Harris County, Texas, is one of the largest and most populous regions in the United States. As such, it is not uncommon for individuals to have financial assets or funds held within the county at the time of their passing. When a loved one passes away, their estate goes through a legal process known as probate, which includes the release of funds to the beneficiaries or heirs. During the probate process, the representative or executor of the decedent's estate may need to draft a sample letter for release of funds in Harris County, Texas. This letter serves as a formal request to release the funds held by various financial institutions within the county, such as banks or credit unions. The purpose of this letter is to provide necessary documentation, instructions, and authorizations that will facilitate the transfer of funds to the rightful beneficiaries or heirs. There are different types of Harris Texas Sample Letters for Release of Funds into Decedent's Estate that may be required based on the specific circumstances or nature of the assets. Some of these letter variations may include: 1. Sample Letter for Release of Bank Account Funds: This type of letter is typically used when the deceased individual had bank accounts in Harris County, Texas. The letter will specify the account numbers, the financial institution, and the request to release the funds to the estate or beneficiaries. 2. Sample Letter for Release of Investment Account Funds: If the decedent had investment accounts or holdings such as stocks, bonds, or mutual funds, a specific letter may be required to release those funds. This letter may include details about the specific investments, account numbers, and instructions for transferring the assets. 3. Sample Letter for Release of Insurance Policy Proceeds: Life insurance policies often involve substantial sums of money that need to be released to the estate or beneficiaries. In this letter, relevant information about the insurance company, policy numbers, and an explanation of how the funds should be disbursed will be mentioned. 4. Sample Letter for Release of Retirement Account Funds: Retirement accounts, such as IRAs or 401(k) plans, require a specific letter to request the release of funds. This letter should include details about the retirement account custodian, the account numbers, and instructions for transferring the funds to the estate or beneficiaries. It is essential to consult with an attorney or legal professional specializing in probate law when generating a sample letter for release of funds into a decedent's estate in Harris County, Texas. This ensures that all necessary legal requirements are met, and the appropriate documentation is provided to the financial institutions involved, expediting the release of funds to the rightful recipients.

Harris Texas Sample Letter for Release of Funds into Decedent's Estate

Description

How to fill out Harris Texas Sample Letter For Release Of Funds Into Decedent's Estate?

Whether you intend to start your company, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business occurrence. All files are grouped by state and area of use, so opting for a copy like Harris Sample Letter for Release of Funds into Decedent's Estate is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few additional steps to get the Harris Sample Letter for Release of Funds into Decedent's Estate. Adhere to the instructions below:

- Make certain the sample meets your individual needs and state law requirements.

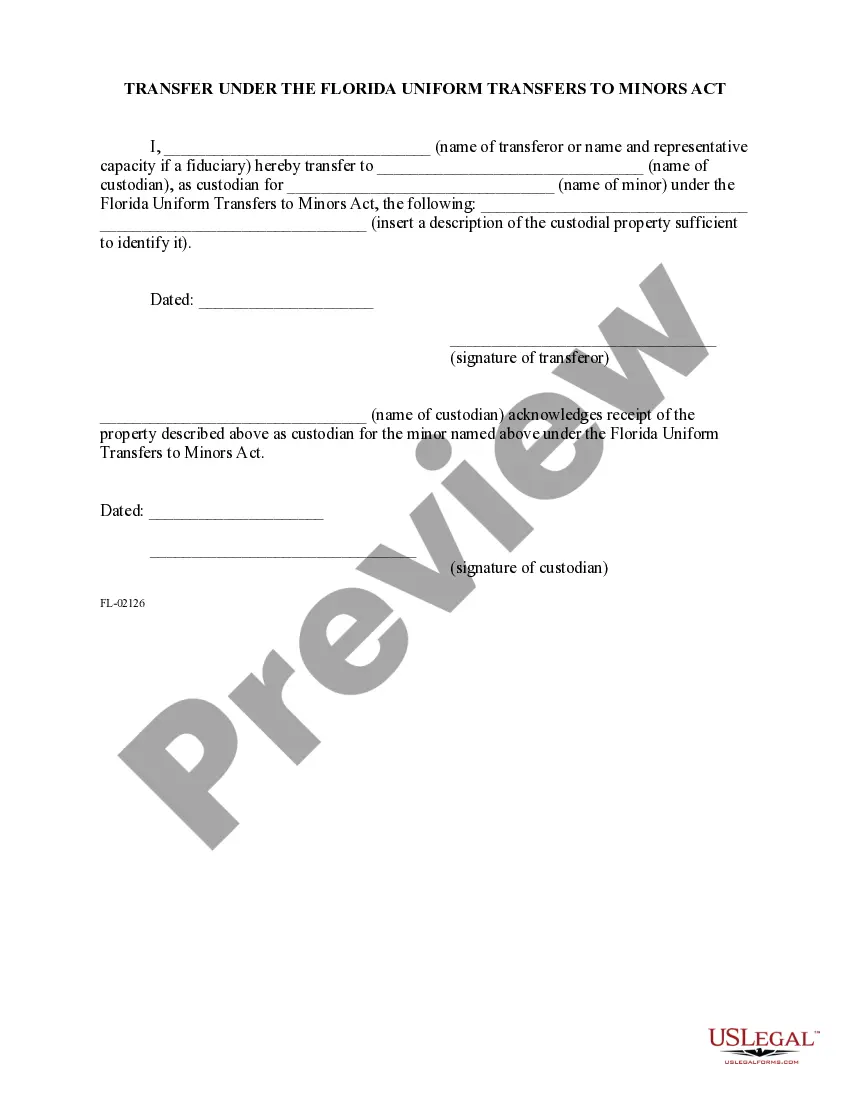

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample once you find the proper one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Harris Sample Letter for Release of Funds into Decedent's Estate in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you can access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

Usually, there can be up to £10,000 to £15,000 in the bank before Probate is needed but this isn't always the case. All banks and building societies have different thresholds for releasing funds without a Grant of Probate.

After death, the beneficiary can claim the money by going to the bank with a death certificate and identification. Your beneficiary designation form will be on file at the bank, so the bank will know that it has legal authority to hand over the funds.

Withdrawal of funds from the estate account must be authorized by the executor or usually all executors jointly if more than one is named in the Will or estate documentation. Documentation to open an estate account varies depending on whether there is a valid Will.

What is a Letter of Administration? LOA (Letter of Administration) is an official court document issued for the purpose of giving authority to a person (it is granted) to administer all the estate of a deceased person. It is issued in case when a person dies intestate (without leaving a Will).

Can An Executor Distribute Money Before Probate? An executor should avoid distributing any cash from the estate before they fully understand the estates total worth and the total value of liabilities. It is highly advised not to distribute any assets to beneficiaries until, at the very least, probate has been granted.

Absolutely not. Even though the executor is one of the beneficiaries of the estate account, at the end of the day the account is not his. The estate belongs to all the beneficiaries. So if an executor withdraws cash from the estate account, he is considered by the law to be taking everyone's money, not just his own.

The bank will have the paperwork, signed by the deceased owner, which authorized the beneficiary to inherit the funds. The beneficiary can withdraw the money or open a new account.

If you need to close a bank account of someone who has died, and probate is required to do so, then the bank won't release the money until they have the grant of probate. Once the bank has all the necessary documents, typically, they will release the funds within two weeks.

What Is a Beneficiary? Beneficiaries, in general, are people or entities that the holder of an account designates to receive the assets in the account, typically, in the event of the account holder's death.

It is important to understand that the only funds that can be released from a deceased's bank or building society account before probate is issued is to settle funeral expenses and inheritance tax (if any). An executor is named in the will and it is this person who is entitled to apply for probate.