Subject: Sample Letter for Release of Funds into Decedent's Estate in Phoenix, Arizona Dear [Bank Representative/Beneficiary], I hope this letter finds you well. I am writing to request the release of funds into the decedent's estate of [Name of the deceased] in accordance with the applicable laws and regulations governing estates in Phoenix, Arizona. As the appointed executor/administrator of the estate, it is my responsibility to ensure the proper management and distribution of assets belonging to the decedent. Given the circumstances, I kindly request the release of funds from various accounts held by [Name of the deceased] in your esteemed financial institution. I have attached the necessary supporting documents, including an authenticated copy of the death certificate, the decedent's will (if applicable), and any other relevant legal documents required to validate this claim. Please find below the relevant information related to the accounts for which the release of funds is sought: 1. Account Name: [Account Holder's Name] Account Number: [Account Number] Type of Account: [Checking/Savings/Investment] Approximate Balance: [Amount] Purpose of Release: [Brief description of intended use] 2. [Repeat above details for each additional account, if applicable] In compliance with the probate laws governing estates in Phoenix, Arizona, I kindly request that you process the release of funds as soon as possible. This will enable me to fulfill my duties as the executor/administrator, ensuring timely payment of any outstanding debts, taxes, and distribution of assets to the beneficiaries as delineated in the decedent's will or as determined by the probate court, as applicable. I understand that additional documentation or legal procedures may be required. Please inform me promptly if any further information is necessary for the timely release of funds. Furthermore, if there are any specific forms or procedures unique to your financial institution that need to be followed, kindly provide them to me so that I can facilitate the process accordingly. I would appreciate your utmost attention and cooperation in handling this matter efficiently, given the sensitive nature of estate settlements. If you require any additional information, please do not hesitate to contact me at [Your Contact Information]. I am available at your convenience to discuss any concerns or questions you may have. Thank you for your attention to this matter, and I look forward to your prompt response and the release of funds as requested. Yours sincerely, [Your Name] [Executor/Administrator of the Estate] [Address] [City, State, ZIP] [Phone Number] [Email Address]

Phoenix Arizona Sample Letter for Release of Funds into Decedent's Estate

Description

How to fill out Phoenix Arizona Sample Letter For Release Of Funds Into Decedent's Estate?

Preparing paperwork for the business or personal needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to generate Phoenix Sample Letter for Release of Funds into Decedent's Estate without expert help.

It's possible to avoid spending money on lawyers drafting your paperwork and create a legally valid Phoenix Sample Letter for Release of Funds into Decedent's Estate by yourself, using the US Legal Forms web library. It is the most extensive online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

If you still don't have a subscription, adhere to the step-by-step instruction below to get the Phoenix Sample Letter for Release of Funds into Decedent's Estate:

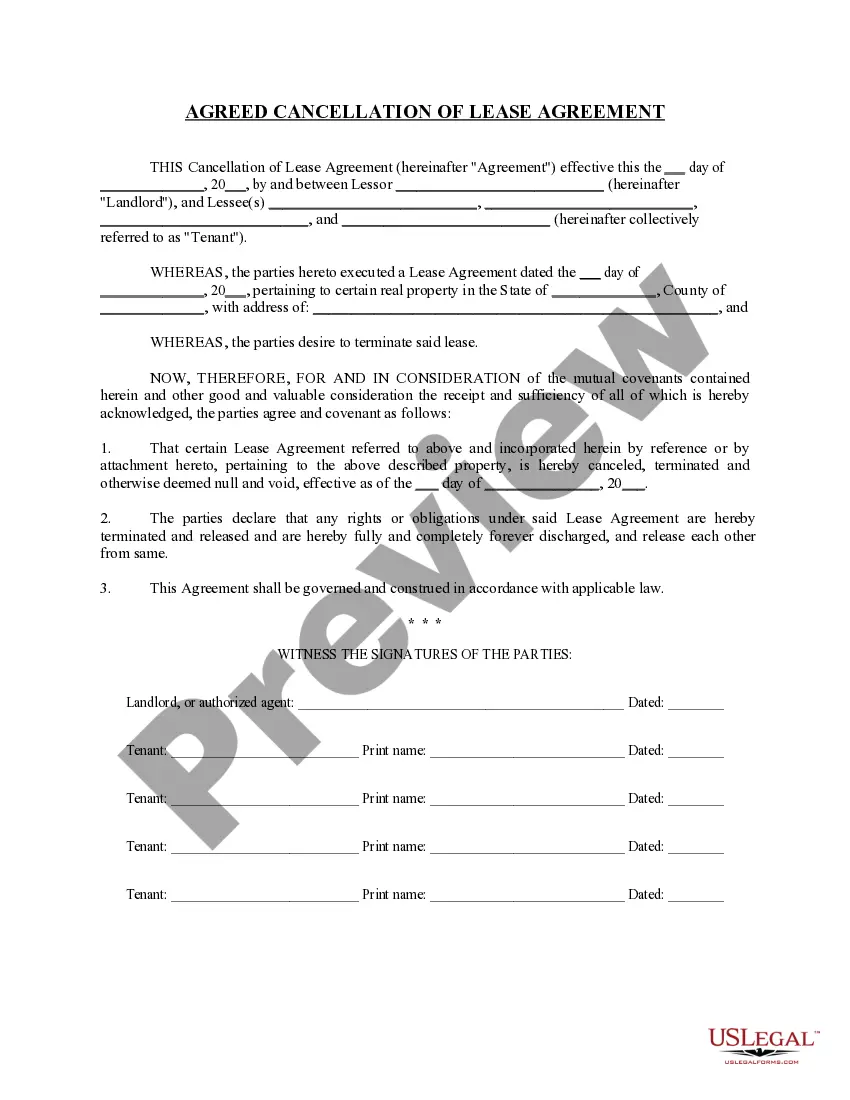

- Look through the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are available.

- To find the one that suits your needs, utilize the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any scenario with just a few clicks!

Form popularity

FAQ

Settling an Estate in Arizona The first step is to file the will and a petition for probate with the county court where the deceased person lived or where they had property if they lived out of state. A personal representative is appointed by the court, which is usually the person named in the will.

As long as there aren't any contests to the will or objections to the executor's actions, the executor will be allowed to settle the estate at the conclusion of the four-month waiting period. That means an executor who is on top of their responsibilities could theoretically wrap up probate in as little as four months.

Under California Probate Code §21110, if a named beneficiary dies before the Will-maker, the heirs (i.e. kindred/related by consanguinity) of the deceased beneficiary may, based on several requirements, inherit the gift in his/or her place. There are important conditions to California's anti-lapse statute.

The general rule is that if a beneficiary dies during probate but prior to the point at which assets earmarked for him/her have legally been transferred into his/her name, those assets become part of the deceased beneficiary's estate.

Executors must not unreasonably delay distributing the estate for their own gain or any other party. However, even after the executor's year, the court will not order a distribution of the estate if the executors can show there is good reason to wait.

How Long Do You Have to File Probate After Death in Arizona? According to Arizona law (ARS14-3108), the executor of an estate has two years from the date of death to file probate. This timeframe can be extended under certain circumstances, such as if the deceased left behind minor children.

Spouse, partner, children, parents, brothers and sisters, business partner, key employee, trust and charitable organization.

A beneficiary should be addressed in a letter in the same manner as any other professional person. The letter should be addressed to the beneficiary, using her title and full name. Begin the salutation with the word ?dear? and then state all relevant issues in a concise and clear manner.

There are three types of beneficiaries: primary, contingent and residuary. Don't worry, we'll explain. A primary beneficiary is the person (or people or organizations) you name to receive your stuff when you die.

Executors' year However, many beneficiaries don't realise that executors and administrators have twelve months before they are obliged to distribute the estate to the beneficiaries. Time runs from the date of death.