A Nassau New York Qualified Personnel Residence Trust (PRT) One Term Holder is a legal arrangement that allows individuals to pass their home or other real estate property to their chosen beneficiaries while minimizing estate and gift taxes. This type of PRT is specific to Nassau County, New York, and is governed by the laws and regulations of the state. A qualified personnel residence trust is typically established by individuals who wish to transfer their primary residence or vacation home to their beneficiaries in a tax-efficient manner. The PRT allows the original owner, known as the granter, to continue residing in the property for a predetermined term, usually between 10 and 20 years. At the end of the term, ownership of the property passes to the beneficiaries, often family members, without being subject to estate taxes. One of the key advantages of a PRT is the potential reduction in estate and gift taxes. By transferring the home to the trust, the current value of the property is frozen for tax purposes, effectively removing any future appreciation from the granter's taxable estate. There are different types of Nassau New York Qualified Personnel Residence Trusts based on the duration of the trust term: 1. Nassau New York PRT One Term Holder — 10 Years: This type of PRT allows thgranteror to retain the right to reside in the property for a period of 10 years, after which the property passes to the beneficiaries. 2. Nassau New York PRT One Term Holder — 20 Years: With this variation, the granter maintains the right to live in the property for a longer term of 20 years before the transfer to the beneficiaries occurs. It is important to note that the PRT is an irrevocable trust, meaning that once established, it cannot be altered or revoked by the granter without the consent of the beneficiaries. In summary, a Nassau New York Qualified Personnel Residence Trust One Term Holder enables individuals in Nassau County, New York, to transfer their primary residence or vacation home to beneficiaries while minimizing estate and gift taxes. The trust's specific term, either 10 or 20 years, determines when the property transfers to the beneficiaries. However, it is recommended to consult with estate planning professionals and attorneys familiar with Nassau County laws to determine the suitability and legal requirements of establishing a PRT.

Nassau New York Qualified Personal Residence Trust One Term Holder

Description

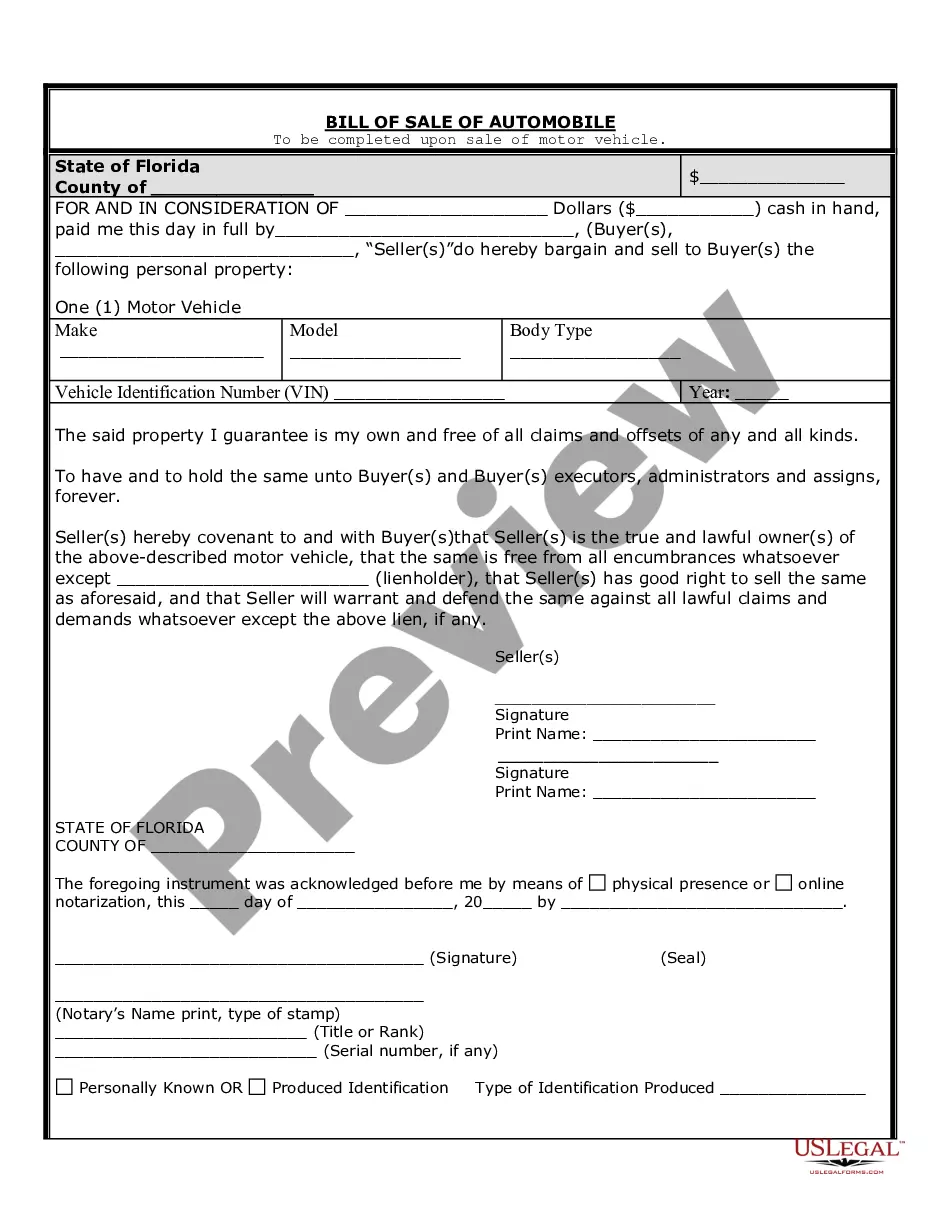

How to fill out Nassau New York Qualified Personal Residence Trust One Term Holder?

Whether you intend to start your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you need to prepare certain documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal templates for any individual or business occurrence. All files are collected by state and area of use, so opting for a copy like Nassau Qualified Personal Residence Trust One Term Holder is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of more steps to get the Nassau Qualified Personal Residence Trust One Term Holder. Adhere to the instructions below:

- Make sure the sample fulfills your individual needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample once you find the proper one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Nassau Qualified Personal Residence Trust One Term Holder in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!