A Hillsborough Florida Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time refers to a specific type of trust arrangement that offers various benefits and protections to the trust or in the state of Florida. This type of trust is established with the intention of providing financial security, asset protection, and control over wealth for the trust or (also known as the granter or settler) both during their lifetime and for their designated beneficiaries in the future. The Hillsborough Florida Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time is a legal instrument which sets forth the terms and conditions under which specific assets and/or properties are transferred to a trust for the benefit of the trust or and their beneficiaries. Once established, the trust becomes irrevocable, meaning that the trust or cannot modify, amend, or revoke its terms without the consent of all parties involved, including the trustee(s) and beneficiaries. One significant feature of this trust arrangement is that it allows the trust or to receive income generated by the trust's assets after a specified time. This income can serve as a reliable source of financial support for the trust or during their lifetime. This provision ensures that the trust or can enjoy the benefits of the trust while still maintaining control over the assets and potentially utilizing the income for personal or business expenses. Different types of Hillsborough Florida Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time include: 1. Income-only trust: This type of trust arrangement offers the trust or regular income payments generated by the trust's assets after a specific period. The principal amount remains untouched and is typically distributed to the beneficiaries upon the trust or's passing. 2. Charitable remainder trust (CRT): This trust structure is designed to provide income to the trust or during their lifetime, followed by the remaining assets being donated to charitable organizations after their death. It allows the trust or to support charitable causes close to their heart while still enjoying income from the trust. 3. Granter retained income trust (GRIT): A GRIT enables the trust or to receive income from the trust for a fixed period while transferring the remainder of the assets to the beneficiaries at the end of the term. The trust or retains an interest in the trust and may continue to benefit from the income generated. 4. Qualified personnel residence trust (PRT): This type of trust allows the trust or to transfer their primary residence or vacation home to the trust while still residing in it and receiving income generated by the property. The trust ultimately transfers ownership of the property to the beneficiaries while potentially minimizing estate taxes. By utilizing a Hillsborough Florida Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time, individuals can achieve comprehensive asset protection, estate planning, and tax planning strategies while maintaining a stream of income to support their financial needs. It is advisable to consult with a qualified estate planning attorney or financial advisor to determine the most appropriate trust structure based on individual circumstances and goals.

Hillsborough Florida Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

How to fill out Hillsborough Florida Irrevocable Trust For Future Benefit Of Trustor With Income Payable To Trustor After Specified Time?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare official documentation that differs throughout the country. That's why having it all accumulated in one place is so valuable.

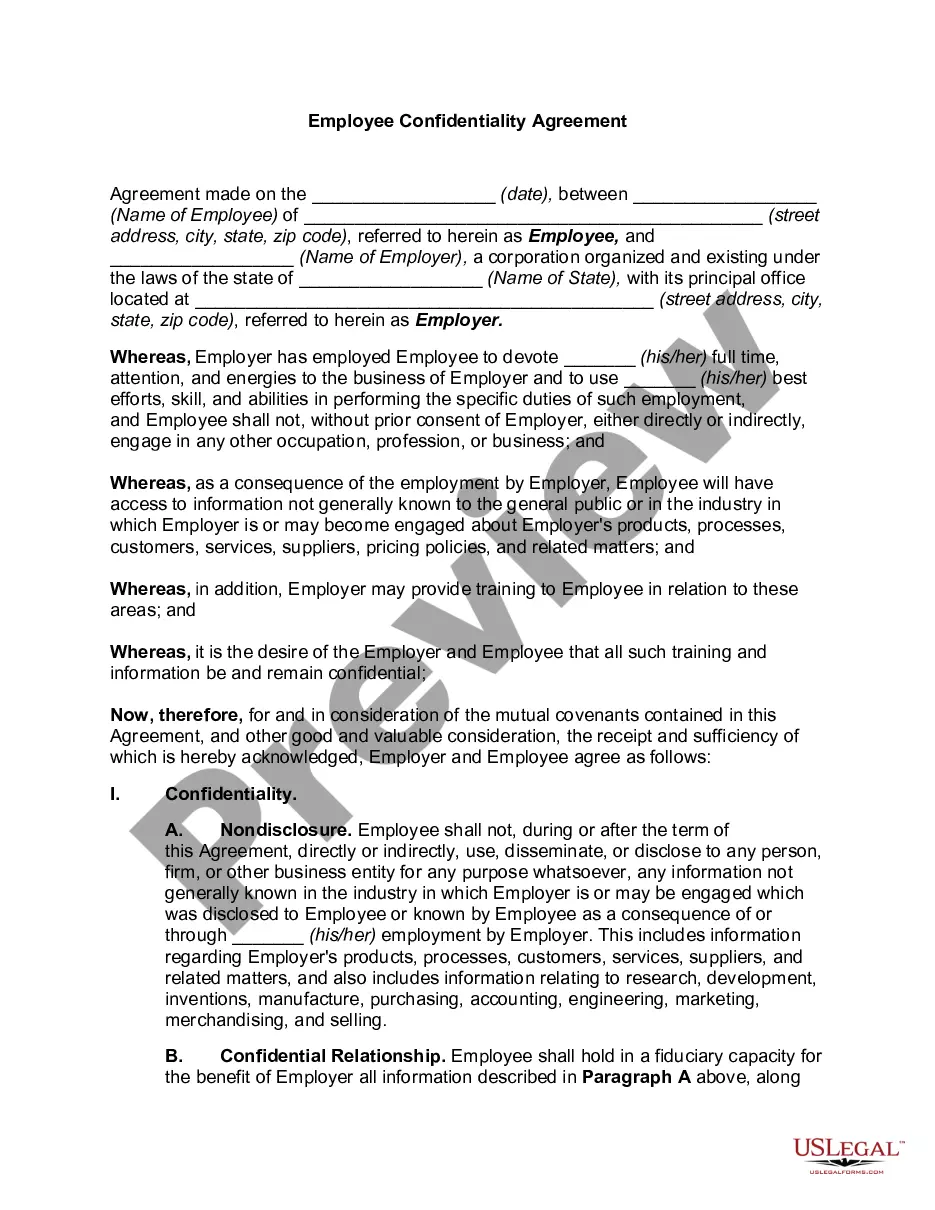

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any individual or business objective utilized in your region, including the Hillsborough Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time.

Locating samples on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Hillsborough Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guide to obtain the Hillsborough Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time:

- Make sure you have opened the correct page with your regional form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Hillsborough Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!