Travis Texas Qualified Personnel Residence Trust One Term Holder is a special type of trust that allows individuals to transfer ownership of their primary residence while still maintaining the right to live in it for a specific term. This legal tool is commonly used by estate planners to minimize estate taxes and protect real estate assets. The Travis Texas Qualified Personnel Residence Trust (PRT) is specifically designed to be in compliance with the laws and regulations of Travis County, Texas. It enables individuals to establish a trust for the benefit of their intended beneficiaries while retaining the right to reside in their primary residence throughout the specified term. One of the key benefits of a PRT is its ability to reduce estate taxes. By transferring the property to the trust, the value of the property is effectively removed from the granter's estate for tax purposes. This can result in substantial tax savings, especially for high-net-worth individuals. Additionally, the PRT allows the granter to maintain control over the property during the term of the trust. They can continue to live in the residence, collect rental income if applicable, and make decisions regarding the property's maintenance and improvements. It's important to note that there are different types of Travis Texas Qualified Personnel Residence Trusts available, depending on the specific needs and goals of the granter. Some variations include: 1. Standard PRT: This is the most common type of PRT, where the granter transfers the ownership of their primary residence to the trust for a fixed term. 2. Granter Retained Income Trust (GRIT): This type of trust allows the granter to retain an income interest in the property while transferring the remainder interest to the trust. The granter continues to receive income from the property during the trust term. 3. Granter Retained Annuity Trust (GREAT): Unlike a PRT, a GREAT is typically used to transfer assets other than a primary residence, such as cash or securities. However, it can also be utilized for a personal residence. In summary, the Travis Texas Qualified Personnel Residence Trust One Term Holder is an estate planning strategy that provides individuals with a way to transfer ownership of their primary residence, while maintaining the right to live in it for a specific term. It offers tax benefits and flexibility for individuals looking to protect their real estate assets and minimize estate taxes.

Travis Texas Qualified Personal Residence Trust One Term Holder

Description

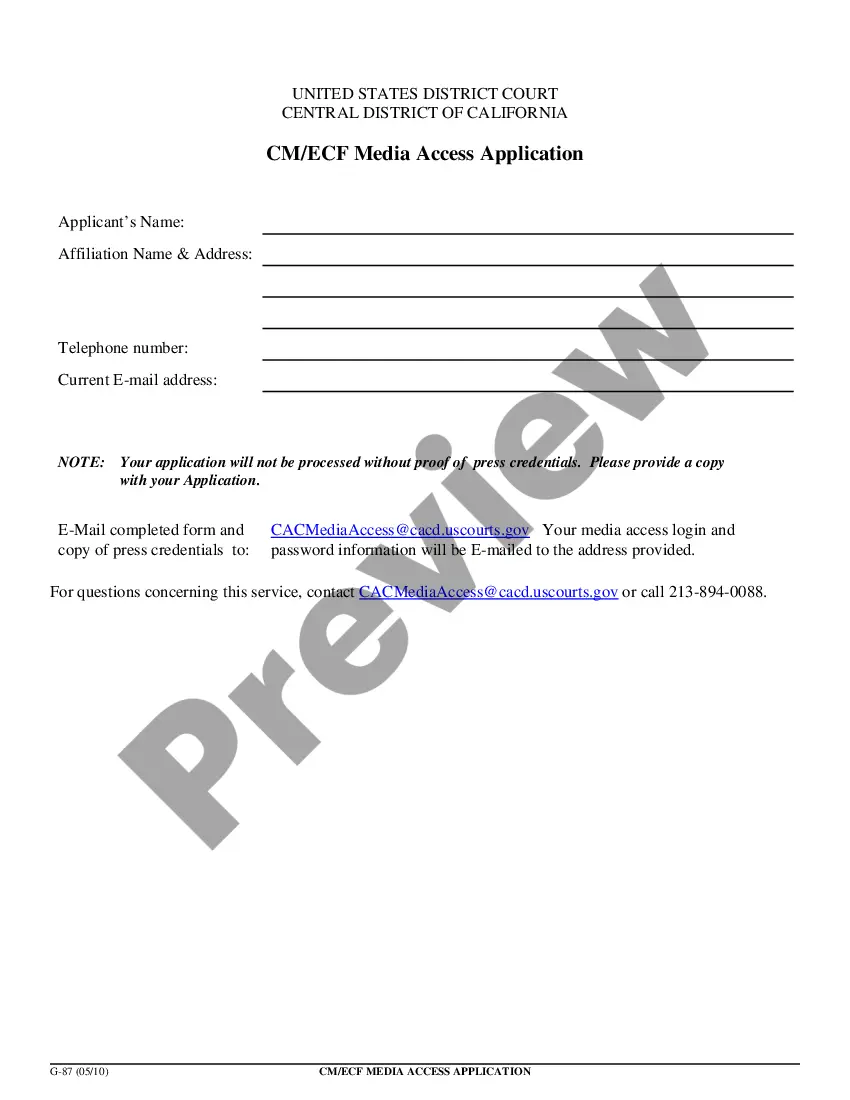

How to fill out Travis Texas Qualified Personal Residence Trust One Term Holder?

If you need to get a reliable legal document supplier to get the Travis Qualified Personal Residence Trust One Term Holder, consider US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed form.

- You can select from more than 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, number of learning resources, and dedicated support team make it simple to locate and execute various papers.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

You can simply type to look for or browse Travis Qualified Personal Residence Trust One Term Holder, either by a keyword or by the state/county the document is created for. After finding the required form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the Travis Qualified Personal Residence Trust One Term Holder template and check the form's preview and description (if available). If you're confident about the template’s language, go ahead and click Buy now. Create an account and choose a subscription option. The template will be instantly available for download once the payment is processed. Now you can execute the form.

Handling your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes this experience less expensive and more affordable. Set up your first company, arrange your advance care planning, draft a real estate contract, or execute the Travis Qualified Personal Residence Trust One Term Holder - all from the comfort of your home.

Join US Legal Forms now!

Form popularity

FAQ

It is possible for a trust to have multiple grantors. If more than one person funded the trust, then they will each be treated as grantors in proportion to the value of the cash or property that they each provided to fund the trust.

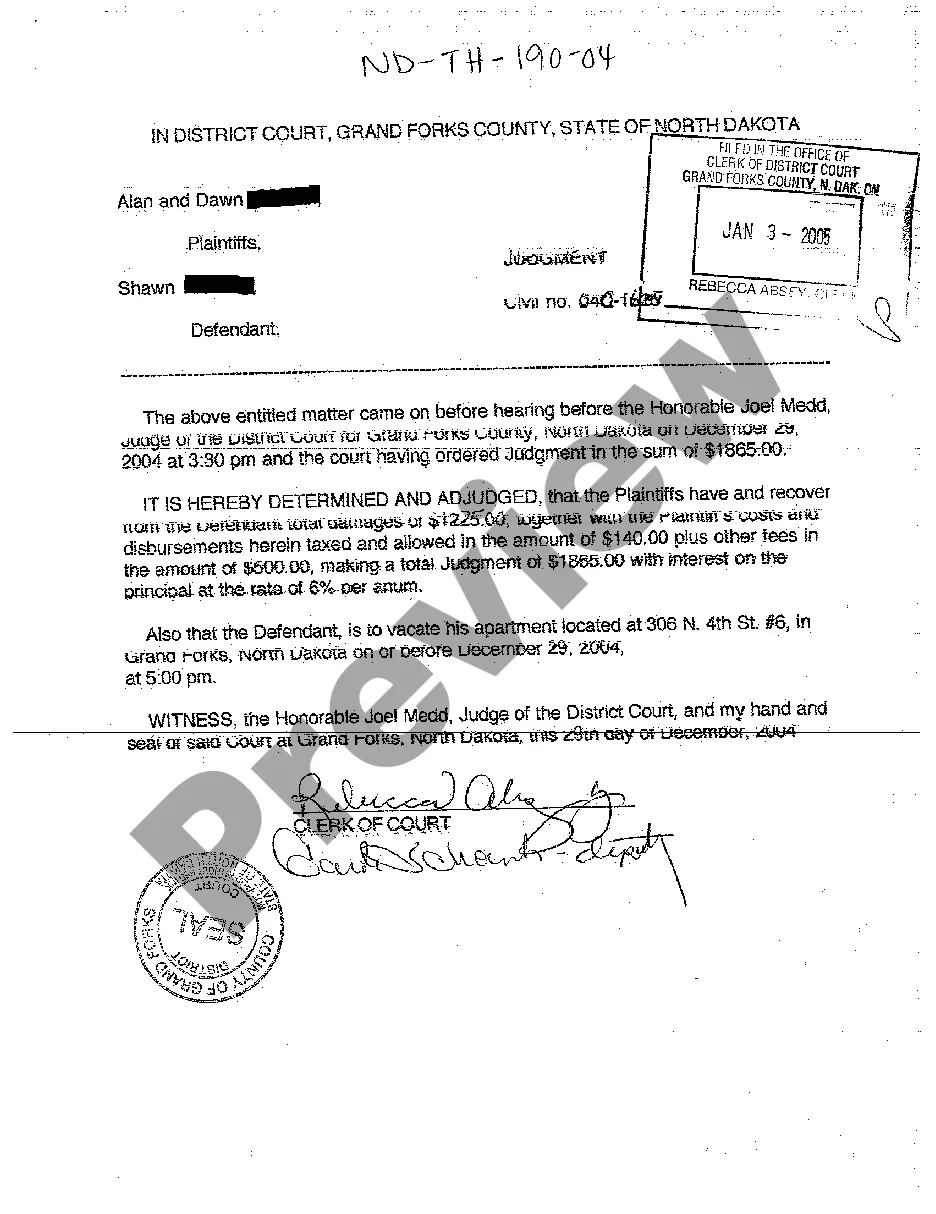

The sale of the residence without any reinvestment of the proceeds in a new residence will cause the QPRT status to terminate as to all of the assets.

A grantor may establish a QPRT for no more than two residences. The trusts can be funded using (1) a principal residence; (2) a vacation home or secondary residence; or (3) a fractional interest in either.

How Does a QPRT Work? Specifically, a QPRT is an irrevocable grantor trust, which allows an individual to take advantage of the gift tax exemption by putting a personal residence, either primary or secondary, into a trust. The grantor determines how long he will retain possession and use of the residence.

The biggest benefit of a QPRT is that it removes the value of your primary or second home and its appreciation from your taxable estate. Continued use of the property. With your home in a QPRT, you can still live in the property rent-free and enjoy any income tax deductions associated with it.

A qualified personal residence trust (QPRT) is a specific type of irrevocable trust that allows its creator to remove a personal home from their estate for the purpose of reducing the amount of gift tax that is incurred when transferring assets to a beneficiary.

Multiple QPRTs? No more than two QPRTs created by the same grantor may exist at the same time. To achieve three QPRTs between a married couple, a separate QPRT can be used for one property, by first changing title to a tenancy-in-common, and then each spouse giving their fractional interest to the trust.

It can offer great tax savings and asset protection. A QPRT is an irrevocable trust whereby the grantor gives away their house to their chosen beneficiaries.

A QPRT is a grantor trust for income tax purposes. This means the trust is not a separate taxpayer and all of the income or capital gain during the term is taxed to the grantor and reported on his or her personal income tax return.