San Diego California Irrevocable Trust is a legal entity established under the laws of the state of California that serves as a valuable estate planning tool for individuals looking to protect and distribute their assets in a tax-efficient manner. It specifically refers to a subchapter S-trust structure, which allows the trust to be treated as an eligible shareholder in an S-corporation. An Irrevocable Trust is a type of trust that, once established, cannot be modified or revoked without the consent of all beneficiaries involved. This legal arrangement grants the trustee or trustees the authority to manage and distribute the assets held within the trust according to the terms set forth by the trust's creator, also known as the granter. Qualifying Subchapter-S Trust (SST) is a specialized form of Irrevocable Trust recognized by the Internal Revenue Service (IRS) that meets specific requirements to be eligible as a shareholder in an S-corporation. By utilizing an SST, the trust itself can serve as an intermediary between the S-corporation and the beneficiaries, providing various benefits such as unique tax planning opportunities and potential estate tax savings. In San Diego, California, there are several variations or subtypes of Irrevocable Trusts that can be established as Qualifying Subchapter-S Trusts, including: 1. Personal Residence Trust (PRT): This trust is designed to safeguard the granter's primary residence or second home while reducing potential estate tax liability. The granter transfers the property's ownership to the trust but retains the right to live in it for a specific period (specified within the trust agreement). 2. Charitable Remainder Trust (CRT): With this type of Irrevocable Trust, the granter can donate assets to a charitable organization and receive an income stream from those assets during their lifetime. Upon the granter's passing, the remaining assets are then distributed to the designated charities. 3. Generation-Skipping Trust (GST): This trust is primarily aimed at minimizing estate taxes and preserving wealth for multiple generations. The assets placed within the trust bypass the granter's children and transfer directly to their grandchildren, thereby avoiding estate taxes in the children's generation. 4. Special Needs Trust (SET): An SET is intended to provide financial support for a person with special needs without jeopardizing their eligibility for government benefits. The trust assets can be used to enhance the individual's quality of life while preserving their access to essential public assistance programs. By establishing a San Diego California Irrevocable Trust that qualifies as a Subchapter-S Trust, individuals can leverage the advantages of this trust structure in combination with specific types of Irrevocable Trusts tailored to their unique circumstances and estate planning goals. It is crucial to consult with an experienced estate planning attorney or financial advisor for personalized guidance in determining the most suitable type of trust for individual needs.

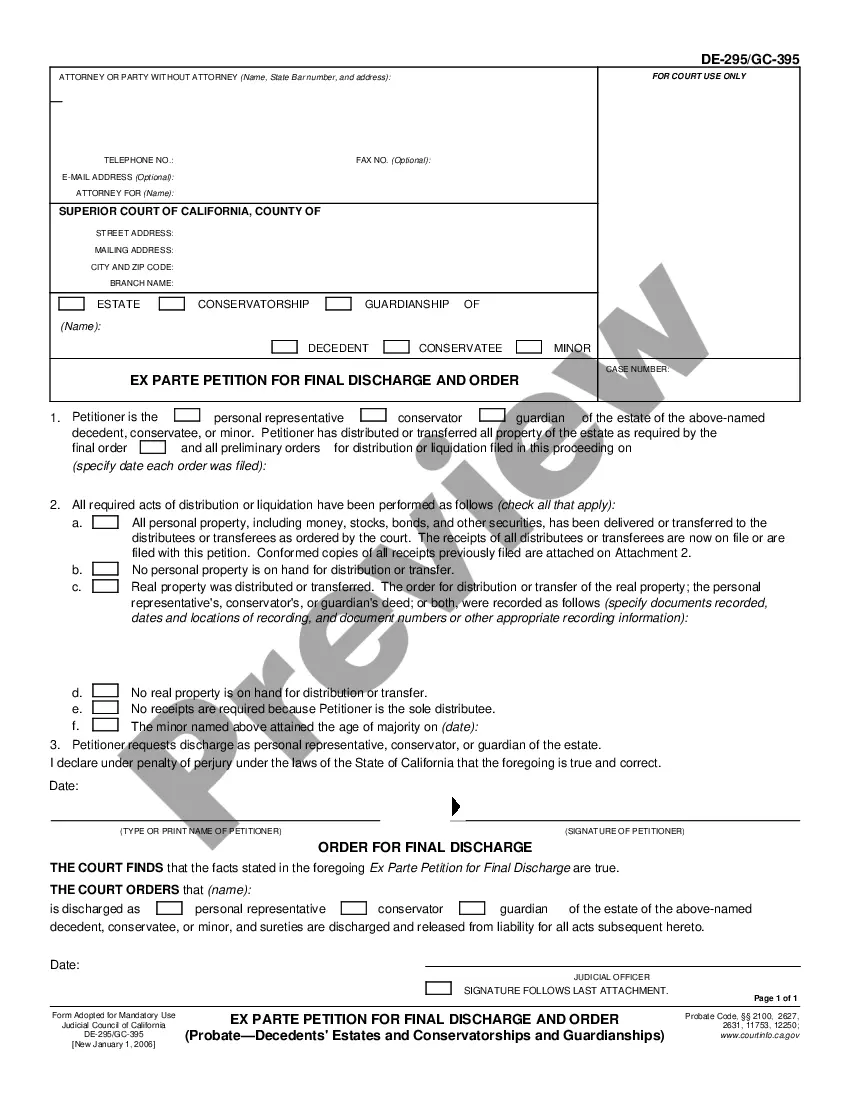

San Diego California Irrevocable Trust which is a Qualifying Subchapter-S Trust

Description

How to fill out San Diego California Irrevocable Trust Which Is A Qualifying Subchapter-S Trust?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare official paperwork that varies from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any individual or business objective utilized in your region, including the San Diego Irrevocable Trust which is a Qualifying Subchapter-S Trust.

Locating forms on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the San Diego Irrevocable Trust which is a Qualifying Subchapter-S Trust will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guide to get the San Diego Irrevocable Trust which is a Qualifying Subchapter-S Trust:

- Ensure you have opened the proper page with your local form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template satisfies your needs.

- Search for another document using the search option if the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the San Diego Irrevocable Trust which is a Qualifying Subchapter-S Trust on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!