A Mecklenburg North Carolina Qualified Personnel Residence Trust (PRT) is a legal instrument designed to help individuals minimize their estate taxes by transferring their primary residence or vacation home to a trust. This trust allows the property to be removed from the individual's estate, reducing the taxable value of their assets upon their death. As a One Term Holder Trust, the PRT is established for a specific term, typically between 10 and 20 years. During this term, the individual maintains the right to live in the property rent-free, enjoying all the benefits and responsibilities of homeownership. After the term expires, the property is transferred to the beneficiaries of the trust, often family members or loved ones, who can then use or sell the property as they see fit. One of the key benefits of a Mecklenburg North Carolina PRT One Term Holder is the potential for significant estate tax savings. By removing the property value from the individual's taxable estate, they can effectively reduce the overall estate tax liability on their assets. Additionally, any appreciation in the property's value during the term of the trust is also excluded from the individual's estate. It's worth noting that there may be different variations or types of Mecklenburg North Carolina Qualified Personnel Residence Trusts, including: 1. Mecklenburg North Carolina Irrevocable Qualified Personnel Residence Trust: This trust cannot be modified or revoked once established. It provides more substantial estate tax benefits but requires the individual to give up all ownership rights and control over the property. 2. Mecklenburg North Carolina Revocable Qualified Personnel Residence Trust: This trust allows the individual to maintain control and ownership of the property during their lifetime. Although it does not provide immediate estate tax reductions, it offers the flexibility to amend or revoke the trust if needed. 3. Mecklenburg North Carolina Charitable Remainder Qualified Personnel Residence Trust: This trust allows individuals to donate their property to a charitable organization while retaining the right to live in the property for a specified term. After the term expires, the property is transferred to the charitable organization, providing potential income tax deductions and estate tax benefits. In conclusion, a Mecklenburg North Carolina Qualified Personnel Residence Trust One Term Holder offers individuals the opportunity to minimize estate taxes by transferring their primary residence or vacation home to a trust for a specific term. With various types available, individuals can choose the trust that best aligns with their estate planning goals and objectives, while potentially providing tax advantages for themselves and their beneficiaries.

Mecklenburg North Carolina Qualified Personal Residence Trust One Term Holder

Description

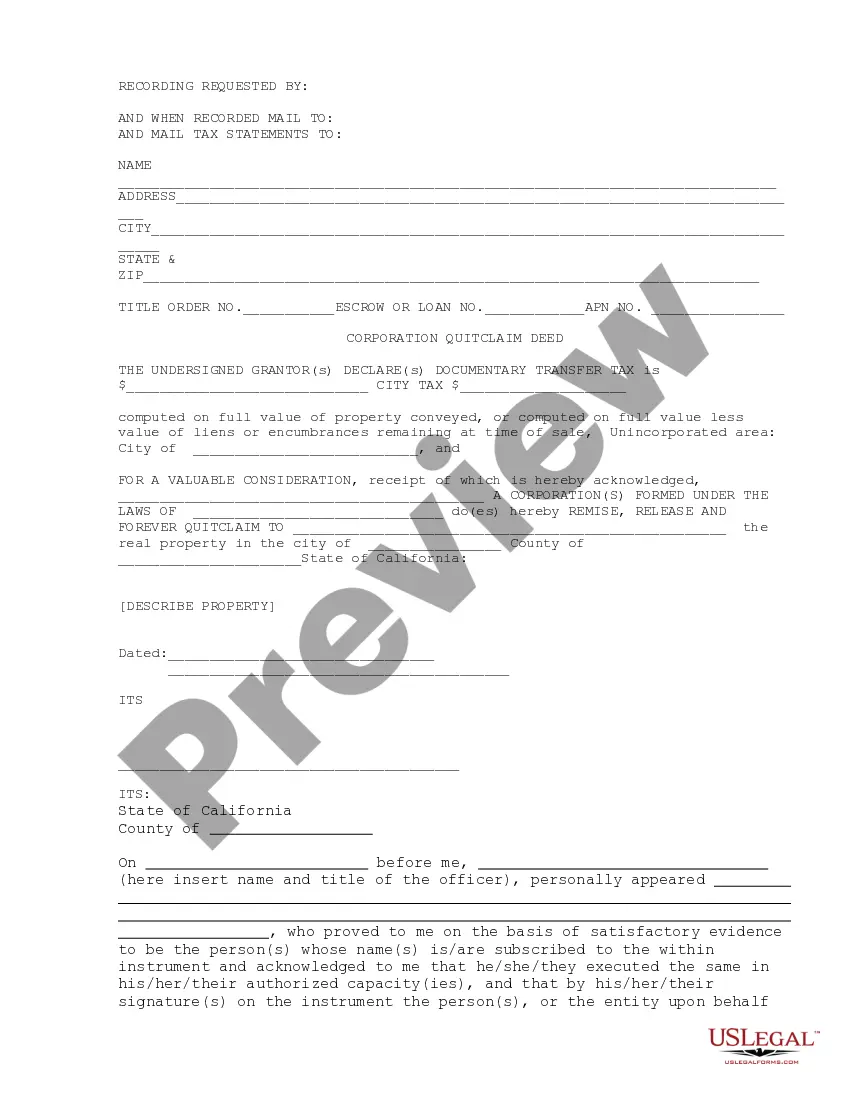

How to fill out Mecklenburg North Carolina Qualified Personal Residence Trust One Term Holder?

Draftwing forms, like Mecklenburg Qualified Personal Residence Trust One Term Holder, to manage your legal affairs is a difficult and time-consumming task. A lot of situations require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can acquire your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal documents intended for different cases and life circumstances. We ensure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the Mecklenburg Qualified Personal Residence Trust One Term Holder template. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is just as easy! Here’s what you need to do before downloading Mecklenburg Qualified Personal Residence Trust One Term Holder:

- Make sure that your template is compliant with your state/county since the regulations for creating legal documents may vary from one state another.

- Learn more about the form by previewing it or going through a brief description. If the Mecklenburg Qualified Personal Residence Trust One Term Holder isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to start using our service and download the form.

- Everything looks good on your side? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your template is ready to go. You can try and download it.

It’s easy to locate and purchase the appropriate document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!

Form popularity

FAQ

Specifically, a QPRT is an irrevocable grantor trust, which allows an individual to take advantage of the gift tax exemption by putting a personal residence, either primary or secondary, into a trust. The grantor determines how long he will retain possession and use of the residence.

A qualified personal residence trust (QPRT) is a specific type of irrevocable trust that allows its creator to remove a personal home from their estate for the purpose of reducing the amount of gift tax that is incurred when transferring assets to a beneficiary.

A qualified personal residence trust (QPRT) is a specific type of irrevocable trust that allows its creator to remove a personal home from their estate for the purpose of reducing the amount of gift tax that is incurred when transferring assets to a beneficiary.

During the initial trust term, a QPRT is a grantor trust under Sec. 677(a) as to the income portion and possibly also Sec. 673(a) for the remainder of the trust, but whether the QPRT remains a grantor trust after the initial trust term depends upon the language in the trust agreement.

QPRT and Other Trust Forms In a bare trust, the beneficiary has the absolute right to the trust's assets (both financial and non-financial, such as real estate and collectibles), as well as the income generated from these assets (such as rental income from properties or bond interest).

The higher the federal rate, the lower the gift value and the lower the potential gift tax. Conversely, a low federal interest rate usually translates into lower estate tax savings. A QPRT is a grantor trust for income tax purposes....Assumptions. Assumptions.Amount placed in QPRT (FMV of residence)$425,0005 more rows ? 30 Sept 2006

It is possible for a trust to have multiple grantors. If more than one person funded the trust, then they will each be treated as grantors in proportion to the value of the cash or property that they each provided to fund the trust.

Multiple QPRTs? No more than two QPRTs created by the same grantor may exist at the same time. To achieve three QPRTs between a married couple, a separate QPRT can be used for one property, by first changing title to a tenancy-in-common, and then each spouse giving their fractional interest to the trust.

A grantor may establish a QPRT for no more than two residences. The trusts can be funded using (1) a principal residence; (2) a vacation home or secondary residence; or (3) a fractional interest in either.

Specifically, a QPRT is an irrevocable grantor trust, which allows an individual to take advantage of the gift tax exemption by putting a personal residence, either primary or secondary, into a trust. The grantor determines how long he will retain possession and use of the residence.