The Clark Nevada Qualifying Subchapter-S Revocable Trust Agreement is a legal document that establishes a trust in accordance with the Subchapter-S provisions of the Internal Revenue Code in the state of Nevada. This type of trust is designed to provide tax benefits and flexibility to small business owners or shareholders who wish to protect their assets and distribute income in a controlled manner. Keywords: Clark Nevada, Qualifying Subchapter-S Revocable Trust Agreement, trust, Subchapter-S, Internal Revenue Code, tax benefits, small business owners, shareholders, assets, income, controlled manner. There are several types of Clark Nevada Qualifying Subchapter-S Revocable Trust Agreements that cater to different specific needs and circumstances. Some of these variations are: 1. Individual Clark Nevada Qualifying Subchapter-S Revocable Trust Agreement: This type of trust is designed for small business owners who want to retain control over their assets while enjoying the tax benefits offered by the Subchapter-S provisions. 2. Family Clark Nevada Qualifying Subchapter-S Revocable Trust Agreement: This trust is created for families who wish to transfer their business assets to future generations while minimizing tax liabilities. It enables efficient estate planning and smooth generational transition. 3. Shareholder Clark Nevada Qualifying Subchapter-S Revocable Trust Agreement: This trust is established by shareholders of a closely-held corporation to facilitate the transfer of business interests while maintaining Subchapter-S status. It allows for seamless ownership changes without risking the loss of tax advantages. 4. Succession Clark Nevada Qualifying Subchapter-S Revocable Trust Agreement: This agreement addresses the orderly transfer of a small business's ownership and control to a selected successor(s). It ensures a smooth transition and minimizes disruptions in business operations. In conclusion, the Clark Nevada Qualifying Subchapter-S Revocable Trust Agreement is a legal instrument that provides business owners or shareholders with an effective tool to protect their assets, distribute income, and gain tax advantages. The variations of this trust agreement cater to specific needs such as individual control, family wealth transfer, shareholder transitions, and succession planning.

Clark Nevada Qualifying Subchapter-S Revocable Trust Agreement

Description

How to fill out Clark Nevada Qualifying Subchapter-S Revocable Trust Agreement?

Preparing documents for the business or individual needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to consider all federal and state laws of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to draft Clark Qualifying Subchapter-S Revocable Trust Agreement without professional help.

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid Clark Qualifying Subchapter-S Revocable Trust Agreement on your own, using the US Legal Forms online library. It is the greatest online collection of state-specific legal templates that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the required form.

In case you still don't have a subscription, follow the step-by-step guideline below to get the Clark Qualifying Subchapter-S Revocable Trust Agreement:

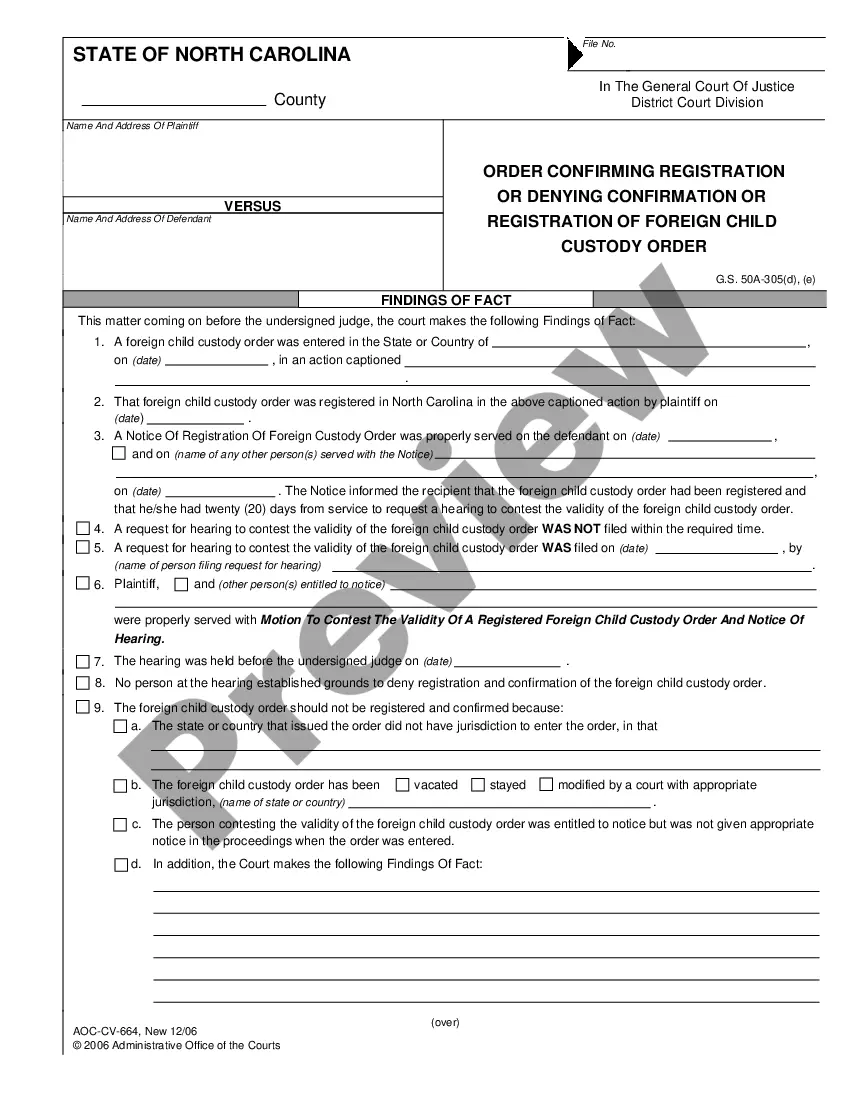

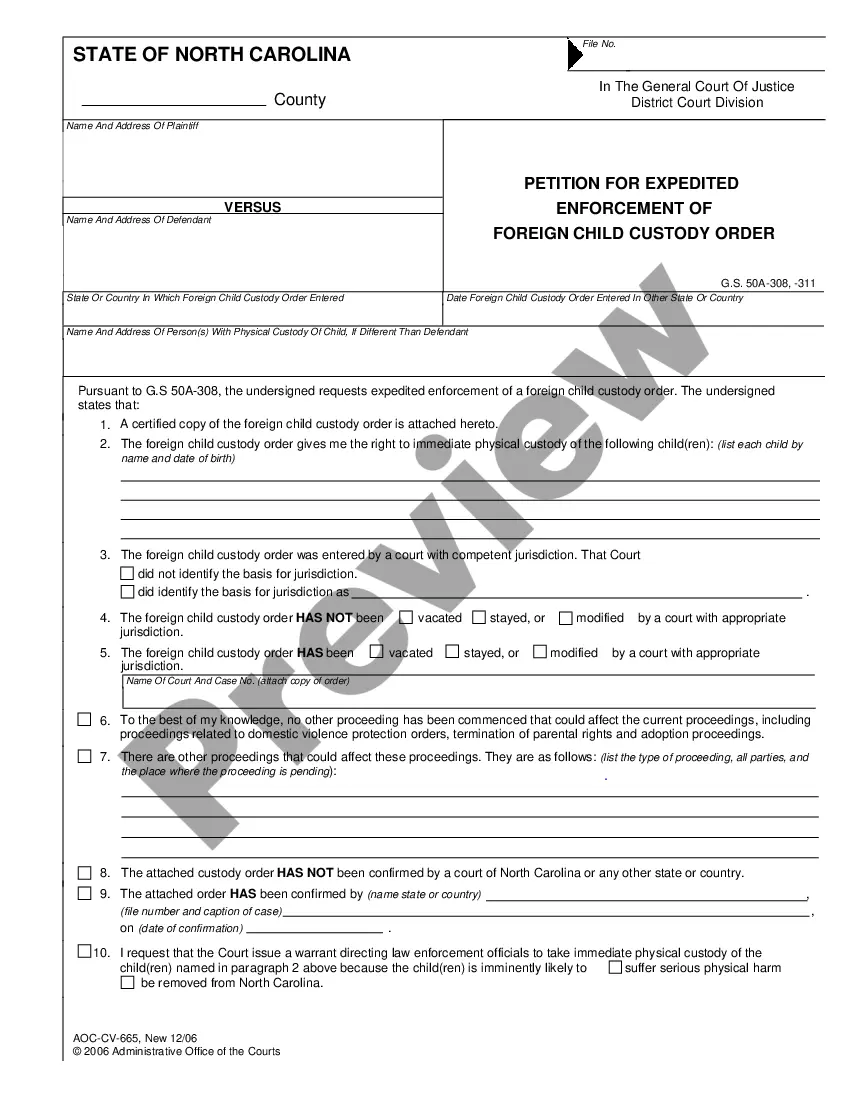

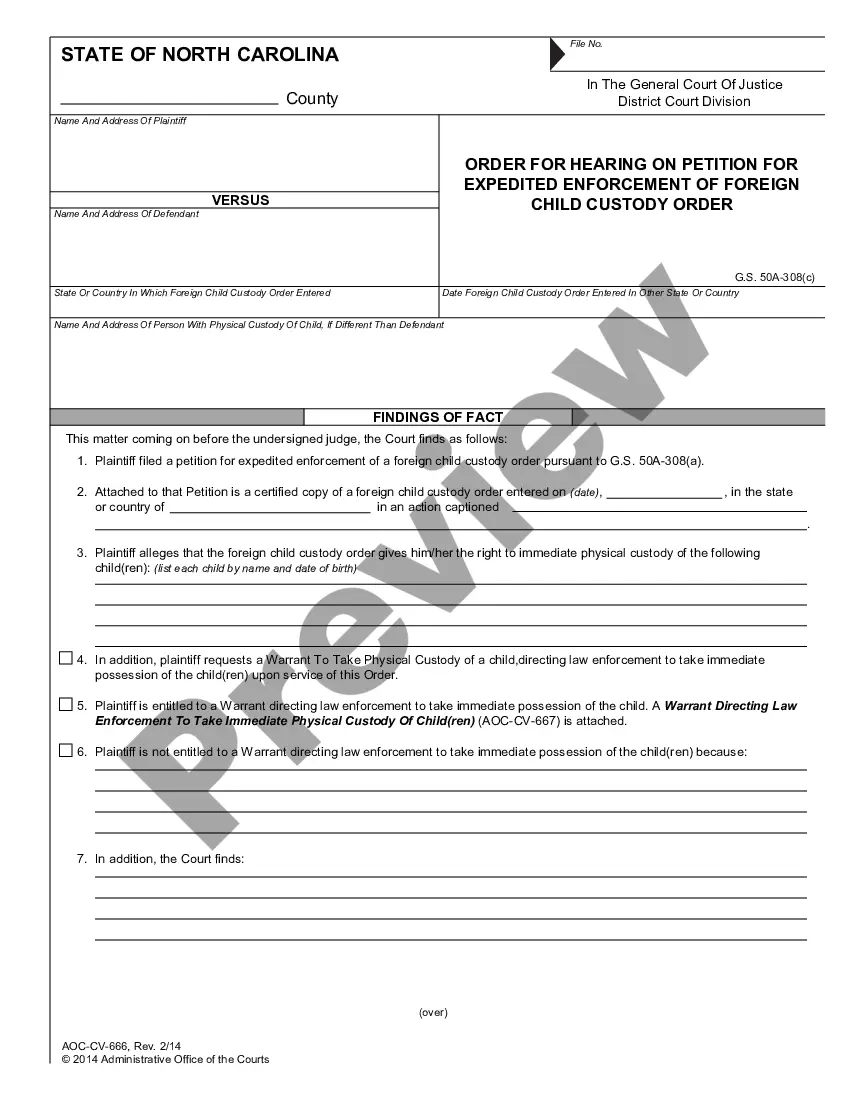

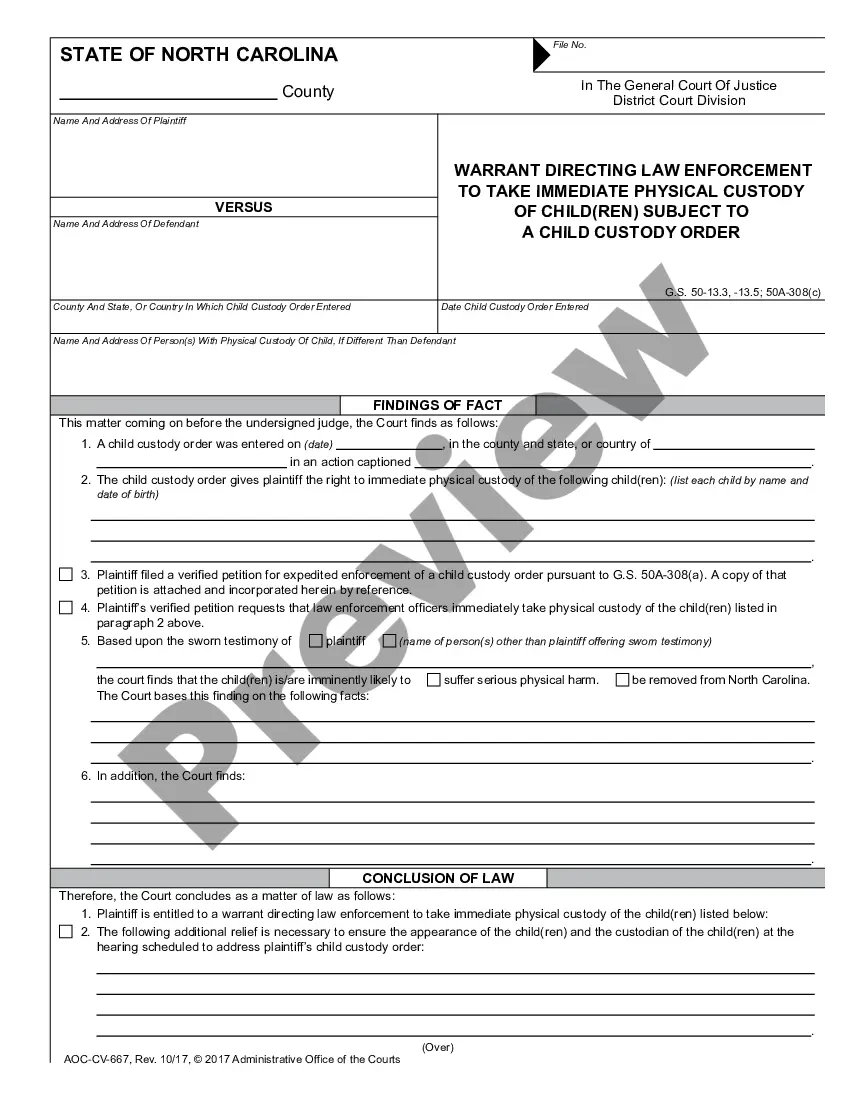

- Look through the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that suits your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal forms for any use case with just a few clicks!