A San Antonio Texas Subsidiary Guaranty Agreement is a legally binding contract that outlines the guarantee provided by a subsidiary company to its parent company located in San Antonio, Texas. This agreement serves as a commitment from the subsidiary to meet its financial obligations and debts on behalf of the parent company if it fails to do so. Keywords: San Antonio Texas, Subsidiary Guaranty Agreement, legally binding contract, guarantee, subsidiary company, parent company, financial obligations, debts. There are several types of San Antonio Texas Subsidiary Guaranty Agreements that may be named based on their specific purposes or characteristics. Some common variations include: 1. Full Guaranty Agreement: This type of subsidiary guaranty agreement provides a comprehensive guarantee, ensuring that the subsidiary will assume full responsibility for any outstanding debts, liabilities, or obligations of the parent company. 2. Limited Guaranty Agreement: In this agreement, the subsidiary's guarantee may be limited to a specific amount or to certain obligations only. This agreement enables the subsidiary to restrict its liability and financial exposure to a predetermined extent. 3. Continuing Guaranty Agreement: A continuing subsidiary guaranty agreement stipulates an ongoing commitment by the subsidiary to stand as a guarantor for the parent company's liabilities. This agreement typically remains in effect until termination or until a specific event occurs, such as the complete repayment of all debts. 4. Termination Guaranty Agreement: This type of subsidiary guaranty agreement specifies the conditions under which the guarantee provided by the subsidiary company can be terminated. These conditions may include the repayment of a certain portion of the debt or the fulfillment of specific performance criteria. 5. Upstream Guaranty Agreement: An upstream subsidiary guaranty agreement involves a parent company requesting a guarantee from its subsidiary. This arrangement commonly occurs when the subsidiary is in a financially stronger position than its parent and can support its financial obligations. 6. Cross-Guaranty Agreement: In a cross-guaranty agreement, multiple subsidiaries within a corporate group mutually guarantee each other's obligations or debts. This type of subsidiary guaranty agreement provides additional assurance to lenders or creditors, as the obligations of one subsidiary can be fulfilled by the assets or resources of another subsidiary within the group. In conclusion, a San Antonio Texas Subsidiary Guaranty Agreement is a legally binding contract that outlines the guarantee provided by a subsidiary company to its parent company located in San Antonio, Texas. This agreement serves as a commitment from the subsidiary to assume financial obligations and debts on behalf of the parent company if it fails to meet them. Different types of subsidiary guaranty agreements include full guaranty, limited guaranty, continuing guaranty, termination guaranty, upstream guaranty, and cross-guaranty agreements.

San Antonio Texas Subsidiary Guaranty Agreement

Description

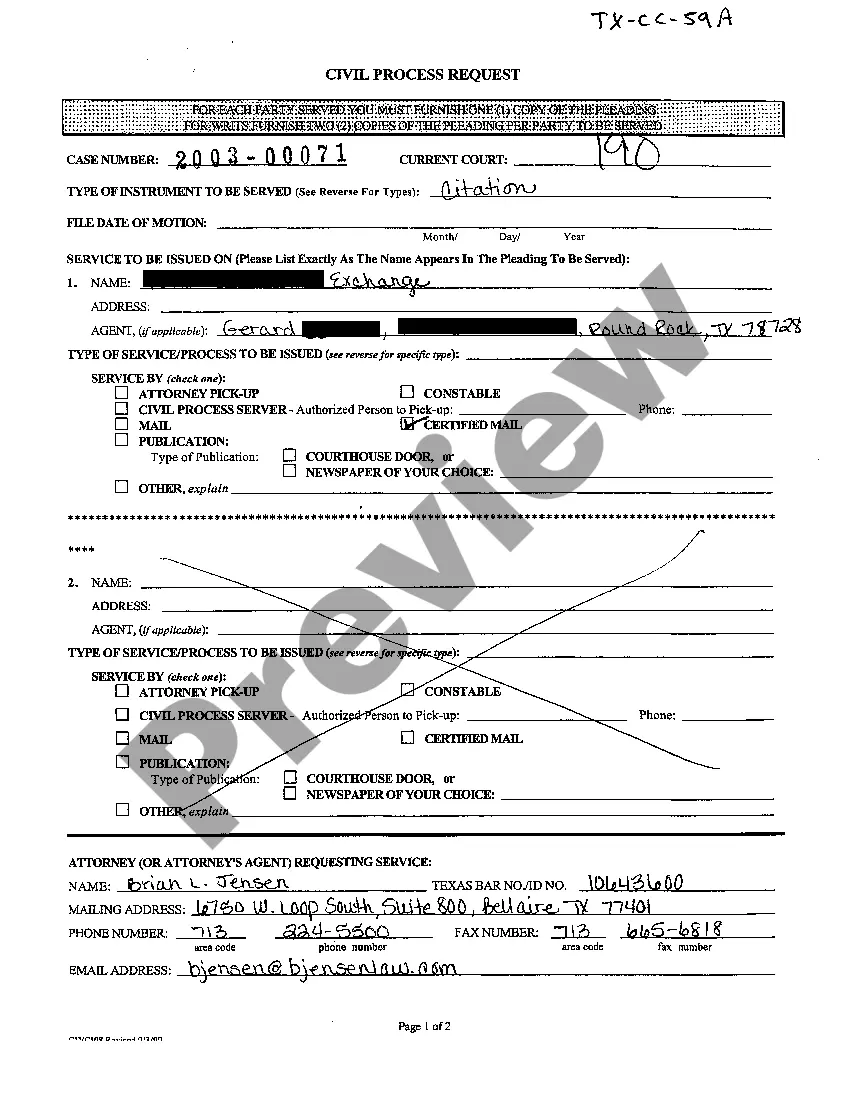

How to fill out San Antonio Texas Subsidiary Guaranty Agreement?

Whether you intend to start your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you must prepare certain paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal templates for any individual or business occasion. All files are collected by state and area of use, so picking a copy like San Antonio Subsidiary Guaranty Agreement is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of additional steps to get the San Antonio Subsidiary Guaranty Agreement. Follow the guide below:

- Make sure the sample fulfills your individual needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the sample when you find the proper one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the San Antonio Subsidiary Guaranty Agreement in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

A lender can enforce a guarantee irrespective of whether or not the lender holds any other security. Unless otherwise prescribed in the guarantee, there is no need for the lender to proceed first against the Obligor or enforce mortgages or other security before enforcing the guarantee.

Personal guarantees are usually enforceable. The typical route would be for the lender to take the guarantor to court to request the enforcement of a judgement against their personal assets. Once a lender takes legal action, the enforcement of a personal guarantee can be a quick process.

Types of Guarantees Bid/Tender Guarantee. Issued in support of an exporter's bid to supply goods or services and, if successful, ensures compensation in the event that the contract is not signed. Performance Guarantee.Advance Payment Guarantee.Warranty Guarantee.Retention Guarantee.

A guarantee must be in writing (or evidenced in writing) and signed by the guarantor or a person authorised by the guarantor (section 4, Statute of Frauds 1677). Guarantees and indemnities are often executed as deeds to overcome any argument about whether good consideration has been given.

An upstream guarantee, also known as a subsidiary guarantee, is a financial guarantee in which the subsidiary guarantees its parent company's debt.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

A loan guaranty is a legal document that is essentially an insurance policy that protects the lender in case the borrower defaults on their loan. The company will insure your company's debt to protect you from loss if they are unable to repay your loans, but it will come at a cost.

The main technical requirement for a guarantee to be valid is that it must be in writing and signed by the guarantor or a person authorised on the guarantor's behalf.

Subsidiary guaranties, also commonly known as upstream guaranties, are instruments used for the benefit of lenders and borrowers alike. Upstream guaranties benefit borrowers and lenders because they enable borrowers to obtain more favorable terms and enable lenders to lend based upon a larger asset pool to secure debt.

According to the Restatement, a party may enforce a guaranty under one of three theories: A promise to be surety for the performance of a contractual obligation, made to the obligee, is binding if: The promise is in writing and signed by the promisor and recites a purported consideration; or.