A Maricopa Arizona Qualifying Subchapter-S Revocable Trust Agreement is a legally binding document executed to establish a revocable trust that qualifies as a Subchapter-S corporation for tax purposes in Maricopa, Arizona. This agreement provides individuals and businesses an effective way to manage their assets, plan for their estate, and minimize tax liabilities. The Maricopa Arizona Qualifying Subchapter-S Revocable Trust Agreement enables individuals or businesses to organize their assets and properties in a manner that allows them to retain control and flexibility during their lifetime, while offering various tax benefits and asset protection for their beneficiaries. Different types of Maricopa Arizona Qualifying Subchapter-S Revocable Trust Agreements may include: 1. Individual Revocable Trust Agreement: This type of agreement is designed for single individuals who wish to establish a trust for their assets, ensuring ease of administration, privacy, and control over the distribution of their estate. 2. Joint Revocable Trust Agreement: This agreement is suitable for married couples or domestic partners who want to combine their assets and estate planning goals. It allows both parties to act as co-trustees and retain control over the trust assets during their lifetime. 3. Family Revocable Trust Agreement: This type of trust agreement goes beyond benefiting a single individual or couple. It aims to provide estate planning solutions for extended family members or multiple generations, allowing for the effective transfer of wealth while minimizing tax implications. 4. Living Trust Agreement: A living trust agreement, also known as an inter vivos trust, is created during the lifetime of the granter. It enables individuals to retain control over their assets, avoid probate, and plan for incapacity or disability. 5. Irrevocable Trust Agreement: Though not typically associated with a Subchapter-S designation, an irrevocable trust agreement in the Maricopa Arizona area signifies a trust arrangement that cannot be modified or terminated without the consent of the beneficiaries. It may have its own unique features and purposes depending on the specific needs of the granter. Ultimately, a Maricopa Arizona Qualifying Subchapter-S Revocable Trust Agreement provides individuals and businesses with a flexible and effective way to protect and manage their assets, plan for their estate, and optimize tax benefits. It is crucial to consult with legal professionals who specialize in estate planning and taxation to draft a trust agreement tailored to individual needs, goals, and compliance with relevant laws and regulations.

Maricopa Arizona Qualifying Subchapter-S Revocable Trust Agreement

Description

How to fill out Maricopa Arizona Qualifying Subchapter-S Revocable Trust Agreement?

Draftwing forms, like Maricopa Qualifying Subchapter-S Revocable Trust Agreement, to take care of your legal matters is a difficult and time-consumming task. A lot of cases require an attorney’s involvement, which also makes this task expensive. However, you can acquire your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents crafted for a variety of scenarios and life situations. We make sure each document is compliant with the regulations of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Maricopa Qualifying Subchapter-S Revocable Trust Agreement form. Go ahead and log in to your account, download the form, and personalize it to your requirements. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly straightforward! Here’s what you need to do before downloading Maricopa Qualifying Subchapter-S Revocable Trust Agreement:

- Ensure that your template is compliant with your state/county since the regulations for writing legal paperwork may vary from one state another.

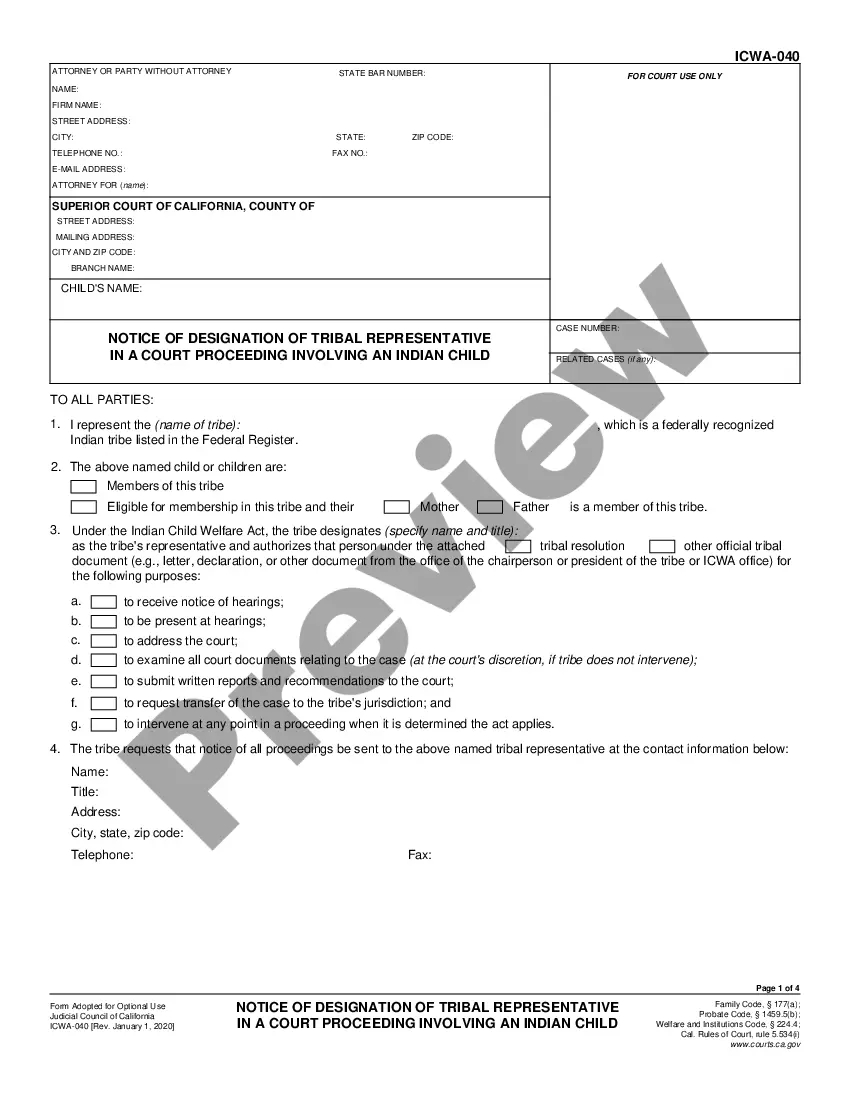

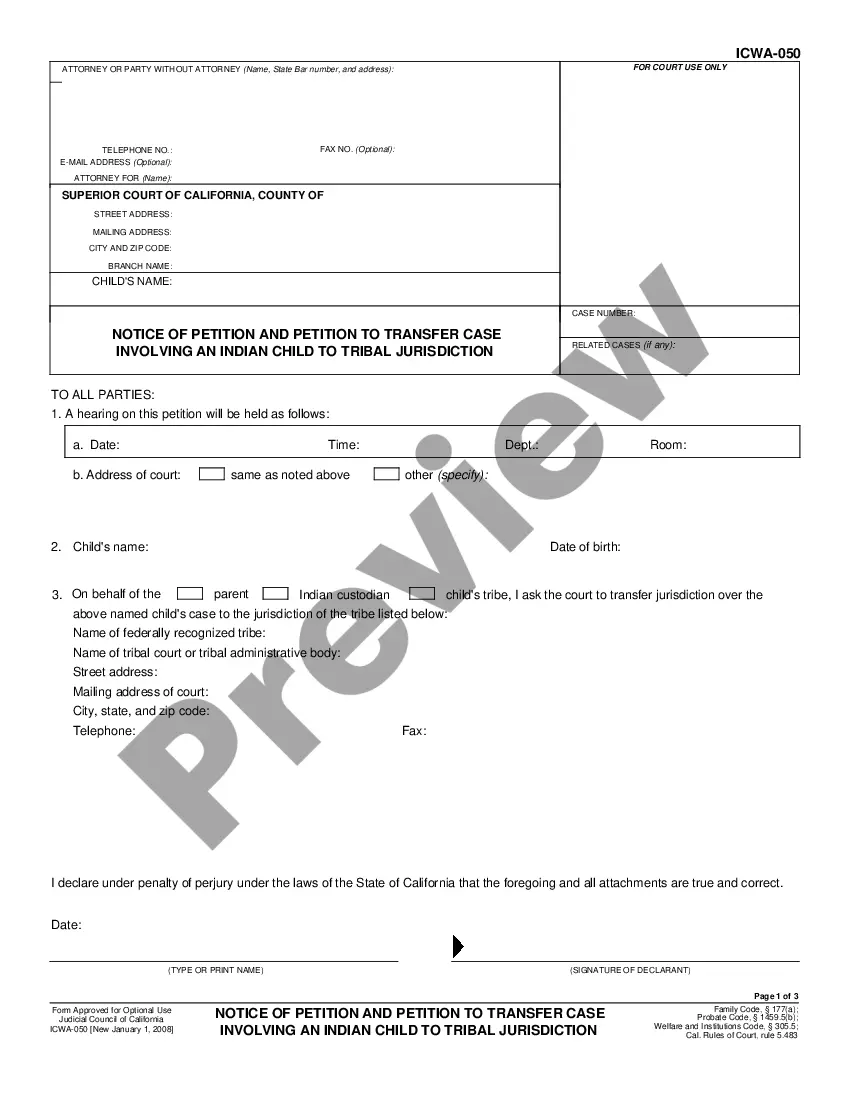

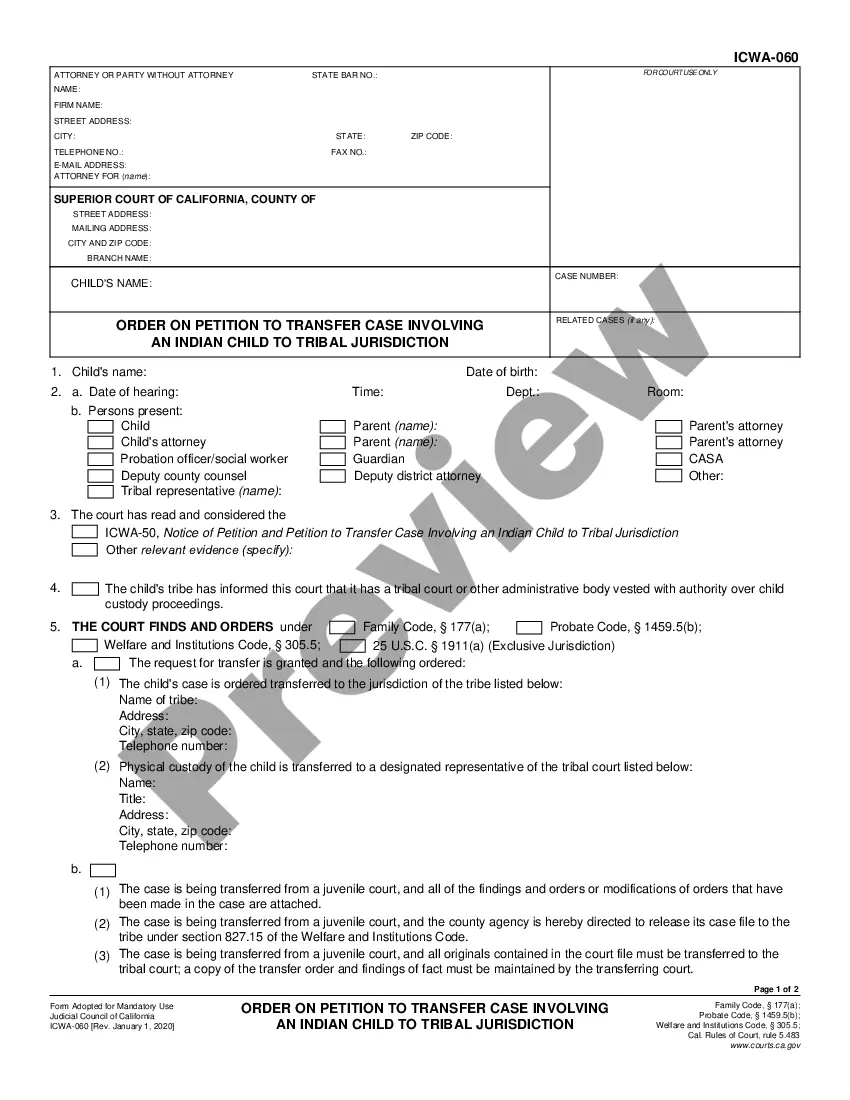

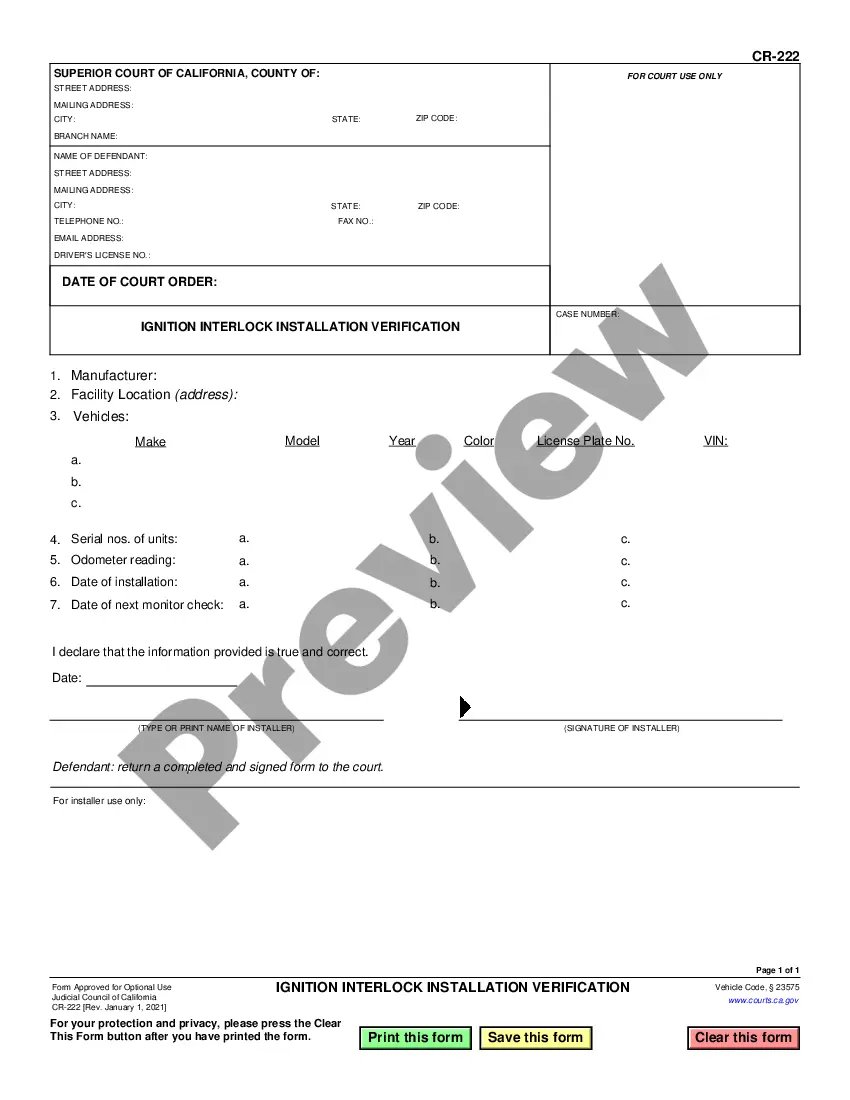

- Find out more about the form by previewing it or going through a brief description. If the Maricopa Qualifying Subchapter-S Revocable Trust Agreement isn’t something you were looking for, then use the header to find another one.

- Sign in or register an account to start utilizing our website and download the document.

- Everything looks great on your end? Click the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment details.

- Your template is all set. You can go ahead and download it.

It’s an easy task to find and buy the needed document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive library. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!