A Montgomery Maryland Revocable Trust for the Lifetime Benefit of Trust or, Lifetime Benefit of Surviving Spouse after Trust or's Death with Trusts for Children is a legal instrument that offers comprehensive estate planning benefits for individuals residing in Montgomery County, Maryland. This type of trust provides flexibility, privacy, and control over assets during the lifetime of the trust or, as well as after their passing. The main purpose of a revocable trust is to transfer assets and property into the trust, allowing for efficient management and distribution upon the trust or's death. By creating a revocable trust, you have the power to modify, alter, or revoke the trust's terms during your lifetime, making it a highly flexible estate planning tool. With a Montgomery Maryland Revocable Trust for the Lifetime Benefit of Trust or, Lifetime Benefit of Surviving Spouse after Trust or's Death with Trusts for Children, specific provisions can be included to ensure the surviving spouse is taken care of, while also providing for the financial needs of any children or other beneficiaries named in the trust. This ensures that your loved ones are provided for and assets are distributed according to your wishes. Some additional types or variations of Montgomery Maryland Revocable Trusts that may exist include: 1. Testamentary Revocable Trust: This trust takes effect upon the death of the trust or and is created within the trust or's will. By specifying the creation of a revocable trust in their will, the trust or can avoid probate and maintain control over the distribution of assets. 2. Irrevocable Life Insurance Trust (IIT): This type of trust is created specifically to hold life insurance policies, removing the death benefit amount from the trust or's taxable estate and providing liquidity to pay estate taxes or other expenses. 3. Medicaid Asset Protection Trust: Designed to help protect assets from nursing home and long-term care costs, this trust allows the trust or to qualify for Medicaid benefits while preserving some assets for their loved ones. 4. Special Needs Trust: This trust is specifically established to provide for the financial needs of a disabled or special needs individual, ensuring that they remain eligible for government benefits while still receiving supplementary funds. 5. Charitable Remainder Trust: By creating this trust, the trust or can donate assets to a charitable organization, while retaining an income stream for themselves or their surviving spouse. This allows for both philanthropic goals and financial benefits. In summary, a Montgomery Maryland Revocable Trust for the Lifetime Benefit of Trust or, Lifetime Benefit of Surviving Spouse after Trust or's Death with Trusts for Children offers extensive estate planning opportunities. By utilizing the appropriate type of revocable trust and including specific provisions, individuals can effectively manage their assets, provide for their loved ones, and ensure their wishes are carried out in Montgomery County, Maryland.

Montgomery Maryland Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children

Description

How to fill out Montgomery Maryland Revocable Trust For Lifetime Benefit Of Trustor, Lifetime Benefit Of Surviving Spouse After Trustor's Death With Trusts For Children?

Creating forms, like Montgomery Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children, to take care of your legal matters is a challenging and time-consumming task. A lot of cases require an attorney’s participation, which also makes this task not really affordable. However, you can get your legal issues into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents crafted for various scenarios and life circumstances. We ensure each form is in adherence with the regulations of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Montgomery Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children template. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your form? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as easy! Here’s what you need to do before downloading Montgomery Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children:

- Make sure that your form is compliant with your state/county since the rules for creating legal papers may vary from one state another.

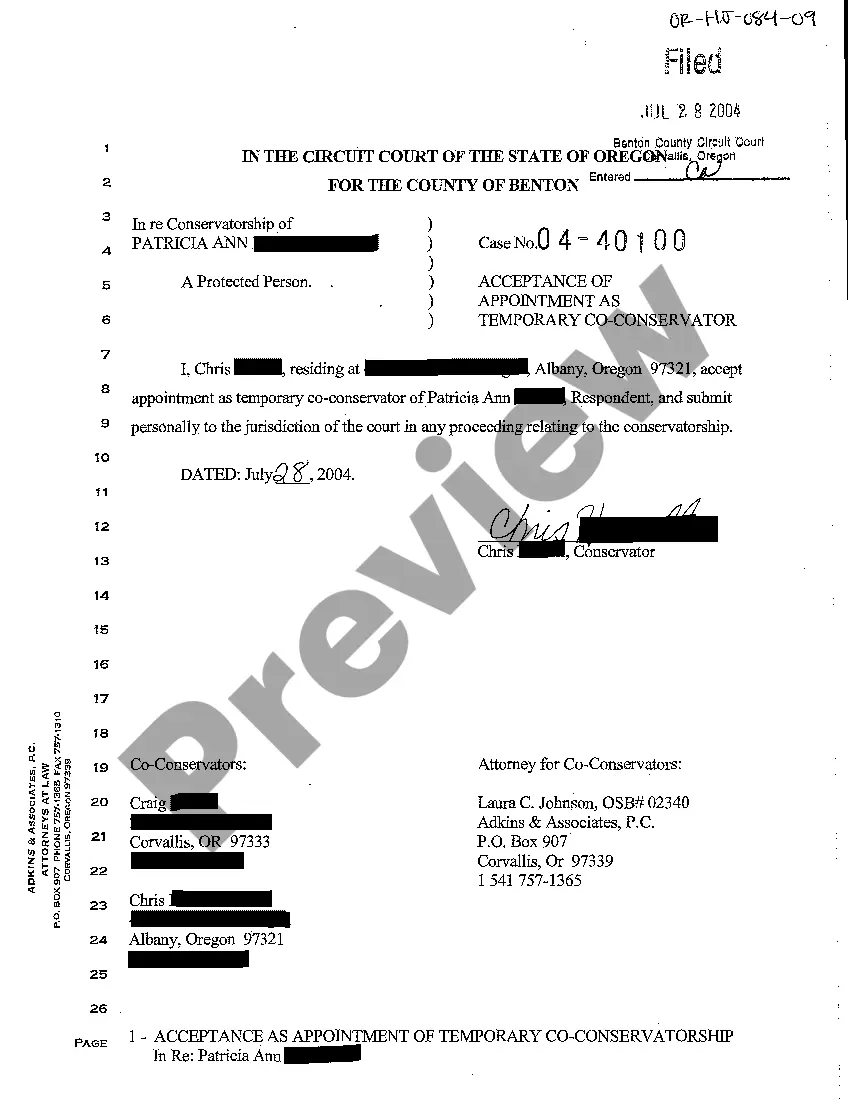

- Learn more about the form by previewing it or going through a brief intro. If the Montgomery Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to start using our website and download the document.

- Everything looks great on your end? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment information.

- Your template is good to go. You can go ahead and download it.

It’s an easy task to find and buy the appropriate template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!