Franklin Ohio Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity

Description

How to fill out Franklin Ohio Revocable Trust For Lifetime Benefit Of Trustor For Lifetime Benefit Of Surviving Spouse After Death Of Trustor's With Annuity?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and many other life situations require you prepare official paperwork that differs throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any individual or business purpose utilized in your region, including the Franklin Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Franklin Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity will be available for further use in the My Forms tab of your profile.

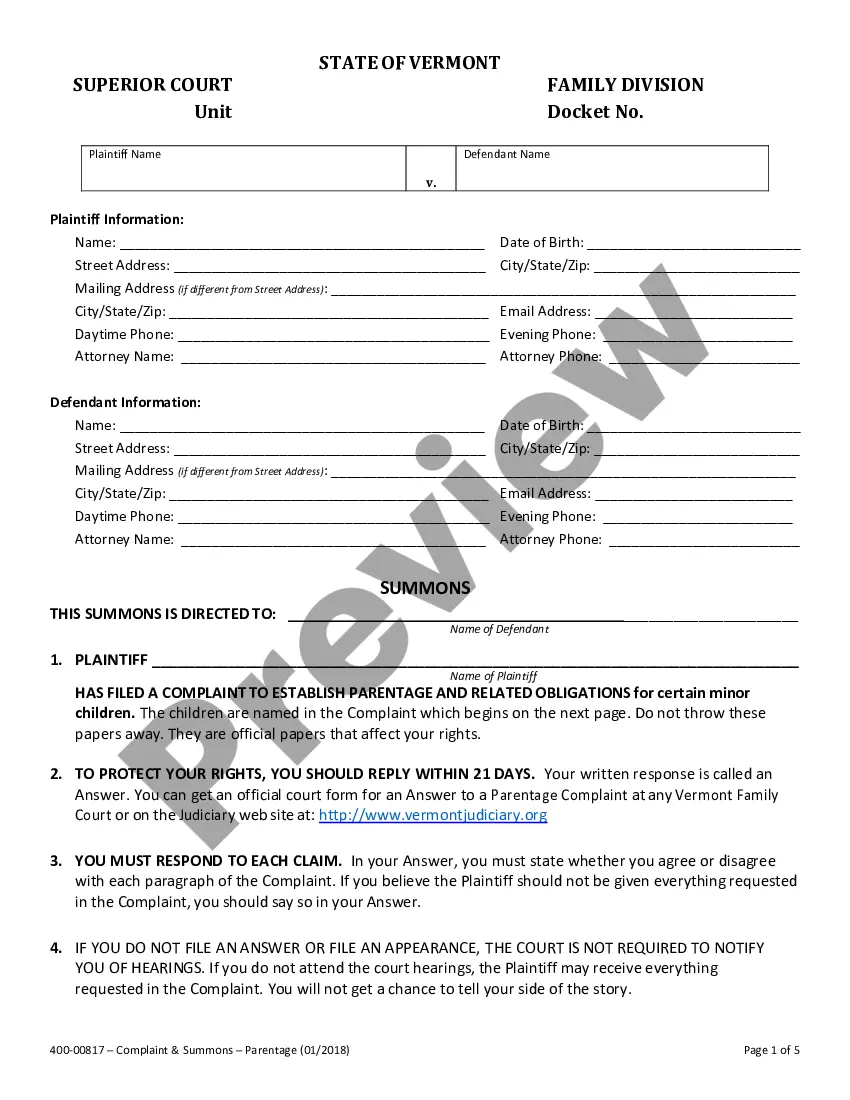

If you are using US Legal Forms for the first time, follow this simple guide to obtain the Franklin Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity:

- Ensure you have opened the correct page with your local form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form satisfies your requirements.

- Look for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Franklin Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

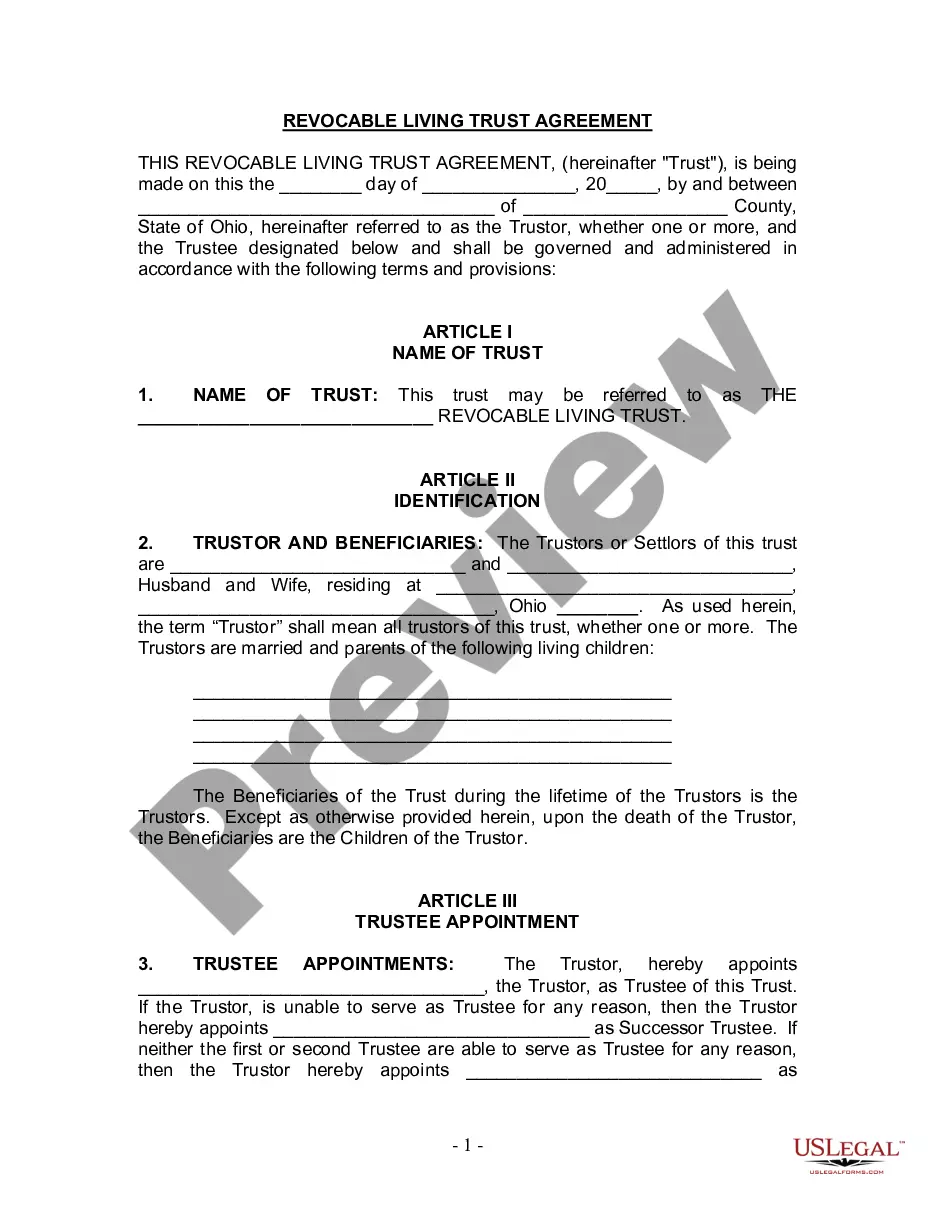

The trust remains revocable while both spouses are alive. The couple may withdraw assets or cancel the trust completely before one spouse dies. When the first spouse dies, the trust becomes irrevocable and splits into two parts: the A trust and the B trust.

What happens in this type of trust is that the trust is a joint revocable trust when both spouses are alive. When one of the spouses dies, the trust will then split into two trusts automatically. Each trust will have half the assets of the trust along with the separate property of the spouse.

The deceased spouse's assets are either put completely into a Family Trust, or split between a Family Trust and a Marital Trust. The Family Trust will no longer be considered part of the surviving spouse's estate upon death.

If the beneficiary of a revocable trust dies before the settlor does, the settlor can simply rewrite his trust instrument to address the change. If the beneficiary dies after the settlor dies and the trust still holds property on behalf of the beneficiary, the property often passes to the beneficiary's estate.

Advantages of Revocable Trusts Continuity of Management During Disability.Flexibility.Avoidance of Probate.Availability of Assets at Death.Lost or Destroyed Originals.No Interruption in Investment Management.Reregistration of Property.May Not Automatically Adapt to Changed Circumstances.

But when the Trustee of a Revocable Trust dies, it is up to their Successor to settle their loved one's affairs and close the Trust. The Successor Trustee follows what the Trust lays out for all assets, property, and heirlooms, as well as any special instructions.

A revocable living trust becomes irrevocable once the sole grantor or dies or becomes mentally incapacitated. If you have a joint trust for you and your spouse, then a portion of the joint trust can become irrevocable when the first spouse dies and will become irrevocable when the last spouse dies.

A revocable trust becomes irrevocable at the death of the person that created the trust. Typically, this person is the trustor, the trustee, and the initial beneficiary, and the trust is typically written so once that person dies, the trust becomes irrevocable.

After one spouse dies, the surviving spouse is free to amend the terms of the trust document that deal with his or her property, but can't change the parts that determine what happens to the deceased spouse's trust property.