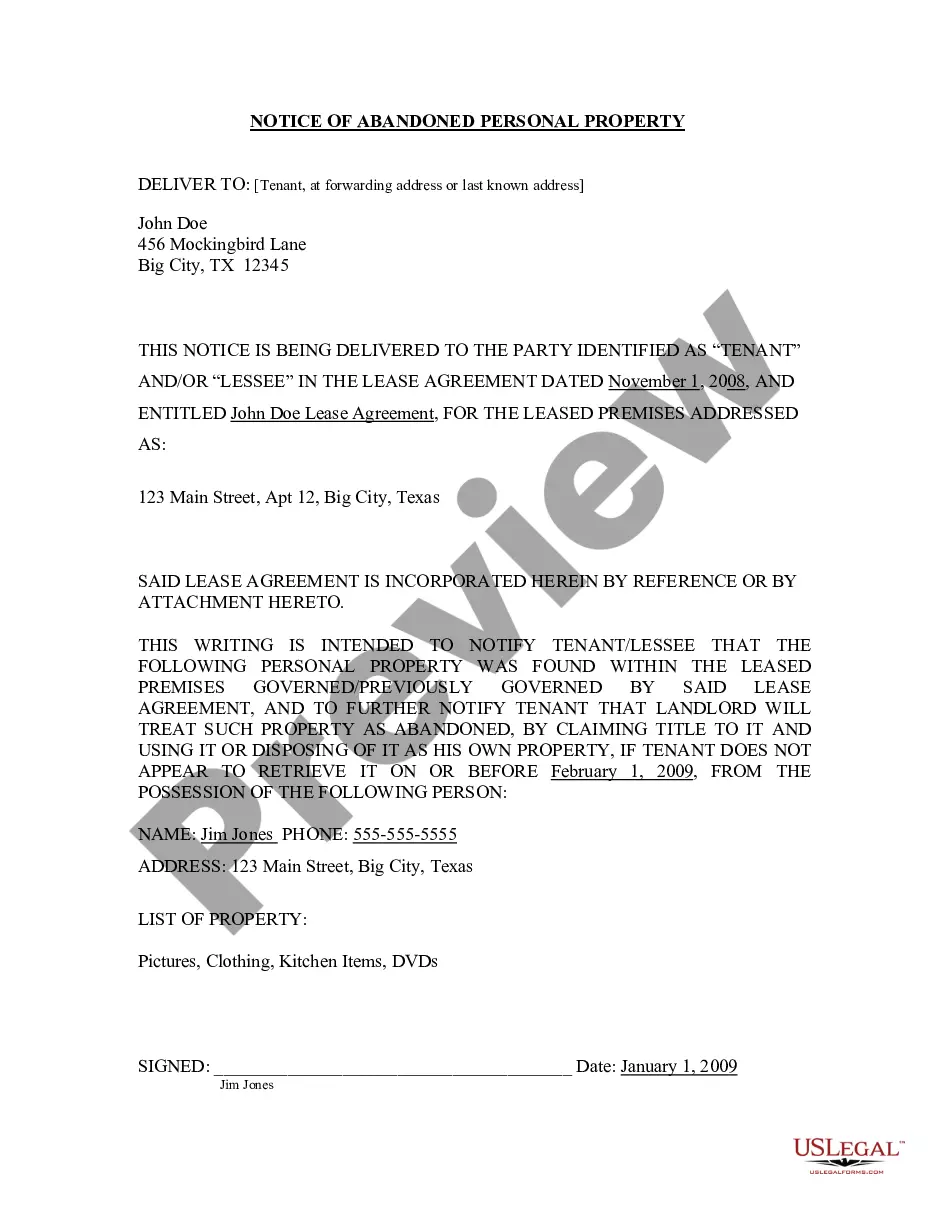

[Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] [Date] [Bank Name] [Bank Address] [City, State, ZIP] Subject: Release of Funds into Decedent's Estate — [Full Name of Decedent] Dear Sir/Madam, I am writing to request the release of funds into the decedent's estate for [Full Name of Decedent], who resided in Fulton, Georgia, at the time of their passing. This letter serves as an official request for the transfer of funds from the deceased individual's account held at [Bank Name]. I hereby declare that I am the legal representative and executor of the estate of the deceased, as outlined in the Last Will and Testament which has been duly filed with the probate court of Fulton County, Georgia. The deceased held the following account(s) at your bank: Account Holder's Name: [Full Name of Decedent] Account Number: [Account Number] Type of Account: [Checking/Savings] Amount Requested: [Specify Amount] As the authorized representative, I kindly request your prompt attention to the release of funds from the above-mentioned account into the designated estate account. The estate account details are as follows: Account Holder's Name: [Your Name] Account Number: [Estate Account Number] Bank Name: [Estate Bank Name] Bank Address: [Estate Bank Address] City, State, ZIP: [Estate Bank City, State, ZIP] Please ensure the funds are transferred in a timely manner in accordance with the laws and regulations governing estates in Fulton County, Georgia. If any additional documentation is required or if there are specific procedures to follow, kindly provide detailed instructions to expedite the process. Moreover, I understand that certain legal requirements may need to be fulfilled before the funds can be released. If there are any necessary forms or affidavits that must be completed, please furnish them along with the corresponding instructions and deadlines. I greatly appreciate your prompt assistance in this matter. Should you require any further documentation or need to discuss any aspect of this request, please do not hesitate to contact me at the provided contact details. Thank you for your attention to this important matter, and I look forward to hearing from you soon. Sincerely, [Your Full Name] [Your Title/Position, if applicable]

Fulton Georgia Sample Letter for Release of Funds into Decedent's Estate

Description

How to fill out Fulton Georgia Sample Letter For Release Of Funds Into Decedent's Estate?

Whether you intend to start your company, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business occasion. All files are collected by state and area of use, so picking a copy like Fulton Sample Letter for Release of Funds into Decedent's Estate is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few more steps to get the Fulton Sample Letter for Release of Funds into Decedent's Estate. Adhere to the instructions below:

- Make certain the sample meets your personal needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to obtain the sample once you find the proper one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Fulton Sample Letter for Release of Funds into Decedent's Estate in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

Once the bank has all the necessary documents, typically, they will release the funds within two weeks. Many will release a sum of money before the grant to deal with essential expenses such as funeral costs. The executor should approach the relevant bank promptly to determine the approach they take.

Identify persons the executor should notify of your death. Include family members, close friends and business associates, including your attorney. Provide contact information for each person, as well as any final message or instructions to be given. Describe your important estate documents and their exact location.

Although there are some exceptions, it is usually against the law for you to start sharing out the estate or to get money from the estate, until you have probate or letters of administration.

Here are some things to consider when drafting a letter to your executor or trustee. Your thoughts about wealth. Share your story about how you came to the assets that you are leaving in your will. How was your wealth created, what do you value and what are your long-term goals for your wealth?

Usually, there can be up to £10,000 to £15,000 in the bank before Probate is needed but this isn't always the case. All banks and building societies have different thresholds for releasing funds without a Grant of Probate.

Can An Executor Distribute Money Before Probate? An executor should avoid distributing any cash from the estate before they fully understand the estates total worth and the total value of liabilities. It is highly advised not to distribute any assets to beneficiaries until, at the very least, probate has been granted.

For the inheritance process to begin, a will must be submitted to probate. The probate court reviews the will, authorizes an executor and legally transfers assets to beneficiaries as outlined. Before the transfer, the executor will settle any of the deceased's remaining debts.

How do I write a Letter of Wishes? The document should be written in plain English, and can either be written by hand or typed. You should sign and date the document, but it must not be witnessed in the same way as your Will, so as to avoid any possible claims that it has become a legal Will or Codicil.

Give the letter a personal touch and address each of your heirs and beneficiaries personally. Tell them any last wishes you may have or any hopes you have for their future. Write as clearly as possible. Use specific details and avoid using shorthand.

If probate is not required then the bank will require a small estates indemnity which confirms that the person closing the account and receiving the funds will do so in accordance with the terms of the will or the Intestacy Rules.

More info

2 Case Management in Decedent's Residence. The decedent was not able to have an official estate administration service carried out by the office of Probate in his residence or if the decedent owned a property. If the decedent's residence was not in Georgia, the executor should contact the office of Probate. 2.4.3 Case Management in Decedent's Residence If the decedent lived elsewhere where there was no probate service available, it is the decedent's personal representatives' responsibility to obtain and file the deceased person's will or other instruments. In order to obtain a will for the decedent, the heirs must have all the original documents needed if they are heirs to his or her estate. The will needs to be dated within a reasonable period of time. When the will is required, the executor should contact the local Probate for the state in which the decedent lived. A will is needed as soon as possible, as the estate assets are still being used for living expenses. 2.4.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.