A Nassau New York Revocable Trust for Lifetime Benefit of Trust or, Lifetime Benefit of Surviving Spouse after Trust or's Death with Trusts for Children is a legal tool that allows individuals to manage and distribute their assets during their lifetime, provide for their spouse after their passing, and establish trusts for the benefit of their children. This type of trust offers a flexible and comprehensive solution for estate planning, ensuring that one's wishes are carried out and loved ones are taken care of. The primary purpose of this trust is to provide ongoing financial stability and support to the trust or during their lifetime. The trust or, also known as the granter or settler, is the individual who establishes and funds the trust. By creating this revocable trust, the trust or retains control over the assets placed within it and can make changes or revoke it entirely if needed. Upon the trust or's death, the trust transitions to benefit the surviving spouse. This means that the surviving spouse can continue to receive income and utilize the trust's assets for their benefit. This provision ensures that the surviving spouse is financially secure and can maintain their standard of living even after the trust or's passing. Furthermore, this type of trust allows for the establishment of trusts for children. These separate trusts can be created to provide financial support, education expenses, and other needs for the trust or's children. By structuring the trust in this way, the trust or can ensure that their children are taken care of in a responsible and controlled manner, providing for their long-term well-being. There may be variations or different types of Nassau New York Revocable Trusts for Lifetime Benefit of Trust or, Lifetime Benefit of Surviving Spouse after Trust or's Death with Trusts for Children, including: 1. Standard Revocable Trust: This is the most common type of revocable trust, allowing for the trust or to retain control and make changes as deemed necessary. 2. Irrevocable Life Insurance Trust (IIT): This specialized trust is designed to hold life insurance policies outside the trust or's taxable estate, providing tax advantages and ensuring that the life insurance proceeds are not subject to estate taxes. 3. Special Needs Trust: If one or more beneficiaries have special needs or disabilities, a special needs trust can be established within the revocable trust to protect their eligibility for government benefits while providing for their supplemental needs. 4. Generation-Skipping Trust: This trust structure allows for assets to pass directly to grandchildren or future generations, avoiding estate taxes imposed on the wealth transfer to the next generation. In summary, a Nassau New York Revocable Trust for Lifetime Benefit of Trust or, Lifetime Benefit of Surviving Spouse after Trust or's Death with Trusts for Children is a versatile estate planning tool that provides financial security and control to the trust or during their lifetime, ensures the lifelong benefit of the surviving spouse, and establishes trusts for the well-being of children. It allows for various types of trusts to cater to different needs and goals.

Nassau New York Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children

Description

How to fill out Nassau New York Revocable Trust For Lifetime Benefit Of Trustor, Lifetime Benefit Of Surviving Spouse After Trustor's Death With Trusts For Children?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Nassau Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business occasions. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Nassau Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Nassau Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children:

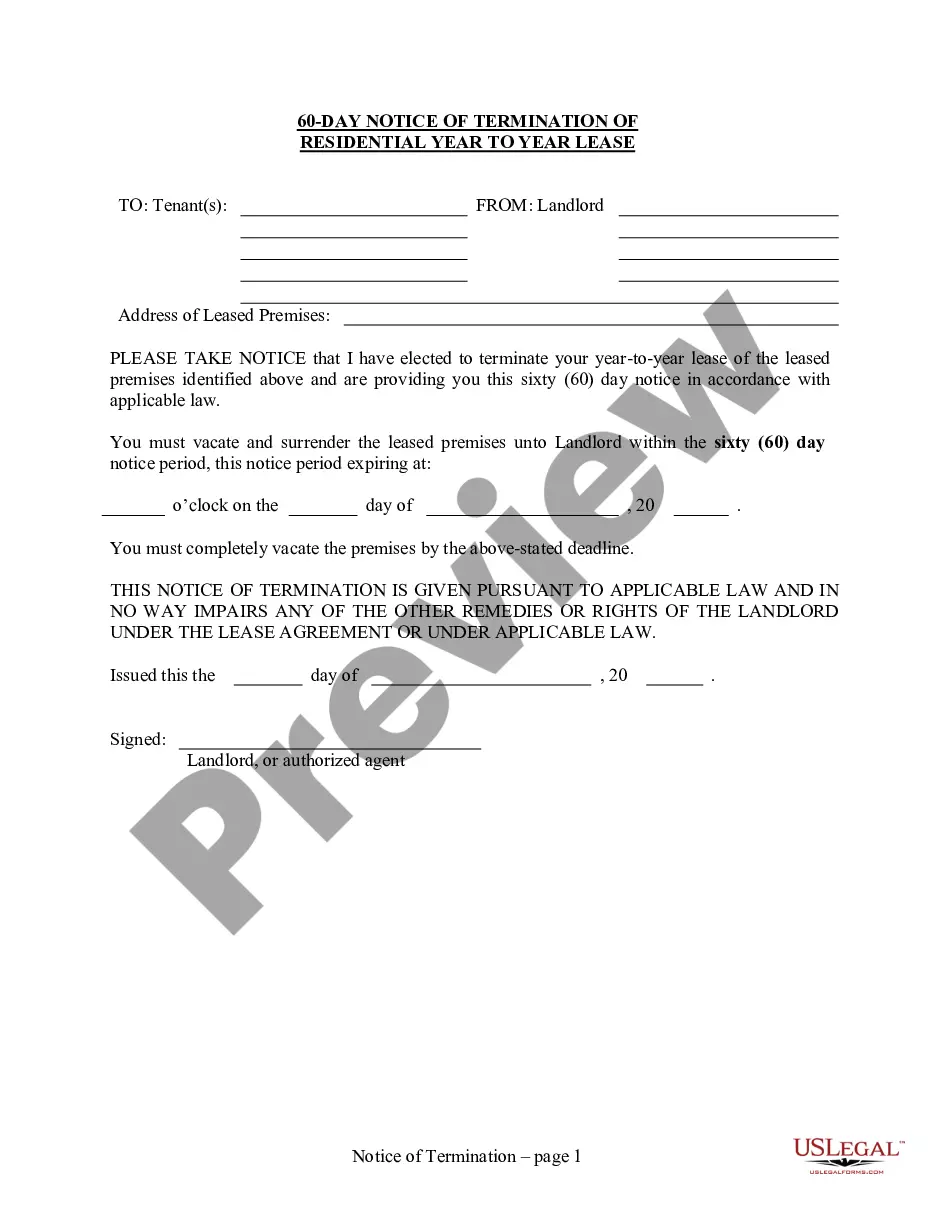

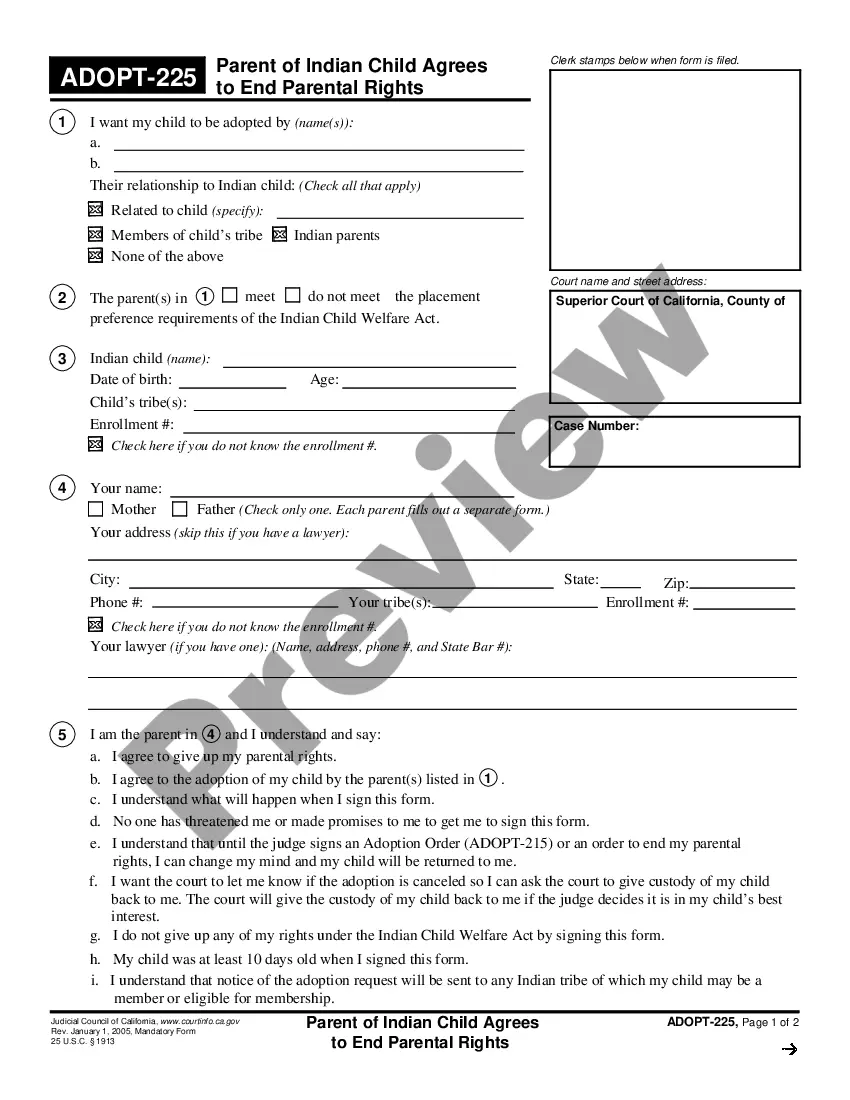

- Take a look at the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template when you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!