Allegheny Pennsylvania Qualifying Subchapter-S Revocable Trust Agreement is a legal document designed to establish a trust for individuals residing in Allegheny County, Pennsylvania, who wish to benefit from the federal tax advantages provided by the Subchapter S Corporation. This trust agreement is often used by individuals who are looking to protect their assets and potentially minimize taxes for their beneficiaries. The Allegheny Pennsylvania Qualifying Subchapter-S Revocable Trust Agreement allows the granter (the person establishing the trust) to retain control and flexibility over their assets during their lifetime while ensuring a smooth transfer of those assets to their chosen beneficiaries upon their death. By establishing a trust, the granter can minimize probate costs and potential delays associated with the distribution of their estate. Keywords: Allegheny Pennsylvania, Qualifying, Subchapter-S, Revocable Trust Agreement, trust, legal document, trust agreement, assets, beneficiaries, tax advantages, Subchapter S Corporation, granter, control, flexibility, lifetime, transfer, death, smooth, probate costs, delays, estate. There might be variations or subtypes of the Allegheny Pennsylvania Qualifying Subchapter-S Revocable Trust Agreement, depending on the specific needs and circumstances of the granter. Some potential variations could include: 1. Allegheny Pennsylvania Qualifying Subchapter-S Irrevocable Trust Agreement: Unlike a revocable trust, this type of trust cannot be modified or revoked once established, providing additional asset protection and potential tax benefits. 2. Allegheny Pennsylvania Qualifying Subchapter-S Special Needs Trust Agreement: Designed specifically for individuals with special needs, this trust ensures that the beneficiary can receive essential government benefits without jeopardizing their eligibility due to the trust's provisions. 3. Allegheny Pennsylvania Qualifying Subchapter-S Charitable Remainder Trust Agreement: This type of trust allows the granter to make charitable donations while still receiving income from the contributed assets throughout their lifetime. Upon the granter's death, the remaining assets are then transferred to the designated charitable organization(s). 4. Allegheny Pennsylvania Qualifying Subchapter-S Generation-Skipping Trust Agreement: This trust is created to transfer assets to grandchildren or subsequent generations while minimizing estate taxes. It allows the granter's children to benefit from the trust income during their lifetime, with the principal eventually passing on to the grandchildren. Note: These are hypothetical variations and may not correspond to actual legal documents in existence. It is crucial to consult with a qualified attorney to determine the applicable types of trusts and their specific provisions under Allegheny Pennsylvania laws.

Allegheny Pennsylvania Qualifying Subchapter-S Revocable Trust Agreement

Description

How to fill out Allegheny Pennsylvania Qualifying Subchapter-S Revocable Trust Agreement?

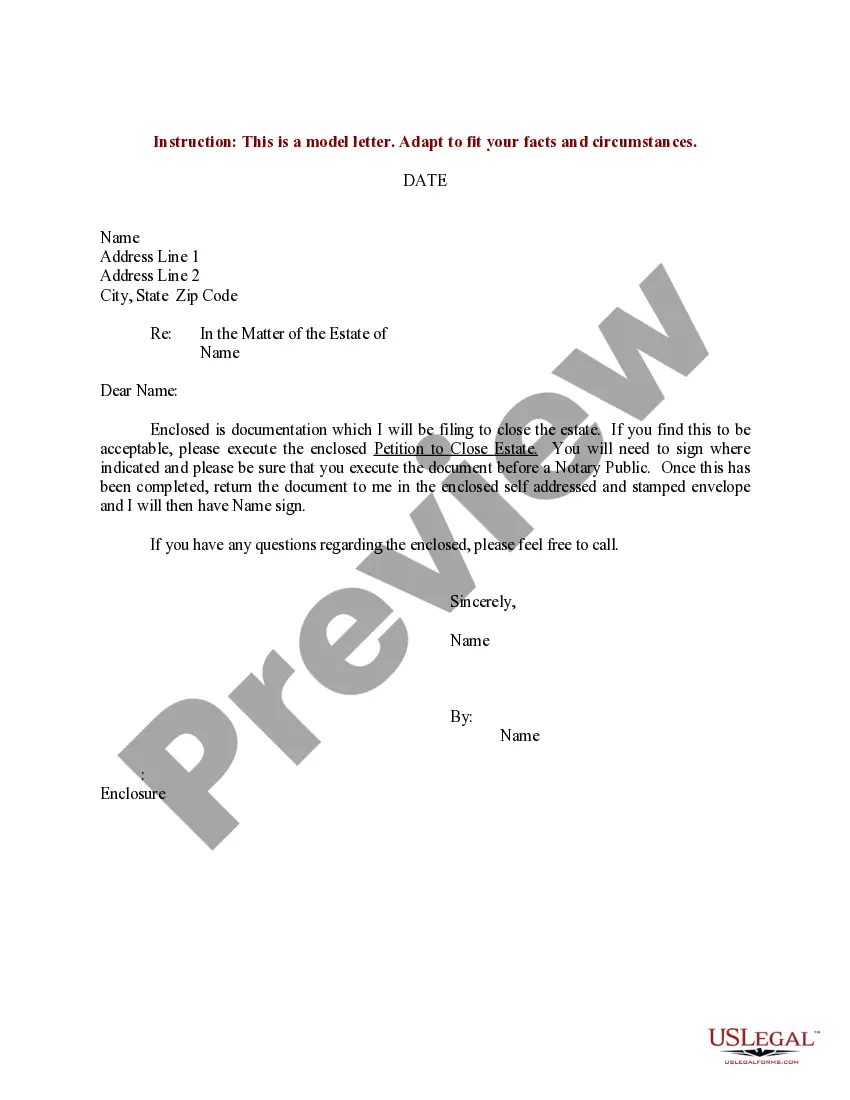

Do you need to quickly create a legally-binding Allegheny Qualifying Subchapter-S Revocable Trust Agreement or probably any other form to take control of your personal or corporate affairs? You can select one of the two options: hire a professional to draft a valid paper for you or create it entirely on your own. Luckily, there's another option - US Legal Forms. It will help you receive professionally written legal documents without paying unreasonable prices for legal services.

US Legal Forms provides a rich catalog of more than 85,000 state-compliant form templates, including Allegheny Qualifying Subchapter-S Revocable Trust Agreement and form packages. We offer templates for an array of life circumstances: from divorce paperwork to real estate documents. We've been out there for more than 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and obtain the necessary template without extra hassles.

- First and foremost, carefully verify if the Allegheny Qualifying Subchapter-S Revocable Trust Agreement is adapted to your state's or county's laws.

- In case the document comes with a desciption, make sure to verify what it's intended for.

- Start the searching process again if the template isn’t what you were looking for by using the search bar in the header.

- Choose the plan that best suits your needs and proceed to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Allegheny Qualifying Subchapter-S Revocable Trust Agreement template, and download it. To re-download the form, just head to the My Forms tab.

It's easy to find and download legal forms if you use our services. Moreover, the paperwork we offer are updated by law professionals, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!