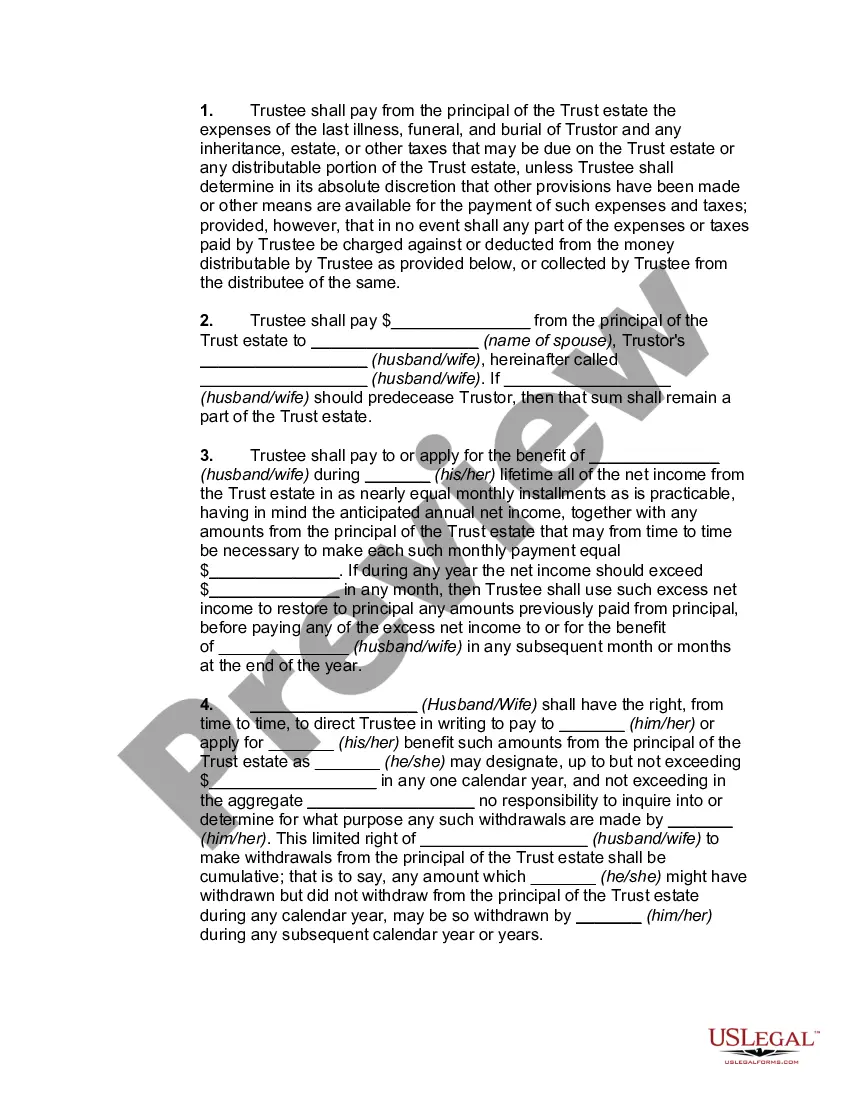

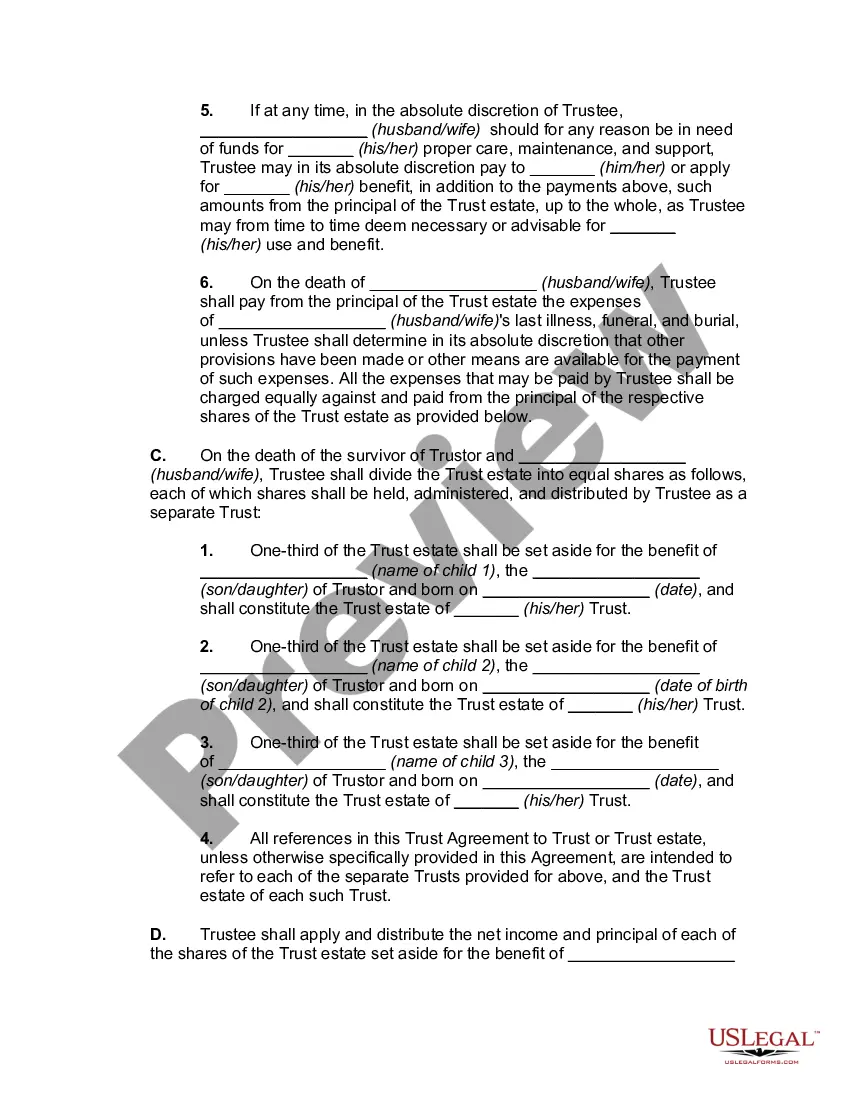

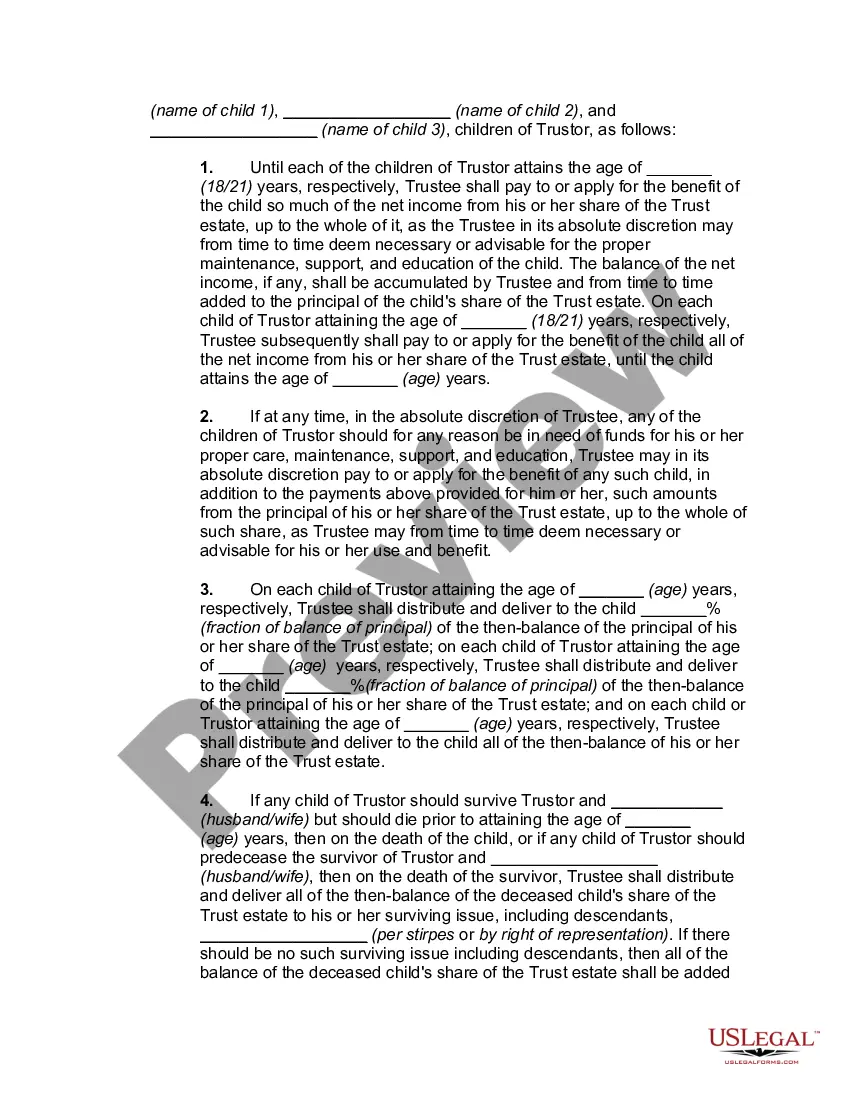

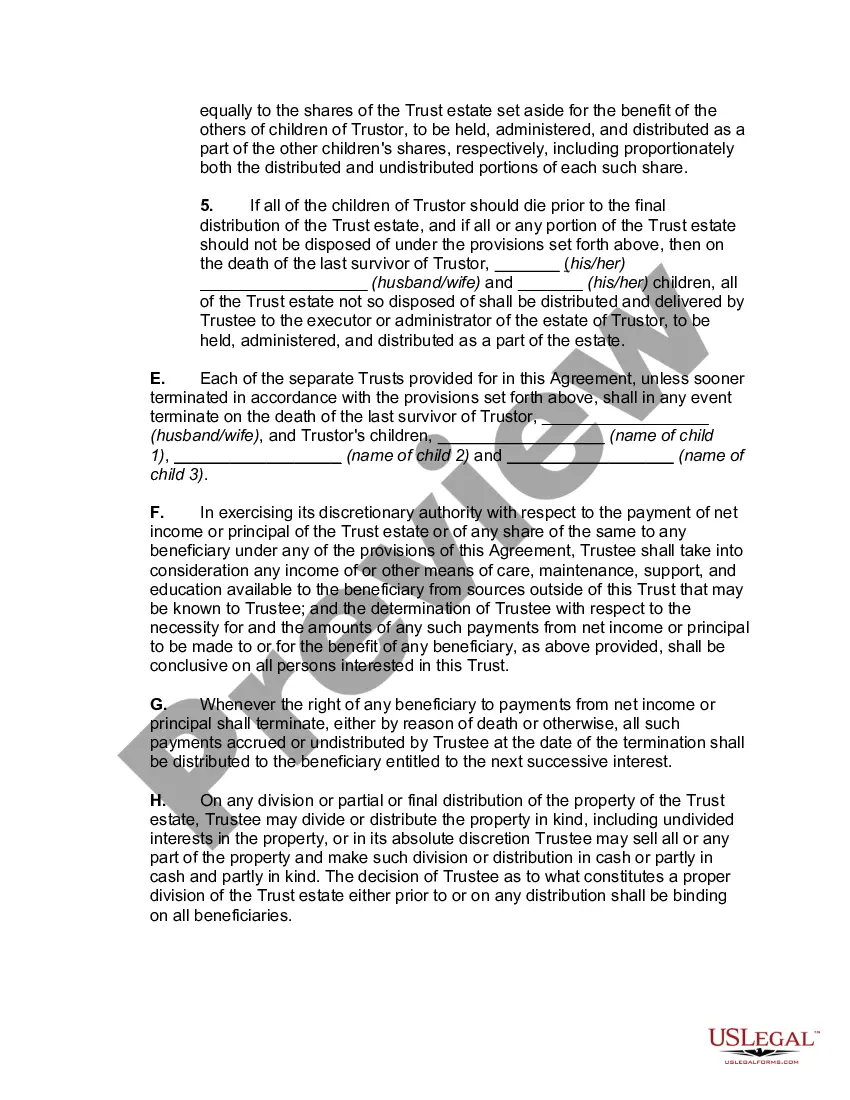

A Chicago Illinois Revocable Trust for Lifetime Benefit of Trust or, Lifetime Benefit of Surviving Spouse after Trust or's Death with Trusts for Children refers to a legal document created by an individual (the trust or) in the city of Chicago, Illinois. This particular type of trust is commonly used to help protect and manage assets during the trust or's lifetime, provide for their surviving spouse after their death, and establish trusts for the benefit of their children. This trust allows the trust or to maintain control and flexibility over their assets while alive. The trust or has the power to modify or revoke the trust at any time, making it a versatile estate planning tool. Additionally, the trust or can designate themselves as the primary beneficiary during their lifetime, ensuring they have access to the trust's income and assets. Upon the trust or's death, the trust then provides continued support and financial security for the surviving spouse. This ensures that the surviving spouse can maintain their lifestyle and have access to the trust's assets for their lifetime. After the death of the surviving spouse, the trust assets are distributed to the designated trusts for the benefit of the children. There may be variations or different types of Chicago Illinois Revocable Trusts for Lifetime Benefit of Trust or, Lifetime Benefit of Surviving Spouse after Trust or's Death with Trusts for Children, depending on the specifics outlined in each document. Some common variations may include: 1. Supplemental Needs Trust: This specific trust structure has provisions to support beneficiaries with disabilities while still protecting their eligibility for government benefits. 2. Education Trust: This trust provides financial support and resources for the education-related expenses of the children, such as tuition fees, books, or other educational resources. 3. Spendthrift Trust: This type of trust provides additional protection for the trust assets by limiting the access of the beneficiaries to the principal amount and only allowing them to receive income generated by the trust. 4. Charitable Remainder Trust: A trust designed to provide income to the trust or their surviving spouse during their lifetime, after which the remaining assets are distributed to charitable organizations. Chicago Illinois Revocable Trusts for Lifetime Benefit of Trust or, Lifetime Benefit of Surviving Spouse after Trust or's Death with Trusts for Children offer individuals in Chicago a comprehensive strategy for estate planning and financial security. By utilizing these trusts, individuals can ensure their assets are well-managed, provide for their loved ones, and leave a lasting legacy.

Chicago Illinois Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children

Description

How to fill out Chicago Illinois Revocable Trust For Lifetime Benefit Of Trustor, Lifetime Benefit Of Surviving Spouse After Trustor's Death With Trusts For Children?

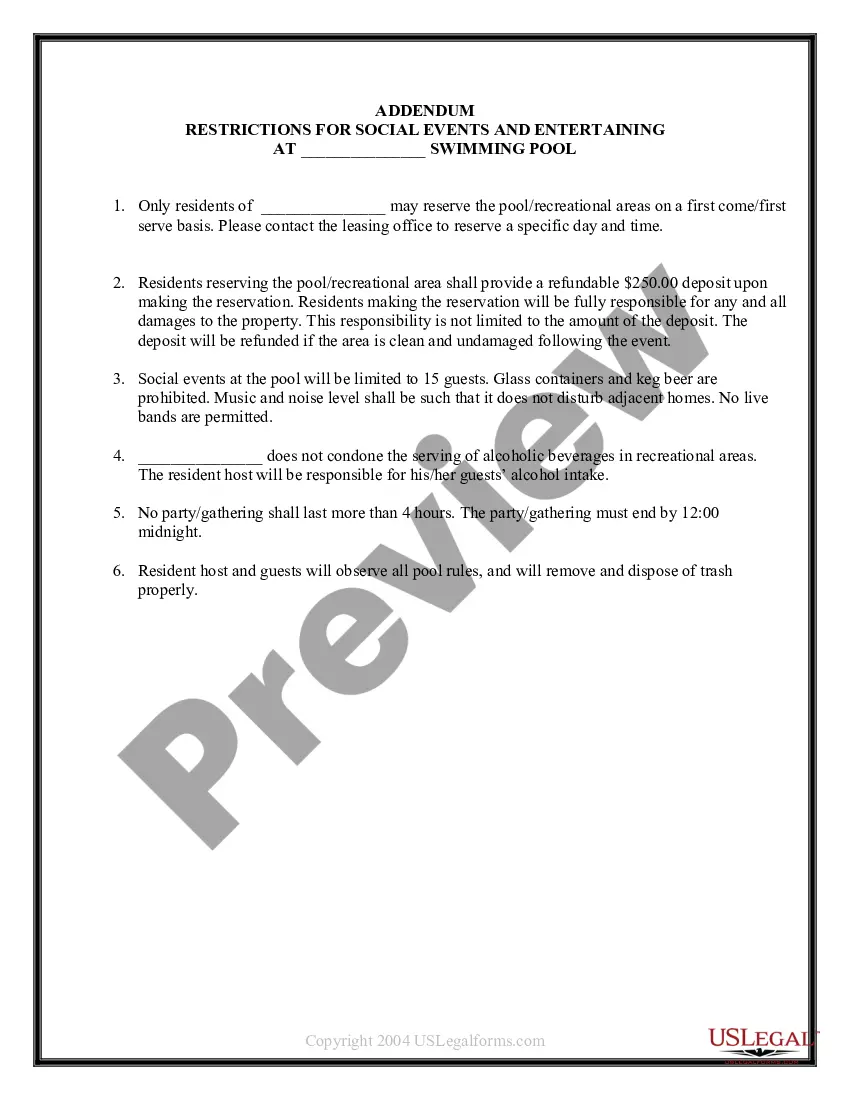

Creating legal forms is a must in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from scratch, including Chicago Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in various types varying from living wills to real estate papers to divorce documents. All forms are organized based on their valid state, making the searching process less overwhelming. You can also find information materials and guides on the website to make any tasks related to document completion straightforward.

Here's how to find and download Chicago Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children.

- Go over the document's preview and outline (if available) to get a general idea of what you’ll get after downloading the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can impact the legality of some documents.

- Examine the related forms or start the search over to locate the right file.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment gateway, and purchase Chicago Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Chicago Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children, log in to your account, and download it. Needless to say, our platform can’t take the place of an attorney entirely. If you need to cope with an extremely challenging situation, we advise getting a lawyer to check your form before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Join them today and get your state-specific documents with ease!