Maricopa Arizona Qualified Personnel Residence Trust (PRT) One Term Holder is a legal arrangement that allows individuals to transfer ownership of their primary residence or secondary home while still maintaining control over the property for a specific term. The term "Maricopa Arizona" refers to the location in Arizona where this trust can be established. A Maricopa Arizona PRT One Term Holder is designed to provide certain tax advantages while allowing the trust creator, known as the granter, to continue living in the property. During the term of the trust, typically a specified number of years, the granter retains the right to reside in the home and use it as their primary or secondary residence. At the end of the term, the property transfers to the beneficiaries named in the trust, such as family members or loved ones, without being subject to estate taxes. This type of trust is particularly useful for individuals who have significant assets tied up in their primary residence or secondary home and want to reduce the potential estate tax burden on their heirs. By placing the property in a Maricopa Arizona PRT One Term Holder, the taxable value of the property is considerably reduced because the granter retains the right to live in the property for the specified term. Upon the transfer of the property to the beneficiaries, its value for estate tax purposes is significantly lower than its fair market value upon transfer to the trust. It is important to note that there are variations and different types of Parts available in Maricopa Arizona. Some of these include: 1. Maricopa Arizona PRT with Multiple Term Holders: This variation allows multiple individuals, such as a couple, to be named as term holders, each with their own specified term. This can provide added flexibility and control over the property while still enjoying the tax benefits. 2. Maricopa Arizona PRT with Life Estate: In this type of PRT, the granter retains the right to live in the property for life. This ensures their continuous use and control over the property until their passing, at which point it transfers to the beneficiaries named in the trust. 3. Maricopa Arizona PRT with Step-Up in Basis: This variation allows the property's basis to be stepped up to its fair market value at the end of the trust term. This means that if the property significantly appreciates in value during the term, the beneficiaries who receive the property can potentially save on capital gains taxes upon its sale. By considering the establishment of a Maricopa Arizona PRT One Term Holder, individuals can effectively minimize their estate tax liability while maintaining control and use of their primary residence or secondary home for a specified term. It is essential to consult with a qualified estate planning attorney to determine the best approach and type of PRT that aligns with individual goals and circumstances.

Maricopa Arizona Qualified Personal Residence Trust One Term Holder

Description

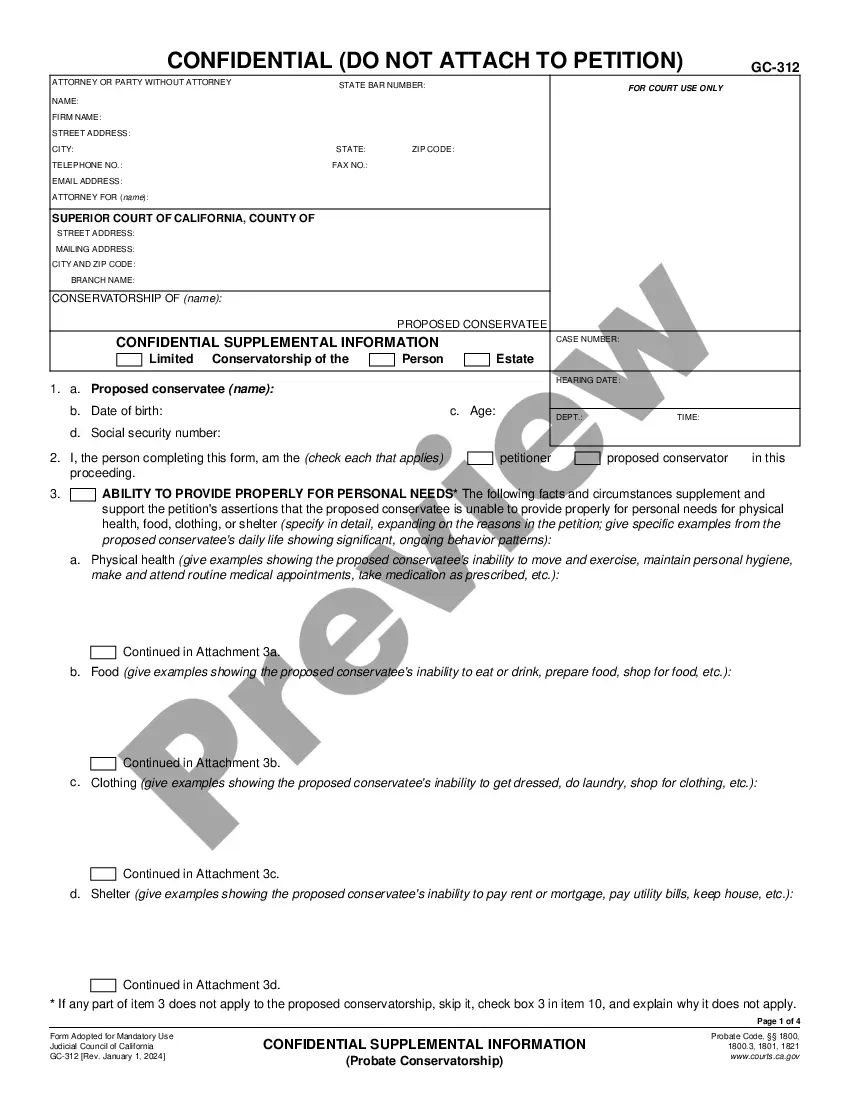

How to fill out Maricopa Arizona Qualified Personal Residence Trust One Term Holder?

Preparing documents for the business or individual demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the specific area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to draft Maricopa Qualified Personal Residence Trust One Term Holder without expert help.

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Maricopa Qualified Personal Residence Trust One Term Holder on your own, using the US Legal Forms web library. It is the greatest online collection of state-specific legal templates that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the required form.

If you still don't have a subscription, adhere to the step-by-step guide below to get the Maricopa Qualified Personal Residence Trust One Term Holder:

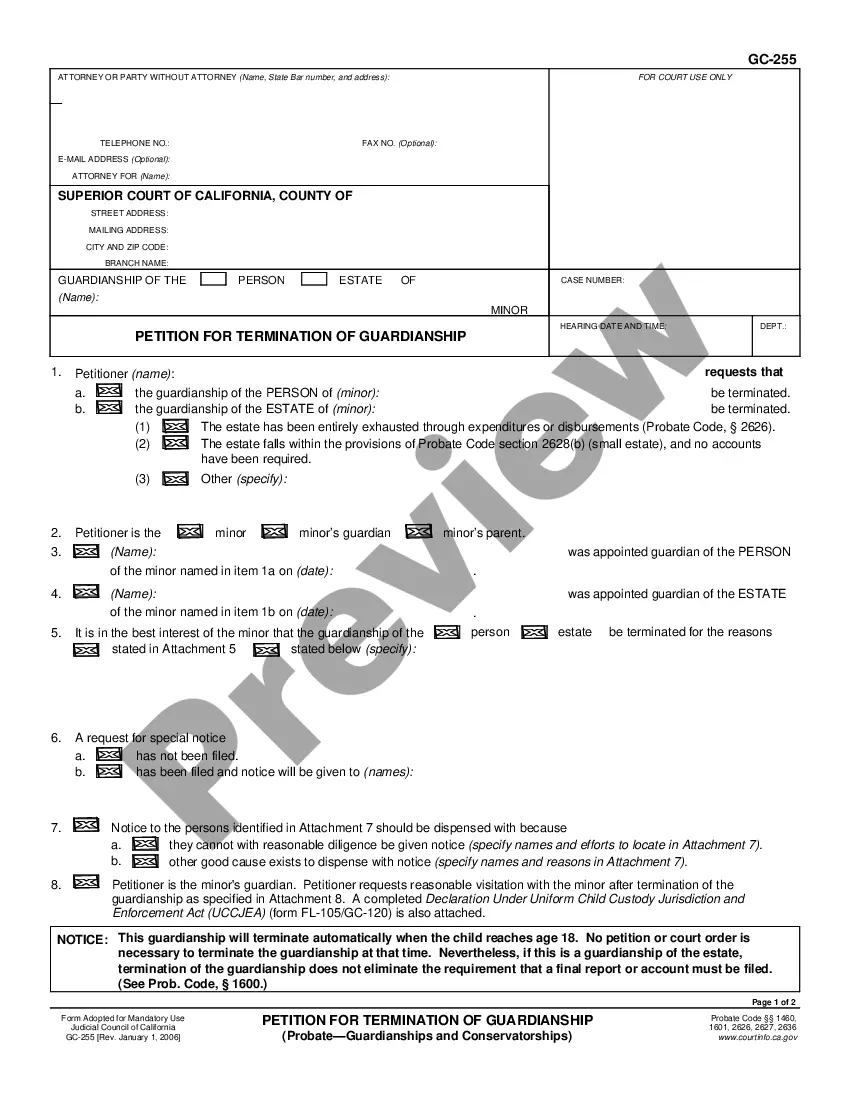

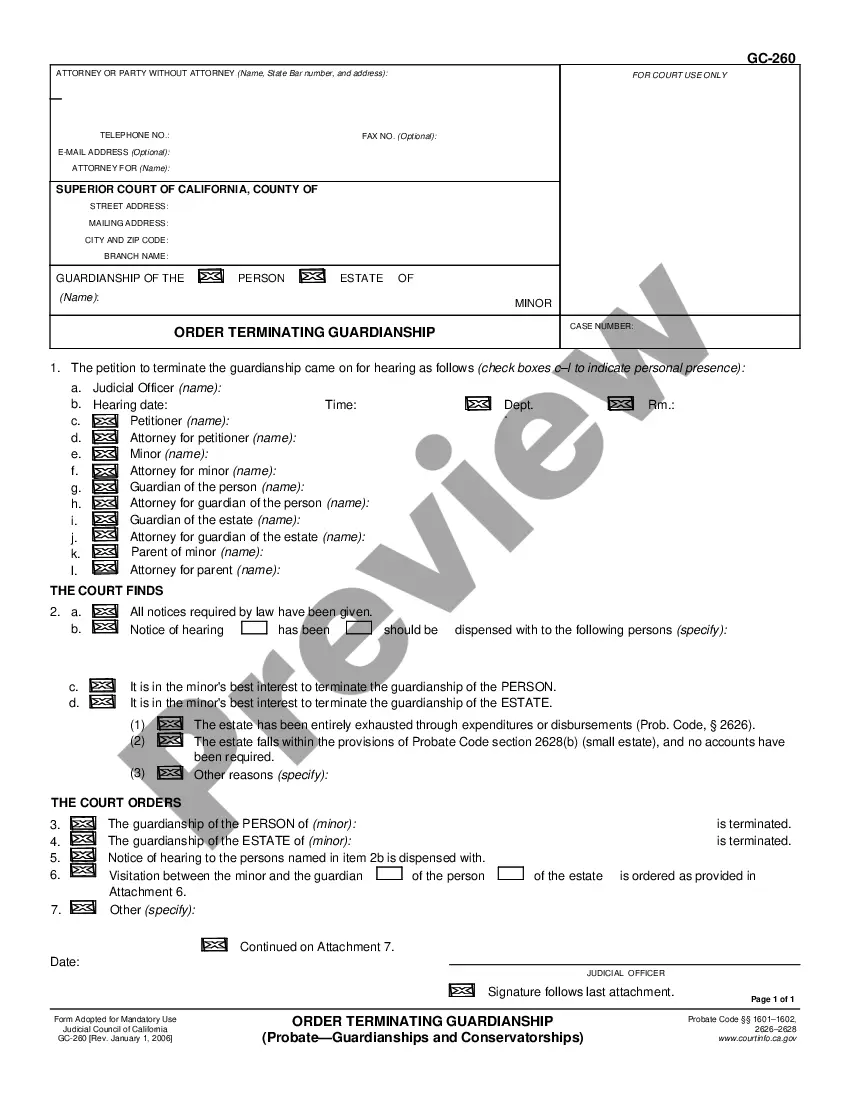

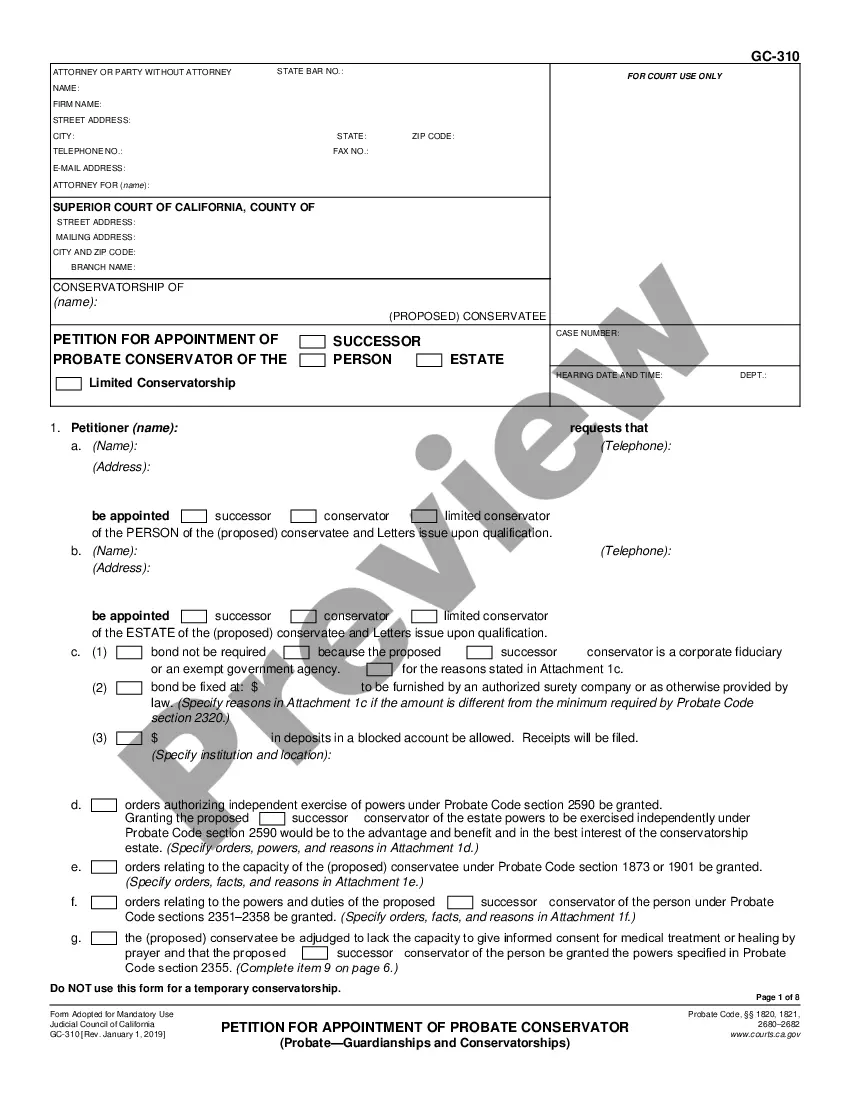

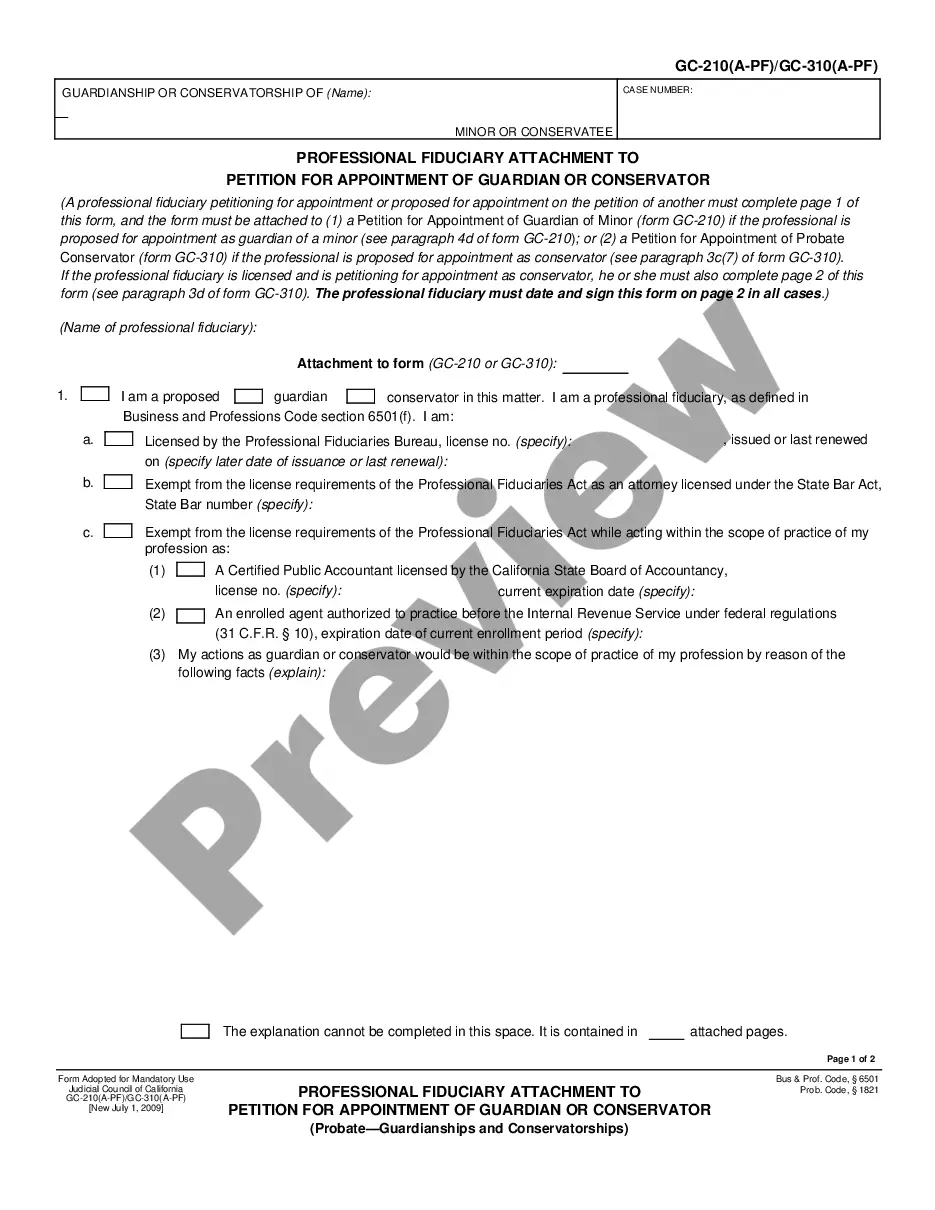

- Look through the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that suits your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any use case with just a few clicks!