Dear [Employee], I am writing to inform you about our company's Employee Automobile Expense Allowance policy. At our company, we understand that you may incur expenses related to the use of your personal vehicle for work purposes. Therefore, we have established a program to reimburse you for these expenses. Salt Lake City, Utah, offers a vast network of roads, highways, and public transportation options. However, we recognize that certain tasks and responsibilities may require the use of a personal vehicle. Hence, our Employee Automobile Expense Allowance program is intended to cover those expenses reasonably incurred while conducting company business. Under this program, eligible employees may be reimbursed for expenses such as fuel, maintenance, insurance, parking fees, and toll charges. To be considered eligible, employees must meet specific criteria, including but not limited to, holding a valid driver's license, appropriate insurance coverage, and adhering to all traffic and safety regulations. In addition to the standard Employee Automobile Expense Allowance, there may be specific categories or types of allowances tailored to different employee roles or tasks. Some examples include: 1. Sales Representative Allowance: This allowance is designed for our sales team, who spend a significant amount of time visiting clients, attending conferences, and making sales pitches. It covers expenses related to client meetings, transportation to and from prospects, meals or accommodation during business trips, and any other relevant sales-related expenses. 2. Field Operations Allowance: Our field operations team may have different requirements due to their responsibilities, such as site visits, equipment transportation, or service calls. This allowance is meant to cover expenses incurred during these activities, including fuel, maintenance, parking, and any other necessary expenses. 3. Management Travel Allowance: Executives and managers who travel frequently for business purposes often encounter various expenses. This allowance is designed to compensate them for costs related to airfare or train tickets, ground transportation, lodging, meals, and other business-related expenses incurred during their trips. To claim reimbursement, you are required to maintain accurate records of your expenses, including receipts, invoices, and any other relevant documentation. These need to be submitted along with a completed expense report form to the HR department within [timeframe] following the expense. Reimbursement will be made according to our company's expense reimbursement policy, procedures, and timelines. It is important to note that this allowance is subject to change and approval by the management team. Furthermore, any misuse or fraudulent claims may result in disciplinary actions, including termination of employment and legal consequences. If you have any questions or need clarification regarding our Employee Automobile Expense Allowance policy or any specific allowance category, please don't hesitate to reach out to me or our HR department. Thank you for your understanding and adherence to this policy. We appreciate your dedication to your work and the company. Sincerely, [Your Name] [Your Title/Position] [Company Name]

Salt Lake Utah Sample Letter for Employee Automobile Expense Allowance

Description

How to fill out Salt Lake Utah Sample Letter For Employee Automobile Expense Allowance?

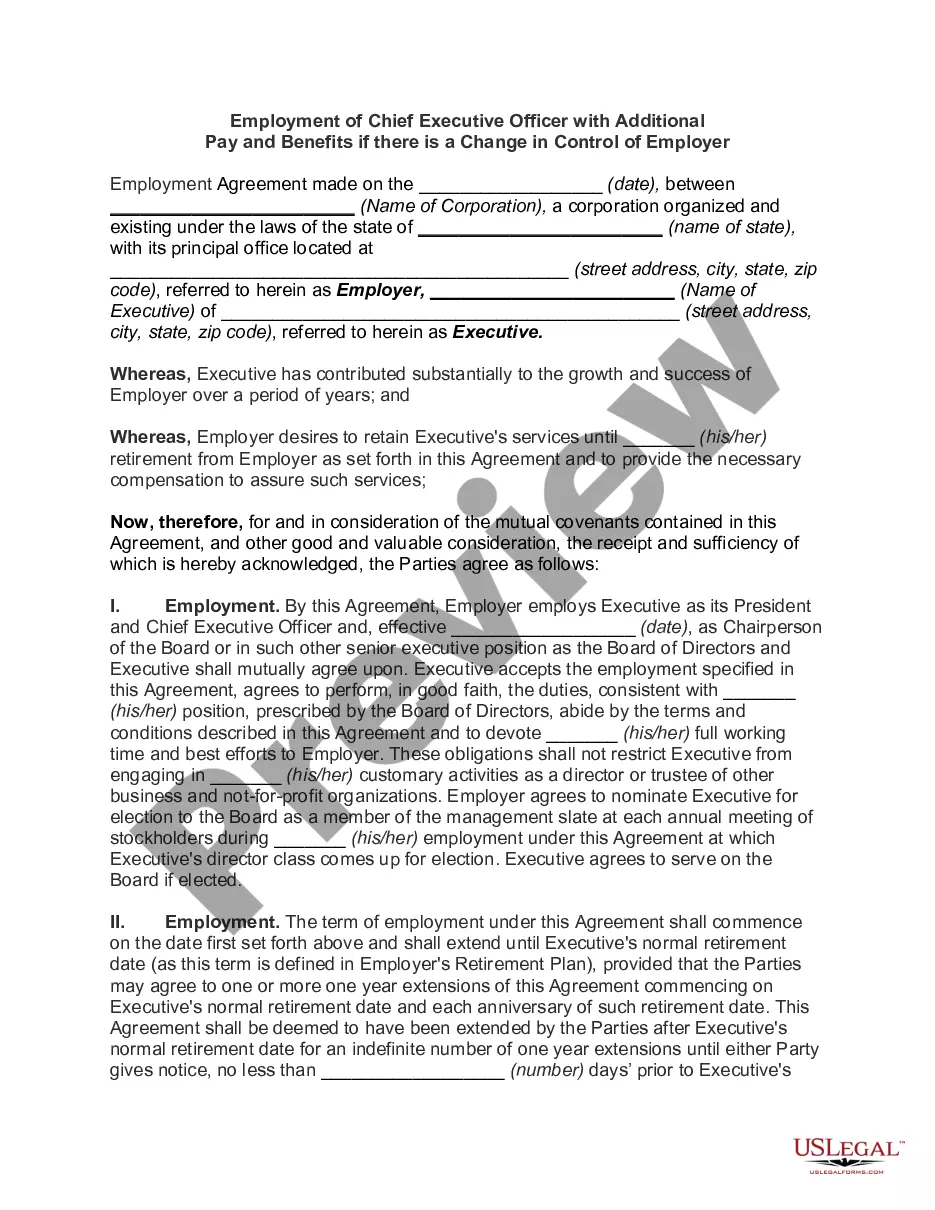

Whether you plan to open your company, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business case. All files are collected by state and area of use, so opting for a copy like Salt Lake Sample Letter for Employee Automobile Expense Allowance is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of more steps to obtain the Salt Lake Sample Letter for Employee Automobile Expense Allowance. Adhere to the guidelines below:

- Make sure the sample meets your individual needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file when you find the proper one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Salt Lake Sample Letter for Employee Automobile Expense Allowance in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you are able to access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!