Miami-Dade Florida Subsidiary Guaranty Agreement is a legal contract that guarantees the obligations of a subsidiary company under a specific agreement. It provides assurance to the lending party or creditor that if the subsidiary fails to meet its obligations, the parent company will step in to fulfill them. This subsidiary guarantee is a common practice in business transactions, particularly in mergers and acquisitions, real estate deals, and financing arrangements. The Miami-Dade Florida Subsidiary Guaranty Agreement is designed to protect the rights of the creditor and ensure that they are not left empty-handed in case the subsidiary company fails to meet its obligations. By signing this agreement, the parent company assumes liability for any financial or contractual obligations of its subsidiary, making the parent company financially responsible for any default or non-payment. This subsidiary guarantee agreement typically outlines the specific obligations for which the parent company is providing its guarantee. It may include payment of debts, performance of services, adherence to contractual terms, or any other obligations outlined in the primary agreement between the creditor and subsidiary. Furthermore, there are different types of Miami-Dade Florida Subsidiary Guaranty Agreements based on the nature of the transaction or arrangement. Some common types include: 1. Real Estate Subsidiary Guaranty Agreement: This agreement is commonly used in real estate deals where a parent company guarantees the obligations of its subsidiary involved in real estate acquisitions, redevelopments, or leasing. 2. Financing Subsidiary Guaranty Agreement: This agreement is frequently used in financing arrangements where a parent company guarantees the repayment of a loan or debt obtained by its subsidiary from a financial institution. 3. Merger and Acquisition Subsidiary Guaranty Agreement: In mergers and acquisitions, this agreement ensures that the parent company remains responsible for any liabilities or obligations of the acquired subsidiary, providing an extra layer of protection to the purchasing entity. 4. Supply Chain Subsidiary Guaranty Agreement: This agreement is applicable in supply chain agreements, where the parent company guarantees the fulfillment of contractual obligations by its subsidiary to maintain the smooth flow of goods or services. In summary, the Miami-Dade Florida Subsidiary Guaranty Agreement is a legal instrument that ensures the parent company's financial responsibility for the obligations of its subsidiary. It protects the interests of the creditor and provides a layer of security in various business transactions.

Miami-Dade Florida Subsidiary Guaranty Agreement

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-0705-WG

Format:

Word;

Rich Text

Instant download

Description

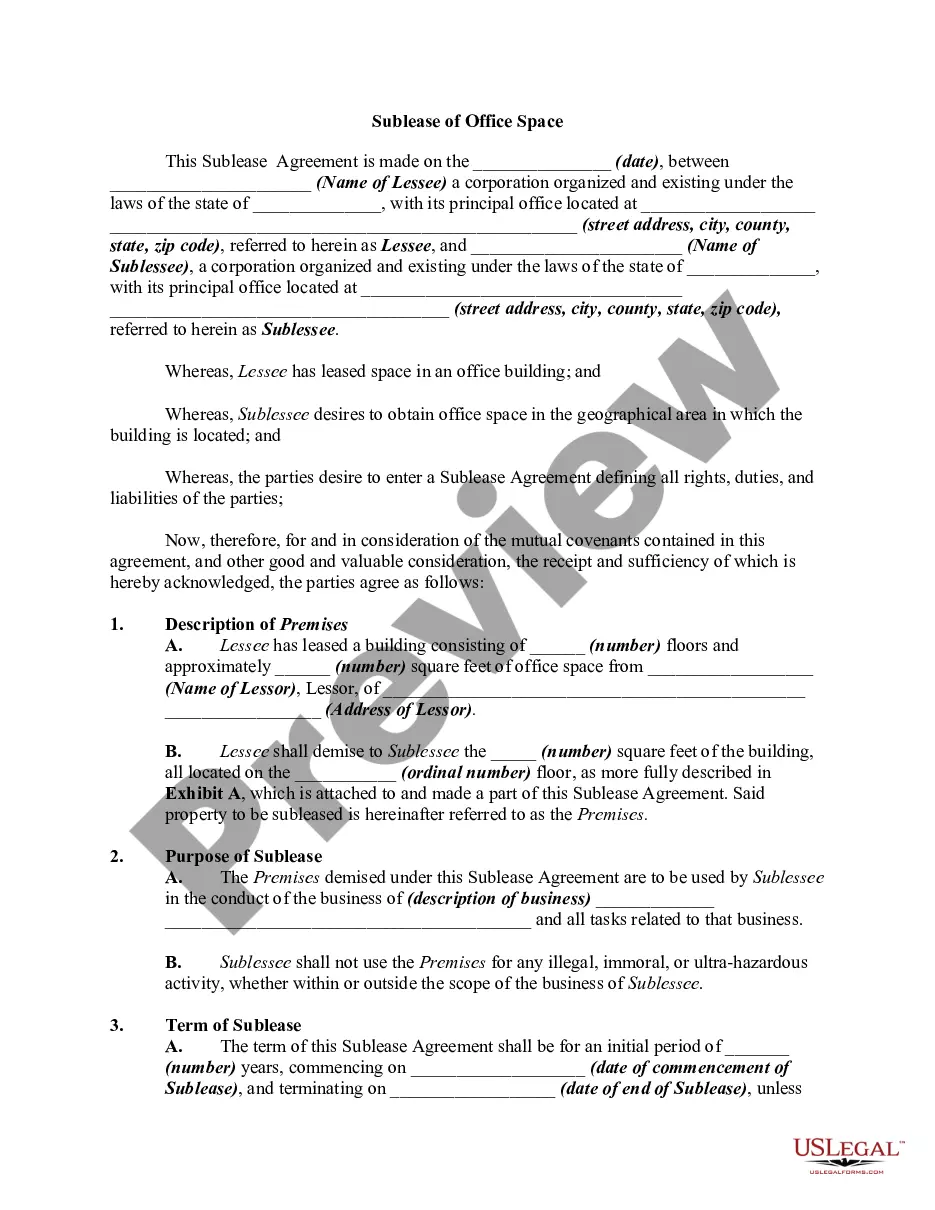

Subsidiary Guaranty Agreement

Miami-Dade Florida Subsidiary Guaranty Agreement is a legal contract that guarantees the obligations of a subsidiary company under a specific agreement. It provides assurance to the lending party or creditor that if the subsidiary fails to meet its obligations, the parent company will step in to fulfill them. This subsidiary guarantee is a common practice in business transactions, particularly in mergers and acquisitions, real estate deals, and financing arrangements. The Miami-Dade Florida Subsidiary Guaranty Agreement is designed to protect the rights of the creditor and ensure that they are not left empty-handed in case the subsidiary company fails to meet its obligations. By signing this agreement, the parent company assumes liability for any financial or contractual obligations of its subsidiary, making the parent company financially responsible for any default or non-payment. This subsidiary guarantee agreement typically outlines the specific obligations for which the parent company is providing its guarantee. It may include payment of debts, performance of services, adherence to contractual terms, or any other obligations outlined in the primary agreement between the creditor and subsidiary. Furthermore, there are different types of Miami-Dade Florida Subsidiary Guaranty Agreements based on the nature of the transaction or arrangement. Some common types include: 1. Real Estate Subsidiary Guaranty Agreement: This agreement is commonly used in real estate deals where a parent company guarantees the obligations of its subsidiary involved in real estate acquisitions, redevelopments, or leasing. 2. Financing Subsidiary Guaranty Agreement: This agreement is frequently used in financing arrangements where a parent company guarantees the repayment of a loan or debt obtained by its subsidiary from a financial institution. 3. Merger and Acquisition Subsidiary Guaranty Agreement: In mergers and acquisitions, this agreement ensures that the parent company remains responsible for any liabilities or obligations of the acquired subsidiary, providing an extra layer of protection to the purchasing entity. 4. Supply Chain Subsidiary Guaranty Agreement: This agreement is applicable in supply chain agreements, where the parent company guarantees the fulfillment of contractual obligations by its subsidiary to maintain the smooth flow of goods or services. In summary, the Miami-Dade Florida Subsidiary Guaranty Agreement is a legal instrument that ensures the parent company's financial responsibility for the obligations of its subsidiary. It protects the interests of the creditor and provides a layer of security in various business transactions.

Free preview