Maricopa Arizona Revocable Trust for Lifetime Benefit of Trust or for Lifetime Benefit of Surviving Spouse after Death of Trust or's with Annuity is a legal instrument that allows individuals in Maricopa, Arizona, to protect their assets and provide financial security for themselves and their surviving spouse. This type of trust is designed to provide lifelong benefits to both the trust or (the person creating the trust) and their surviving spouse, particularly after the trust or's death. It is often used as a means to ensure that the surviving spouse maintains a consistent income and financial stability. The key feature of this trust is the inclusion of an annuity, which serves as a regular income stream for the surviving spouse. The annuity payments can be structured to provide a fixed amount or be adjusted for inflation, depending on the trust or's preferences and financial needs. This ensures that the surviving spouse is financially supported throughout their lifetime. By establishing a revocable trust, the trust or retains control and flexibility over their assets during their lifetime. They can make changes or even revoke the trust if circumstances change or if they wish to modify its terms. This flexibility allows the trust or to adapt the trust to their evolving financial situation and priorities. The Maricopa Arizona Revocable Trust for Lifetime Benefit of Trust or for Lifetime Benefit of Surviving Spouse after Death of Trust or's with Annuity can have variations or additional features depending on individual circumstances and goals. Some potential types or variations of this trust include: 1. Maricopa Arizona Revocable Trust for Lifetime Benefit of Trust or with a Non-Spousal Beneficiary: This variation of the trust is designed to provide lifetime benefits to a non-spousal beneficiary after the trust or's death. It ensures that the chosen beneficiary receives a regular income stream for their lifetime. 2. Maricopa Arizona Revocable Trust for Lifetime Benefit of Trust or with Charitable Annuity: This type of trust combines the benefits of a lifetime annuity for the trust or with a charitable contribution. It allows the trust or to support a charitable organization of their choice while also receiving a regular income during their lifetime. 3. Maricopa Arizona Revocable Trust for Lifetime Benefit of Trust or with Multiple Annuities: Some individuals may choose to include multiple annuities in their trust to provide income to multiple beneficiaries or to structure different types of income streams for different purposes. It is important to consult with a qualified estate planning attorney in Maricopa, Arizona, to determine the specific type of revocable trust that suits an individual's needs and goals. The attorney can provide personalized guidance and drafting expertise to ensure the trust aligns with the trust or's intentions and helps achieve their desired financial outcomes.

Maricopa Arizona Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity

Description

How to fill out Maricopa Arizona Revocable Trust For Lifetime Benefit Of Trustor For Lifetime Benefit Of Surviving Spouse After Death Of Trustor's With Annuity?

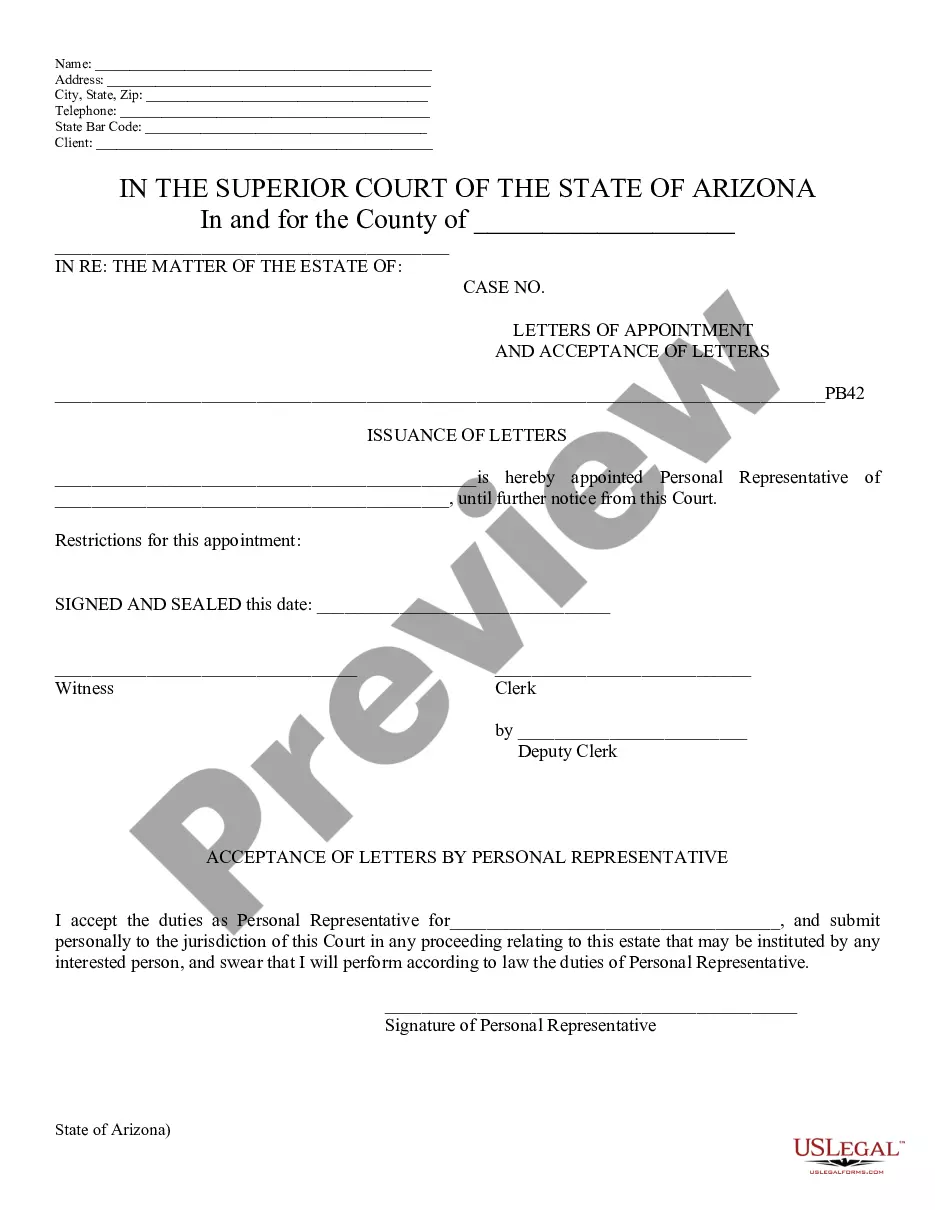

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to create some of them from the ground up, including Maricopa Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in various categories varying from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching experience less challenging. You can also find information resources and tutorials on the website to make any tasks associated with paperwork execution straightforward.

Here's how to purchase and download Maricopa Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity.

- Go over the document's preview and outline (if available) to get a basic idea of what you’ll get after getting the document.

- Ensure that the template of your choosing is adapted to your state/county/area since state regulations can impact the validity of some documents.

- Examine the related document templates or start the search over to find the right document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the option, then a suitable payment gateway, and buy Maricopa Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Maricopa Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity, log in to your account, and download it. Needless to say, our website can’t take the place of an attorney entirely. If you have to deal with an exceptionally complicated situation, we advise getting a lawyer to review your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Join them today and get your state-compliant paperwork with ease!

Form popularity

FAQ

If the beneficiary of a revocable trust dies before the settlor does, the settlor can simply rewrite his trust instrument to address the change. If the beneficiary dies after the settlor dies and the trust still holds property on behalf of the beneficiary, the property often passes to the beneficiary's estate.

But when the Trustee of a Revocable Trust dies, it is up to their Successor to settle their loved one's affairs and close the Trust. The Successor Trustee follows what the Trust lays out for all assets, property, and heirlooms, as well as any special instructions.

Once the grantor dies, the terms written into a revocable trust cannot be modified in any way, nor can anyone add or remove assets.

The deceased spouse's assets are either put completely into a Family Trust, or split between a Family Trust and a Marital Trust. The Family Trust will no longer be considered part of the surviving spouse's estate upon death.

What happens in this type of trust is that the trust is a joint revocable trust when both spouses are alive. When one of the spouses dies, the trust will then split into two trusts automatically. Each trust will have half the assets of the trust along with the separate property of the spouse.

After one spouse dies, the surviving spouse is free to amend the terms of the trust document that deal with his or her property, but can't change the parts that determine what happens to the deceased spouse's trust property.

Death of the Grantor (also called the Trustor) of the Trust. A revocable trust becomes irrevocable at the death of the person that created the trust.

A revocable living trust becomes irrevocable once the sole grantor or dies or becomes mentally incapacitated. If you have a joint trust for you and your spouse, then a portion of the joint trust can become irrevocable when the first spouse dies and will become irrevocable when the last spouse dies.

A revocable trust turns into an irrevocable trust when the grantor of the trust dies. Typically, the grantor is also the trustee and the first beneficiary of the trust. Once the grantor dies, the terms written into a revocable trust cannot be modified in any way, nor can anyone add or remove assets.

Interesting Questions

More info

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.