Tarrant Texas is a county located in the northern part of Texas, United States. It is home to several cities and towns, including Fort Worth, Arlington, and Grapevine. With a rich history and diverse population, Tarrant County offers a wide range of experiences for residents and visitors alike. When it comes to property sales in Tarrant County, it is crucial to ensure all documentation is accurate and error-free. In some cases, corrections may be required to rectify mistakes or discrepancies that occurred during the sale process. A Sample Letter for Correction to Sale of Property can be used as a guideline to address such issues effectively. There are different types of Tarrant Texas Sample Letters for Correction to Sale of Property, each serving a specific purpose. Some common types include: 1. Correction of Property Address: This type of letter is used when there is an error in the property address mentioned in the sale documents. It might be due to typographical mistakes, wrong street names, or incorrect zip codes. The letter should clearly state the correct address details and provide supporting evidence, such as legal documents or tax records, to validate the correction. 2. Correction of Sale Price: If there was an error or discrepancy in the sale price mentioned in the property sale documents, a letter for correction is required. This letter should include the accurate sale price, reasons for the correction, and any supporting documents to validate the new price. 3. Correction of Buyer or Seller Information: In situations where the buyer or seller's information mentioned in the property sale documents is incorrect, a correction letter is necessary. This letter should provide accurate details of the parties involved, such as names, addresses, contact information, and any other relevant identifying information. It should also state the reasons for the correction and include supporting documents like identification cards or legal documents. 4. Correction of Legal Descriptions: If there are errors in the legal descriptions of the property, a correction letter should be sent to rectify the situation. This letter should clearly state the correct legal description and include supporting evidence, such as surveys, property deeds, or official records, to validate the correction. 5. Correction of Encumbrances or Liens: In cases where encumbrances or liens on the property were erroneously included or omitted in the sale documents, a correction letter is necessary. This letter should specify the correct encumbrances or liens and provide supporting documentation, such as lien releases or property title reports, to validate the correction. These are just a few examples of the various types of Tarrant Texas Sample Letters for Correction to Sale of Property. It is essential to tailor the letter to the specific circumstances of the correction needed and ensure all relevant information and supporting documents are included. By using a well-crafted correction letter, property sale errors can be effectively addressed and rectified, ensuring a smooth and accurate transaction process.

Tarrant Texas Sample Letter for Correction to Sale of Property

Description

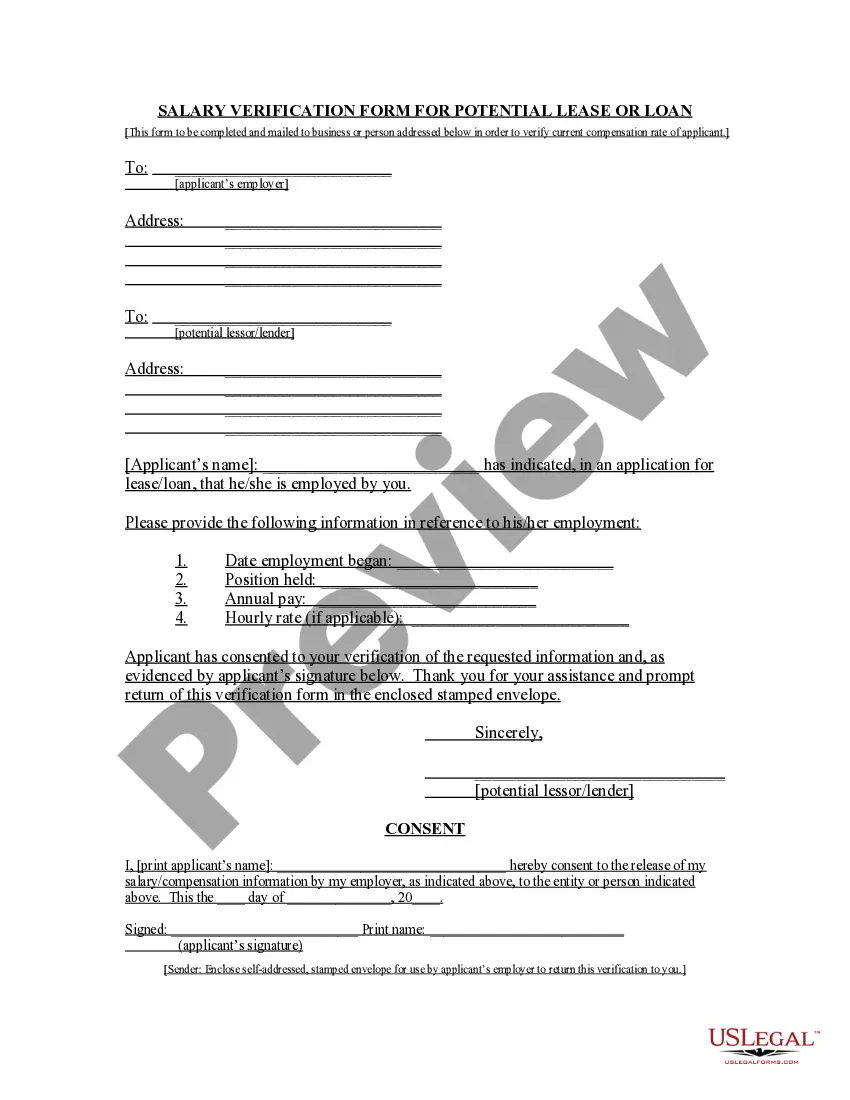

How to fill out Sample Letter For Correction To Sale Of Property?

How much time does it usually require for you to compose a legal document.

Considering that each state has its own laws and regulations for every life situation, locating a Tarrant Sample Letter for Correction to Sale of Property that meets all local criteria can be tiring, and acquiring it from a professional attorney is frequently costly.

Numerous online services provide the most frequent state-specific templates for download, yet utilizing the US Legal Forms library is the most advantageous.

Select the subscription plan that best fits your needs. Register for an account on the platform or Log In to advance to payment options. Pay via PayPal or with your credit card. Change the file format if necessary. Click Download to save the Tarrant Sample Letter for Correction to Sale of Property. Print the document or utilize any preferred online editor to finalize it electronically. Regardless of how many times you must utilize the retrieved document, you can find all the files you’ve ever downloaded in your profile by accessing the My documents tab. Give it a shot!

- US Legal Forms is the largest online collection of templates, compiled by states and areas of utilization.

- In addition to the Tarrant Sample Letter for Correction to Sale of Property, you can find any particular document necessary to conduct your business or personal matters, complying with your county specifications.

- Professionals verify all samples for their relevance, ensuring you can prepare your paperwork accurately.

- Using the service is exceptionally easy.

- If you already possess an account on the platform and your subscription is active, you simply need to Log In, select the required form, and download it.

- You can access the document in your profile at any time later.

- Otherwise, if you are unfamiliar with the site, there will be a few more steps to finish before you acquire your Tarrant Sample Letter for Correction to Sale of Property.

- Examine the content of the page you are currently on.

- Review the description of the sample or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now once you are confident in your chosen document.

Form popularity

FAQ

To protest a property tax appraisal, the property owner, the owner's designated agent, or a lessee of the property entitled by law to do so must file a notice of protest with TARRANT APPRAISAL REVIEW BOARD (TARB) not with Tarrant Appraisal District (TAD).

While there's little risk your property taxes will increase, we do not advise you protest yourself. In 2010, of those who filed their own protest, only 22% achieved a value reduction. Of those who were represented, 79% achieved a reduction.

Just search for your account and select the red E-STATEMENT button from the account options to access your statement. You may also contact our office at 817-884-1100 to request a statement or email us at taxoffice@tarrantcounty.com.

If you are dissatisfied with your appraised value or if errors exist in the appraisal records regarding your property, you should file a Form 50-132, Notice of Protest (PDF) with the ARB. In most cases, you have until May 15 or 30 days from the date the appraisal district notice is delivered whichever date is later.

How to Protest Property Taxes in Tarrant County. We recommend protesting your appraised value, even if you file on your own. You will need to file a Notice of Protest Form (Form 50-132), which will include your reasons for protesting.

(817) 284-0024.

MAY 15. This is the last day to file a protest with Tarrant Appraisal District for the current year.

Please contact the operator to update the mailing address as well as contacting the Tarrant Appraisal District mineral department at mineral@tad.org.

Can I file an Affidavit of Heirship with the Probate courts? No, these documents should be filed in the County Clerk Official Public Records Office located in room B20 at 100 W. Weatherford, Fort Worth, Texas.