Fairfax, Virginia is a city located in Northern Virginia, just outside of Washington, D.C. Known for its rich history, vibrant culture, and thriving economy, Fairfax is a popular residential and business hub. In regard to estate planning and asset protection, one commonly utilized legal instrument is the Fairfax Virginia Qualifying Subchapter-S Revocable Trust Agreement. A Qualifying Subchapter-S Revocable Trust Agreement serves as a flexible and effective tool to manage and protect assets during one's lifetime and efficiently transfer them to designated beneficiaries after their passing. This type of trust agreement is specifically designed to qualify for the subchapter S tax status under the Internal Revenue Code, providing additional tax benefits. By establishing a Qualifying Subchapter-S Revocable Trust Agreement, individuals can avoid probate, maintain privacy, and potentially reduce estate taxes. This trust allows the granter to retain control over their assets while providing guidelines for their management and distribution. Additionally, the revocable nature of the trust allows the granter to amend or revoke the trust during their lifetime, offering flexibility and adaptability. There are different variations of Fairfax Virginia Qualifying Subchapter-S Revocable Trust Agreements tailored to meet various estate planning needs. Some variations of this trust include: 1. Fairfax Virginia Irrevocable Subchapter-S Revocable Trust Agreement: This type of trust differs from the traditional revocable trust as it cannot be amended or revoked once it is established. It offers enhanced asset protection benefits and may be suitable for individuals seeking to shield their assets from potential creditors or lawsuits. 2. Fairfax Virginia Special Needs Subchapter-S Revocable Trust Agreement: This trust agreement is specifically designed to provide for individuals with special needs or disabilities. It allows the granter to set aside funds or assets to support the beneficiary's well-being without jeopardizing their eligibility for government benefits like Medicaid or Supplemental Security Income. 3. Fairfax Virginia Generation-Skipping Subchapter-S Revocable Trust Agreement: This trust plan involves transferring assets to grandchildren or subsequent generations, thereby "skipping" the level of beneficiaries who would typically receive them. This may help to minimize estate taxes and provide long-term financial security for future generations. In conclusion, the Fairfax Virginia Qualifying Subchapter-S Revocable Trust Agreement is a valuable legal instrument that offers flexibility, asset protection, and tax advantages for individuals residing in Fairfax, Virginia, or owning assets within the region. By utilizing varying types of this trust agreement, individuals can customize their estate plans to meet their unique needs and ultimately provide for their loved ones in a secure and tax-efficient manner.

Fairfax Virginia Qualifying Subchapter-S Revocable Trust Agreement

Description

How to fill out Fairfax Virginia Qualifying Subchapter-S Revocable Trust Agreement?

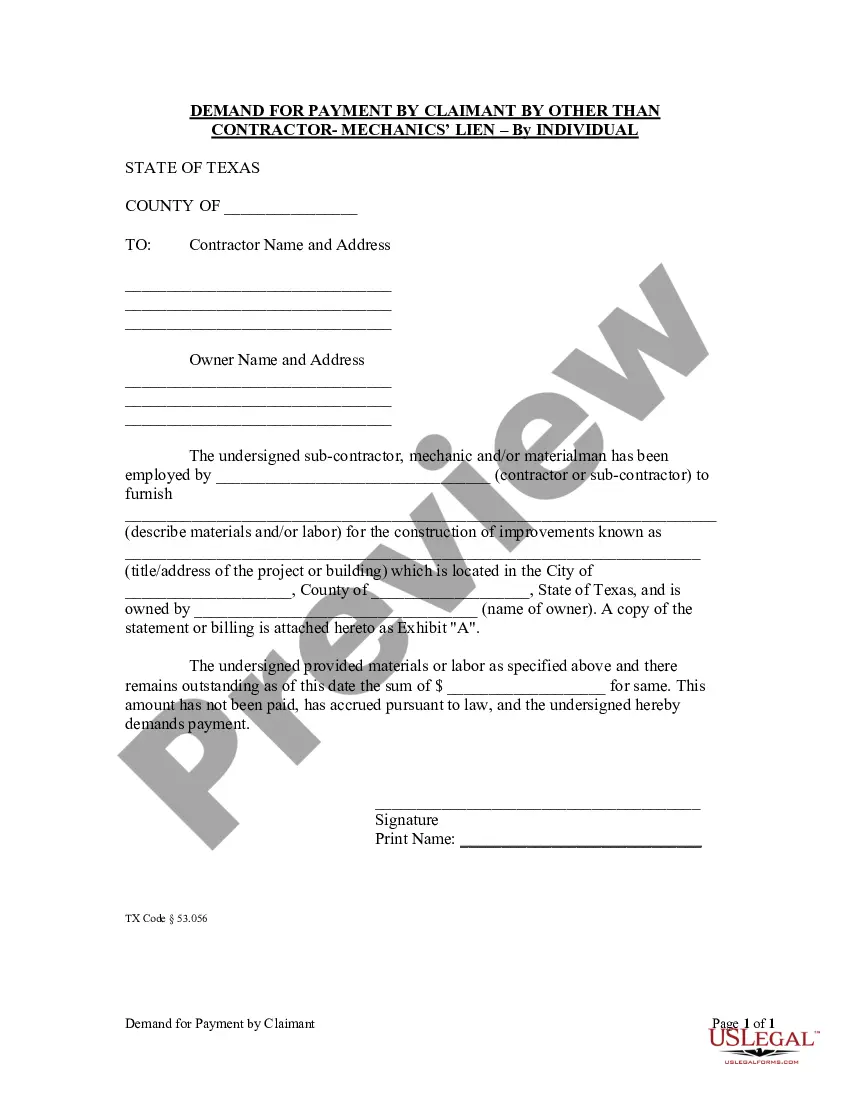

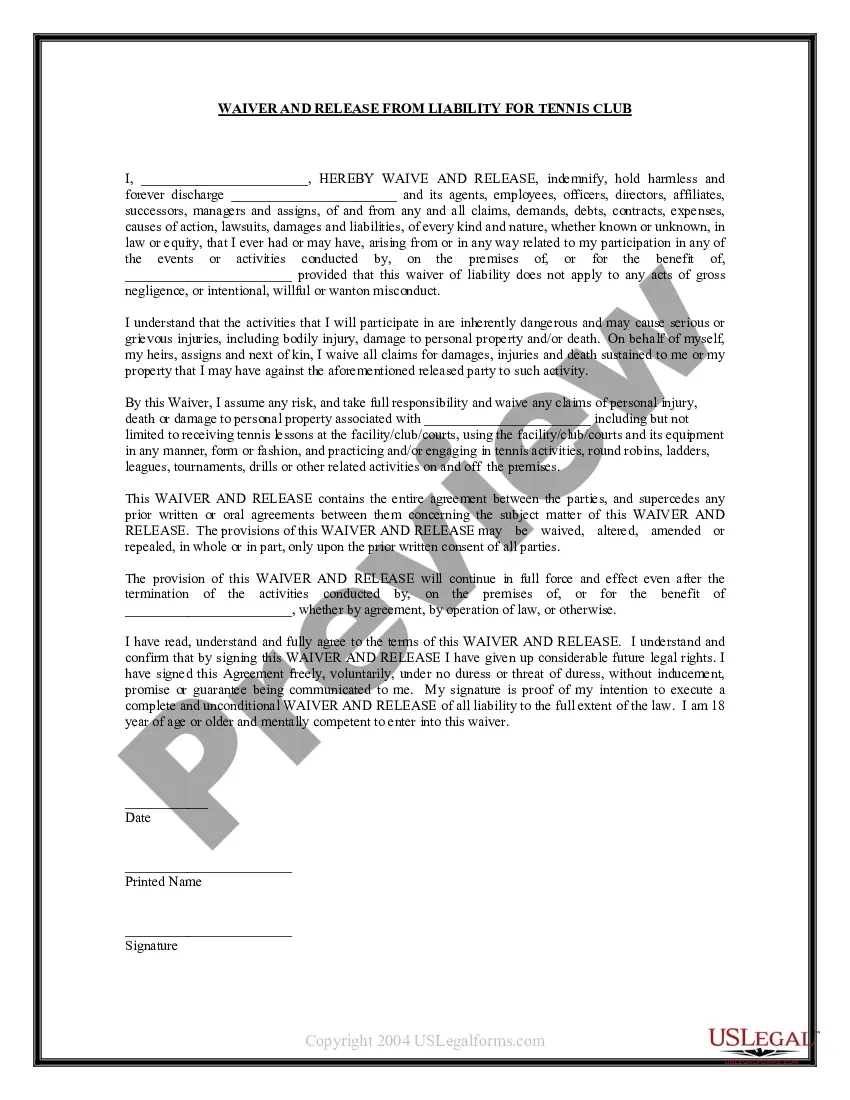

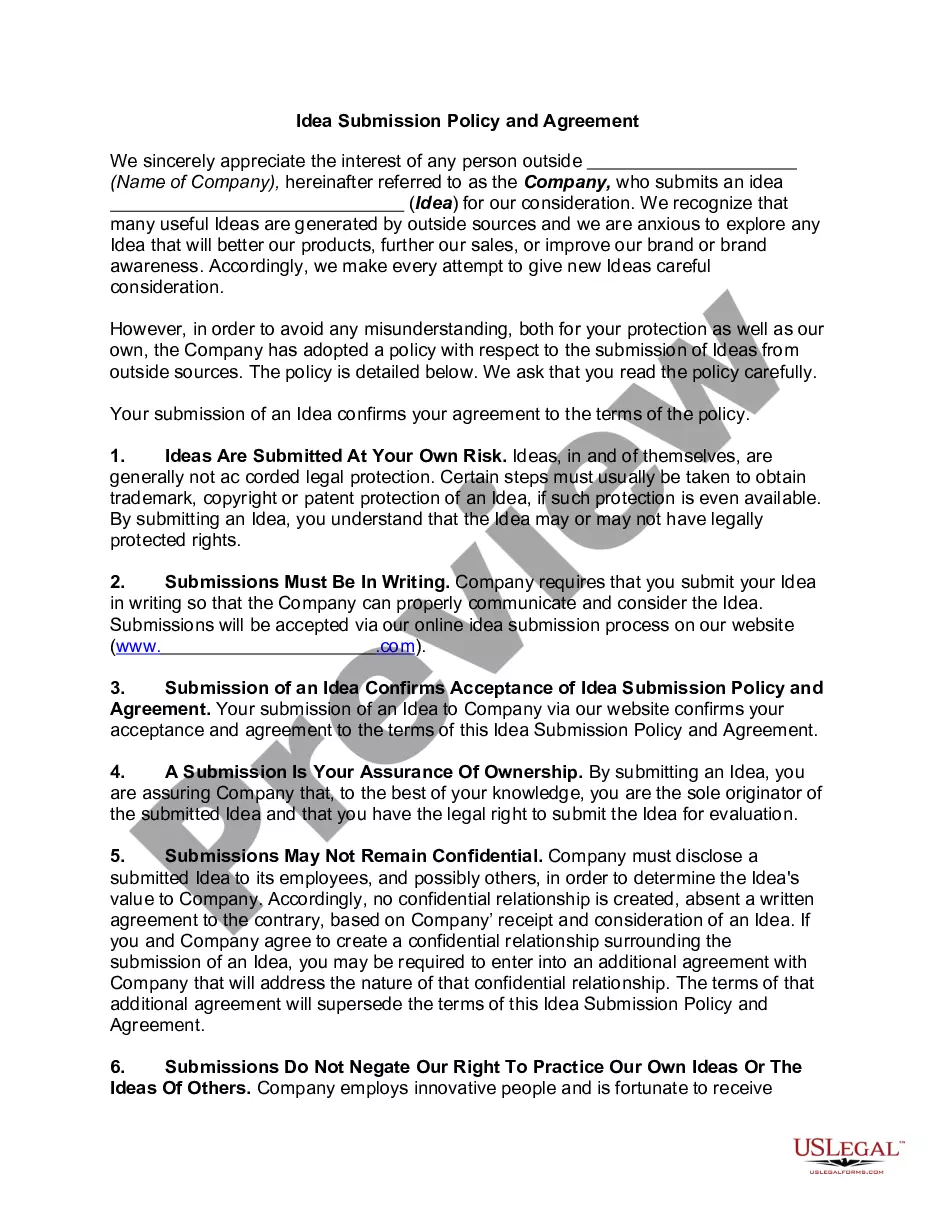

Preparing legal documentation can be burdensome. Besides, if you decide to ask a lawyer to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Fairfax Qualifying Subchapter-S Revocable Trust Agreement, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario collected all in one place. Consequently, if you need the latest version of the Fairfax Qualifying Subchapter-S Revocable Trust Agreement, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Fairfax Qualifying Subchapter-S Revocable Trust Agreement:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your Fairfax Qualifying Subchapter-S Revocable Trust Agreement and save it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!