Subject: Chicago Illinois Sample Letter for Closing of Estate — Request to Execute Dear [Executor's Name], I hope this letter finds you well. As the legal representative of the deceased's estate, I am writing to formally request your assistance in executing the closing procedures of the estate in accordance with the laws and regulations of Chicago, Illinois. [Keyword: Estate Closing] [Keyword: Executor] The purpose of this letter is to provide you with a comprehensive overview of the required documents, forms, and legal procedures necessary for the completion of the estate closing process. By adhering to these steps, we aim to ensure a smooth and efficient resolution of the estate's affairs. 1. Obtain a Certified Copy of the Death Certificate: Please obtain a certified copy of the deceased's death certificate from the vital records' office. This document will be crucial in verifying the death and establishing the legal grounds for estate administration. 2. Compile the Inventory of Assets: The next step is to compile a detailed inventory of all the assets owned by the deceased. This includes bank accounts, real estate properties, vehicles, investments, insurance policies, and any other valuables. Accurate and thorough documentation of these assets will facilitate an accurate distribution process. [Keyword: Assets Inventory] 3. Settle Debts and Taxes: Before distributing the estate to its beneficiaries, it is essential to settle any outstanding debts and taxes owed by the deceased. This includes mortgage payments, outstanding loans, credit card bills, and any taxes owed to the federal and state governments. The estate's funds will be used to clear these obligations. 4. File the Final Income Tax Return: As per the requirements of the Internal Revenue Service (IRS), the executor must file the final income tax return on behalf of the deceased. This return should cover the period from the beginning of the tax year up until the date of death. [Keyword: Taxes] 5. Submit the Closing Documents: Upon completion of the above steps, it is necessary to submit the following documents to the appropriate court in Chicago, Illinois, for the final determination of estate closing: — Petition for Final Distribution and Discharge — Affidaviwarshipsi— - Waiver of Notice — Final Account and Report By submitting these documents, we seek the court's approval for the closing of the estate and the distribution of assets to the rightful beneficiaries. [Keyword: Closing Documents] Please note that this sample letter provides a general outline and does not replace the guidance of legal professionals who can offer tailored advice based on the specific circumstances of the estate. Thank you for your attention to this matter. I kindly request your prompt response outlining the next steps in ensuring the timely execution of the estate closing process. If you require any further documentation or assistance, please do not hesitate to contact me. Sincerely, [Your Name] [Your Contact Information]

Chicago Illinois Sample Letter for Closing of Estate - Request to Execute

Description

How to fill out Chicago Illinois Sample Letter For Closing Of Estate - Request To Execute?

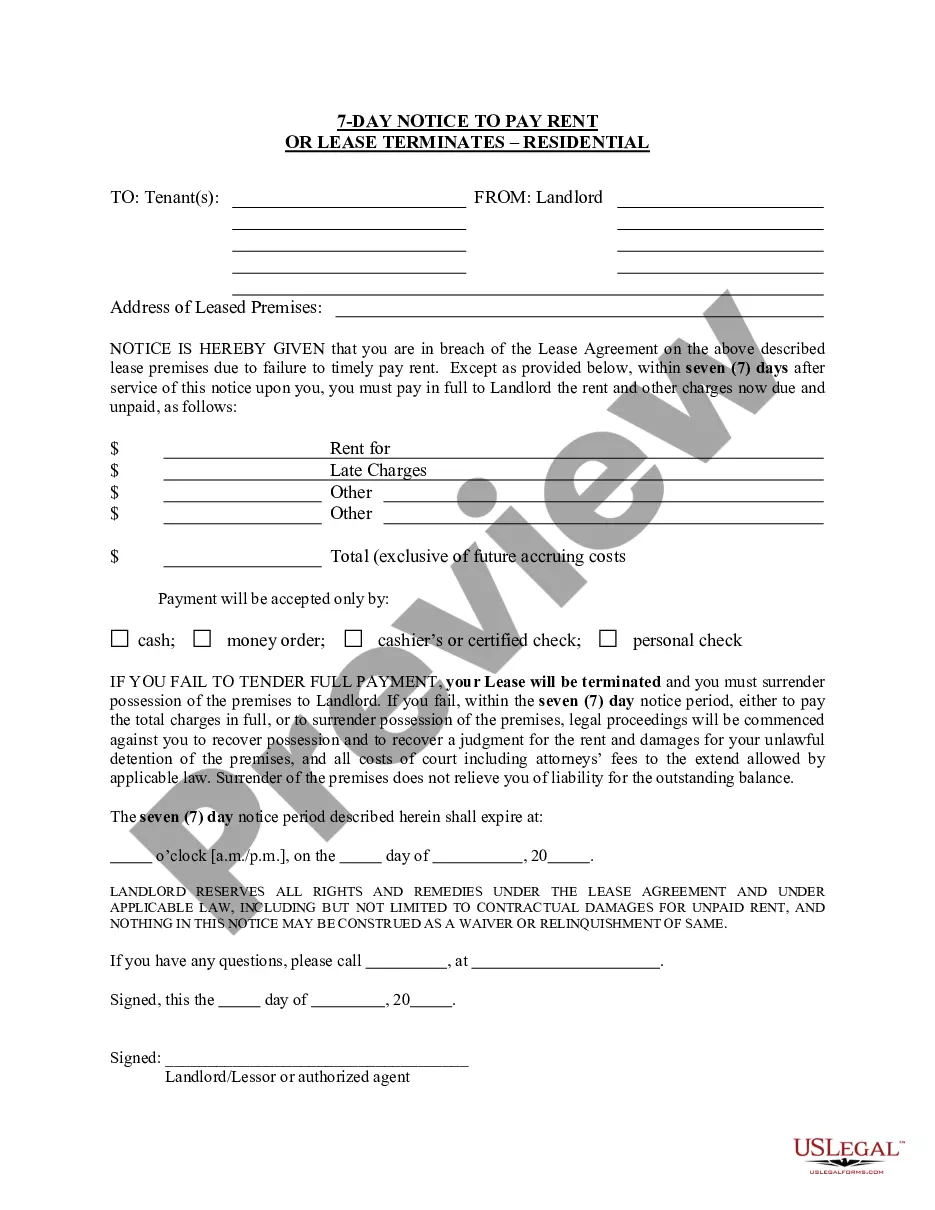

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask an attorney to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Chicago Sample Letter for Closing of Estate - Request to Execute, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case collected all in one place. Consequently, if you need the current version of the Chicago Sample Letter for Closing of Estate - Request to Execute, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Chicago Sample Letter for Closing of Estate - Request to Execute:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Chicago Sample Letter for Closing of Estate - Request to Execute and download it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

A (relatively) quick way to compel a lazy or unhelpful executor to account for his activities is to apply for an order that he/she exhibits an inventory and account in respect of the administration. This should be done by applying to the Probate Registry by a claim form supported by an affidavit.

Closing of an Illinois Probate Estate The executor must file a final accounting with the court showing how estate assets were handled. The accounting will list the assets, possible income the estate generated, the amount paid for any debts or other expenses, and the distributions made to beneficiaries.

If you believe that the executor is not living up to their duties, you have two legal options: petition the court or file a civil lawsuit. Beneficiaries can petition the court to have the executor removed from their positon if they can prove they should be removed for one of the reasons listed above.

State law allows for two years for the will to be entered into the court records. However, an heir may file sooner if the executor fails to file within 60 days of the death of the person.

Illinois, for example, requires executors to allow six months. California requires a bit less, with four months.

In Illinois, a Probate case will generally last at least six months due to the necessity of the claims publication requirement under the Illinois Probate Act. Thus, a typical Illinois Probate will run between six and twelve months.

In Pennsylvania, there is no set deadline for filing probate. However, the law requires that the inheritance tax be wholly paid within nine months after the person's passing unless there has been a request for an extension.

Here are some things to consider when drafting a letter to your executor or trustee. Your thoughts about wealth. Share your story about how you came to the assets that you are leaving in your will. How was your wealth created, what do you value and what are your long-term goals for your wealth?

Deadline to close the estate: 14 months from the date the will is admitted to probate. If the estate remains open after 14 months, the court will expect the representative to account or report to the court to explain why the estate needs to remain open.

Virginia has no set time limit for settling an estate. You can take the time you need to grieve and get your affairs in order before you settle the estate. However, Virginia courts do generally recommend that you start the process within a week to 30 days after the funeral.