Contra Costa California Qualifying Subchapter-S Revocable Trust Agreement is a legal document that establishes a trust arrangement in compliance with the subchapter S provisions of the Internal Revenue Code. This trust agreement is specifically tailored for individuals residing in Contra Costa County, California, who wish to create a revocable trust while enjoying the tax benefits provided by Subchapter S. The Contra Costa California Qualifying Subchapter-S Revocable Trust Agreement serves as an effective estate planning tool, enabling individuals to maintain control over their assets during their lifetime while ensuring a smooth transition of those assets to the named beneficiaries upon their death. By designating a trustee, who can be the creator of the trust or a third party, the trust agreement ensures that the assets are managed and distributed in accordance with the creator's wishes. This Trust Agreement offers various types of Contra Costa California Qualifying Subchapter-S Revocable Trust Agreements, including: 1. Individual Subchapter-S Revocable Trust Agreement: This type of trust agreement is designed for individuals who wish to create a trust solely for themselves. It allows the creator to transfer assets into the trust, maintain control over their assets during their lifetime, and designate beneficiaries to inherit those assets upon their death. 2. Spousal Subchapter-S Revocable Trust Agreement: This type of trust agreement is designed for married couples. It allows both spouses to establish separate trusts, maintaining control over their individual assets during their lifetime. Upon the death of one spouse, the surviving spouse becomes the primary beneficiary of the deceased spouse's trust, ensuring the seamless transfer of assets without the need for probate. 3. Joint Subchapter-S Revocable Trust Agreement: This type of trust agreement is designed for couples who want to create a single trust to hold their combined assets. It allows both partners to maintain control over their assets during their lifetime and designates beneficiaries to inherit the assets upon the death of both partners. The Contra Costa California Qualifying Subchapter-S Revocable Trust Agreement provides individuals and couples in Contra Costa County with a flexible and efficient estate planning solution. By availing the tax advantages of Subchapter S, this trust agreement helps to preserve the creator's wealth, protect assets, and facilitate the transfer of assets to their chosen beneficiaries.

Contra Costa California Qualifying Subchapter-S Revocable Trust Agreement

Description

How to fill out Contra Costa California Qualifying Subchapter-S Revocable Trust Agreement?

Creating legal forms is a necessity in today's world. However, you don't always need to seek professional help to create some of them from scratch, including Contra Costa Qualifying Subchapter-S Revocable Trust Agreement, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in different categories varying from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching process less overwhelming. You can also find information materials and tutorials on the website to make any tasks related to paperwork execution simple.

Here's how to find and download Contra Costa Qualifying Subchapter-S Revocable Trust Agreement.

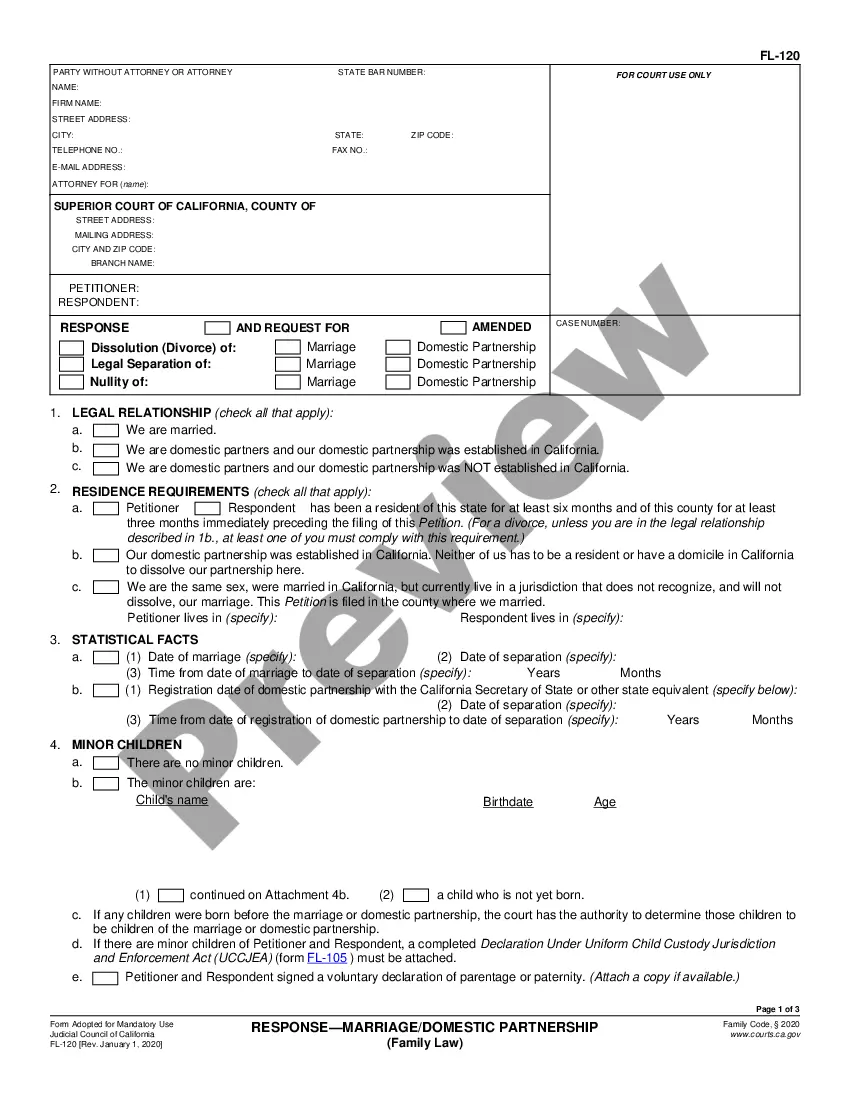

- Take a look at the document's preview and outline (if available) to get a basic idea of what you’ll get after downloading the form.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can impact the legality of some documents.

- Check the related forms or start the search over to find the right document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment method, and buy Contra Costa Qualifying Subchapter-S Revocable Trust Agreement.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Contra Costa Qualifying Subchapter-S Revocable Trust Agreement, log in to your account, and download it. Of course, our platform can’t replace a legal professional entirely. If you need to cope with an extremely difficult case, we recommend getting an attorney to review your form before signing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of users. Join them today and get your state-specific paperwork with ease!