The Clark Nevada Irrevocable Trust is a specialized type of trust that falls under the category of Qualifying Subchapter-S Trusts. This trust structure provides several unique benefits and options for individuals looking to manage their assets and plan for the future. One type of Clark Nevada Irrevocable Trust is the Granter Retained Annuity Trust (GREAT). A GREAT allows the Granter to transfer assets while retaining an annuity interest for a certain period of time. This type of trust is particularly useful for minimizing estate taxes and transferring wealth to beneficiaries. Another type of Clark Nevada Irrevocable Trust is the Qualified Personnel Residence Trust (PRT). With a PRT, the Granter transfers their primary residence or vacation home into the trust while retaining the right to reside in the property for a specified period. This trust enables the Granter to reduce the value of their estate for estate tax purposes while still maintaining control over their residence. Additionally, there is the Charitable Lead Annuity Trust (FLAT), which allows the Granter to contribute assets to the trust while providing annual payments to a charitable organization for a set period. This trust structure offers both charitable giving opportunities and estate tax benefits. The Clark Nevada Irrevocable Trust serves as an effective tool for asset protection, estate planning, and tax optimization. It is important to consult with a qualified attorney or financial advisor to determine the suitability and specific advantages of this trust structure based on individual circumstances. Keywords: Clark Nevada Irrevocable Trust, Qualifying Subchapter-S Trust, Granter Retained Annuity Trust (GREAT), Qualified Personnel Residence Trust (PRT), Charitable Lead Annuity Trust (FLAT), asset protection, estate planning, tax optimization, estate taxes, beneficiaries, wealth transfer, annuity interest, primary residence, vacation home, charitable giving, attorney, financial advisor.

Clark Nevada Irrevocable Trust which is a Qualifying Subchapter-S Trust

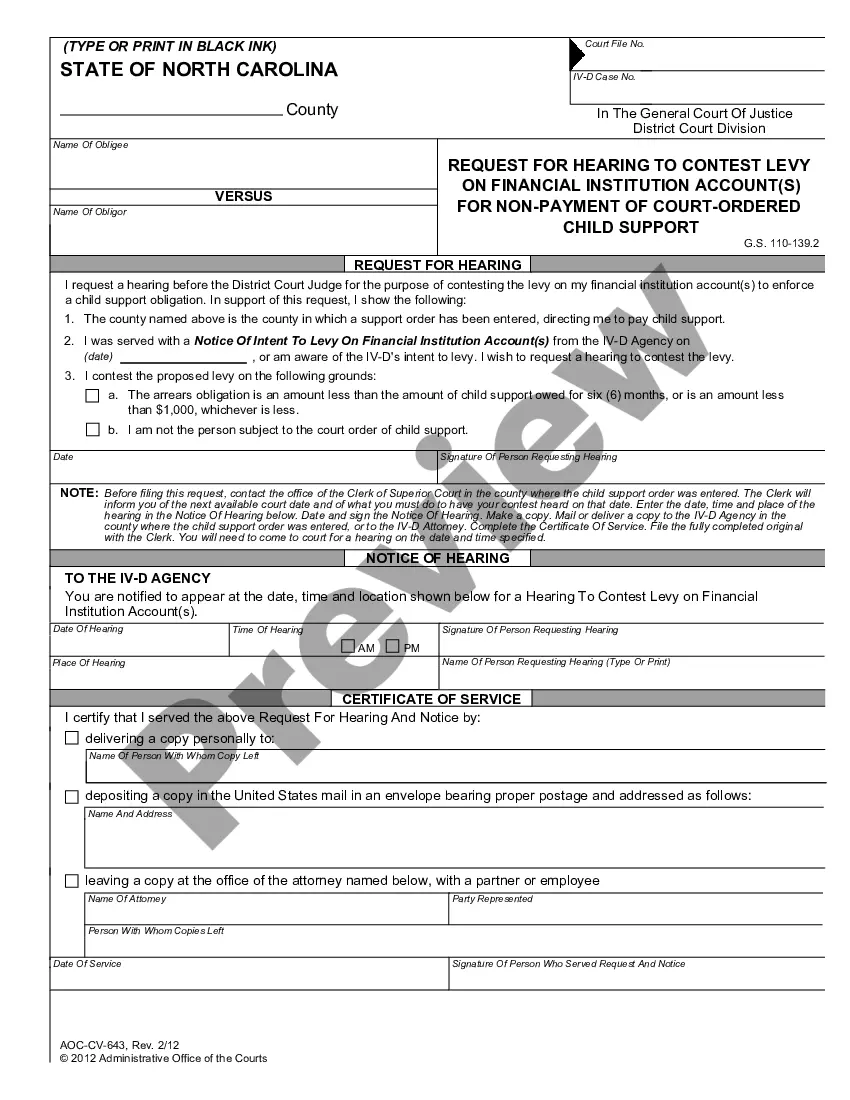

Description

How to fill out Clark Nevada Irrevocable Trust Which Is A Qualifying Subchapter-S Trust?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare formal paperwork that differs throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and download a document for any individual or business objective utilized in your county, including the Clark Irrevocable Trust which is a Qualifying Subchapter-S Trust.

Locating forms on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the Clark Irrevocable Trust which is a Qualifying Subchapter-S Trust will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guide to obtain the Clark Irrevocable Trust which is a Qualifying Subchapter-S Trust:

- Make sure you have opened the right page with your regional form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form meets your requirements.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Clark Irrevocable Trust which is a Qualifying Subchapter-S Trust on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!