Phoenix Arizona Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity

Description

How to fill out Revocable Trust For Lifetime Benefit Of Trustor For Lifetime Benefit Of Surviving Spouse After Death Of Trustor's With Annuity?

Whether you intend to launch your enterprise, engage in a transaction, request your identification renewal, or tackle family-related legal matters, it's essential to organize particular documentation that complies with your local laws and regulations.

Finding the appropriate documents may require considerable time and effort unless you make use of the US Legal Forms library.

The service offers users over 85,000 expertly prepared and verified legal documents for any individual or business situation. All papers are categorized by state and purpose, making it quick and easy to select a copy such as the Phoenix Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity.

Forms offered by our library are reusable. With an active subscription, you can access all of your previously obtained documents anytime in the My documents section of your account. Stop wasting time searching for current official documents. Register for the US Legal Forms platform and maintain your paperwork in order with the largest online form collection!

- Ensure the template meets your personal requirements and state legal obligations.

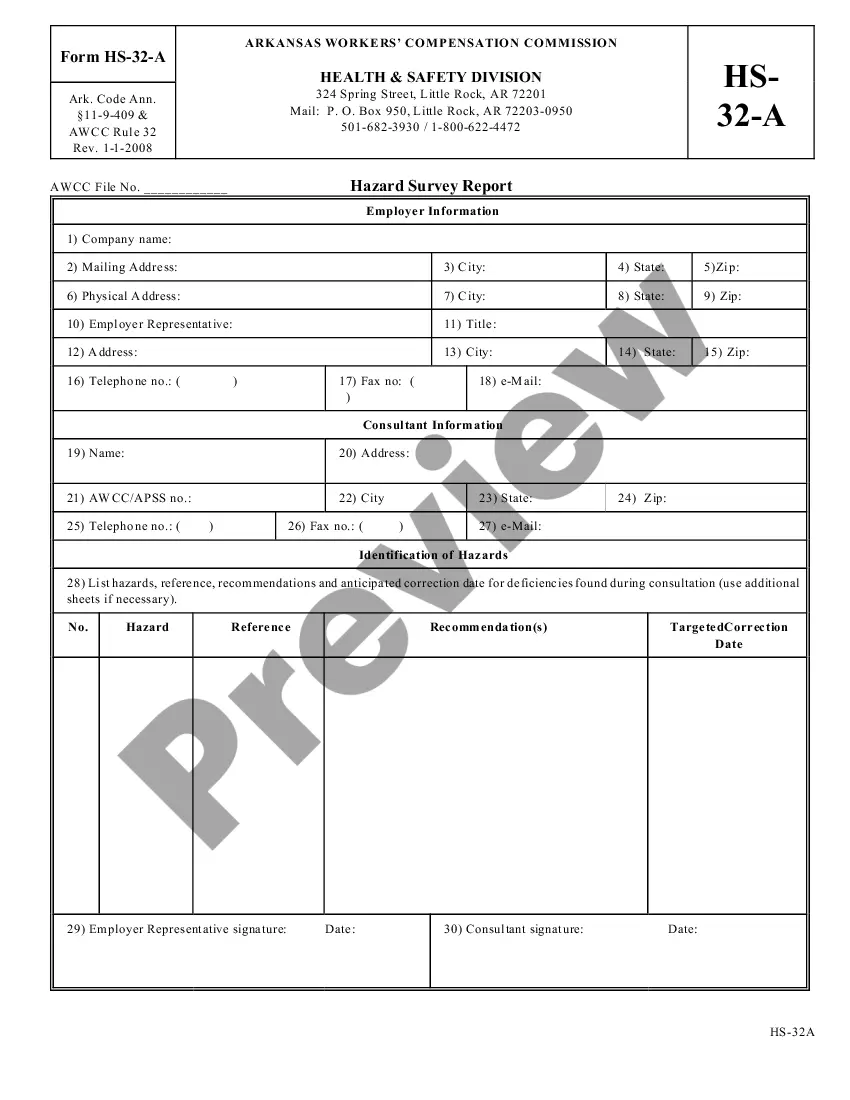

- Review the form description and check the Preview if available on the page.

- Utilize the search option specifying your state above to locate another template.

- Click Buy Now to acquire the document when you discover the correct one.

- Choose the subscription plan that best fits your needs for continued access.

- Log in to your account and pay the service with credit card or PayPal.

- Download the Phoenix Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity in your desired file format.

- Print the document or fill it out and sign it electronically via an online editor to save time.

Form popularity

FAQ

The trust itself must report income to the IRS and pay capital gains taxes on earnings. It must distribute income earned on trust assets to beneficiaries annually. If you receive assets from a simple trust, it is considered taxable income and you must report it as such and pay the appropriate taxes.

Upon the death or incapacity of the trustor, when a revocable trust becomes irrevocable, the trust must file form 1041. Unlike an individual, trust and estate income is subject to the highest marginal tax rate once the income of the trust or estate exceeds $7,500 (I.R.C.

The income keeps the same character as it had for the trust; for example, if the trust had long-term capital gains and distributes them, the beneficiary has long-term capital gains. This amount is a deduction on the trust's income tax return. So, somebody's going to pay income taxes on any income earned by the trust.

So, the list below are some more disadvantages of an irrevocable trust: Loss of Control over Assets. Inflexible as opposed to a Revocable Trust. Unforeseen circumstances. IRS rules state if you die within three years, assets transfer back to the estate.

Some of the Cons of a Revocable Trust Shifting assets into a revocable trust won't save income or estate taxes. No asset protection. Although assets held in an irrevocable trust are generally beyond the reach of creditors, that's not true with a revocable trust.

Drawbacks of a Living Trust Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork.Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required.Transfer Taxes.Difficulty Refinancing Trust Property.No Cutoff of Creditors' Claims.

Trust beneficiaries must pay taxes on income and other distributions that they receive from the trust. Trust beneficiaries don't have to pay taxes on returned principal from the trust's assets. IRS forms K-1 and 1041 are required for filing tax returns that receive trust disbursements.

Typically, a revocable trust will allow you to receive all of the benefits of the trust assets (the trust income and the right to use trust assets) as you choose during your lifetime. Following your death, the trust assets are distributed in the manner you've directed through the trust terms.

When the grantor, who is also the trustee, dies, the successor trustee named in the Declaration of Trust takes over as trustee. The new trustee is responsible for distributing the trust property to the beneficiaries named in the trust document.

Upon the death of the grantor, grantor trust status terminates, and all pre-death trust activity must be reported on the grantor's final income tax return. As mentioned earlier, the once-revocable grantor trust will now be considered a separate taxpayer, with its own income tax reporting responsibility.