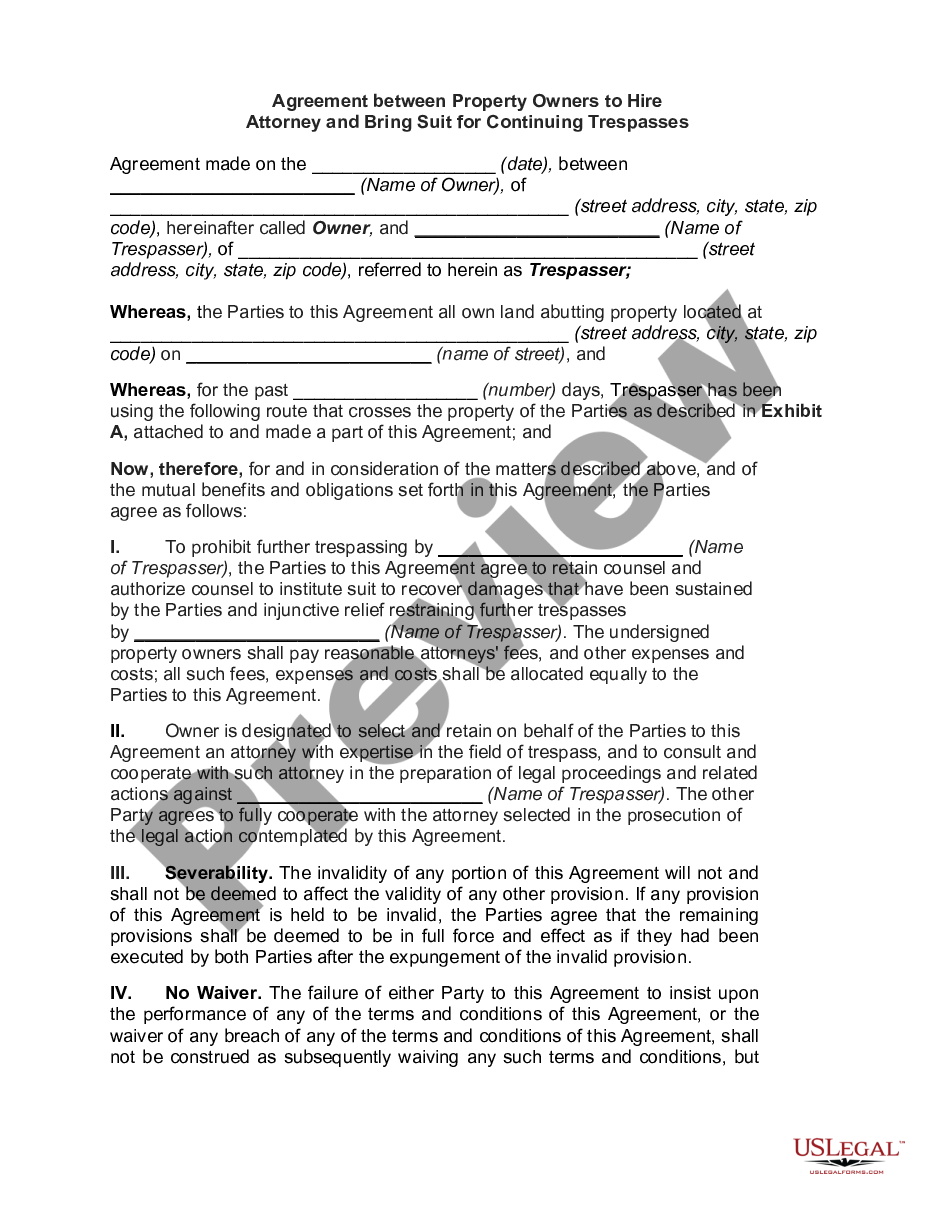

Dear [Executor/Executrix's Name], RE: CLOSING OF ESTATE FOR [Deceased's Name], DECEASED I hope this letter finds you well. As the representative of the estate of [Deceased's Name], it is with somber sentiment that I present to you the comprehensive breakdown of assets and expenses, ultimately leading to the closing of the estate. 1. IDENTIFICATION OF ASSETS: (a) Real Estate Properties: — Residential Property located at [Address] — Commercial Property located at [Address] — Rental Property located at [Address] (b) Personal Property: — Vehicles (with their respective makes, models, and registration details) — Jewelry, including watches, necklaces, rings, and other valuable items — Artwork, collectibles, and antique— - Electronics, appliances, furniture, and household items — Cash holdings, bank accounts, and investment portfolios — Business interests and partnerships in [Business Name(s)] — Insurance policies (life, health, property, etc.) 2. ASSET VALUATION: In accordance with legal procedures and expert appraisals, the assets have been evaluated as follows: (a) Real Estate Properties: — Residential Property: Valued at $________ — Commercial Property: Valued at $________ — Rental Property: Valued at $________ (b) Personal Property: — Vehicles: Valued at $_______— - Jewelry: Valued at $________ — Artwork, Collectibles, and Antiques: Valued at $________ — Electronics, Appliances, Furniture, and Household Items: Valued at $________ — Cash Holdings, Bank Accounts, and Investment Portfolios: Valued at $________ — Business Interests and Partnerships: Valued at $________ — Insurance Policies: Valued at $________ 3. EXPENSES INCURRED: Throughout the administration process, the following expenses have been disbursed: — Funeral expenses, including memorial services, burial/cremation costs, and obituary publication — Legal fees for estate administration and probate proceedings — Outstanding debt payments, mortgages, and loans on properties/assets — Utility bills, maintenance costs, and property taxes — Insurance premiums and policy settlements — Professional appraisal fee— - Executor/Executrix fees or commission — Any outstanding taxes, penalties, or fees owed by the estate 4. DISTRIBUTION AND ALLOCATIONS: Considering the aforementioned asset valuation and expenses incurred, the remaining estate will be distributed among beneficiaries and heirs as per the last will and testament, or in accordance with the laws of intestate succession in Ohio, if applicable. The distribution plan has been duly executed and documented accordingly. 5. CONCLUSION: With the assets adequately valued and necessary expenses settled, the estate of [Deceased's Name] is now ready to be closed. All assets have been distributed, debts paid, and legal obligations fulfilled to the best of our abilities. We request that you review the information provided, and if you have any queries or concerns, please do not hesitate to contact our legal team at [Contact Details]. Kindly sign and date the enclosed documents, which signifies your understanding and acknowledgment of the estate closing process. Please return the signed copies to our office at your earliest convenience. Thank you for entrusting us with the administration of [Deceased's Name]'s estate. We express our deepest sympathies during this difficult time and trust that our dedicated services have brought solace and closure to all parties involved. Yours sincerely, [Your Name] [Your Position/Title] [Law Firm/Organization Name]

Franklin Ohio Sample Letter for Closing of Estate with Breakdown of Assets and Expenses

Description

How to fill out Franklin Ohio Sample Letter For Closing Of Estate With Breakdown Of Assets And Expenses?

Do you need to quickly create a legally-binding Franklin Sample Letter for Closing of Estate with Breakdown of Assets and Expenses or maybe any other form to manage your own or corporate affairs? You can select one of the two options: contact a professional to write a valid paper for you or draft it completely on your own. The good news is, there's a third option - US Legal Forms. It will help you receive neatly written legal documents without having to pay unreasonable prices for legal services.

US Legal Forms offers a rich catalog of more than 85,000 state-compliant form templates, including Franklin Sample Letter for Closing of Estate with Breakdown of Assets and Expenses and form packages. We provide documents for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been on the market for over 25 years and got a spotless reputation among our clients. Here's how you can become one of them and obtain the necessary document without extra hassles.

- To start with, carefully verify if the Franklin Sample Letter for Closing of Estate with Breakdown of Assets and Expenses is tailored to your state's or county's regulations.

- If the form has a desciption, make sure to check what it's intended for.

- Start the search over if the form isn’t what you were seeking by utilizing the search box in the header.

- Choose the subscription that is best suited for your needs and proceed to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Franklin Sample Letter for Closing of Estate with Breakdown of Assets and Expenses template, and download it. To re-download the form, just head to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. Additionally, the documents we provide are reviewed by law professionals, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Most assets can be distributed by preparing a new deed, changing the account title, or by giving the person a deed of distribution. For example: To transfer a bank account to a beneficiary, you will need to provide the bank with a death certificate and letters of administration.

The final accounting is a summary of accounts filed by the probate executor, showing details of important financial undertakings during the accounting period. This form may not outline all the information, but those records are kept for future use.

To distribute everything evenly, one can simply list beneficiaries. If certain items are to be left to certain people, that must be spelled out in the will. For the inheritance process to begin, a will must be submitted to probate.

Beneficiaries are entitled to a proper accounting of the estate. The executor must provide proper accounting, in Court format, to beneficiaries in a timely manner.

The California petition for final distribution gives the court a detailed history of the probate case. More specifically, it explains why the estate is ready to close and outlines the distributions to beneficiaries.

Do not show any income earned after death as adjustments to inventory. To prepare this schedule, list any and all income earned by the estate after the date of death, such as interest on bank accounts or investments, rental income, and dividends. To prepare this schedule, list the disbursements paid by the estate.

Yes. Before the executor distributes the estate, they have to give the beneficiaries a final accounting of their administration of the estate, including any fee they're charging. And the beneficiaries must agree with it for the executor to proceed.

The executor first uses the funds in the account to pay any of the estate's creditors and then distributes the money according to local inheritance laws. In most states, most or all of the money goes to the deceased's spouse and children.

Once the Grant of Probate has been issued, the executor has to keep accounts and have these ready to show beneficiaries if they ask for them.

To split your estate fairly between your beneficiaries, you'll need to add up the total value of your estate and share it equally. Include all of your assets, property, and savings. Remember that some assets, like life insurance and retirement accounts, won't get distributed right away.

Interesting Questions

More info

The Government provides a temporary exemption from sales and use tax to homebuyers that are purchasing the primary residence on behalf of a federally recognized Indian tribe for more than 30 days. The exemption does not include use tax, real estate transfer tax, title tax, real property taxes or municipal tax. Use this tool to determine which exemptions you may possess. . The executor will apply for Letters Testamentary. On Attachment 1, the estate representative fills in the value of each such asset. Letters of Authority make it possible for the executor to administer the estate. Estate (Large) Forms ; PC-EGT-4. 6R, Letters of Intent [Not to sell or lease title] ; PC-EGT-34. . The executor will apply for Letters Testamentary. On Attachment 1, the estate representative fills in the value of each such asset. Letters of Authority make it possible for the executor to administer the estate.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.