Title: Phoenix, Arizona: What You Should Know About Estate Distribution to a Church — Sample Letter Included Introduction: In the vibrant city of Phoenix, Arizona, countless individuals leave behind significant assets and properties in their estates. Oftentimes, these generous individuals express their desire to distribute a portion or the entirety of their estate to a church that holds special meaning to them. To navigate this process seamlessly, it is crucial to understand the legal and financial aspects involved. In this article, we will provide a detailed description of estate distribution to a church in Phoenix, Arizona, including various types of sample letters that could be used in different situations. I. Understanding Estate Distribution to a Church in Phoenix, Arizona: When an individual passes away, their estate enters into the probate process, which involves the distribution of their assets and settling of their debts. If the deceased person wishes to bequeath a portion of their estate to a church in Phoenix, Arizona, specific legal steps must be followed. Ensuring compliance with estate and tax laws is essential to help prevent any potential issues. II. Types of Phoenix, Arizona Sample Letters for Distribution of Estate to a Church: 1. Sample Letter Requesting Information: This type of letter is used when the executor or representative of the deceased's estate seeks information about the church's acceptance of estate distributions. It includes queries related to the church's policies, procedures, and any requirements associated with accepting estates. 2. Sample Letter Informing the Church of Intentions: In situations where the deceased person has already established their desire to distribute their estate to the church, this letter notifies the church administration of their intentions. It typically includes relevant contact information and requests a meeting to discuss the necessary arrangements. 3. Sample Letter for Donation Allocation: After initial communication with the church, this letter is crafted to specify the intended allocation of assets or funds. It outlines the exact percentage or amount to be distributed and may also include any specific purposes or programs within the church that the deceased wishes to support. 4. Sample Letter for Executor/Representative Certification: This letter is addressed to the church and confirms the executor's or representative's authority to act on behalf of the deceased's estate. It includes relevant legal documentation, such as a copy of the will or any court-issued letters of administration. III. Conclusion: Navigating the process of distributing an estate to a church in Phoenix, Arizona, requires careful attention to legal and administrative matters. By understanding the various types of Phoenix Arizona sample letters for estate distribution to a church, you can ensure effective communication with the church administration. Properly written letters help facilitate the fulfillment of the deceased's wishes and promote a seamless transfer of assets while complying with relevant legal requirements.

Phoenix Arizona Sample Letter for Distribution of Estate to Church

Description

How to fill out Phoenix Arizona Sample Letter For Distribution Of Estate To Church?

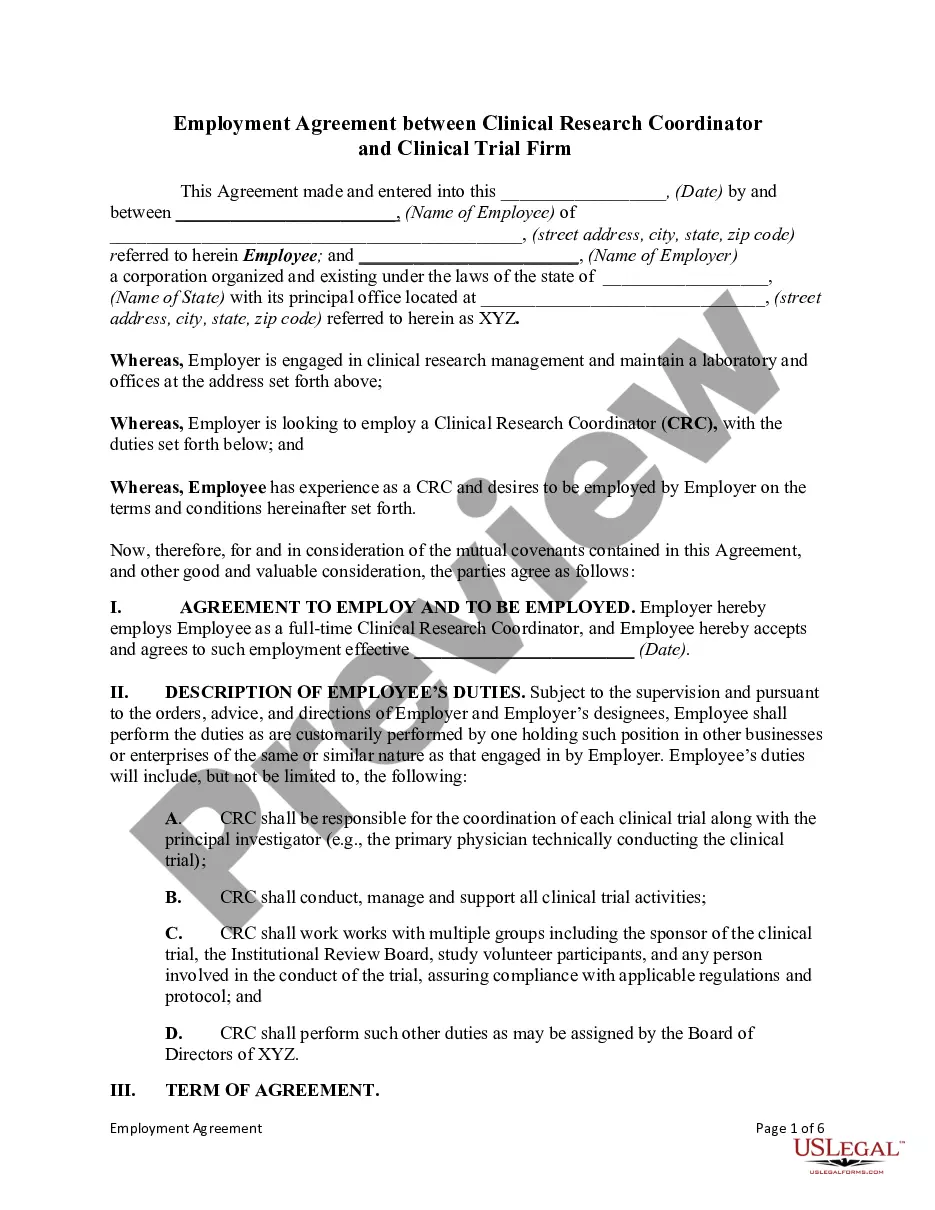

Are you looking to quickly draft a legally-binding Phoenix Sample Letter for Distribution of Estate to Church or maybe any other form to take control of your own or corporate affairs? You can select one of the two options: contact a legal advisor to draft a legal paper for you or draft it entirely on your own. Luckily, there's an alternative solution - US Legal Forms. It will help you get professionally written legal papers without having to pay unreasonable prices for legal services.

US Legal Forms offers a huge collection of more than 85,000 state-specific form templates, including Phoenix Sample Letter for Distribution of Estate to Church and form packages. We offer templates for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been out there for more than 25 years and got a spotless reputation among our clients. Here's how you can become one of them and get the needed template without extra troubles.

- First and foremost, double-check if the Phoenix Sample Letter for Distribution of Estate to Church is adapted to your state's or county's regulations.

- If the form includes a desciption, make sure to check what it's suitable for.

- Start the search over if the template isn’t what you were seeking by utilizing the search bar in the header.

- Choose the subscription that best suits your needs and proceed to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Phoenix Sample Letter for Distribution of Estate to Church template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. Moreover, the paperwork we provide are reviewed by industry experts, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!