A Mecklenburg North Carolina Revocable Trust for the Lifetime Benefit of the Trust or, Lifetime Benefit of the Surviving Spouse after the Trust or's Death, with Trusts for Children is a legal document created to manage and distribute assets during and after the lifetime of the Trust or (the person who establishes the trust). This type of trust provides flexibility, control, and protection for the Trust or, the Surviving Spouse, and their children. The Mecklenburg North Carolina Revocable Trust is designed to be revocable, meaning the Trust or has the ability to modify or revoke the trust during their lifetime. This flexibility allows the Trust or to make changes to the trust provisions based on their changing circumstances or wishes. The primary purpose of establishing this type of trust is to ensure the lifetime financial benefit of the Trust or. The assets placed in the trust can be managed and distributed for the Trust or's benefit while they are alive. This could include the ability to access income generated by the trust assets, use trust property, or receive distributions as needed. Upon the Trust or's death, the Mecklenburg North Carolina Revocable Trust provides for the lifetime benefit of the Surviving Spouse. This means that the Surviving Spouse has the right to continue receiving income or distributions from the trust for their lifetime. This provision ensures that the Surviving Spouse is financially taken care of after the Trust or's passing. Additionally, the trust can establish separate trusts for the children of the Trust or. These trusts can be created to provide for the financial needs of the children and protect their inheritance. The Mecklenburg North Carolina Revocable Trust allows the Trust or to specify the terms and conditions under which the children can access their trust funds, ensuring responsible management and preventing misuse. The Mecklenburg North Carolina Revocable Trust for Lifetime Benefit of Trust or, Lifetime Benefit of Surviving Spouse after Trust or's Death with Trusts for Children can be customized to meet individual needs and preferences. It offers a range of benefits, including: 1. Flexibility: The ability to modify or revoke the trust during the Trust or's lifetime gives them control over their assets. 2. Privacy: Trusts are not subject to public probate proceedings, ensuring confidentiality and maintaining the privacy of the family's finances. 3. Asset protection: Trust assets may be shielded from potential creditors, lawsuits, and other legal claims, providing an extra layer of protection. 4. Tax planning: The trust can be structured in a way that minimizes estate taxes and capital gains taxes, potentially preserving more wealth for future generations. 5. Smooth distribution: By establishing separate trusts for children, the Trust or can ensure an organized and controlled distribution of assets to the intended beneficiaries. Some possible variations or additional types of Mecklenburg North Carolina Revocable Trusts for Lifetime Benefit of Trust or, Lifetime Benefit of Surviving Spouse after Trust or's Death with Trusts for Children may include: 1. Irrevocable Trust: Unlike a revocable trust, an irrevocable trust cannot be altered or revoked by the Trust or once it's established. This type of trust may provide additional asset protection benefits and potential tax advantages. 2. Special Needs Trust: This trust is designed to provide for the care and needs of a beneficiary with special needs. It can ensure that the beneficiary remains eligible for government benefits while still receiving additional financial support from the trust. 3. Generation-Skipping Trust: This trust allows the Trust or to skip a generation and distribute assets directly to grandchildren or future descendants, potentially reducing estate taxes and benefiting multiple generations. 4. Charitable Remainder Trust: This trust allows the Trust or to donate assets to a charitable organization while retaining an income stream from those assets for themselves or other beneficiaries. It is essential to consult with a qualified attorney or estate planning professional to determine the most suitable trust structure and provisions based on individual circumstances and goals.

Mecklenburg North Carolina Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children

Description

How to fill out Mecklenburg North Carolina Revocable Trust For Lifetime Benefit Of Trustor, Lifetime Benefit Of Surviving Spouse After Trustor's Death With Trusts For Children?

Preparing papers for the business or personal needs is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to generate Mecklenburg Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children without expert help.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Mecklenburg Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children by yourself, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary form.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the Mecklenburg Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children:

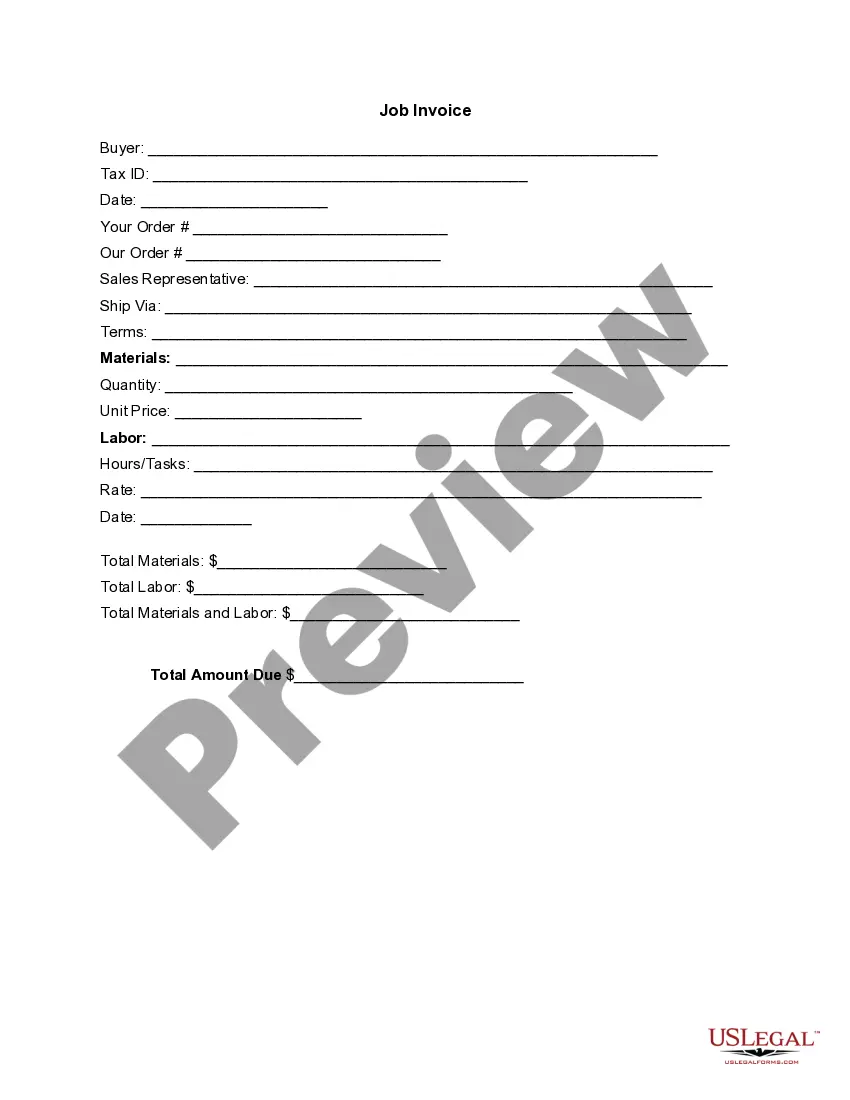

- Look through the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that fits your requirements, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any scenario with just a few clicks!