Palm Beach Florida Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity

Description

How to fill out Palm Beach Florida Revocable Trust For Lifetime Benefit Of Trustor For Lifetime Benefit Of Surviving Spouse After Death Of Trustor's With Annuity?

Whether you plan to start your company, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business occasion. All files are grouped by state and area of use, so picking a copy like Palm Beach Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few additional steps to obtain the Palm Beach Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity. Adhere to the guidelines below:

- Make certain the sample fulfills your personal needs and state law regulations.

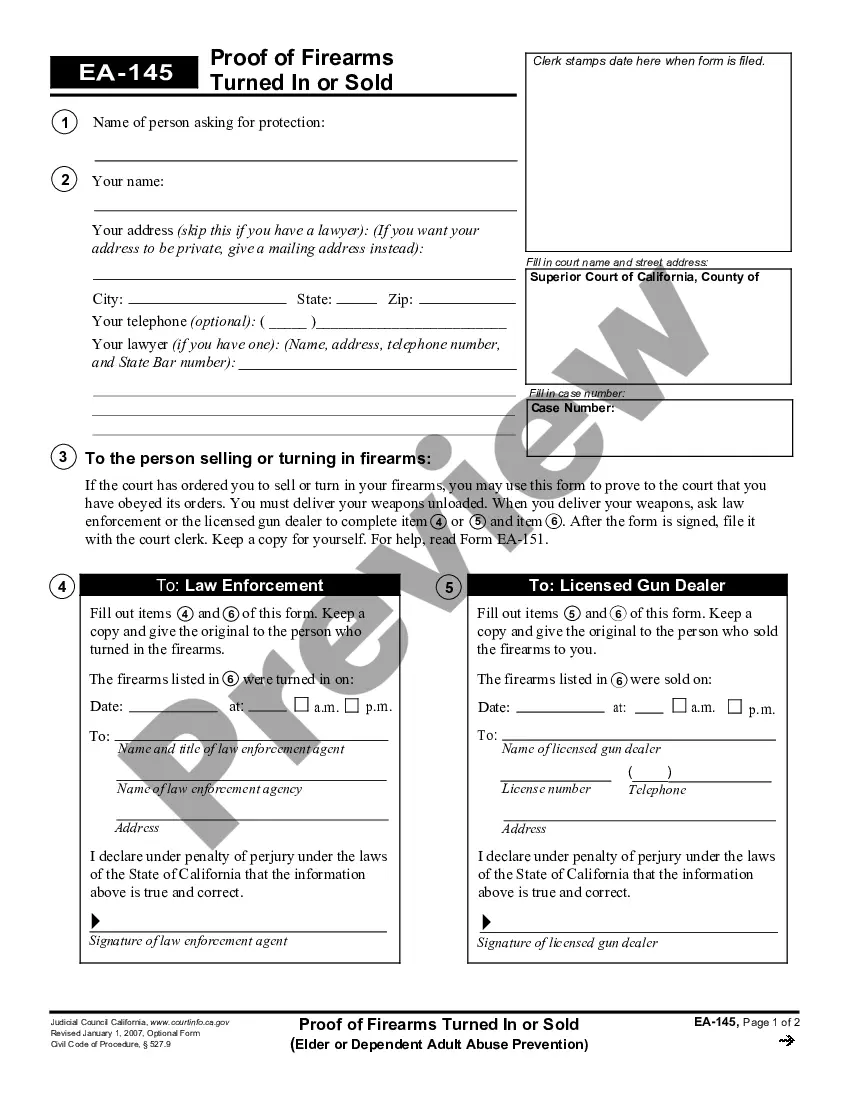

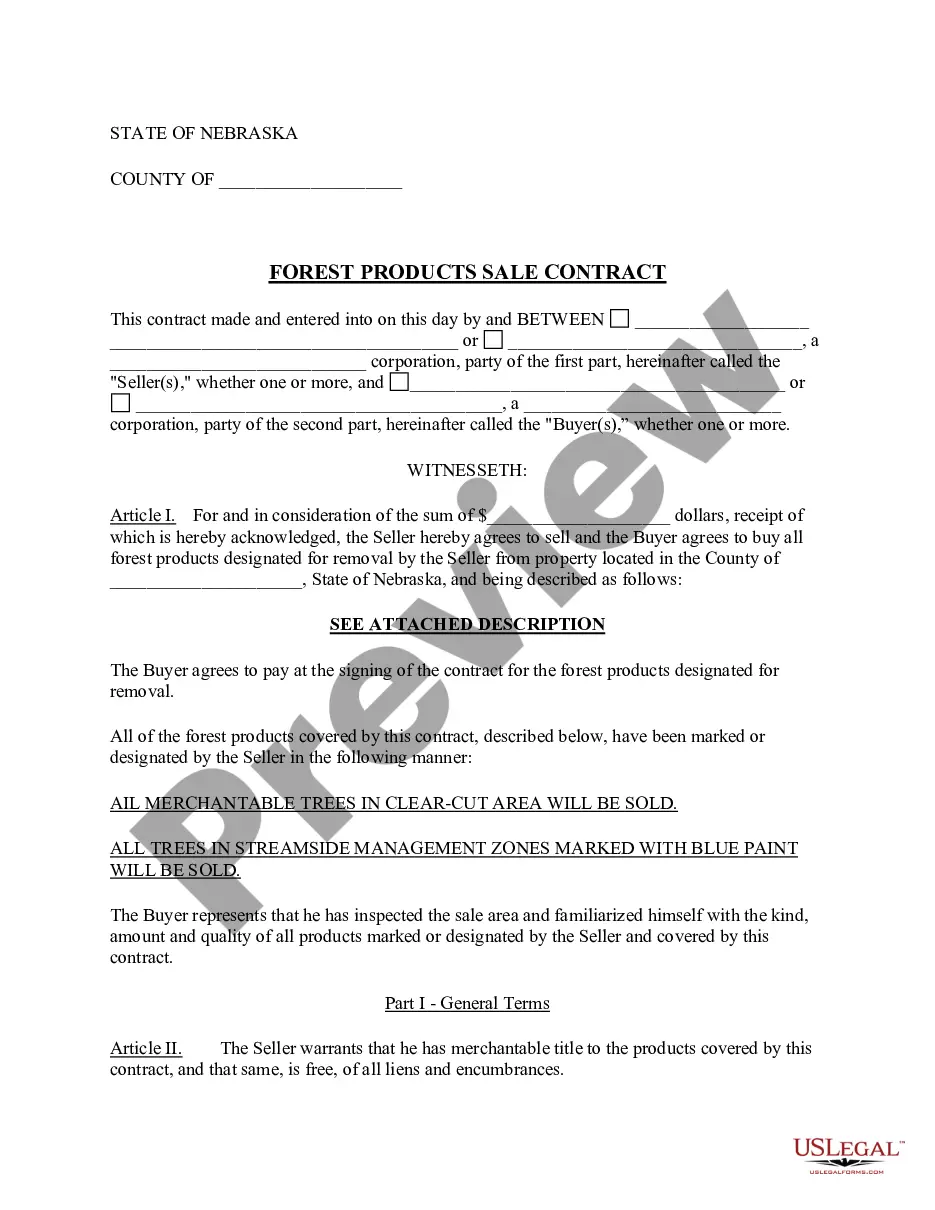

- Read the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to obtain the file once you find the proper one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Palm Beach Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

After one spouse dies, the surviving spouse is free to amend the terms of the trust document that deal with his or her property, but can't change the parts that determine what happens to the deceased spouse's trust property.

The deceased spouse's assets are either put completely into a Family Trust, or split between a Family Trust and a Marital Trust. The Family Trust will no longer be considered part of the surviving spouse's estate upon death.

A lifetime trust, also called a lifetime asset protection trust (LAPT) is a special type of trust designed to protect your loved ones and their inheritance from ruinous decision-making and the actions of creditors.

But when the Trustee of a Revocable Trust dies, it is up to their Successor to settle their loved one's affairs and close the Trust. The Successor Trustee follows what the Trust lays out for all assets, property, and heirlooms, as well as any special instructions.

A lifetime trust can apply to any trust you create and will last for the lifetime of the beneficiary or beneficiaries. It can be applied to an irrevocable trust, a revocable living trust or a testamentary trust.

Any income generated by a revocable trust is taxable to the trust's creator (who is often also referred to as a settlor, trustor, or grantor) during the trust creator's lifetime. This is because the trust's creator retains full control over the terms of the trust and the assets contained within it.

A revocable living trust becomes irrevocable once the sole grantor or dies or becomes mentally incapacitated. If you have a joint trust for you and your spouse, then a portion of the joint trust can become irrevocable when the first spouse dies and will become irrevocable when the last spouse dies.

A life beneficiary is a person whothrough a trust or a willhas been granted benefits that last for their lifetime. This can take several forms, such as an AB Trust or a life estate, though the beneficiary of a life estate is more commonly called a life tenant.

What happens in this type of trust is that the trust is a joint revocable trust when both spouses are alive. When one of the spouses dies, the trust will then split into two trusts automatically. Each trust will have half the assets of the trust along with the separate property of the spouse.

If the beneficiary of a revocable trust dies before the settlor does, the settlor can simply rewrite his trust instrument to address the change. If the beneficiary dies after the settlor dies and the trust still holds property on behalf of the beneficiary, the property often passes to the beneficiary's estate.