Tarrant Texas Sample Letter for Closing of Estate - Request to Execute

Description

How to fill out Tarrant Texas Sample Letter For Closing Of Estate - Request To Execute?

Dealing with legal forms is a must in today's world. However, you don't always need to look for professional help to create some of them from scratch, including Tarrant Sample Letter for Closing of Estate - Request to Execute, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in various categories ranging from living wills to real estate papers to divorce papers. All forms are organized based on their valid state, making the searching experience less challenging. You can also find information resources and guides on the website to make any activities related to paperwork completion straightforward.

Here's how you can purchase and download Tarrant Sample Letter for Closing of Estate - Request to Execute.

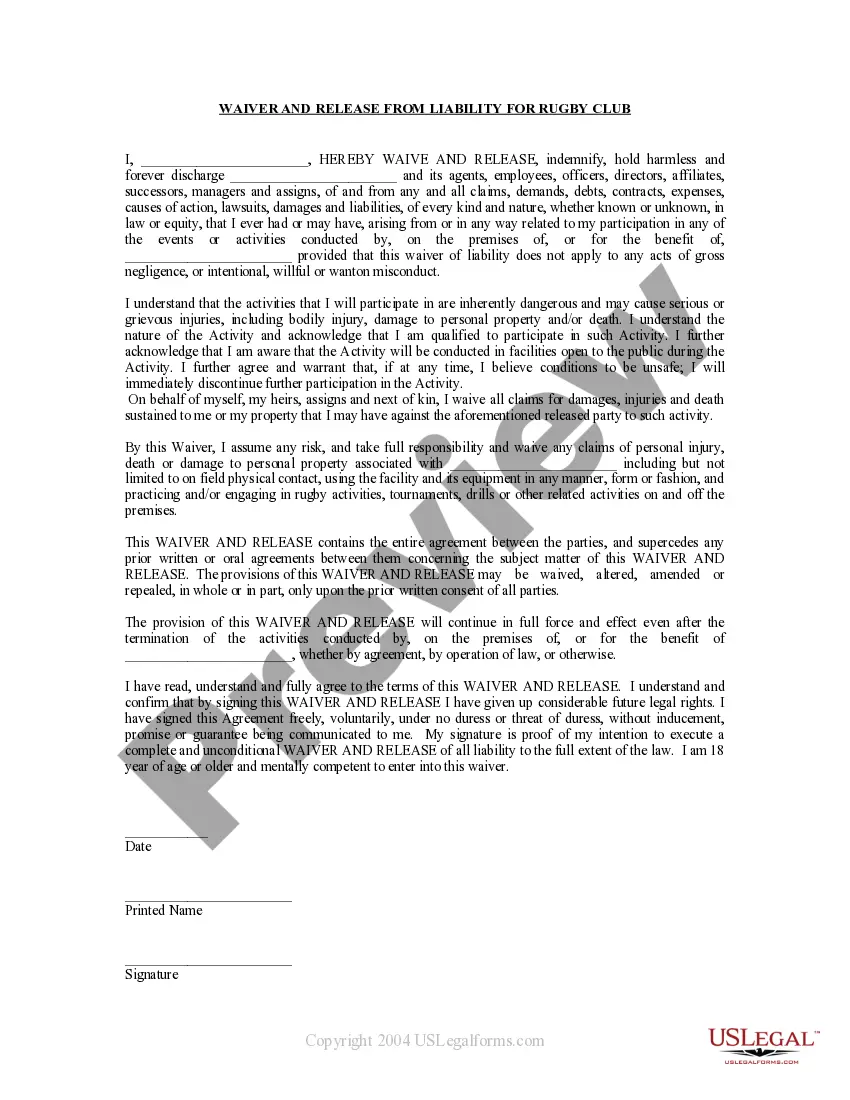

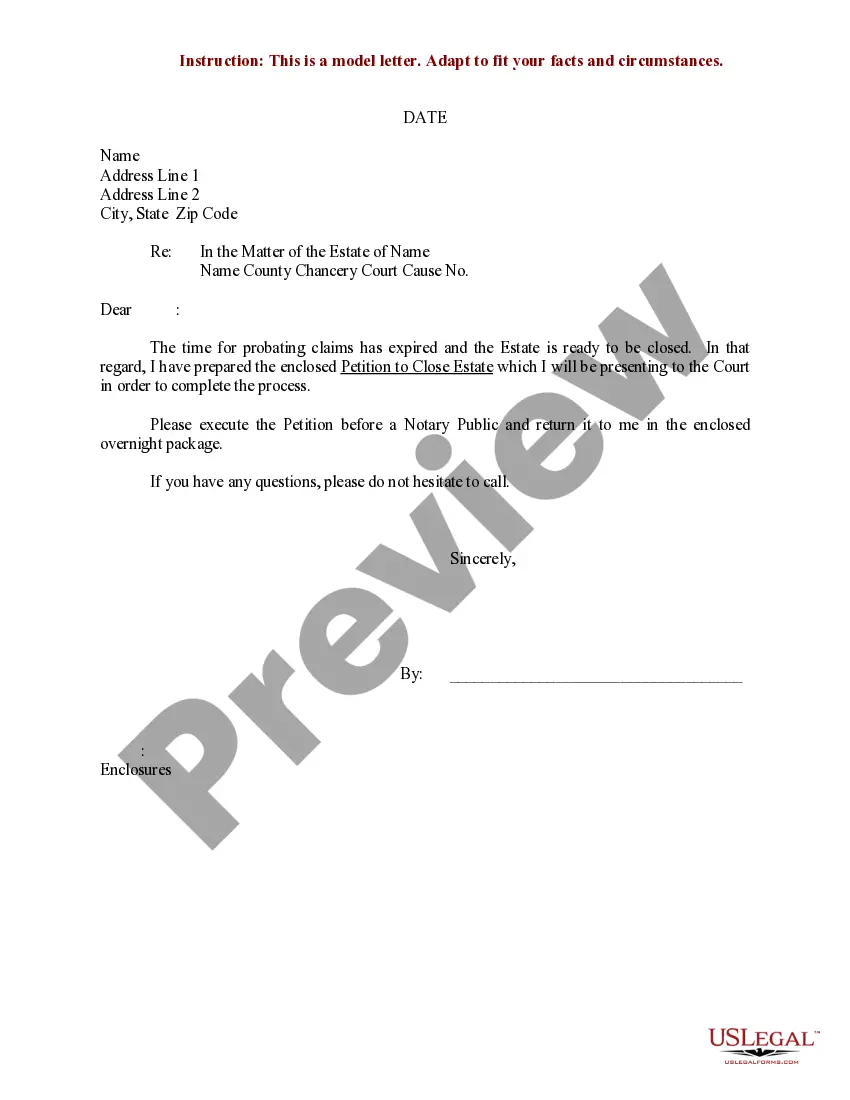

- Take a look at the document's preview and outline (if available) to get a basic information on what you’ll get after downloading the form.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can impact the validity of some records.

- Check the related document templates or start the search over to find the correct file.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Pick the option, then a suitable payment method, and purchase Tarrant Sample Letter for Closing of Estate - Request to Execute.

- Select to save the form template in any offered format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Tarrant Sample Letter for Closing of Estate - Request to Execute, log in to your account, and download it. Needless to say, our platform can’t take the place of a lawyer entirely. If you need to cope with an exceptionally challenging situation, we recommend getting a lawyer to check your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of customers. Become one of them today and purchase your state-compliant paperwork with ease!

Form popularity

FAQ

Here are some things to consider when drafting a letter to your executor or trustee. Your thoughts about wealth.Describe key players in the family.What matters to you?Give your trustee the power to make decisions, even when that means saying no.

Place your name, address and phone number at the top of the letter, followed by the date, then the name, address and phone number of the individual or agency handling your deceased relative's estate.

A letter of instruction is a cheat sheet for anyone involved in settling your affairs. Unlike a will, this letter has no legal authority. However, it can provide an easy-to-understand explanation of your overall estate plan to your executor and lay out your wishes to your family for things not covered by the will.

A Texas executor, administrator, trustee, or other fiduciaries can be removed by the probate court but not because the beneficiaries under the will don't like him. A Texas executor can only be removed for specific reasons that must be pled and proven by the beneficiaries who are seeking his removal.

Filing a closing report, notice of closing estate, or petition for judicial discharge. The court can order the probate closed if there is a demand for an accounting and distribution or a demand for closing is made. The court can order the probate closed on its own motion.

Give the letter a personal touch and address each of your heirs and beneficiaries personally. Tell them any last wishes you may have or any hopes you have for their future. Write as clearly as possible. Use specific details and avoid using shorthand.

You should wait 10 months before distributing the estate because claimants who want to challenge a Will have six months from the issue of a Grant of Probate to bring a claim under the Inheritance (Provision for Family and Dependants) Act 1975 (the Act).

The most common way of closing an estate in Texas is to file a Notice of Closing Estate with the county court. This document acts as an affidavit and confirms that you have discharged your duties. It must state the following: All known debts have been paid or satisfied as much as the estate assets would allow.

The general rule in Texas is that the executor has four years from the date of death of the testator (person who drafted the will) to file for probate.

The general rule in Texas is that the executor has four years from the date of death of the testator (person who drafted the will) to file for probate.