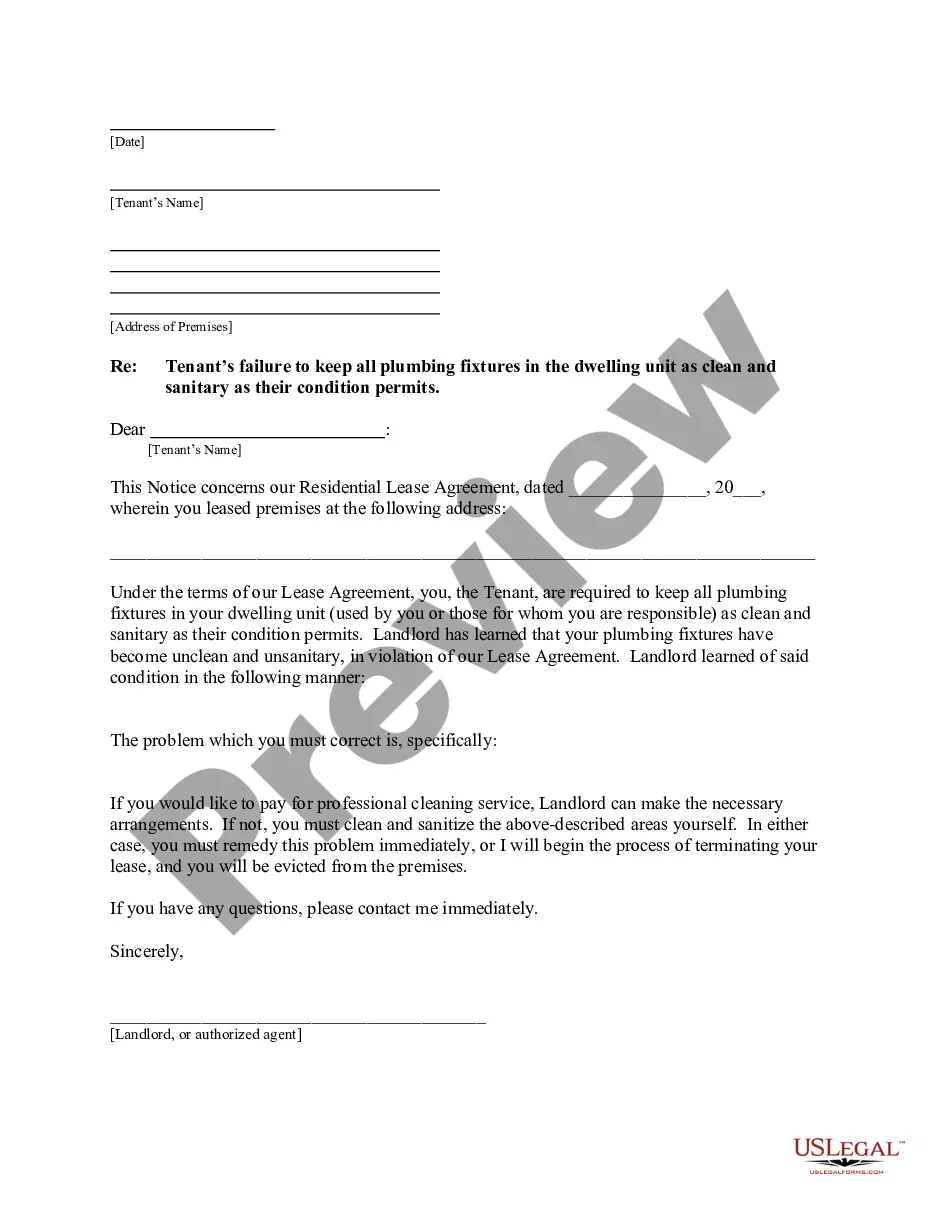

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Kings Assignment of Interest in Trust.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!