Subject: Request for Payoff Balance of Mortgage in Orange, California Dear [Lender's Name/Joint Accounts Manager], I hope this letter finds you well. I am writing to request a detailed payoff balance of my mortgage for the property located at [Your Property Address], in Orange, California. I currently hold a mortgage with your esteemed institution [Lender's Name] and wish to settle the outstanding balance. Furthermore, I kindly request that you provide me with a comprehensive statement specifying the exact amount required to pay off my mortgage completely, including any interest, fees, and penalties that may apply, as of the date of this letter. In addition, I would appreciate itemized details outlining the breakdown of the remaining principal, interest, and any other pertinent charges. As I plan to settle this mortgage promptly, it would be greatly appreciated if you could expedite the delivery of the requested information to facilitate a smooth and swift transaction. I intend to make a lump sum payment and would like to ensure the funds are available at the time of settlement. Furthermore, it would be advantageous if you can provide the acceptable modes of payment and any specific instructions for the mortgage payoff process, along with the timeframe within which the payment should be made. This will enable me to make the necessary arrangements and ensure a seamless conclusion to our mortgage agreement. Since my aim is to satisfy the mortgage obligation in its entirety, I kindly request that you promptly inform all relevant departments within your institution to update the status of my account as "paid in full" following the settlement. Moreover, please provide me with an official document or letter confirming the successful discharge of the mortgage lien. I highly appreciate your immediate attention to this matter and your cooperation throughout this process. Should you require any additional information or documentation to proceed with my request, please let me know at your earliest convenience. You may contact me at [Your Contact Information] or via email at [Your Email Address]. Thank you for your support, and I look forward to receiving the requested information from you promptly. I am eagerly anticipating the successful resolution of our mortgage agreement, and I sincerely appreciate your assistance in facilitating this process. Yours sincerely, [Your Name] [Your Mortgage Account Number] [Your Property Address] [City, State, ZIP Code]

Orange California Sample Letter Requesting Payoff Balance of Mortgage

Description

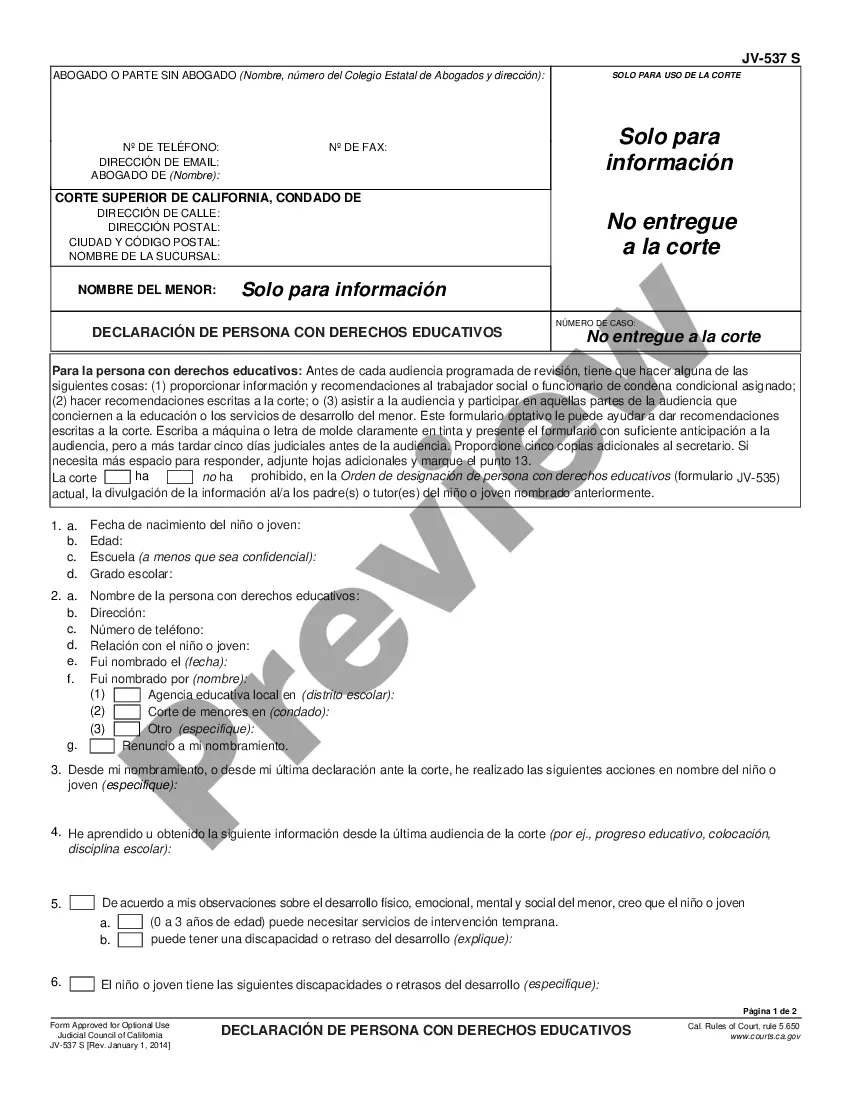

How to fill out Orange California Sample Letter Requesting Payoff Balance Of Mortgage?

Whether you plan to open your company, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain documentation meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business occasion. All files are grouped by state and area of use, so picking a copy like Orange Sample Letter Requesting Payoff Balance of Mortgage is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of more steps to get the Orange Sample Letter Requesting Payoff Balance of Mortgage. Adhere to the guidelines below:

- Make certain the sample meets your individual needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to get the file once you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Orange Sample Letter Requesting Payoff Balance of Mortgage in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

You can calculate a mortgage payoff amount using a formula Work out the daily interest rate by multiplying the loan balance by the interest rate, then multiplying that by 365. This figure, multiplied by the days until payoff, plus the loan balance, gives you your mortgage payoff amount.

How to Write a Loan Payoff Letter? Your organization's logo and contact information as the header of the page. A centered headline in bold stating "Loan Payoff Letter." The name and full address of the lender.A memo introduction (either ATTN or RE) with the borrower's name, full address, and the number of the account.

How to get your 10-day payoff letter. You'll need to request a 10-day payoff letter from your current loan servicer, which you may be able to do online. Not all lenders offer an online request option, however, so you may need to call or email your loan servicer directly to get this information.

Your payoff amount is different from your current balance. Your current balance might not reflect how much you actually have to pay to completely satisfy the loan. Your payoff amount also includes the payment of any interest you owe through the day you intend to pay off your loan.

Your payoff amount also includes the payment of any interest you owe through the day you intend to pay off your loan. The payoff amount may also include other fees you have incurred and have not yet paid. If you are paying off your loan early, you may have to pay a pre-payment penalty.

To get a payoff amount, you generally need to request it from the servicer. The servicer will then prepare the statement, which will include the total amount you owe and a date that the amount is good through. In addition, it will provide instructions on how to wire the payment or where to send a check.

A payoff statement should include the name and address of the lender preparing the statement and be addressed to the lender that requested the payoff. It also needs to include the customer's name, the loan number and the terms of the loan, including the balance and the interest rate.

The current principal balance is the amount still owed on the original amount financed without any interest or finance charges that are due. A payoff quote is the total amount owed to pay off the loan including any and all interest and/or finance charges.

A payoff statement for a mortgage, sometimes referred to as a payoff letter, is a document that details the exact amount of money needed to fully pay off your mortgage loan. The payoff amount isn't just your outstanding balance; it also encompasses any interest you owe and potential fees your lender might charge.

You can find information on property records by contacting your local Secretary of State or county recorder of deeds. After you pay off your mortgage, your lender should also return the original note to you.

More info

The letter will be sent to FEMA which will notify the homeowner and/or survivor of their right to proceed through the homeowner's and/or FEMA approved loan. A second letter is required if the state provides funds to the individual. Preferred lenders provide a variety of financial products and services, including personal, business and home financing options, checking/savings accounts and high interest savings accounts from multiple financial institutions. Preferred lenders often have more advantageous rates than other lenders. It is the homeowner's sole responsibility to verify the eligibility of a borrower or any other applicant. Federal and state laws prohibit any lender from engaging in lending discrimination on the basis of a borrower's race, color, national origin, religion, sex, disability or familial status. Lender policies are subject to change without notice. FACTS — WHAT IS A HELPER LOAN? HELPER LOANS: The definition goes back from the beginning in the law.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.