Franklin Ohio Joint Trust with Income Payable to Trustees During Joint Lives is a specific type of trust that is commonly used in estate planning and asset protection strategies. This trust allows trustees (also known as granters or settlers) to transfer their assets into a trust while receiving income from those assets during their joint lives. It is named after the city of Franklin in the state of Ohio, where this type of trust is frequently established. In this particular trust arrangement, the trustees create a legal entity known as a joint trust. The trust document outlines the details of the trust, including the appointed trustees, beneficiaries, and how the assets are to be managed. The primary purpose of this trust is to provide financial security for the trustees during their joint lifetimes, ensuring a steady stream of income while maintaining control over the assets. The income generated from the assets within the trust is paid directly to the trustees, allowing them to utilize these funds for personal expenses or investment opportunities. By establishing this type of trust, individuals can safeguard their assets, create a reliable income stream, and potentially reduce their tax liability. It is important to note that there may be variations or alternative names for this specific type of trust, depending on the specific jurisdiction and legal requirements. Some potential variations or names for the Franklin Ohio Joint Trust with Income Payable to Trustees During Joint Lives may include: 1. Ohio Joint Revocable Living Trust with Income Retained by Trustees During Joint Lives 2. Franklin Living Trust with Income Payable to Trustees During Joint Lives 3. Joint Income Trust for Franklin Residents in Ohio 4. Franklin Ohio Joint Granter Trust with Income Retained by Settlers During Joint Lives These specific variations may reflect slight differences in the legal language and terminology used, but ultimately serve the purpose of achieving the same goals outlined in the original trust description. It is crucial to consult a qualified estate planning attorney in Franklin, Ohio, for guidance and the most accurate information when establishing or utilizing this type of trust.

Franklin Ohio Joint Trust with Income Payable to Trustors During Joint Lives

Description

How to fill out Franklin Ohio Joint Trust With Income Payable To Trustors During Joint Lives?

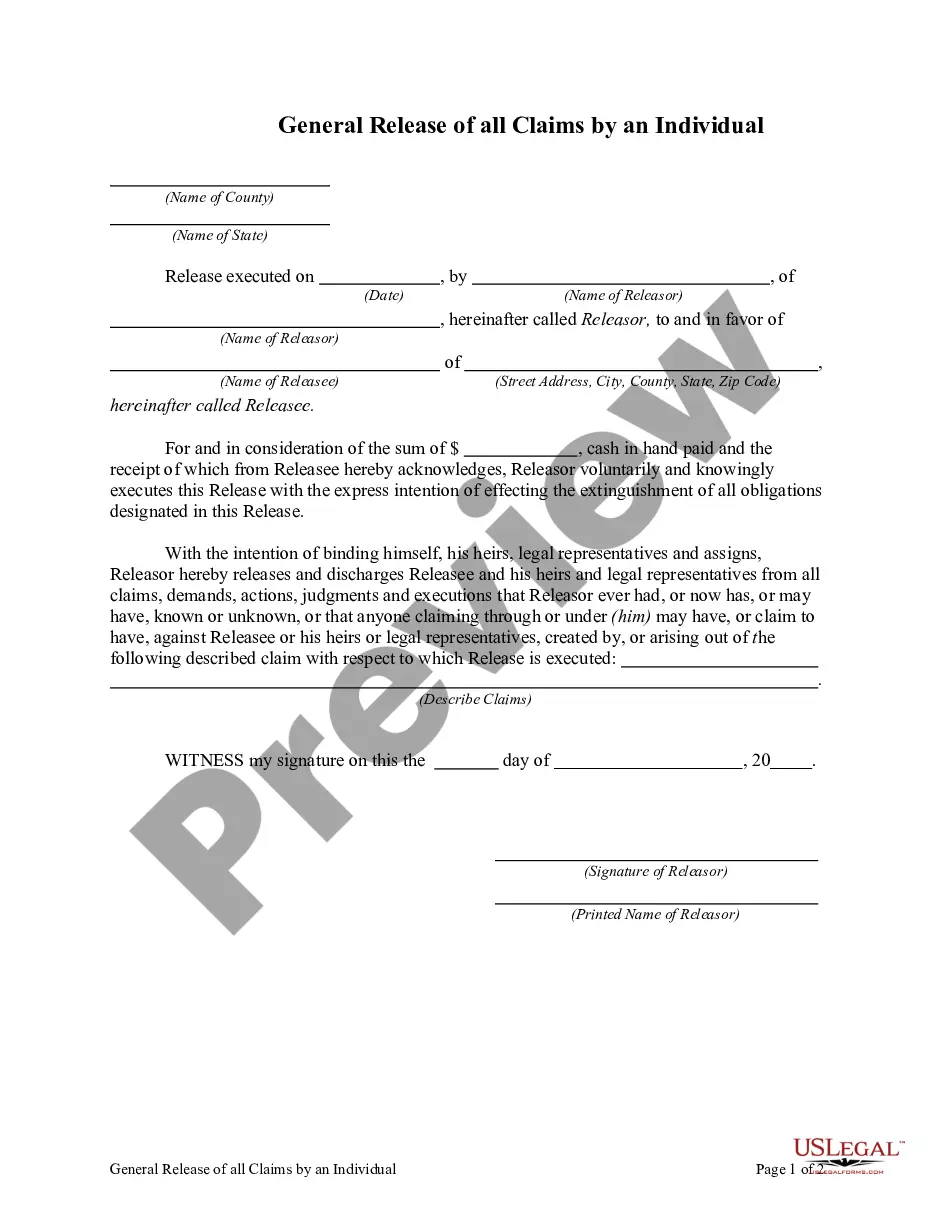

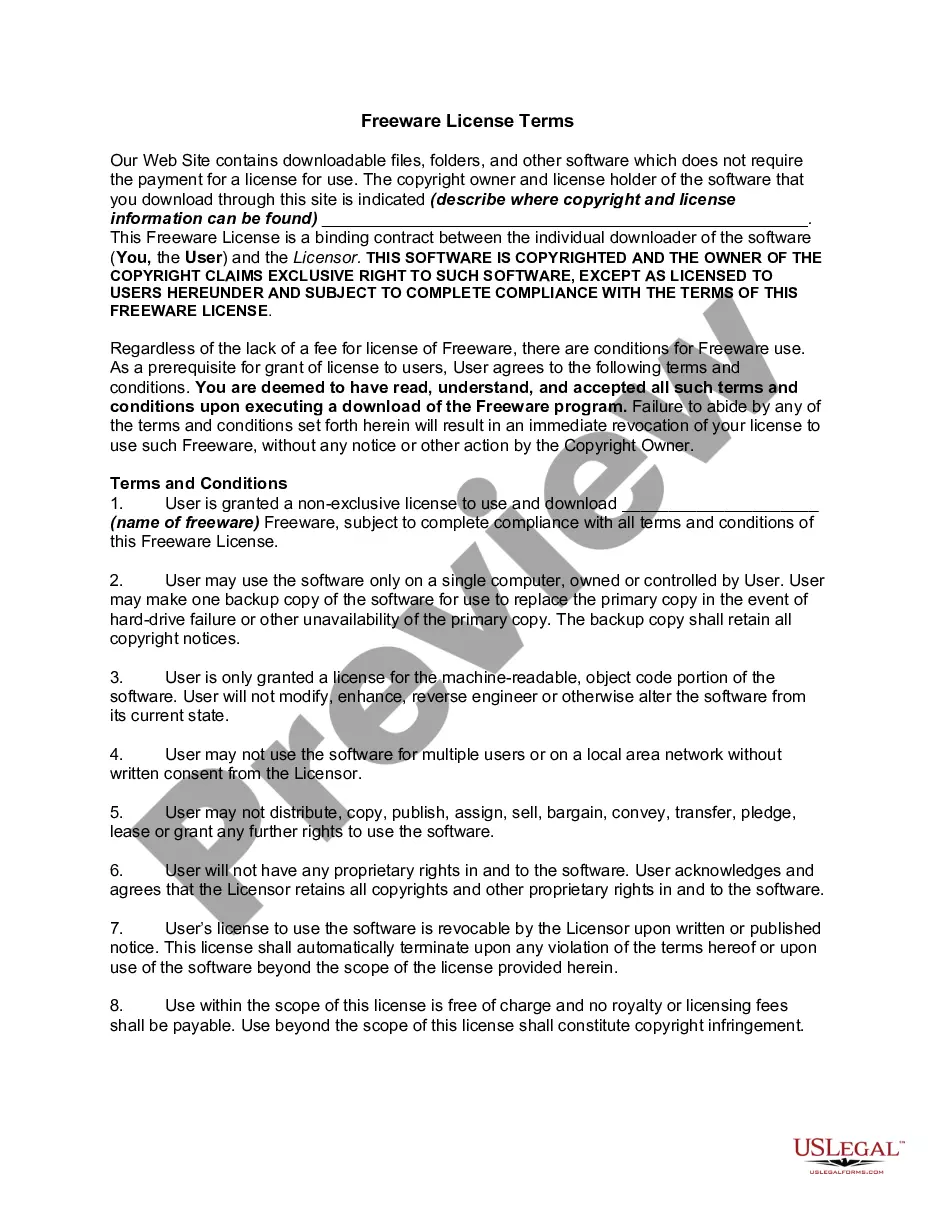

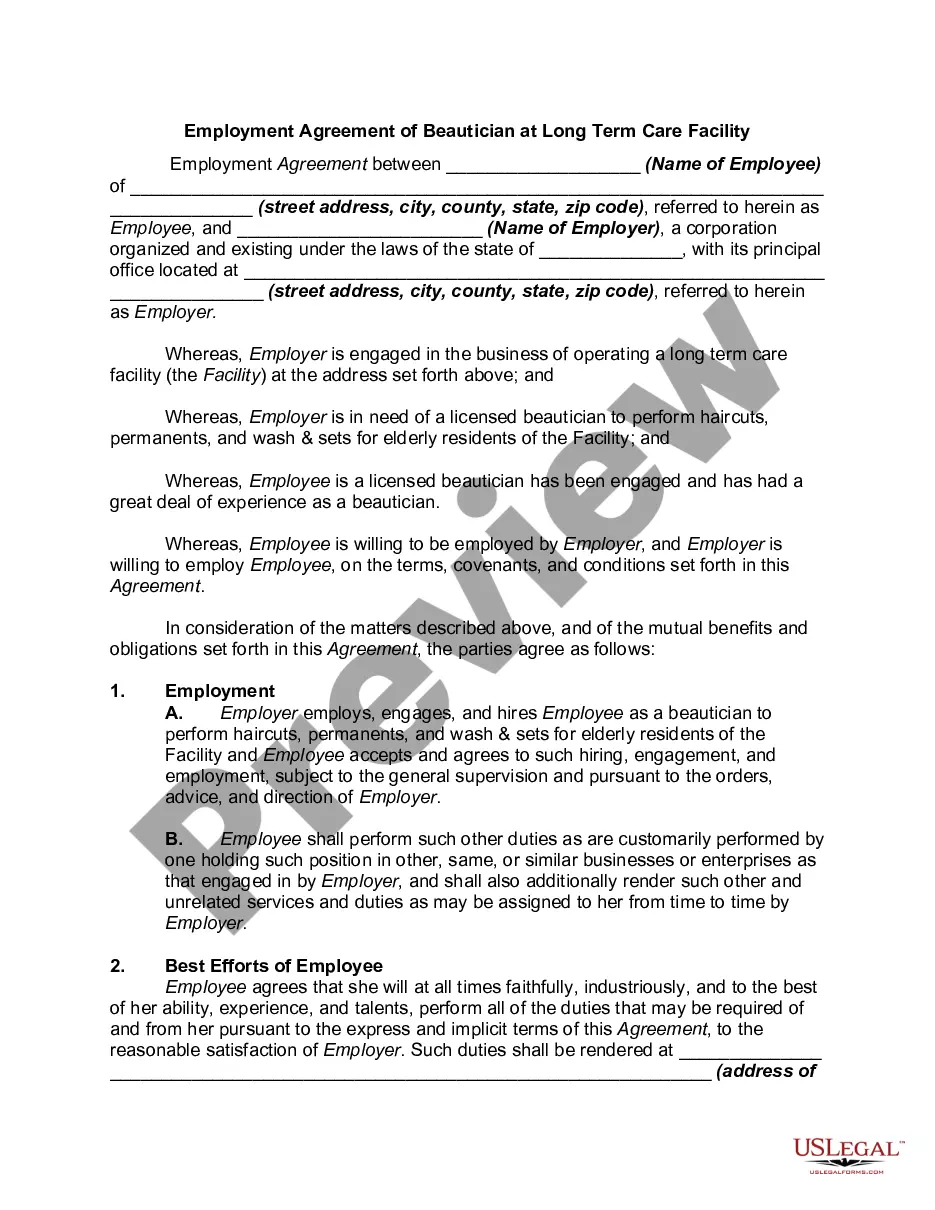

Preparing legal paperwork can be burdensome. Besides, if you decide to ask a lawyer to draft a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Franklin Joint Trust with Income Payable to Trustors During Joint Lives, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case gathered all in one place. Consequently, if you need the latest version of the Franklin Joint Trust with Income Payable to Trustors During Joint Lives, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Franklin Joint Trust with Income Payable to Trustors During Joint Lives:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your Franklin Joint Trust with Income Payable to Trustors During Joint Lives and download it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

Assets held in a joint revocable trust are considered to be equally owned by the two spouses as joint grantors of the joint revocable trust at the time of the first spouse's death, however, only their 50% share is stepped-up in basis.

An estate or trust can generate income that must be reported on Form 1041, United States Income Tax Return for Estates and Trusts.

If you establish a trust, the IRS identifies it through your social security number. You are not required to file a separate tax return. If you receive income from trust assets, you would report this on your individual return. The assets, however, remain under the ownership of the trust.

Schedule K-1 (Form 1041), Beneficiary's Share of Income, Deductions, Credits, etc. Use Schedule K-1 to report a beneficiary's share of the estate's or trust's income, credits, deductions, etc., on your Form 1040, U.S. Individual Income Tax Return.

A: Trusts must file a Form 1041, U.S. Income Tax Return for Estates and Trusts, for each taxable year where the trust has $600 in income or the trust has a non-resident alien as a beneficiary.

The IRS assumes this money was already taxed before it was put into the trust. After money is placed into the trust, the interest it accumulates is taxable as incomeeither to the beneficiary or the trust. The trust is required to pay taxes on any interest income it holds and doesn't distribute past year-end.

Yes, if the trust is a simple trust or complex trust, the trustee must file a tax return for the trust (IRS Form 1041) if the trust has any taxable income (gross income less deductions is greater than $0), or gross income of $600 or more.

If a joint living trust is drafted so that upon the first spouse's death the amount of the entire property is included in the decedent spouse's death, the surviving spouse will receive a step2010up in cost basis as to the entire amount of the property in the Trust.

A: Trusts must file a Form 1041, U.S. Income Tax Return for Estates and Trusts, for each taxable year where the trust has $600 in income or the trust has a non-resident alien as a beneficiary.

The answer to your question is likely yes, you will get a 100 percent step up in basis, as your facts indicate that the securities are community property. The general rule is that property acquired during marriage that is not inheritance or gift is considered community property.